Why is the specialty chemicals important right now?

As part of the $924.6 bn specialty chemicals market space, there are massive revenue streams within each of the industrial applications. These segments analysed within this report included construction chemicals, industrial & institutional cleaners, electronic chemicals, surfactants, flavours, fragrance, specialty coatings, water soluble polymers, catalyst, oil field chemicals, food additives, plastic additives, feed additives, printing inks, specialty pulp & paper chemicals, specialty adhesives & sealants, cosmetic chemicals, lubricating oil additives, water management chemicals, textile chemicals, textile chemicals, nutraceutical ingredients, among others to tap into. This report shows you where these business opportunities are.

The recovery of the construction industry in North America and Europe from sub-prime crises and euro-debt crises along with growing demand from end-user industries in Asia-Pacific, Middle East, and Latin America is expected to provide immense growth opportunities to the industry players across the value chain in the global specialty chemicals market.

What are the specialty chemicals market prospects?

Visiongain’s definitive new report assesses that the specialty chemicals market will reach $924.6bn in 2017. The performance of the industry is forecast to accelerate, with a healthy growth trajectory over the ten-year period 2017-2027.

Visiongain’s timely 228 page report reveals how best to compete in the lucrative specialty chemicals market space and maximize your company’s potential.

Read on to discover how this report can help you develop your business.

This report addresses the pertinent issues:

• Where are the most lucrative specialty chemical market prospects?

• Who are the leading specialty chemical companies and what does the competitive landscape look like?

• What are the regional, technical and regulatory barriers to market entry?

• What are the technological issues influencing the market?

• Why is the specialty chemical market prospering and how can you fully exploit this?

• When will the specialty chemical market fully mature and why?

Research and analysis highlights

Independent, impartial and objective analysis

167 tables, charts and graphs illustrating the specialty chemicals market prospects

Global specialty chemicals market forecast and analysis 2017-2027

20 specialty chemicals submarket forecasts by type and application covering the period 2017-2027

• Construction Chemicals Forecast 2017-2027

• Industrial & Institutional Cleaners Forecast 2017-2027

• Electronic Chemicals Forecast 2017-2027

• Surfactants Forecast 2017-2027

• Flavours Forecast 2017-2027

• Fragrance Forecast 2017-2027

• Water Soluble Polymers Forecast 2017-2027

• Catalysts Forecast 2017-2027

• Oil Field Chemicals Forecast 2017-2027

• Food Additives Forecast 2017-2027

• Plastic Additives Forecast 2017-2027

• Feed Additives Forecast 2017-2027

• Printing Inks Forecast 2017-2027

• Pulp & Paper Chemicals Forecast 2017-2027

• Adhesive & Sealants Forecast 2017-2027

• Cosmetic Chemicals Forecast 2017-2027

• Lubricating Oil Additives Forecast 2017-2027

• Water Management Chemicals Forecast 2017-2027

• Textile Chemicals Forecast 2017-2027

• Nutraceutical Ingredients Forecast 2017-2027

• Others Specialty Chemicals Forecast 2017-2027

5 regional and 15 leading national specialty chemicals market forecasts from 2017-2027

North America Specialty Chemicals Forecast 2017-2027

• US Specialty Chemicals Forecast 2017-2027

• Canada Specialty Chemicals Forecast 2017-2027

• Mexico Specialty Chemicals Forecast 2017-2027

Europe Specialty Chemicals Forecast 2017-2027

• UK Specialty Chemicals Forecast 2017-2027

• Germany Specialty Chemicals Forecast 2017-2027

• France Specialty Chemicals Forecast 2017-2027

• Spain Specialty Chemicals Forecast 2017-2027

• Italy Specialty Chemicals Forecast 2017-2027

• Russia Specialty Chemicals Forecast 2017-2027

• Rest of Europe Specialty Chemicals Forecast 2017-2027

Asia Pacific Specialty Chemicals Forecast 2017-2027

• China Specialty Chemicals Forecast 2017-2027

• Japan Specialty Chemicals Forecast 2017-2027

• India Specialty Chemicals Forecast 2017-2027

• Rest of Asia Pacific Specialty Chemicals Forecast 2017-2027

Latin America Specialty Chemicals Forecast 2017-2027

• Brazil Specialty Chemicals Forecast 2017-2027

• Rest of Latin America Specialty Chemicals Forecast 2017-2027

Middle East & Africa Specialty Chemicals Forecast 2017-2027

• South Africa Specialty Chemicals Forecast 2017-2027

• Kingdom of Saudi Arabia Specialty Chemicals Forecast 2017-2027

• Rest of Middle East & Africa Specialty Chemicals Forecast 2017-2027

Profiles of 10 leading companies, involved with specialty chemicals

• AkzoNobel N.V.

• Arkema S.A.

• BASF SE

• Evonik Industries AG

• The Dow Chemical Company

• Albermarle Corporation

• Clariant AG

• Bayer AG

• Huntsman Corporation

• E. I. du Pont de Numours and Company

Qualitative analysis including drivers, restraints, and opportunity in the specialty chemicals market

Porter’s Five Forces analysis

And there’s more.

How this report will benefit you

• You have almost certainly an excess of conflicting and yet unclear information – you want one definitive report to base your business decisions upon – this Visiongain report provides that clarity

• Our insightful report speaks to your needs for definitive market data, objective impartial analysis and immediate clear conclusions – to allow you to formulate clear decisive business strategies

• You need the information now in an easily digestible form – this is where this Visiongain reports excels

• Forecasts give you a crucial advantage. That knowledge of the future is central to your strategic decision making.

• Knowledge is vital to you and your business. You need every piece of evidence to inform your crucial investment decisions – let Visiongain give you that clear advantage

• Without this vital report, you will fall behind your competitors

Who should read this report?

• Chemical companies

• Oil & gas companies

• Electronics companies

• Food manufacturers

• Cosmetics & fragrance companies

• Paper & pulp companies

• Printing ink companies

• Adhesives & sealants companies

• Plastic companies

• Water management companies

• Textile companies

• Nutraceutical companies

• Contractors

• Suppliers

• Technologists

• Government agencies

• Consultants

• Market analysts

• Business development managers

• Marketing managers

• Investors

• Banks

• Government agencies

Don’t miss out on this business advantage

This information is not available elsewhere. With our specialty chemicals report you are less likely to fall behind in knowledge or miss opportunity. Discover how the report benefits your research, analyses, and decisions. Also see how you save time and receive recognition for commercial insight.

Visiongain’s study is for everybody needing commercial analyses for the specialty chemicals market and leading companies. Find data, trends and predictions. Get our report today specialty chemicals. Please order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Specialty Chemicals Market

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report

1.5 Who is This Report For?

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to Specialty Chemicals

2.1 Construction Chemicals

2.2 Industrial & Institutional Cleaners

2.3 Electronic Chemicals

2.4 Surfactants

2.5 Flavours & Fragrance

2.6 Water Soluble Polymers

2.7 Catalysts

2.8 Oilfield Chemicals

2.9 Food Additives

2.10 Plastic Additives

2.11 Feed Additives

2.12 Printing Inks

2.13 Specialty Pulp & Paper Chemicals

2.14 Specialty Adhesives & Sealants

2.15 Cosmetic Chemicals

2.16 Lubricating Oil Additives

2.17 Water Management Chemicals

2.18 Textile Chemicals

2.19 Nutraceutical Ingredients

2.20 Other Specialty Chemicals

2.21 Segmentation of Specialty Chemicals Market

3. Specialty Chemicals: Global Market by Type, 2017-2027

3.1 Construction Chemicals Market Forecast & Analysis 2017-2027

3.1.1 Construction Chemicals Market Forecast & Analysis by Region, 2017-2027

3.1.2 Construction Chemicals Market Forecast & Analysis by Type, 2017-2027

3.2 Industrial & Institutional Cleaners Market Forecast & Analysis 2017-2027

3.2.1 Industrial & Institutional Cleaners Market Forecast & Analysis by Region, 2017-2027

3.2.2 Industrial & Institutional Cleaners Market Forecast & Analysis by Type, 2017-2027

3.3 Electronic Chemicals Market Forecast & Analysis 2017-2027

3.3.1 Electronic Chemicals Market Forecast & Analysis by Region, 2017-2027

3.3.2 Electronic Chemicals Market Forecast & Analysis by Type, 2017-2027

3.4 Surfactants Market Forecast & Analysis 2017-2027

3.4.1 Surfactants Market Forecast & Analysis by Region, 2017-2027

3.4.2 Surfactants Market Forecast & Analysis by Type, 2017-2027

3.5 Flavours & Fragrance Market Forecast & Analysis 2017-2027

3.5.1 Flavours & Fragrance Market Forecast & Analysis by Region, 2017-2027

3.5.2 Flavours & Fragrance Market Forecast & Analysis by Type, 2017-2027

3.6 Water Soluble Polymers Market Forecast & Analysis 2017-2027

3.6.1 Water Soluble Polymers Market Forecast & Analysis by Region, 2017-2027

3.6.2 Water Soluble Polymers Market Forecast & Analysis by Type, 2017-2027

3.7 Catalyst Market Forecast & Analysis 2017-2027

3.7.1 Catalyst Market Forecast & Analysis by Region, 2017-2027

3.7.2 Catalyst Market Forecast & Analysis by Type, 2017-2027

3.8 Oil Field Chemicals Market Forecast & Analysis 2017-2027

3.8.1 Oil Field Chemicals Market Forecast & Analysis by Region, 2017-2027

3.8.2 Oil Field Chemicals Market Forecast & Analysis by Type, 2017-2027

3.9 Food Additives Market Forecast & Analysis 2017-2027

3.9.1 Food Additives Market Forecast & Analysis by Region, 2017-2027

3.9.2 Food Additives Market Forecast & Analysis by Type, 2017-2027

3.10 Plastic Additives Market Forecast & Analysis 2017-2027

3.10.1 Plastic Additives Market Forecast & Analysis by Region, 2017-2027

3.10.2 Plastic Additives Market Forecast & Analysis by Type, 2017-2027

3.11 Feed Additives Market Forecast & Analysis 2017-2027

3.11.1 Feed Additives Market Forecast & Analysis by Region, 2017-2027

3.11.2 Feed Additives Market Forecast & Analysis by Type, 2017-2027

3.12 Printing Inks Market Forecast & Analysis 2017-2027

3.12.1 Printing Inks Market Forecast & Analysis by Region, 2017-2027

3.12.2 Printing Inks Market Forecast & Analysis by Type, 2017-2027

3.13 Specialty Pulp & Paper Chemicals Market Forecast & Analysis 2017-2027

3.13.1 Specialty Pulp & Paper Chemicals Market Forecast & Analysis by Region, 2017-2027

3.13.2 Specialty Pulp & Paper Chemicals Market Forecast & Analysis by Type, 2017-2027

3.14 Specialty Adhesives & Sealants Market Forecast & Analysis 2017-2027

3.14.1 Specialty Adhesives & Sealants Market Forecast & Analysis by Region, 2017-2027

3.14.2 Specialty Adhesives & Sealants Market Forecast & Analysis by Type, 2017-2027

3.15 Cosmetic Chemicals Market Forecast & Analysis 2017-2027

3.15.1 Cosmetic Chemicals Market Forecast & Analysis by Region, 2017-2027

3.15.2 Cosmetic Chemicals Market Forecast & Analysis by Type, 2017-2027

3.16 Lubricating Oil Additives Market Forecast & Analysis 2017-2027

3.16.1 Lubricating Oil Additives Market Forecast & Analysis by Region, 2017-2027

3.16.2 Lubricating Oil Additives Market Forecast & Analysis by Type, 2017-2027

3.17 Water Management Chemicals Market Forecast & Analysis 2017-2027

3.17.1 Water Management Chemicals Market Forecast & Analysis by Region, 2017-2027

3.17.2 Water Management Chemicals Market Forecast & Analysis by Type, 2017-2027

3.18 Textile Chemicals Market Forecast & Analysis 2017-2027

3.18.1 Textile Chemicals Market Forecast & Analysis by Region, 2017-2027

3.18.2 Textile Chemicals Market Forecast & Analysis by Type, 2017-2027

3.19 Nutraceutical Ingredients Market Forecast & Analysis 2017-2027

3.19.1 Nutraceutical Ingredients Market Forecast & Analysis by Region, 2017-2027

3.19.2 Nutraceutical Ingredients Market Forecast & Analysis by Type, 2017-2027

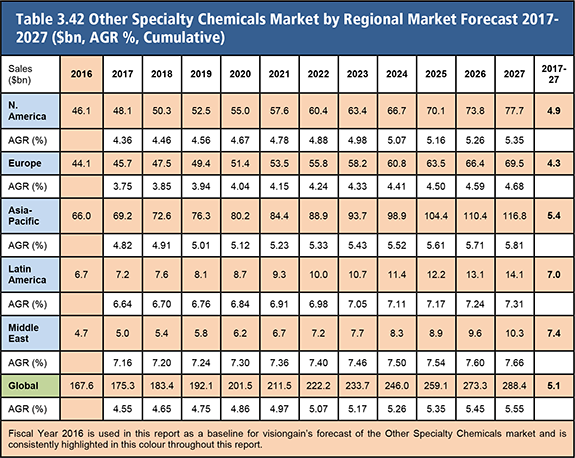

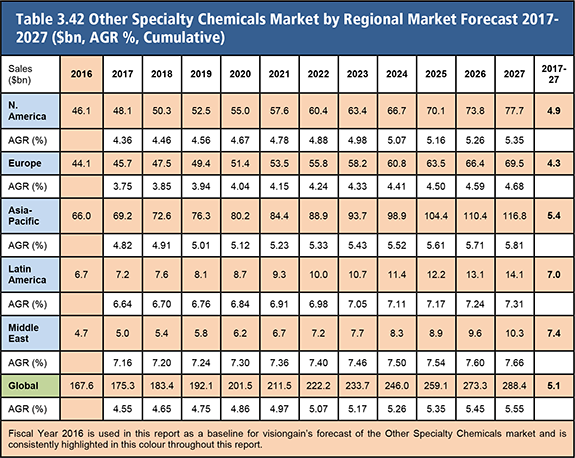

3.20 Other Specialty Chemicals Market Forecast & Analysis 2017-2027

3.20.1 Other Specialty Chemicals Market Forecast & Analysis by Region, 2017-2027

4. Specialty Chemicals: Global Market by Geography, 2017-2027

4.1 North America Specialty Chemicals Market Forecasts 2017-2027

4.1.1 North America Specialty Chemicals Market Forecast & Analysis By Type, 2017-2027

4.1.2 North America Specialty Chemicals Market Forecast & Analysis By Country, 2017-2027

4.2 Europe Specialty Chemicals Market Forecasts 2017-2027

4.2.1 Europe Specialty Chemicals Market Forecast & Analysis By Type, 2017-2027

4.2.2 Europe Specialty Chemicals Market Forecast & Analysis By Country, 2017-2027

4.3 Asia-Pacific Specialty Chemicals Market Forecasts 2017-2027

4.3.1 Asia-Pacific Specialty Chemicals Market Forecast & Analysis By Type, 2017-2027

4.3.2 Asia-Pacific Specialty Chemicals Market Forecast & Analysis By Country, 2017-2027

4.4 Latin America Specialty Chemicals Market Forecasts 2017-2027

4.4.1 Latin America Specialty Chemicals Market Forecast & Analysis By Type, 2017-2027

4.4.2 Latin America Specialty Chemicals Market Forecast & Analysis By Country, 2017-2027

4.5 Middle East & Africa Specialty Chemicals Market Forecasts 2017-2027

4.5.1 Middle East & Africa Specialty Chemicals Market Forecast & Analysis By Type, 2017-2027

4.5.2 Middle East & Africa Specialty Chemicals Market Forecast & Analysis By Country, 2017-2027

5. Qualitative Analysis: Specialty Chemicals

5.1 Market Dynamics

5.1.1 Drivers

5.1.2 Restraints

5.1.3 Opportunities

5.2 Porter’s Five Forces Analysis for the Specialty Chemicals

5.2.1 Bargaining Power Of Suppliers:

5.2.2 Bargaining Power Of Buyers

5.2.3 Threat Of Substitutes

5.2.4 Threat Of New Entrants

5.2.5 Intensity Of Competitive Rivalry

6. Leading Companies In The Specialty Chemicals Market

6.1 AkzoNobel N.V.

6.1.1 AkzoNobel N.V. Product Portfolio

6.1.2 AkzoNobel N.V. Financial Performance Overview

6.1.3 AkzoNobel N.V. Financial Performance

6.1.4 AkzoNobel N.V. Segment Information

6.1.5 AkzoNobel N.V. Geographic Analysis

6.2 Arkema S.A.

6.2.1 Arkema S.A. Product Portfolio

6.2.2 Arkema S.A. Financial Performance Overview

6.2.3 Arkema S.A. Financial Performance

6.2.4 Arkema S.A. Segment Information

6.2.5 Arkema S.A. Geographic Analysis

6.3 BASF SE

6.3.1 BASF SE Product Portfolio

6.3.2 BASF SE Financial Performance Overview

6.3.3 BASF SE Financial Performance

6.3.4 BASF SE Segment Information

6.3.5 BASF SE Geographic Analysis

6.4 Evonik Industries AG

6.4.1 Evonik Industries AG Product Portfolio

6.4.2 Evonik Industries AG Financial Performance Overview

6.4.3 Evonik Industries AG Financial Performance

6.4.4 Evonik Industries AG Segment Information

6.4.5 Evonik Industries AG Geographic Analysis

6.5 The Dow Chemical Company

6.5.1 The Dow Chemical Company Product Portfolio

6.5.2 The Dow Chemical Company Financial Performance Overview

6.5.3 The Dow Chemical Company Financial Performance

6.5.4 The Dow Chemical Company Segment Information

6.5.5 The Dow Chemical Company Geographic Analysis

6.6 Albermarle Corporation

6.6.1 Albermarle Corporation Product Portfolio

6.6.2 Albermarle Corporation Financial Performance Overview

6.6.3 Albermarle Corporation Financial Performance

6.6.4 Albermarle Corporation Segment Information

6.6.5 Albermarle Corporation Geographic Analysis

6.7 Clariant AG

6.7.1 Clariant AG Product Portfolio

6.7.2 Clariant AG Financial Performance Overview

6.7.3 Clariant AG Financial Performance

6.7.4 Clariant AG Segment Information

6.8 Bayer AG

6.8.1 Bayer AG Product Portfolio

6.8.2 Bayer AG Financial Performance Overview

6.8.3 Bayer AG Financial Performance

6.8.4 Bayer AG Segment Information

6.8.5 Bayer AG Geographic Analysis

6.9 Huntsman Corporation

6.9.1 Huntsman Corporation Product Portfolio

6.9.2 Huntsman Corporation Financial Performance Overview

6.9.3 Huntsman Corporation Financial Performance

6.9.4 Huntsman Corporation Segment Information

6.9.5 Huntsman Corporation Geographic Analysis

6.10 E. I. du Pont de Numours and Company

6.10.1 E. I. Du Pont De Numours And Company Product Portfolio

6.10.2 E. I. Du Pont De Numours And Company Financial Performance Overview

6.10.3 E. I. Du Pont De Numours And Company Financial Performance

6.10.4 E. I. Du Pont De Numours And Company Segment Information

6.10.5 E. I. Du Pont De Numours And Company Geographic Analysis

7. Conclusion & Recommendation

8. Glossary

List of Tables

Table 3.1 Specialty Chemicals Market by Type Market Forecast, 2017-2027 ($bn, AGR %, Cumulative)

Table 3.2 Construction Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.3 Construction Chemicals Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.4 Industrial & Institutional Cleaners Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.5 Industrial & Institutional Cleaners Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.6 Electronic Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.7 Electronic Chemicals Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.8 Surfactants Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.9 Surfactants Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.10 Flavours & Fragrance Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.11 Flavours & Fragrance Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.12 Flavours Market by Application Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.13 Fragrance Market by Application Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.14 Water Soluble Polymers Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.15 Water Soluble Polymers Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.16 Catalyst Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.17 Catalyst Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.18 Oil Field Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.19 Oil Field Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.20 Food Additives Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.21 Food Additives Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.22 Plastic Additives Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.23 Plastic Additives Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.24 Feed Additives Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.25 Feed Additives Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.26 Printing Inks Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.27 Printing Inks Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.28 Specialty Pulp & Paper Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.29 Specialty Pulp & Paper Chemicals Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.30 Specialty Adhesives & Sealants Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.31 Specialty Adhesives & Sealants Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.32 Cosmetic Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.33 Cosmetic Chemicals Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.34 Lubricating Oil Additives Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.35 Lubricating Oil Additives Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.36 Water Management Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.37 Water Management Chemicals Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.38 Textile Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.39 Textile Chemicals Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.40 Nutraceutical Ingredients Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.41 Nutraceutical Ingredients Market by Type Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 3.42 Other Specialty Chemicals Market by Regional Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 4.1 Specialty Chemicals Market Forecast by Region & Country, 2017-2027 ($bn, AGR %, Cumulative)

Table 4.2 Specialty Chemicals Market by Type Market Forecast, 2017-2027 ($bn, AGR %, Cumulative)

Table 4.3 North America Specialty Chemicals Market by Country Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 4.4 Europe Specialty Chemicals Market by Type Market Forecast, 2017-2027 ($bn, AGR %, Cumulative)

Table 4.5 Europe Specialty Chemicals Market by Country Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 4.6 Asia-Pacific Specialty Chemicals Market by Type Market Forecast, 2017-2027 ($bn, AGR %, Cumulative)

Table 4.7 Asia-Pacific Specialty Chemicals Market by Country Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 4.8 Latin America Specialty Chemicals Market by Type Market Forecast, 2017-2027 ($bn, AGR %, Cumulative)

Table 4.9 Latin America Specialty Chemicals Market by Country Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 4.10 Middle East & Africa Specialty Chemicals Market by Type Market Forecast, 2017-2027 ($bn, AGR %, Cumulative)

Table 4.11 Middle East & Africa Specialty Chemicals Market by Country Market Forecast 2017-2027 ($bn, AGR %, Cumulative)

Table 6.1 AkzoNobel N.V. Product Portfolio

Table 6.2 Arkema S.A. Product Portfolio

Table 6.3 BASF SE Product Portfolio

Table 6.4 Evonik Industries AG Product Portfolio

Table 6.5 The Dow Chemical Company Product Portfolio

Table 6.6 Albermarle Corporation Product Portfolio

Table 6.7 Bayer AG Product Portfolio

Table 6.8 Huntsman Corporation Product Portfolio

Table 6.9 DuPont Product Portfolio

List of Figures

Figure 1.1 Leading Market Players Specialty Chemicals Industry

Figure 2.1 Global Specialty Chemicals Market Segmentation Overview, 2017

Figure 3.1 Global Specialty Chemicals Market by Type, 2016, (% Share)

Figure 3.2 Construction Chemicals Market by Region, 2016, (% Share)

Figure 3.3 Construction Chemicals Market by Type, 2016, (% Share)

Figure 3.4 Industrial & Institutional Cleaners Market by Region, 2016, (% Share)

Figure 3.5 Industrial & Institutional Cleaners Market by Type, 2016, (% Share)

Figure 3.6 Electronic Chemicals Market by Region, 2016, (% Share)

Figure 3.7 Electronic Chemicals Market by Type, 2016, (% Share)

Figure 3.8 Surfactants Market by Region, 2016, (% Share)

Figure 3.9 Surfactants Market by Type, 2016, (% Share)

Figure 3.10 Flavours & Fragrance Market by Region, 2016, (% Share)

Figure 3.11 Flavours & Fragrance Market by Type, 2016, (% Share)

Figure 3.12 Flavours Market by Application, 2016, (% Share)

Figure 3.13 Fragrance Market by Application, 2016, (% Share)

Figure 3.14 Water Soluble Polymers Market by Region, 2016, (% Share)

Figure 3.15 Water Soluble Polymers Market by Type, 2016, (% Share)

Figure 3.16 Catalyst Market by Region, 2016, (% Share)

Figure 3.17 Catalyst Market by Type, 2016, (% Share)

Figure 3.18 Oil Field Chemicals Market by Region, 2016, (% Share)

Figure 3.19 Oil Field Chemicals Market by Type, 2016, (% Share)

Figure 3.20 Food Additives Market by Region, 2016, (% Share)

Figure 3.21 Food Additives Market by Type, 2016, (% Share)

Figure 3.22 Plastic Additives Market by Region, 2016, (% Share)

Figure 3.23 Plastic Additives Market by Type, 2016, (% Share)

Figure 3.24 Feed Additives Market by Region, 2016, (% Share)

Figure 3.25 Feed Additives Market by Type, 2016, (% Share)

Figure 3.26 Printing Inks Market by Region, 2016, (% Share)

Figure 3.27 Printing Inks Market by Type, 2016, (% Share)

Figure 3.28 Specialty Pulp & Paper Chemicals Market by Region, 2016, (% Share)

Figure 3.29 Specialty Pulp & Paper Chemicals Market by Type, 2016, (% Share)

Figure 3.30 Specialty Adhesives & Sealants Market by Region, 2016, (% Share)

Figure 3.31 Specialty Adhesives & Sealants Market by Type, 2016, (% Share)

Figure 3.32 Cosmetic Chemicals Market by Region, 2016, (% Share)

Figure 3.33 Cosmetic Chemicals Market by Type, 2016, (% Share)

Figure 3.34 Lubricating Oil Additives Market by Region, 2016, (% Share)

Figure 3.35 Lubricating Oil Additives Market by Type, 2016, (% Share)

Figure 3.36 Water Management Chemicals Market by Region, 2016, (% Share)

Figure 3.37 Water Management Chemicals Market by Type, 2016, (% Share)

Figure 3.38 Textile Chemicals Market by Region, 2016, (% Share)

Figure 3.39 Textile Chemicals Market by Type, 2016, (% Share)

Figure 3.40 Nutraceutical Ingredients Market by Region, 2016, (% Share)

Figure 3.41 Nutraceutical Ingredients Market by Type, 2016, (% Share)

Figure 3.42 Other Specialty Chemicals Market by Region, 2016, (% Share)

Figure 4.1 Global Specialty Chemicals Market, By Geography, 2016, $bn (% share)

Figure 4.2 North America Specialty Chemicals Market by Type, 2016, (% Share)

Figure 4.3 North America Specialty Chemicals Market by Country, 2016, (% Share)

Figure 4.4 U.S. Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.5. Canada Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.6. Mexico Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.7. European Specialty Chemicals Market by Type, 2016, (% Share)

Figure 4.8. European Specialty Chemicals Market by Country, 2016, (% Share)

Figure 4.9. UK Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.10. Germany Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.11. France Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.12. Spain Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.13. Italy Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.14. Russia Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.15. Rest of Europe Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.16. Asia-Pacific Specialty Chemicals Market by Type, 2016, (% Share)

Figure 4.17. Asia-Pacific Specialty Chemicals Market by Country, 2016, (% Share)

Figure 4.18. China Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.19. Japan Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.20. India Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.21. Rest of Asia-Pacific Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.22. Latin America Specialty Chemicals Market by Type, 2016, (% Share)

Figure 4.23. Latin America Specialty Chemicals Market by Country, 2016, (% Share)

Figure 4.24. Brazil Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.25. Rest of Latin America Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.26. Middle East & Africa Specialty Chemicals Market by Type, 2016, (% Share)

Figure 4.27. Middle East & Africa Specialty Chemicals Market by Type, 2016, (% Share)

Figure 4.28. South Africa Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.29. Kingdom of Saudi Arabia Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 4.30. Rest of Middle East & Africa Specialty Chemicals Market, Forecast ($bn) 2017-2027

Figure 5.1 Market Dynamics: Specialty Chemicals Market 2016-2027

Figure 5.2 Porter’s Five Forces Analysis for Specialty Chemicals Market, 2016-2027

Figure 6.1 AkzoNobel N.V. Revenue 2014-2016 ($mn)

Figure 6.2 AkzoNobel N.V. Segment Performance 2016 (% Share of Revenue)

Figure 6.3 AkzoNobel N.V. Geographic Analysis 2016 (% Share of Revenue)

Figure 6.4 Arkema S.A. Revenue 2014-2016 ($mn)

Figure 6.5 Arkema S.A. Segment Performance 2016 (% Share of Revenue)

Figure 6.6 Arkema S.A. Geographic Analysis 2016 (% Share of Revenue)

Figure 6.7 BASF SE Corporation Revenue 2014-2016 ($mn)

Figure 6.8 BASF SE Segment Performance 2016 (% Share of Revenue)

Figure 6.9 BASF SE Geographic Analysis 2016 (% Share of Revenue)

Figure 6.10 Evonik Industries AG Revenue 2014-2016 ($mn)

Figure 6.11 Evonik Industries AG Segment Performance 2016 (% Share of Revenue)

Figure 6.12 Evonik Industries AG Geographic Analysis 2016 (% Share of Revenue)

Figure 6.13 The Dow Chemical Company Revenue 2014-2016 ($mn)

Figure 6.14 The Dow Chemical Company Segment Performance 2016 (% Share of Revenue)

Figure 6.15 The Dow Chemical Company Geographic Analysis 2016 (% Share of Revenue)

Figure 6.16 Albemarle Corporation Revenue 2014-2016 ($mn)

Figure 6.17 Albermarle Corporation Segment Performance 2016 (% Share of Revenue)

Figure 6.18 Albermarle Corporation Geographic Analysis 2016 (% Share of Revenue)

Figure 6.19 Clariant AG Revenue 2014-2016 ($bn)

Figure 6.20 Clariant AG Segment Performance 2016 (% Share of Revenue)

Figure 6.21 Bayer AG, Revenue 2014-2016 ($Million)

Figure 6.22 Bayer AG, Segment Performance 2016 (% Share of Revenue)

Figure 6.23 Bayer AG, Geographic Analysis 2016 (% Share of Revenue)

Figure 6.24 Huntsman Corporation Revenue 2014-2016 ($bn)

Figure 6.25 Huntsman Corporation Segment Performance 2016 (% Share of Revenue)

Figure 6.26 Huntsman Corporation Geographic Analysis 2016 (% Share of Revenue)

Figure 6.27 DuPont Revenue 2014-2016 ($Mn)

Figure 6.28 DuPont Segment Performance 2016 (% Share of Revenue)

Figure 6.29 DuPont Geographic Analysis 2016 (% Share of Revenue)