Visiongain has launched a new electronics report Passive Radar Market 2020-2030: Contracts & Forecasts by Type (Passive Bistatic Radar, Passive Multi-Static Radars, Others), by Platform (Civilian Aviation Applications, Military Applications, Others), by Geography with Regional and National Forecasts and Analysis of the Leading Companies.

The passive radar market study analyses the market in global level and provides forecasts in terms of revenue (US$ million) from 2020 to 2030. It recognizes the drivers and restraints affecting the industry and analyses their impact during the forecast period. It identifies the significant opportunities for market growth in the next few years. In addition, the market is segmented on the basis of type, application and geography that is further divided into The Americas, Europe, Asia Pacific and rest of the world regions. In addition, the geographic regions are studied at country level for this research study. Furthermore, the passive radar market based on type is further segmented into passive bistatic radar and passive multi-static radars and others, and applications into civilian aviation applications, military applications and others. The key players have been profiled and the information covered are company overviews, financial information, business strategies and recent developments.

The global passive radar market is projected to grow from US$ 2,324 million in 2020 to US$ 4,313 million by 2030, at a CAGR of 6.38% between 2020 and 2030. Global passive radar market report is intended to be an overview of the market across two key submarkets, Passive Bistatic Radar and Passive Multi-Static Radars. This report contains estimates of the market values of these submarkets as well as values across key national markets. In addition, this report contains an overview and survey of the leading companies in the market. It also includes regional analysis based on various countries including US, Canada, UK, Russia, Denmark, Germany, France, China, Japan, and India. In addition, passive radar systems offer several key benefits. First, they are hard to detect by conventional means. Electronic sensors cannot pick them up because they do not transmit their own signals. They have no dedicated transmitters generating heat, so they cannot be detected by their thermal signatures. And although the broadcast antennas are visible to the naked eye, they are generally small and quite difficult to spot. This high level of discretion is a major advantage in air surveillance, because potentially hostile or non-cooperative aircraft have no way of knowing that they are being watched. The second major benefit of passive radars is that they are relatively easy to set up. They do not operate in their own frequency band so there is no need to request frequency allocations before using them.

The Visiongain report analyst commented “Within 5-10 years, passive radar systems would likely be in a prime state with fully-fielded systems in place over the 10-15 years. Passive radar decreases electronic countermeasures in vulnerability systems and improves stealth target detection capability. Ongoing advancement in the passive radar industry would reject conventional ways to defeat enemy air defences, make it difficult to accomplish air superiority over passive radar opponents, and will need to adjust thinking to preserve US potential for power projection. The history of passive radar goes back to the early days of radar in the United Kingdom in 1935. The future of PCR will depend heavily on the emergence of incentives such as FM and electronic broadcasting networks.”

Leading companies featured in the report are BAE Systems, Leonardo S.p.A, Lockheed Martin, Thales SA, Raytheon Company, SRC Inc, HENSOLDT, Ramet A.S., Indra Sistemas SA, OMNIPOL a. s.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1. Passive Radar Market Overview

1.2. Why You Should Read This Report

1.3. How This Report Delivers

1.4. Key Questions Answered By This Analytical Report Include

1.5. Who Is This Report For?

1.6. Methodology

1.6.1 Secondary Research

1.6.2 Market Evaluation & Forecasting Methodology

1.7. Frequently Asked Questions (FAQ)

1.8. Associated Visiongain Reports

1.9. About Visiongain

2. Global Passive Radar Market 2020-2030

2.1. Introduction to Global Passive Radar Market Forecast 2020-2030

2.2 Global Passive Radar Market Forecast 2020–2030

3. Market Dynamics

3.1 Driver

3.1.1 UAV increasing investment by governments

3.1.2 Growing safety and security concerns

3.1.3 Increase in demand for real-time imaging

3.1.4 Potential to provide internet connectivity

3.2 Restraints and Challenges

3.2.1 Lack of dedicated launch vehicles for Passive Radars

3.2.2 Design-Related Limitations of Passive Radars

3.3 Opportunities

3.3.1 Growing safety and security concerns

4. Global Passive Radar Market by Type

4.1. Introduction

4.2. Passive Bistatic Radar (PBR)

4.3. Passive Multi-Static Radars

4.4. Others

5. Global Passive Radar Market by Application 2020-2030

5.1 Introduction

5.2 Civilian Aviation

5.3 Military

5.4 Others

6. Global Passive Radar Market by Geography 2020-2030

6.1 Introduction

6.2 The Americas Passive Radar market Analysis and Forecast 2020-2030

6.2.1 US Passive Radar Market Analysis and Forecast 2020-2030

6.2.2 Canada Passive Radar Market Analysis and Forecast 2020-2030

6.2.2 Mexico Passive Radar Market Analysis and Forecast 2020-2030

6.3 Europe Passive Radar Market Analysis and Forecast 2020-2030

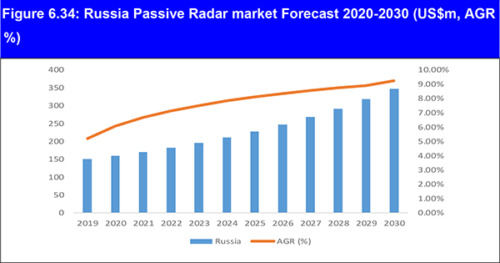

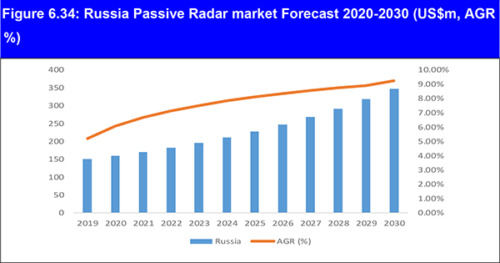

6.3.1 Russia Passive Radar Market Analysis and Forecast 2020-2030

6.3.2 UK Passive Radar Market Analysis and Forecast 2020-2030

6.3.3 France Passive Radar market Analysis and Forecast 2020-2030

6.3.4 Germany Passive Radar market Analysis and Forecast 2020-2030

6.3.5 Rest of Europe Passive Radar market Analysis and Forecast 2020-2030

6.4 Asia Oceania Passive Radar market Analysis and Forecast 2020-2030

6.4.1 China Passive Radar Market Analysis and Forecast 2020-2030

6.4.2 India Passive Radar market Analysis and Forecast 2019-2097.

6.4.3 Australia Passive Radar market Analysis and Forecast 2020-2030

6.4.4 South Korea Passive Radar market Analysis and Forecast 2020-2030

6.4.5 Rest of Asia Oceania Passive Radar market Analysis and Forecast 2020-2030

6.5 ROW Passive Radar Market Analysis and Forecast 2020-2030

7. Leading Companies in Global Passive Radar Market

7.1 BAE Systems Plc.

7.1.1 BAE Systems Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

7.1.2 BAE Systems Revenue, by Business Segment, 2018 and Research & Development, 2016-2018

7.1.3 BAE Systems AB Passive Radar Products / Services

7.1.4 BAE Systems AB Key Developments

7.1.5 BAE Systems Analysis

7.2 Leonardo S.p.A.

7.2.1 Leonardo S.P.A. Revenue, by Business Segment, 2018 and Revenue & Y-o-Y Growth, 2016-2018

7.2.3 Leonardo S.P.A.Passive Radar Products / Services

7.2.4 Leonardo S.p.A Company Developments

7.2.5 Leonardo S.p.A Analysis

7.3 Lockheed Martin Corporation

7.3.1 Lockheed Martin Corporation Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

7.3.2 Lockheed Martin Corporation Revenue, by Business Segment, 2018 and Research & Development, 2016-2018

7.3.3 Lockheed Martin Corporation Passive Radar Products & Services

7.3.4 Lockheed Martin Corporation Developments

7.3.5 Lockheed Martin Corporation Analysis

7.4 Thales Group SA

7.4.1 Thales Group Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

7.4.2 Thales Group Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

7.4.3 Thales Group Products & Services

7.4.4 Thales Group Developments

7.4.5 Thales Group SA Analysis

7.5 The Raytheon Company

7.5.1 Raytheon Company Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

7.5.2 Raytheon Company Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

7.5.3 The Raytheon Company Passive Radar Products & Services

7.5.4 The Raytheon Company Developments

7.5.5 The Raytheon Company Analysis

7.6 SRC Inc.

7.6.1 SRC, Inc. Passive Radar Products & Services

7.6.2 SRC, Inc. Developments

7.6.3 SRC, Inc. Analysis

7.7 HENSOLDT

7.7.1 Hensoldt Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

7.7.2 Hensoldt Passive Radar Products & Services

7.7.3 Hensoldt Developments

7.7.4 Hensoldt Analysis

7.8 RAMET.

7.8.1 Ramet Passive Radar Products & Services

7.8.2 Ramet Analysis

7.9 Indra Sistemas SA

7.9.1 Indra Sistemas SA Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

7.9.2 Indra Sistemas SA Passive Radar Products & Services

7.9.3 Indra Sistemas SA Developments

7.9.4 Indra Sistemas SA Analysis

7.10 OMNIPOL a. s.

7.10.1 OMNIPOL a. s. Passive Radar Products / Services

7.10.2 OMNIPOL a. s. Developments

7.10.3 OMNIPOL a. s. Analysis

7.11 Other Companies

7.11.1 ERA a.s.

7.11.2Advanced Electronics Company

7.11.3Nutaq

8. Conclusions and Recommendations

9. Glossary

List of Tables

Table 2.1:Global Passive Radar Market Forecast 2020-2030 (US$ Bn, AGR %, CAGR %, Cumulative)

Table 4.1: Global Passive Radar MarketForecast 2020-2030 (US$ Mn, AGR %, CAGR %)

Table 4.2 Table 4.2 Passive Bistatic Radar (PBR) Market Forecast 2020-2030 ($mn, AGR %, CAGR %, Cumulative)

Table 4.3 Passive Multi-Static Radar Market Forecast 2020-2030 ($mn, AGR %, CAGR %, Cumulative)

Table 4.4 Other Market Forecast 2020-2030 ($mn, AGR %, CAGR %, Cumulative)

Table 5.1 Global Passive Radar Market Revenue Forecast by Application 2020-2030 ($mn, AGR %, Cumulative)

Table 5.2 Civilian Aviation Market Forecast 2020-2030 ($mn, AGR %, CAGR %, Cumulative)

Table 5.3 Military Applications Market Forecast 2020-2030 ($mn, AGR %, CAGR %, Cumulative)

Table 5.4 Other Market Forecast 2020-2030 ($mn, AGR %, CAGR %, Cumulative)

Table 6.1 Global Passive Radar Market Revenue Forecast by Geography 2020-2030 (US$mn, AGR %, Cumulative)

Table 6.2 American Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.3 American Passive Radar market Revenue Forecast by country 2020-2030 (US$mn, AGR %, CAGR%)

Table 6.4: American Passive Radar market Revenue Forecast by Type 2020-2030 (US$mn, AGR %, CAGR%)

Table 6.5: American Passive Radar market Revenue Forecast by Application 2020-2030 (US$mn, AGR %, CAGR%)

Table 6.6 US Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.7 Canadian Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.8 Mexico Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.9 European Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.10 European Passive Radar market Revenue Forecast by country 2020-2030 (US$mn, AGR %, Cumulative)

Table 6.11: European Passive Radar market Revenue Forecast by Type 2020-2030 (US$mn, AGR %, CAGR)

Table 6.12: European Passive Radar market Revenue Forecast by Application 2020-2030 (US$mn, AGR %, CAGR%)

Table 6.13 Russia Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.14 UK Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.15 French Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.16 German Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.17 Rest of Europe Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.18 Asia Oceania Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.19 Asia Oceania Passive Radar market Revenue Forecast by country 2020-2030 (US$mn, AGR %, Cumulative)

Table 6.20: Asia Oceania Passive Radar market Revenue Forecast by Type 2020-2030 (US$mn, AGR %, CAGR%)

Table 6.21: Asia Oceania Passive Radar market Revenue Forecast by Application 2020-2030 (US$mn, AGR %, CAGR%)

Table 6.22 China Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.23 India Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.24 Australia Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.25 South Korea Passive Radar market Forecast 2020-2030 ($bn, AGR %, CAGR %, Cumulative)

Table 6.26 Rest of Asia Oceania Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.27 ROW Passive Radar market Forecast 2020-2030 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.28: ROW Passive Radar market Revenue Forecast by Type 2020-2030 (US$mn, AGR %, CAGR%)

Table 6.29: ROW Passive Radar market Revenue Forecast by Application 2020-2030 (US$mn, AGR %, CAGR)

Table 7.1 BAE Systems Overview

Table 7.2: BAE Systems AB Passive Radar Market Products / Services (Product Segment, Product)

Table 7.3 Leonardo S.P.A. Overview

Table 7.4: Leonardo S.P.A. Passive Radar Market Products / Services (Product Segment, Product)

Table 7.5 Lockheed Martin Corporation Company Overview

Table 7.6: Lockheed Martin Corporation Passive Radar Market Products / Services (Product Segment, Product)

Table 7.7 Thales Group overview

Table 7.8 Thales Group Products & Services (Segment of Business, Product, Specification / Features)

Table 7.9 The Raytheon Company overview

Table 7.10 The Raytheon Company Passive Radar Products & Services (Segment of Business, Product, Specification / Features)

Table 7.11 SRC, Inc. Company overview

Table 7.12 SRC, Inc. Passive Radar Products & Services (Segment of Business, Product, Specification / Features)

Table 7.13 HENSOLDT overview

Table 7.14 Hensoldt Passive Radar Products & Services (Segment of Business, Product, Specification / Features)

Table 7.15 RAMET Overview

Table 7.16 Ramet Passive Radar Products & Services (Segment of Business, Product, Specification / Features)

Table 7.17 Indra Sistemas SA Overview

Table 7.18 Indra Sistemas SA Passive Radar Products & Services (Segment of Business, Product, Specification / Features)

Table 7.19 OMNIPOL a. s. Overview

Table 7.20: OMNIPOL a. s. Passive Radar Market Products / Services (Product Segment, Product)

List of Figures

Figure 2.1: Global Passive Radar Market Forecast 2020-2030 (US$ Bn, AGR %)

Figure 4.1 Global Passive Radar Market Forecast by Type 2020-2030 (US$mn)

Figure 4.2 Global Passive Radar Market by Type Share Forecast 2020 (%)

Figure 4.3 Global Passive Radar Market Forecast by Type Share Forecast 2025 (%)

Figure 4.4 Global Passive Radar Market Forecast by Type Share Forecast 2030 (%)

Figure 4.5: Passive Bistatic Radar (PBR) Market Forecast 2020-2030 (US$mn, AGR %)

Figure 4.6: Passive Multi-Static Radar Market Forecast 2020-2030 (US$mn, AGR %)

Figure 4.7: Other Market Forecast 2020-2030 (US$mn, AGR %)

Figure 5.1 Global Passive Radar Market Forecast by Application 2020-2030 (US$ Mn)

Figure 5.2 Global Passive Radar Market by Application Share Forecast 2020 (%)

Figure 5.3 Global Passive Radar Market Forecast by Application Share Forecast 2025 (%)

Figure 5.4 Global Passive Radar Market Forecast by Application Share Forecast 2030 (%)

Figure 5.5: Civilian Aviation Market Forecast 2020-2030 (US$mn, AGR %)

Figure 5.6: Military Applications Market Forecast 2020-2030 (US$mn, AGR %)

Figure 5.7: Other Market Forecast 2020-2030 (US$mn, AGR %)

Figure 6.1 Global Passive Radar Market Forecast by Geography 2020-2030 (US$mn)

Figure 6.2: Global Passive Radar Market Share Forecast by Geography 2020 (%)

Figure 6.3: Global Passive Radar market Share Forecast by Geography 2025 (%)

Figure 6.4: Global Passive Radar market Share Forecast by Geography 2030 (%)

Figure 6.5: American Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.6: The Americas Passive Radar market Forecast by Country 2020-2030 (US$ Mn, AGR (%))

Figure 6.7: The Americas Passive Radar market Share Forecast by Country 2020 (%)

Figure 6.8: The Americas Passive Radar market Share Forecast by Country 2025 (%)

Figure 6.9: The Americas Passive Radar market Share Forecast by Country 2030 (%)

Figure 6.10: The Americas Passive Radar market Forecast by Type 2020-2030 (US$mn)

Figure 6.11: The Americas Passive Radar market Share Forecast by Type 2020 (%)

Figure 6.12: The Americas Passive Radar market Share Forecast by Type 2025 (%)

Figure 6.13: The Americas Passive Radar market Share Forecast by Type 2030 (%)

Figure 6.14: American Passive Radar market Forecast by Application 2020-2030 (US$mn & Total AGR%)

Figure 6.15: American Passive Radar market Share Forecast by Application 2020 (%)

Figure 6.16: American Passive Radar market Share Forecast by Application 2025 (%)

Figure 6.17: American Passive Radar market Share Forecast by Application 2030 (%)

Figure 6.18: US Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.19: Canadian Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.20: Mexico Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.21: European Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.22: European Passive Radar market Forecast by Country 2020-2030 (US$mn)

Figure 6.23: European Passive Radar market Share Forecast by Country 2020 (%)

Figure 6.24: European Passive Radar market Share Forecast by Country 2025 (%)

Figure 6.25: European Passive Radar market Share Forecast by Country 2030 (%)

Figure 6.26: European Passive Radar market Forecast by Type 2020-2030 (US$mn)

Figure 6.27: European Passive Radar market Share Forecast by Type 2020 (%)

Figure 6.28: European Passive Radar market Share Forecast by Type 2025 (%)

Figure 6.29: European Passive Radar market Share Forecast by Type 2030 (%)

Figure 6.30: European Passive Radar market Forecast by Application 2020-2030 (US$mn)

Figure 6.31: European Passive Radar market Share Forecast by Application 2020 (%)

Figure 6.32: European Passive Radar market Share Forecast by Application 2025 (%)

Figure 6.33: European Passive Radar market Share Forecast by Application 2030 (%)

Figure 6.34: Russia Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.35: UK Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.36: French Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.37: German Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.38: Rest of Europe Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.39: Asia Oceania Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.40: Asia Oceania Passive Radar market Forecast by Country 2020-2030 (US$mn)

Figure 6.41: Asia Oceania Passive Radar market Share Forecast by Country 2020 (%)

Figure 6.42: Asia Oceania Passive Radar market Share Forecast by Country 2025 (%)

Figure 6.43: Asia Oceania Passive Radar market Share Forecast by Country 2030 (%)

Figure 6.44: Asia Oceania Passive Radar market Forecast by Type 2020-2030 (US$mn)

Figure 6.45: Asia Oceania Passive Radar market Share Forecast by Type 2020 (%)

Figure 6.46: Asia Oceania Passive Radar market Share Forecast by Type 2025 (%)

Figure 6.47: Asia Oceania Passive Radar market Share Forecast by Type 2030 (%)

Figure 6.48: Asia Oceania Passive Radar market Forecast by Application 2020-2030 (US$mn)

Figure 6.49: Asia Oceania Passive Radar market Share Forecast by Application 2020 (%)

Figure 6.50: Asia Oceania Passive Radar market Share Forecast by Application 2025 (%)

Figure 6.51: Asia Oceania Passive Radar market Share Forecast by Application 2030 (%)

Figure 6.52: China Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.53: India Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.54: Australia Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.55: South Korea Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.56: Rest of Asia Oceania Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.57: ROW Passive Radar market Forecast 2020-2030 (US$m, AGR %)

Figure 6.58: ROW Passive Radar market Forecast by Type 2020-2030 (US$mn)

Figure 6.59: ROW Passive Radar market Share Forecast by Type 2020 (%)

Figure 6.60: ROW Passive Radar market Share Forecast by Type 2025 (%)

Figure 6.61: ROW Passive Radar market Share Forecast by Type 2030 (%)

Figure 6.62: ROW Passive Radar market Forecast by Application 2020-2030 (US$mn)

Figure 6.63: ROW Passive Radar market Share Forecast by Application 2020 (%)

Figure 6.64: ROW Passive Radar market Share Forecast by Application 2025 (%)

Figure 6.65: ROW Passive Radar market Share Forecast by Application 2030 (%)

Figure 7.1 BAE Systems Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 7.2 BAE Systems Revenue, by Business Segment, 2018 (% Share) and Research & Development, 2016-2018 (US$ Bn)

Figure 7.3 Leonardo S.P.A. Revenue, by Business Segment, 2018 and Revenue & Y-o-Y Growth, 2016-2018

Figure 7.4 Lockheed Martin Corporation Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 7.5 Lockheed Martin Corporation Revenue, by Business Segment, 2018 (% Share) and Research & Development, 2016-2018 (US$ Bn)

Figure 7.6 Thales Group Revenue, by Geographic Region, 2019 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 7.7 Thales Group Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Mn)

Figure 7.8 Raytheon Company Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 7.9 Raytheon Company Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Mn)

Figure 7.10 Hensoldt Revenue, by Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 7.11 Indra Sistemas SA Revenue, by Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Companies and Government Organisations Mentioned in This Report