The latest report from business intelligence provider Visiongain offers a comprehensive analysis of the global oil sands market. Visiongain calculates the oil sands market to be worth $86.6bn in 2019 in the current oil price scenario.

Are you fully aware that the oil sands market will experience an upswing in 2019 as as companies continue to expand again after the oil price crash a number of years ago. The extent to which oil sands investment recovers will be highly dependent upon oil prices. Oil sands are towards the top end of the cost spectrum in terms of oil resource development, though there is a significant difference between the breakeven prices of new in-situ and oil sands mining projects. However, operators have an incentive to continue producing from existing oil sands projects, as in nearly all cases operational expenditure per barrel (OPEX/bbl) will be lower than the oil price and most under-construction projects will also be completed due to funds already having been committed.

This is an example of the business critical headline that you need to know about

And more importantly, you need to read visiongain’s objective analysis of how this will impact your company and the industry more generally. How are you and your company reacting to this news? Are you sufficiently informed? By ordering and reading our brand new report today you will be fully informed and ready to act.

Read on to discover how you can exploit the future business opportunities emerging in the oil sands sector – despite the current market contraction. Visiongain’s new study tells you and tells you NOW.

In this brand new report you will receive 120 in-depth tables, the report reveals the key drivers and challenges affecting the oil sands market and provides global, regional and submarkets forecasts and analysis for you to examine.

By ordering and reading this report today, you will be better informed.

What the report contains:

• Global oil sands market forecasts and analysis from 2019-2029

– The report provides detailed sales projections of the market, the competitors, and the commercial drivers and restraints. In addition to market forecasts from 2019-2029, our new study shows current market data, market shares, original critical analysis, and revealing insight into commercial developments

• 120 tables, charts, and graphs

– The analysis provides a thorough assessment of the current and future oil sands market prospects. This analysis will achieve quicker, easier understanding. Also you will gain from our analyst’s industry expertise allowing you to demonstrate your authority on the oil sands sector

• Sales forecasts for the key oil sands submarkets from 2019-2029

– In-situ submarket forecast 2019-2029

– Mining submarket forecast 2019-2029

– Upgrading submarket forecast 2019-2029

• Extensive Project Tables of major oil sands Projects

• Discover market share and profiles of some of the leading companies within the oil sands sector

– Athabasca Oil

– Canadian Natural Resources Ltd

– Canadian oil Sands Ltd

– Cenovus Energy

– Devon Energy Corporation

– Dover Operating Corporation

– Husky Energy Inc.

– Imperial Oil

– Laricina Energy Ltd

– MEG Energy Ltd.

Why you should buy this report

• This report will keep your industry knowledge up to speed. Don’t get left behind

• This report will reinforce strategic decision-making based upon definitive and reliable market data

• You will learn how to exploit new technological trends

• You will be able to realise your company’s full potential within the market

• You will better understand the competitive landscape and identify potential new business opportunities & partnerships

Visiongain’s study is for intended for anyone requiring commercial analyses for the oil sands market and leading companies. You will find data, trends and predictions.

Buy our report today Oil Sands Market Report 2019-2029: Forecasts & Analysis by Method (In Situ, Mining, Upgraders), by Region (North America, Latin America, MEA and RoW) and by Key National Market (including the US, Canada, Venezuela, Brazil and More) Plus Analysis of the Leading Companies in the Sector. Avoid missing out by staying informed – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1 Report Overview

1.1 Global Oil Sands Market Overview

1.2 Global Oil Sands Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Secondary Research

1.7.2 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2 Introduction to the Oil Sands Market

2.1 Global Oil Sands Market Structure

2.2 Oil Sands Market Definition

2.3 Technological Analysis of the North American Oil Sands Industry

2.3.1 Strip Mining Techniques

2.3.2 Cyclic Steam Stimulation (CSS)

2.3.3 Steam Assisted Gravity Drainage (SAGD)

2.3.4 Combustion Overhead Gravity Drainage (COGD)

2.3.5 Vapour Extraction (VAPEX)

2.3.6 Electro-Thermal Dynamic Stripping Process (ET-DSP)

2.3.7 In Situ Combustion (ISC), Fire Flooding or Toe to Heel Air Injection (THAI)

2.4 Global Oil Sands Reserves

2.5 The Economics of Oil Production from Sands

2.6 Exploration & Development of Oil Sands

2.7 Transporting Heavy Oil

3 Global Oil Sand Market 2019-2029

3.1 Global Oil Sand Market Forecast 2019-2029

3.2 Global Oil Sand Market Drivers & Restraints

3.2.1 Rising Oil Prices

3.2.2 Availability of Large Amount of Oil Sand

3.2.3 Source of Job Creation and Government Revenue

3.2.4 High Capital and Operational Expenditure

4 Global Oil Sand Market Forecast by Technique 2019-2029

4.1 Global Oil Sand In Situ Submarket Forecast 2019-2029

4.1.1 Global Oil Sand In Situ Submarket Analysis

4.2 Global Oil Sand Mining Submarket Forecast 2019-2029

4.2.1 Global Oil Sand Mining Submarket Analysis

4.3 Global Oil Sand Upgraders Submarket Forecast 2019-2029

4.3.1 Global Oil Sand Upgraders Submarket Analysis

5 Leading Regional Oil Sand Markets Forecast 2019-2029

5.1 North America Oil Sand Market Forecast 2019-2029

5.1.1 North America Oil Sand Market, By Country 2019-2029

5.2 Latin America Oil Sand Market Forecast 2019-2029

5.2.1 Latin America Oil Sand Market, By Country 2019-2029

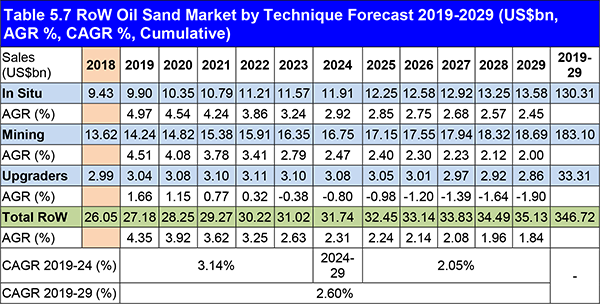

5.3 RoW Oil Sand Market Forecast 2019-2029

5.3.1 RoW Oil Sand Market Overview

6 SWOT Analysis of the Oil Sands Market 2019-2029

7 Company Profiles

7.1 Oil Sands Companies 2019

7.2 Athabasca Oil Corporation

7.2.1 Athabasca Oil Corporation Overview

7.2.2 Athabasca Oil Corporation Sales 2014-2018

7.2.3 Athabasca Oil Corporation Net Income 2014-2018

7.2.4 Athabasca Oil Corporation Key Ratios

7.3 Canadian Natural Resources Ltd.

7.3.1 Canadian Natural Resources Ltd. Overview

7.3.2 Canadian Natural Resources Ltd. Sales 2014-2018

7.3.3 Canadian Natural Resources Ltd. Net Income 2014-2018

7.3.4 Canadian Natural Resources Ltd. Key Ratios

7.4 Canadian Oil Sands Ltd.

7.4.1 Canadian Oil Sands Ltd. Overview

7.4.2 Canadian Oil Sands Ltd. Sales 2014-2018

7.4.3 Canadian Oil Sands Ltd. Net Income 2014-2018

7.4.4 Canadian Oil Sands Ltd. Key Ratios

7.5 Cenovus Energy Inc.

7.5.1 Cenovus Energy Inc. Overview

7.5.2 Cenovus Energy Inc. Sales 2014-2018

7.5.3 Cenovus Energy Inc. Net Income 2014-2018

7.5.4 Cenovus Energy Inc. Key Ratios

7.6 Devon Energy Corporation

7.6.1 Devon Energy Corporation Overview

7.6.2 Devon Energy Corporation Sales 2014-2018

7.6.3 Devon Energy Corporation Net Income 2014-2018

7.6.4 Devon Energy Corporation Key Ratios

7.7 Dover Operating Corporation

7.7.1 Dover Operating Corporation Overview

7.7.2 Dover Operating Corporation Sales 2014-2018

7.7.3 Dover Operating Corporation Net Income 2014-2018

7.7.4 Dover Operating Corporation Key Ratios

7.8 Husky Energy Inc.

7.8.1 Husky Energy Inc. Overview

7.8.2 Husky Energy Inc. Sales 2014-2018

7.8.3 Husky Energy Inc. Net Income 2014-2018

7.8.4 Husky Energy Inc. Key Ratios

7.9 Imperial Oil Ltd.

7.9.1 Imperial Oil Ltd. Overview

7.9.2 Imperial Oil Ltd. Sales 2014-2018

7.9.3 Imperial Oil Ltd. Net Income 2014-2018

7.9.4 Imperial Oil Ltd. Key Ratios

7.10 Laricina Energy Ltd.

7.10.1 Laricina Energy Ltd. Overview

7.11 MEG Energy Ltd.

7.11.1 MEG Energy Ltd. Overview

7.11.2 MEG Energy Ltd. Sales 2014-2018

7.11.3 MEG Energy Ltd. Net Income 2014-2018

7.11.4 MEG Energy Ltd. Key Ratios

7.12 Other Notable Companies in the Oil Sands Market Value Chain

8 Conclusions

9 Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 3.1 Global Oil Sand Market Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.1 Global Oil Sand Market Forecast By Technique 2019-2029 (US$bn, AGR %, Cumulative)

Table 4.2 Global Oil Sand Market CAGR Forecast 2019-2024, 2024-2029, 2019-2029 (CAGR %)

Table 4.3 Global Oil Sand In Situ Submarket by Region Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.4 Oil Sands Project List – In Situ

Table 4.5 Global Oil Sand Mining Submarket by Region Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.6 Oil Sands Project List – Mining

Table 4.7 Global Oil Sand Upgraders Submarket by Region Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.8 Oil Sands Project List – Upgraders

Table 5.1 Leading Regional Oil Sand Market By Technique Forecast 2019-2029 (US$bn, Global AGR %, Cumulative)

Table 5.2 Leading Regional Oil Sand Markets CAGR Forecast 2019-2024, 2024-2029, 2019-2029 (CAGR %)

Table 5.3 North America Oil Sand Market by Technique Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.4 North America Oil Sand Market by Country Forecast 2019-2029 (US$bn, AGR %, Cumulative)

Table 5.5 Latin America Oil Sand Market by Technique Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.6 Latin America Oil Sand Market by Country Forecast 2019-2029 (US$bn, AGR %, Cumulative)

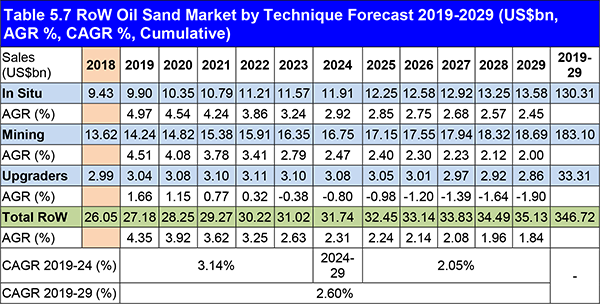

Table 5.7 RoW Oil Sand Market by Technique Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 6.1 Global Oil Sands Market SWOT Analysis 2019-2029

Table 7.1 Oil Sands Market Companies 2019

Table 7.2 Athabasca Oil Corporation Profile 2019 (CEO, HQ, Founded, No. of Employees, Website)

Table 7.4 Athabasca Oil Corporation Sales 2014-2018 (US$m, AGR %)

Table 7.5 Net Income 2014-2018 (US$m, AGR %)

Table 7.7 Canadian Natural Resources Ltd. Profile 2019 (CEO, HQ, Founded, Website)

Table 7.9 Canadian Natural Resources Ltd. Sales 2014-2018 (US$m, AGR %)

Table 7.10 Net Income 2014-2018 (US$m, AGR %)

Table 7.11 Canadian Natural Resources Ltd. Profitibility 2009-2018

Table 7.12 Canadian Oil Sands Ltd. Profile 2019 (CEO, HQ, Founded, Website)

Table 7.14 Canadian Oil Sands Ltd. Sales 2014-2018 (US$m, AGR %)

Table 7.15 Net Income 2014-2018 (US$m, AGR %)

Table 7.16 Canadian Oil Sands Ltd. Profitibility 2009-2018

Table 7.17 Cenovus Energy Inc. Profile 2019 (CEO, Parent Company Sales US$m, Sales in the Market US$m, Business Segment in the Market, HQ, Founded, No. of Employees, Website)

Table 7.19 Cenovus Energy Inc. Sales 2014-2018 (US$m, AGR %)

Table 7.20 Net Income 2014-2018 (US$m, AGR %)

Table 7.21 Cenovus Energy Inc. Profitibility 2009-2018

Table 7.22 Devon Energy Corporation Profile 2019 (CEO, HQ, Founded, No. of Employees, Website)

Table 7.24 Devon Energy Corporation Sales 2014-2018 (US$m, AGR %)

Table 7.25 Net Income 2014-2018 (US$m, AGR %)

Table 7.26 Devon Energy Corporation Profitability 2009-2018

Table 7.27 Dover Operating Corporation Profile 2019 (CEO, HQ, Founded, No. of Employees, Website)

Table 7.28 Dover Operating Corporation Oil Sand Project Name, Bitumen Capacity (thousand barrels per day), Region, Start Up Year, Status, Type (Mining/In Situ)

Table 7.29 Dover Operating Corporation Sales 2014-2018 (US$m, AGR %)

Table 7.30 Net Income 2014-2018 (US$m, AGR %)

Table 7.31 Dover Operating Corporation Profitability 2009-2018

Table 7.32 Husky Energy Inc. Profile 2019 (CEO, HQ, Founded, No. of Employees, Website)

Table 7.34 Husky Energy Inc. Sales 2014-2018 (US$m, AGR %)

Table 7.35 Net Income 2014-2018 (US$m, AGR %)

Table 7.36 Husky Energy Inc. Profitability 2009-2018

Table 7.37 Imperial Oil Ltd. Profile 2019 (CEO, Founded, No. of Employees, Website)

Table 7.39 Imperial Oil Ltd. Sales 2014-2018 (US$m, AGR %)

Table 7.40 Net Income 2014-2018 (US$m, AGR %)

Table 7.41 Imperial Oil Ltd. Profitability 2009-2018

Table 7.42 Laricina Energy Ltd. Profile 2019 (CEO, HQ, Founded, Website)

Table 7.44 MEG Energy Ltd. Profile 2019 (CEO, HQ, Founded, Website)

Table 7.46 MEG Energy Ltd. Sales 2014-2018 (US$bn, AGR %)

Table 7.47 Net Income 2014-2018 (US$bn, AGR %)

Table 7.48 MEG Energy Ltd. Profitability 2009-2018

Table 7.49 Other Notable Companies in the Oil Sands Market Value Chain

List of Figures

Figure 1.1 Global Oil Sands Market Segmentation Overview

Figure 2.1 Global Oil Sands Market Segmentation Overview

Figure 2.2 Adding Value to Bitumen in Terms of Oil Gravity (°API)

Figure 2.3 Energy Content of Bitumen and Other Fuel Products (Kilo Joule/Kilogram)

Figure 3.1 Global Oil Sand Market Forecast 2019-2029 (US$bn, AGR %)

Figure 4.1 Global Oil Sand Market Forecast By Technique 2019-2029 (US$bn, Global AGR %)

Figure 4.2 Global Oil Sand Market Share By Technique 2019 (% Share)

Figure 4.3 Global Oil Sand Market By Technique 2024 (% Share)

Figure 4.4 Global Oil Sand Market Share By Technique Forecast 2029 (% Share)

Figure 4.5 Global Oil Sand In Situ Submarket by Region AGR Forecast 2019-2029 (%)

Figure 4.6 Global Oil Sand In Situ Submarket by Region Forecast 2019-2029 (US$bn, Global AGR %)

Figure 4.7 Global Oil Sand In Situ Submarket by Region 2019, 2024, 2029 (% Share)

Figure 4.8 Global Oil Sand Mining Submarket by Region AGR Forecast 2019-2029 (%)

Figure 4.9 Global Oil Sand Mining Submarket by Region Forecast 2019-2029 (US$bn, Global AGR %)

Figure 4.10 Global Oil Sand Mining Submarket by Region 2019, 2024, 2029 (% Share)

Figure 4.11 Global Oil Sand Upgraders Submarket by Region AGR Forecast 2019-2029 (%)

Figure 4.12 Global Oil Sand Upgraders Submarket by Region Forecast 2019-2029 (US$bn, Global AGR %)

Figure 4.13 Global Oil Sand Upgraders Submarket by Region 2019, 2024, 2029 (% Share)

Figure 5.1 Leading Regional Oil Sand Market AGR Forecast 2019-2029 (AGR %)

Figure 5.2 Leading Regional Oil Sand Markets Forecast 2019-2029 (US$bn, Global AGR %)

Figure 5.3 Leading Regional Oil Sand Market Share Forecast 2019 (% Share)

Figure 5.4 Leading Regional Oil Sand Market Share Forecast 2024 (% Share)

Figure 5.5 Leading Regional Oil Sand Market Share Forecast 2029 (% Share)

Figure 5.7 North America Oil Sand Market By Technique Forecast 2019-2029 (US$bn, Total North America Market Sales AGR %)

Figure 5.8 North America Oil Sand Market By Technique Forecast 2019, 2024, 2029 (% Share)

Figure 5.9 North America Oil Sand Market by Country Forecast 2019-2029 (US$bn, North America AGR %)

Figure 5.10 North America Oil Sand Market by Country Market Share Forecast 2019 (% Share)

Figure 5.11 North America Oil Sand Market by Country Market Share Forecast 2024 (% Share)

Figure 5.12 North America Oil Sand Market by Country Market Share Forecast 2029 (% Share)

Figure 5.13 Latin America Oil Sand Market By Technique Forecast 2019-2029 (US$bn, Total Latin America Market Sales AGR %)

Figure 5.14 Latin America Oil Sand Market By Technique Forecast 2019, 2024, 2029 (% Share)

Figure 5.15 Latin America Oil Sand Market by Country Forecast 2019-2029 (US$bn, Latin America AGR %)

Figure 5.16 Latin America Oil Sand Market by Country Market Share Forecast 2019 (% Share)

Figure 5.17 Latin America Oil Sand Market by Country Market Share Forecast 2024 (% Share)

Figure 5.18 Latin America Oil Sand Market by Country Market Share Forecast 2029 (% Share)

Figure 5.19 RoW Oil Sand Market By Technique Forecast 2019-2029 (US$bn, Total RoW Market Sales AGR %)

Figure 5.20 RoW Oil Sand Market By Technique Forecast 2019, 2024, 2029 (% Share)

Figure 7.1 Athabasca Oil Corporation Sales 2014-2018 (US$m, AGR %)

Figure 7.2 Athabasca Oil Corporation Net Income 2014-2018 (US$m, AGR %)

Figure 7.3 Canadian Natural Resources Ltd. Sales 2014-2018 (US$m, AGR %)

Figure 7.4 Canadian Natural Resources Ltd. Net Income 2014-2018 (US$m, AGR %)

Figure 7.5 Canadian Oil Sands Ltd. Sales 2014-2018 (US$m, AGR %)

Figure 7.6 Canadian Oil Sands Ltd. Net Income 2014-2018 (US$m, AGR %)

Figure 7.7 Cenovus Energy Inc. Sales 2014-2018 (US$m, AGR %)

Figure 7.8 Cenovus Energy Inc. Net Income 2014-2018 (US$m, AGR %)

Figure 7.9 Devon Energy Corporation Sales 2014-2018 (US$m, AGR %)

Figure 7.10 Devon Energy Corporation Net Income 2014-2018 (US$m, AGR %)

Figure 7.11 Dover Operating Corporation Sales 2014-2018 (US$m, AGR %)

Figure 7.12 Dover Operating Corporation Net Income 2014-2018 (US$m, AGR %)

Figure 7.13 Husky Energy Inc. Sales 2014-2018 (US$m, AGR %)

Figure 7.14 Husky Energy Inc. Net Income 2014-2018 (US$m, AGR %)

Figure 7.15 Imperial Oil Ltd. Sales 2014-2018 (US$m, AGR %)

Figure 7.16 Imperial Oil Ltd. Net Income 2014-2018 (US$m, AGR %)

Figure 7.17 MEG Energy Ltd. Sales 2014-2018 (US$bn, AGR %)

Figure 7.18 MEG Energy Ltd. Net Income 2014-2018 (US$bn, AGR %)

Alberta Oilsands Inc

Athabasca Oil Corporation

Baytex Energy

BP

Canadian Natural Resources Ltd.

Canadian Oil Sands Ltd.

Cenovus Energy Inc.

Chevron

ConocoPhillips

Deloro Resources Ltd.

Devon Energy Corporation

Earth Energy Resources Inc.

E-T Energy

ExxonMobil Corporation

GreenRiver Resources

Habanero Resources

Husky Energy Inc.

Imperial Oil Ltd.

Ivanhoe Energy Inc.

Koch Oil Sands Operating ULC

Korea National Oil Corp. (KNOC)

Laricina Energy Ltd.

Legacy Oil & Gas

MEG Energy Ltd.

Mocal Energy Ltd.

Mullen Group Ltd.

Murphy Oil Corporation

North American Energy Partners Inc.

North West Upgrading Inc.

Occidental Petroleum Corporation

Opti Canada Inc.

OSUM Oil Sands Corporation

Pan Orient Energy Corporation

Pengrowth Energy

Penn West Exploration

Perpetual Energy Inc.

Petrobank Energy & Resources Inc.

Petrobras

Petro-Canada

ProSep Inc.

Saipem SpA

Sinopec Corporation

Talisman Energy Inc.

Tesoro Corporation

Titanium Corporation Inc.

URS Flint Energy Services Ltd.

UTS Energy Corporation

Value Creation, Inc.

Willbros Group, Inc.