Visiongain has forecasted that the global Offshore Oil & Gas Decommissioning market will see a capital expenditure (CAPEX) of $8,279 million in 2020. Decommissioning of ageing offshore oil and gas projects has increased substantially over the past few years. Moreover, over 600 projects along the Gulf of Mexico, the North Sea and Asia Pacific are likely to be disposed of over the next five to six years. This, in turn, is projected to drive the global offshore oil and gas decommissioning market over the forecast period. Increasing stringent decommissioning regulation are projected to play a crucial role to promote the growth in this market over the next 10 years. Offshore decommissioning is highly complex and potentially has a vast environmental impact. It is also a global industry, and therefore understanding regulations worldwide are essential for companies operating within the market. Crucially, the development of regulation in the offshore decommissioning market has the ability to impact the rate at which the market grows and also how much-decommissioning processes are going to cost.

Read on to discover the potential business opportunities available.

With such established global offshore oil and gas fields, decommissioning becomes increasingly pertinent. As global offshore oil and gas fields mature, ageing structures must be removed. With the average lifetime of an offshore oil and gas field in the region of 25 to 40 years, this leaves many global structures in need of decommissioning. The cost involved in the decommissioning varies from project to project and coast to coast. The majority of costs are associated with the jacket, topside and subsea structure removal phases and well P&A. Decommissioning projects are highly complex, lengthy and expensive; the process involves many different stages and can take more than a decade to complete. With such environmental, economic and social pressures, the offshore decommissioning market is set to drastically increase, creating substantial business opportunities along the way.

There are hundreds of companies who either possess offshore oil and gas assets that will need to be decommissioned over the next decade, or who provide consultancy, engineering and other services to the decommissioning industry. Therefore, the following list of companies is by no means exhaustive. Companies have been broken down into three groups: oil and gas companies with offshore assets; decommissioning contractors; and decommissioning consultancies.

Leading Companies in the Offshore Oil & Gas Decommissioning Market

Oil and Gas Companies with Offshore Assets:

• Apache Corporation

• BP

• Canadian Natural Resources (CNR)

• Chevron Corporation

• ConocoPhillips

• Eni

• ExxonMobil Corporation

• Petronas

• PTTEP Australasia

• Royal Dutch Shell

• Statoil

• Total S.A.

Visiongain’s global Offshore Oil & Gas Decommissioning market report can keep you informed and up to date with the developments in the market, across four different regions: The Gulf of Mexico and North America, the North Sea, Asia Pacific and Rest of the World.

With reference to this report, it details the key investments trend in the global market, subdivided by regions, capital and operational expenditure and project type. Through extensive secondary research and interviews with industry experts, Visiongain has identified a series of market trends that will impact the Offshore Oil & Gas Decommissioning market over the forecast timeframe.

The report will answer questions such as:

• How is the offshore oil & gas decommissioning market evolving?

• What is driving and restraining the offshore oil & gas decommissioning market?

• How will each offshore oil & gas decommissioning submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2029?

• How will the market shares for each offshore oil & gas Decommissioning submarket develop from 2019 to 2029?

• What will be the main driver for the overall market from 2019 to 2029?

• Will leading offshore oil & gas decommissioning markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

• How will the market shares of the national markets change by 2029 and which geographical region will lead the market in 2029?

• Who are the leading players and what are their prospects over the forecast period?

• What are the decommissioning projects for these leading companies?

• How will the industry evolve during the period between 2019 and 2029?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides forecasts for the Global Offshore Oil & Gas Decommissioning market, by TYPE, for the period 2020-2030

• Well P&A CAPEX 2020-2030

• Jackside & Topside Removal CAPEX 2020-2030

• Others CAPEX 2020-2030

2) The report also forecasts and analyses the global Offshore Oil & Gas Decommissioning market by Regions from 2020-2030

• Gulf of Mexico and North America CAPEX 2020-2030

• North Sea CAPEX 2020-2030

• Asia-Pacific CAPEX 2020-2030

• Rest of the World CAPEX 2020-2030

Among the regions, the North Sea region is estimated to account for 48.65% of the world offshore oil and gas decommissioning market in 2020 while the Gulf of Mexico and North America region is projected to be a second largest region for the decommissioning of offshore oil and gas platforms. The Gulf of Mexico is anticipated to experience a large number of oil and gas platforms being decommissioned over the next 10 years. The North Sea region is projected to be the largest region, and it is expected to grow at a CAGR of 5.5% over the period of 2020 to 2025 and 2.95% over the period of 2025 to 2030.

3) The report reveals global regulations and agreements affecting the Offshore Oil and Gas Decommissioning Industry:

4) The report includes Leading Companies analysis in the Offshore Oil & Gas Decommissioning Market Companies

• Companies with Offshore Assets

• Decommissioning Contractors

• Decommissioning Consultancies

5) The report provides detailed profiles of the leading companies operating within the Offshore Oil & Gas Decommissioning market:

• BP Plc

• Canadian Natural Resources

• Chevron Corporation

• ConocoPhillips

• ExxonMobil Corporation

• Total S.A.

• Royal Dutch Shell Plc

• ENI

This independent 156-page report guarantees you will remain better informed than your competitors. With 116 tables and figures examining the Offshore Oil & Gas Decommissioning market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure by Type and by Region, as well as in-depth profiles of Companies that will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Oil and Gas sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 Global Offshore Oil & Gas Decommissioning Market Overview

1.2 Global Offshore Oil & Gas Decommissioning Market Segmentation

1.3 Market Definition

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Why You Should Read This Report?

1.7 Who is This Report For?

1.8 Methodology

1.9 Frequently Asked Questions (FAQ)

1.10 Associated Visiongain Reports

1.11 About Visiongain

2. Introduction and Brief History of Offshore Oil & Gas Decommissioning

2.1 What are the stages of Offshore Oil & Gas Decommissioning?

2.1.1 Project Planning and Permitting

2.1.2 Well Plugging and Abandonment (P&A)

2.1.3 Pipeline Cleaning and Decommissioning

2.1.4 Jacket and Topsides Removal

2.1.5 Onshore Disposal

2.1.6 Site Clearance

2.1.7 Continued Monitoring

2.2 Classification of On Shore Facilities

3. Global Offshore Oil & Gas Decommissioning Market: What are the Global Market Dynamics?

3.1 Drivers and Restraints

3.2 Drivers: What are the Factors Promoting the Growth in the Offshore Oil & Gas Decommissioning Market?

3.2.1 Aging of Oil and Gas Fields and Offshore Infrastructure

3.2.2 Crude Oil Prices

3.3 Visiongain’s Oil Price Assumptions and Forecast

3.3 Decommissioning Options: Survey Outcome

4. Global Regulations Regarding the Offshore Oil and Gas Decommissioning Industry

4.1 1958 Geneva Convention on the Continental Shelf

4.2 1972 London Dumping Convention

4.3 1982 United Nations (UN) Law of the Sea Convention

4.4 International Maritime Organization (IMO) Guidelines

5. Offshore Oil & Gas Decommissioning Markets Forecasts, by Type 2020-2030

5.1 Offshore Oil & Gas Decommissioning of Well P&A Market Forecast 2020 2030

5.2 Jackside & Topside Removal Offshore Oil & Gas Decommissioning Market Forecast 2020 2030

5.3 Other Offshore Oil & Gas Decommissioning Market Forecast 2020 2030

6. Offshore Oil & Gas Decommissioning Market Forecast, by Region 2020-2030

6.1 Which Geographic Regional Offshore Oil & Gas Decommissioning Markets Share Forecast 2020-2030

6.2 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Forecast 2020-2030

6.2.1 North American Regulations

6.2.2 Notice to Lessees and Operators on “Idle Iron”

6.2.3 National Artificial Reef Plan

6.2.4 What is the Structure of the Gulf of Mexico Offshore Oil and Gas Decommissioning Market?

6.2.5 What are the Market Dynamics of the Gulf of Mexico Offshore Oil and Gas Decommissioning Market?

6.2.6 What is the Scenario of Offshore Oil & Gas Decommissioning in Gulf of Mexico and North America Market by Type?

6.2.7 Which is the Largest Market among the Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market 2020-2030?

6.3 North Sea Offshore Oil & Gas Decommissioning Market Forecast 2020-2030

6.3.1 Characteristics of the North Sea Offshore Oil and Gas Decommissioning Market

6.3.2 Historical Trends in the North Sea Offshore Oil and Gas Decommissioning Market

6.3.3 European Regulations

6.3.5 Which is the Largest Market among the North Sea Offshore Oil & Gas Decommissioning Market 2020-2030?

6.4 Asia-Pacific Offshore Oil & Gas Decommissioning Market Forecast 2020-2030

6.4.1 Characteristics of the Asia-Pacific Offshore Oil and Gas Decommissioning Market

6.4.2 What are the Dynamics in Asia-Pacific’s Offshore Oil & Gas Decommissioning Market?

6.4.3 What is the Scenario of Offshore Oil & Gas Decommissioning in the Asia-Pacific Market by Type?

6.4.4 Which is the Largest Market among the Asia-Pacific Offshore Oil & Gas Decommissioning Market?

6.5 RoW Offshore Oil & Gas Decommissioning Market Forecast 2020-2030

6.5.1 What is the Scenario of Offshore Oil & Gas Decommissioning in the RoW market by Type?

6.5.2 Which is the Largest Market among the RoW Offshore Oil & Gas Decommissioning Market?

7. PEST Analysis of the Global Offshore Oil and Gas Decommissioning Market

8. Leading Companies in the Offshore Oil & Gas Decommissioning Market

8.1 Oil and Gas Companies with Offshore Assets

8.2 BP PLC

8.2.1 BP Company Highlights, 2019

8.2.2 BP Company Performance

8.2.3 BP Recent Developments

8.3 Canadian Natural Resources Limited

8.3.1 Canadian Natural Resources Recent Developments

8.3.2 Canadian Natural Resources Company Performance

8.3.3 Canadian Natural Resources Recent Developments

8.4 Chevron Corporation

8.4.1 Chevron Corporation Company Performance

8.4.2 Chevron Corporation Recent Developments

8.5 ConocoPhillips

8.5.1 ConocoPhillips Company Highlights, 2019

8.5.2 ConocoPhillips Company Performance

8.5.3 ConocoPhillips Recent Developments

8.6 ExxonMobil Corporation

8.6.1 ExxonMobil Company Highlights, 2019

8.6.2 ExxonMobil Company Performance

8.6.3 ExxonMobil Recent Developments

8.7 Total S.A.

8.7.1 Total S.A. Company Highlights

8.7.2 Total S.A. Company Performance

8.7.3 Total S.A. Recent Developments

8.8 Royal Dutch Shell PLC

8.8.1 Royal Dutch Shell PLC Company Highlights, 2019

8.8.2 Royal Dutch Shell PLC Company Performance

8.8.3 Royal Dutch Shell PLC Recent Developments

8.9 ENI

8.9.1 ENI Company Performance

8.10 Leading Decommissioning Contractors

8.11 Leading Decommissioning Consultancies

9. Conclusions and Recommendations

9.1 Key Findings

9.2 Recommendations

10. Glossary

Draft Decommissioning Programmes Under Consideration

Approved Decommissioning Programmes

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 3.1 Visiongain’s Anticipated Brent Crude Oil Price, 2019, 2020-2022, 2023-2025, 2026-2030 ($/bbl)

Table 5.1 Global Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn, AGR (%), CAGR (%), 2020-2030

Table 5.2 Global Well P&A Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 5.3 Global Jackside & Topside Removal Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 5.4 Global Other Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.1 Regional Offshore Oil & Gas Decommissioning Markets Forecasts ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.2 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.3 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.4 The Gulf of Mexico Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.5 Rest of NA Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.6 North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.7 North Sea Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.8 UK North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.9 Norwegian North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.10 Denmark Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.11 Netherlands Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.12 Rest of North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.13 Asia-Pacific Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.14 Asia-Pacific Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.15 China Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.16 Japan Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.17 Australia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.18 Indonesia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.19 Malaysia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.20 Rest of APAC Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.21 RoW Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.22 RoW Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.23 Latin America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.24 Middle East and Africa Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 7.1 PEST Analysis of the Global Offshore Oil and Gas Decommissioning Market 2020-2030

Table 8.1 BP PLC Profile 2019 (CEO, Total Company Revenue US$m, Decommissioning Liabilities $m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.2 Canadian Natural Resources Limited Profile 2019 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.3 Chevron Corporation Profile 2019 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.4 ConocoPhillips Company Profile 2019 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.5 ExxonMobil Corporation Profile 2019 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.6 Total S.A. Profile 2019 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.7 Royal Dutch Shell plc Profile 2019 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.8 ENI 2019 (CEO, Total Company Revenue US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.9 ENI Total Company Revenue 2012-2019 (US$m, AGR %)

Table 8.10 Leading Decommissioning Contractors

Table 8.11 Leading Decommissioning Consultancies

List of Figures

Figure 1.1 Global Offshore Oil & Gas Decommissioning Market Segmentation

Figure 2.1 Stages in Offshore Oil and Gas Decommissioning?

Figure 3.1 Global Offshore Oil & Gas Decommissioning Market Drivers and Restraints 2020-2030

Figure 4.1 Global Legislation Regarding the Offshore Oil and Gas Decommissioning Market

Figure 5.1 Global Offshore Oil & Gas Decommissioning Market Forecast ($Mn, AGR (%), 2020-2030

Figure 5.2 Global Well P&A Offshore Oil & Gas Decommissioning Market by Region Forecast ($Mn, AGR (%), 2020-2030

Figure 5.3 Global Jackside & Topside Removal Offshore Oil & Gas Decommissioning Market by Region Forecast ($Mn), AGR (%), 2020-2030

Figure 5.4 Global Other Offshore Oil & Gas Decommissioning Market by Region Forecast ($Mn), AGR (%), 2020-2030

Figure 6.1 Regional Offshore Oil & Gas Decommissioning Markets Forecasts ($Mn, AGR (%), 2020-2030

Figure 6.2 Regional and Leading National Offshore Oil & Gas Decommissioning Markets Forecasts (AGR (%), 2020-2030

Figure 6.3 Regional Offshore Oil & Gas Decommissioning Markets Share Forecast (% Share), 2020

Figure 6.4 Regional Offshore Oil & Gas Decommissioning Markets Share Forecast (% Share), 2025

Figure 6.5 Regional Offshore Oil & Gas Decommissioning Markets Share Forecast (% Share), 2030

Figure 6.6 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.7 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.8 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.9 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market By Country (% Share), 2020

Figure 6.10 The Gulf of Mexico Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.11 The Gulf of Mexico Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.12 Rest of NA Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.13 Rest of NA Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.14 North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.15 North Sea Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.16 North Sea Offshore Installations by Country (%) 2020

Figure 6.17 North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.18 North Sea Offshore Oil & Gas Decommissioning Market by Country (% Share), 2020

Figure 6.19 UK North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.20 UK North Sea Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.21 Norwegian North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

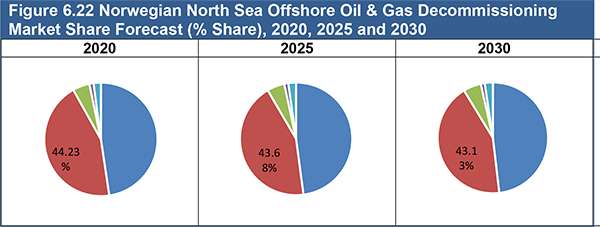

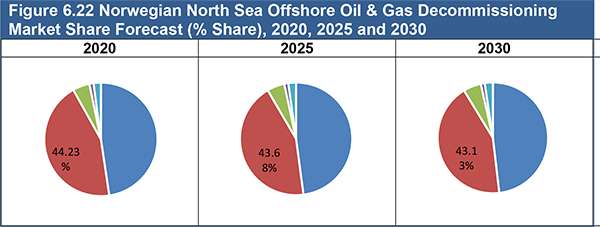

Figure 6.22 Norwegian North Sea Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.23 Denmark Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.24 Denmark Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.25 Netherlands Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.26 Netherlands Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.27 Rest of North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.28 Rest of North Sea Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.29 Asia-Pacific Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.30 Asia-Pacific Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.31 Asia-Pacific Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.32 Asia-Pacific Offshore Oil & Gas Decommissioning Market by Country (% Share), 2020

Figure 6.33 China Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.34 China Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.35 Japan Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.36 Japan Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.37 Australia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.38 Australia Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.39 Indonesia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.40 Indonesia Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.41 Malaysia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.42 Malaysia Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.43 Rest of APAC Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.44 Rest of APAC Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.45 RoW Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.46 RoW Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.47 RoW Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.48 RoW Offshore Oil & Gas Decommissioning Market by Region (% Share), 2020

Figure 6.49 Latin America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.50 Latin America Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 6.51 Middle East and Africa Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2020-2030

Figure 6.52 Middle East and Africa Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2020, 2025 and 2030

Figure 8.1 Business Performance of BP PLC, 2015-2019, $Mn

Figure 8.2 Business Performance of BP PLC, By Business Segments, 2019, %share

Figure 8.3 Business Performance of Canadian Natural Resources Limited, 2015-2019, $Mn

Figure 8.4 Business Performance of Chevron Corporation, 2015-2019, $Mn

Figure 8.5 Business Performance of Chevron Corporation, By Business Segments, 2019, %share

Figure 8.6 Company Revenue of ConocoPhillips Company, 2015-2019, $Mn

Figure 8.7 Business Performance of ConocoPhillips Company, By Product, 2019, %Share

Figure 8.8 Business Performance of ConocoPhillips Company, By Geography, 2019, %Share

Figure 8.9 Total Company Revenue of ExxonMobil Corporation, 2015-2019, $Mn

Figure 8.10 Business Performance of ExxonMobil Corporation, By Business Segments, 2019, %share

Figure 8.11 Total Company Revenue of Total S.A., 2015-2019, $Mn

Figure 8.12 Business Performance of Total S.A., By Business Segments, 2019, %share

Figure 8.13 Total Company Revenue of Royal Dutch Shell plc, 2015-2019, $Mn

Figure 8.14 Business Performance of Royal Dutch Shell plc, By Business Segments, 2019, %share

Figure 8.15 ENI Total Company Revenue 2012-2019 (US$m, AGR %)