Industries > Energy > Next Generation Energy Storage Technologies (EST) Market Forecast 2020-2030

Next Generation Energy Storage Technologies (EST) Market Forecast 2020-2030

Analysis of Technology Maturity, Performance & Commercialisation of Mechanical (Innovative Pumped Hydro Storage (PHS), Advanced Adiabatic Compressed Air Energy Storage (AA-CAES), Isothermal CAES & Liquid Air Energy Storage (LAES)), Chemical (Hydrogen Storage & Fuel Cells), Electrical (Superconducting Magnetic Energy Storage (SMES)), Electrochemical (Lithium-Air, Lithium-Sulphur, Lithium-Ion, Magnesium-Ion & Zinc-Air Batteries) & Thermal Technologies for Renewable Energy Sources (RES) Integration

This 257-page report addresses the development of the global next generation energy storage technologies market, analysing the prospects for 4 technology submarkets and regional markets, and including next gen EST capacity forecasts for the period 2020-2030. It is essential reading for stakeholders in the power networks and energy storage markets. Do not miss an opportunity to remain informed of key market dynamics and investment opportunities. Contact us to learn more about the report today.

Did you know?

– Global next generation energy storage technologies are expected to reach a capacity of 5,460.6 MW IN 2019

-Mechanical and Electrochemical sub-markets are expected to be the fastest growing sectors in the Energy Storage market.

– The need to decarbonize electricity sector globally will contribute to widespread deployment of ESTs

– The regulatory environment will play a critical role in the potential of ESTs in the US

– BRICS countries are projected to have the highest growth in the next-generation energy storage market.

5 Reasons why you must order and read this report today:

• Global Next-Generation Energy Storage Capacity (MW) And Value ($m) Forecasts From 2020-2030

Next Generation Energy Storage Technologies (EST) Capacity Forecasts (MW) From 2020-2030

• Mechanical Technologies Forecast 2020-2030

• Chemical Technologies Forecast 2020-2030

• Electrical Technologies Forecast 2020-2030

• Electrochemical Technologies Forecast 2020-2030

• Thermal Technologies Forecast 2020-2030

Regional Next-Generation Energy Storage Value ($bn) Forecasts From 2020-2030 Covering

• Europe Forecast 2020-2030

• North America Forecast 2020-2030

• China and Japan Forecast 2020-2030

• Rest of the World Forecast 2020-2030

Regional Next-Generation Energy Storage Capacity (MW) Forecasts From 2020-2030 Covering

• USA and Canada Forecast 2020-2030

• EU 5 Forecast 2020-2030

• Rest of Europe Forecast 2020-2030

• BRICS Forecast 2020-2030

• Asia-Pacific Forecast 2020-2030

• Rest of World 2020-2030

• Profile Of 13 Leading Companies In The Next-Generation Energy Storage Sector

• Johnson Controls

• LG Chem Ltd.

• Duke Energy Corporation

• NextEra Energy Inc.

• Edison International

• Samsung SDI Co. Ltd.

• Mitsubishi Electric Corporation

• BYD Co. Ltd.

• Robert Bosch GmbH

• ABB Group

• Tesla Inc.

• CATL Corporation

• Panasonic Corporation

• Interview with Brian Perusse and Taylor Sloane from Fluence Energy LLC, a company formed by Siemens and AES.

The Next Generation Energy Storage Technologies (EST) Market Forecast 2020-2030 report is intended for industry professional to help them fully understand the technological developments and their true market potential.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 Global Next-Generation Energy Storage Technologies Market Overview

1.2 Market Definition

1.3 Why You Should Read This Report

1.4 Benefits of This Report

1.5 Structure of This Report

1.6 Key Questions Answered by This Report

1.7 Who is This Report For?

1.8 Methodology

1.8.1 Primary Research

1.8.2 Secondary Research

1.8.3 Market Sizing

1.8.4 Forecasting

1.8.5 Visiongain’s Added Value

1.9 Frequently Asked Questions (FAQ’s)

1.10 Associated Visiongain Reports

1.11 About Visiongain

2. Introduction to Established and Emerging Energy Storage Technologies

2.1 Categorisation of Energy Storage Technologies

2.2 Installed Energy Storage Capacity

2.3 The Rise of Emerging Energy Storage Technologies

3. The Drivers and Restraints of Next-Generation Energy Storage Technologies

3.1 An Introduction to the Dynamics of the Market

3.2 The Factors that Will Drive and Restrain the Market

3.2.1 Rising Energy Prices Indirectly Incentivise ESTs

3.2.2 Investments in Research, Development, and Demonstration

3.2.3 The Importance of Renewable Energy Integration

3.2.4 Smart Grids and Distributed Power Generation Systems

3.2.5 Growing Electricity Demand

3.2.6 The Developing Alternative Vehicle Market as a Growth Factor

3.2.7 The High Capital Costs of Emerging Energy Storage Technologies

3.2.8 Limited Cost Recovery Opportunities

3.2.9 The Policy and Regulatory Challenges Ahead

3.2.10 The Impact of Weak Market Demand for ESTs

3.2.11 Geographical and Spatial Constraints of Mature Energy Storage Technologies

3.2.12 The Need for Large-Scale Demonstration Projects

3.2.13 Raw Material Availability

3.2.14 Technology Development and Deployment Patterns

3.2.15 The Limitations of Established Energy Storage Technologies

3.2.16 Long Investment Cycles

3.2.17 Opportunities for Home Energy Storage and Arbitrage

3.3 Global Next Generation Energy Storage Technologies Market Forecast By Technologies 2020-2030

4. Next-Generation Mechanical Energy Storage Technologies 2020-2030

4.1 Innovative Pumped Hydro Storage Market

4.1.1 An Introduction to Innovative Pumped Hydro Storage

4.1.2 The Nature of the Innovation

4.1.3 The Performance Characteristics of Innovative PHS Installations

4.1.4 The Applications and Key Competitors of Innovative PHS

4.1.5 Current Deployment of Innovative PHS

4.1.6 Drivers and Restraints of Innovative PHS

4.1.7 The Outlook for Innovative PHS

4.1.8 Companies and Stakeholders Involved in the Innovative PHS Market

4.2 Adiabatic and Isothermal Compressed Air Energy Storage

4.2.1 An Introduction to Adiabatic and Isothermal Compressed Air Energy Storage

4.2.2 The Nature of the Innovation

4.2.3 The Performance Characteristics of Adiabatic and Isothermal CAES

4.2.4 The Applications and Key Competitors of Advanced CAES

4.2.5 Current Deployment of Compressed Air Energy Storage

4.2.6 Drivers and Restraints of Advanced Compressed Air Energy Storage

4.2.7 The Outlook for Advanced Compressed Air Energy Storage

4.2.8 Companies and Stakeholders Involved in the Advanced CAES Market

4.3 Liquid-Air Energy Storage (LAES)

4.3.1 An Introduction to Liquid-Air Energy Storage

4.3.2 The Nature of the Innovation

4.3.3 The Performance Characteristics of Liquid-Air Energy Storage

4.3.4 The Applications and Key Competitors of Liquid-Air Energy Storage

4.3.5 Current Deployment of Liquid-Air Energy Storage

4.3.6 Drivers and Restraints of the Liquid-Air Energy Storage Market

4.3.7 The Outlook for Liquid-Air Energy Storage

4.3.8 Companies and Stakeholders Involved in the Liquid-Air Energy Storage Market

5. Next-Generation Chemical Energy Storage Technologies 2020-2030

5.1 Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.1 An Introduction to Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.2 The Nature of the Innovation

5.1.3 The Performance Characteristics of Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.4 The Applications and Key Competitors of Large-Scale Hydrogen Storage Systems and Hydrogen Fuel Cells

5.1.5 Current Deployment of Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.6 Drivers and Restraints of Large-Scale Hydrogen Storage Systems and Hydrogen Fuel Cells

5.1.7 The Outlook for Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.8 Companies and Stakeholders Involved in the Hydrogen and Fuel Cells Energy Storage Market

6. Next-Generation Electrical Energy Storage Technologies Analysis

6.1 Superconducting Magnetic Energy Storage (SMES)

6.1.1 An Introduction to SMES

6.1.2 The Nature of the Innovation

6.1.3 The Performance Characteristics of Superconducting Magnetic Energy Storage

6.1.4 The Applications and Key Competitors of Superconducting Magnetic Energy Storage

6.1.5 Current Deployment of Superconducting Magnetic Energy Storage

6.1.6 Drivers and Restraints of Superconducting Magnetic Energy Storage

6.1.7 The Outlook for Superconducting Magnetic Energy Storage

6.1.8 Companies and Stakeholders Involved in the Superconducting Magnetic Energy Storage Market

7. Next-Generation Electrochemical Energy Storage Technologies 2020-2030

7.1 An Introduction to Next-Generation Battery Technologies

7.2 The Key Drivers of Innovation in the Market

7.3 Key Patterns of Innovation in the Market

7.4 Lithium-air (Li-Air)

7.4.1 Nature of the Innovation

7.4.2 The Performance Characteristics of Lithium-Air Batteries

7.4.3 The Applications and Key Competitors of Lithium-Air Batteries

7.4.4 Current Deployment of Lithium-Air Batteries

7.4.5 The Drivers and Restraints of the Lithium-Air Batteries Market

7.4.6 The Outlook for Lithium-Air Batteries

7.4.7 Key Companies and Stakeholders Involved in the Lithium-Air Battery Market

7.5 Lithium-Sulphur (Li-S)

7.5.1 Nature of the Innovation

7.5.2 The Performance Characteristics of Lithium-Sulphur Batteries

7.5.3 The Applications and Key Competitors of Lithium-Sulphur Batteries

7.5.4 Current Deployment of Lithium-Sulphur Batteries

7.5.5 The Drivers and Restraints of the Lithium-Sulphur Battery Market

7.5.6 The Outlook for Lithium-Sulphur Batteries

7.5.7 Key Companies and Stakeholders Involved in the Lithium-Sulphur Battery Market

7.6 Magnesium-Ion (Mg-ion)

7.6.1 Nature of the Innovation

7.6.2 The Performance Characteristics of Magnesium-Ion Batteries

7.6.3 The Applications and Key Competitors of Magnesium-Ion Batteries

7.6.4 Current Deployment of Magnesium-Ion Batteries

7.6.5 The Drivers and Restraints of Magnesium-Ion Batteries

7.6.6 The Outlook for Magnesium-Ion Batteries

7.6.7 Key Companies and Stakeholders Involved in the Magnesium-Ion Battery Market

7.7 Zinc-Air (Zn-air)

7.7.1 Nature of the Innovation

7.7.2 The Performance Characteristics of Zinc-Air Batteries

7.7.3 The Main Applications and Key Competitors of Zinc-Air Batteries

7.7.4 Current Deployment of Zinc-Air Batteries

7.7.5 The Drivers and Restraints of the Zinc-Air Battery Market

7.7.6 The Outlook for Zinc-Air Batteries

7.7.7 Key Companies and Stakeholders in the Zinc-Air Battery Market

7.8 Concluding Remarks on Emerging Battery Storage Technologies

8. Next-Generation Thermal Energy Storage Technologies 2020-2030

8.1 An Introduction to Next-Generation Thermal Battery Storage Technologies

9. Expert Opinion

9.1 Brian Perusse, Taylor Sloane – Fluence Energy

9.1.1 About Fluence Energy

9.1.2 The Future of the Industry

9.1.3 Fluence Energy Future Plans

10. PESTEL Analysis of the Next-Generation Energy Storage Market

11. Established and Emerging Energy Storage Technologies, a Comparative Analysis

12. The Global Landscape of the Emerging Energy Storage Technologies Market 2020-2030

12.1 Next-Generation Energy Storage Technologies Capital Expenditures Outlook 2020-2030

12.2. Next Generation Energy Storage Technologies Capacity Outlook per Region 2020-2030

12.2.1 Next-Generation Energy Storage Technologies in US and Canada 2020-2030

12.2.2 Next-Generation Energy Storage Technologies in the 5 Major European Countries 2020-2030

12.2.3 Next-Generation Energy Storage Technologies in the rest of European Countries 2020-2030

12.2.4 Next-Generation Energy Storage Technologies in BRICS 2020-2030

12.2.5 Next-Generation Energy Storage Technologies in Asia-Pacific

12.2.6 Next-Generation Energy Storage Technologies in the Rest of World.

13. The Leading Companies in the Next-Generation Energy Storage Technologies Market

13.1 Johnson Controls

13.1.1 Johnson Controls Net Company Revenue 2013-2018

13.1.2 Johnson Controls Revenue in the Energy Storage Technologies Market 2013-2018

13.2 LG Chem Ltd.

13.2.1 LG Chem Ltd. Total Company Revenue 2014-2018

13.3 Duke Energy Corporation

13.3.1 Duke Energy Corporation Total Company Sales 2013-2018

13.3.2 Duke Energy Corporation Total Company Revenues in the Energy Storage Technologies Market 2014-2017

13.4 NextEra Energy, Inc.

13.4.1 NextEra Energy, Inc. Total Company Operating Revenue 2013-2018

13.4.2 NextEra Energy, Inc. Operating Revenue in the Renewable Technologies Market 2013-2018

13.5 Edison International

13.5.1 Edison International Total Company Operating Revenues 2013-2018

13.6 Samsung SDI Co. Ltd.

13.6.1 Samsung SDI Co. Ltd. Total Company Sales 2013-2018

13.6.2 Samsung SDI Co. Ltd. Revenue from LI-Ion Batteries 2015-2018

13.7 Mitsubishi Electric Corporation

13.7.1 Mitsubishi Electric Corporation Total Company Revenue 2013-2019

13.7.2 Mitsubishi Electric Corporation Revenue from Energy and Electric Systems 2013-2019

13.8 BYD Co. Ltd.

13.8.1 BYD Co. Ltd. Total Company Revenue 2013-2018

13.8.2 BYD Co. Ltd. Revenue from Rechargeable Battery and Photovoltaic 2013-2018

13.9 Robert Bosch GmbH

13.9.1 Robert Bosch GmbH Total Company Revenue 2013-2018

13.9.2 Robert Bosch GmbH Revenue from Energy and Building technology 2013-2018

13.10 ABB Group

13.10.1 ABB Group Total Company Revenue 2013-2018

13.10.2 ABB Group Revenue in the Electrification Products Market 2014-2018

13.11 Tesla, Inc.

13.11.1 Tesla Inc. Total Company Revenue 2013-2018

13.11.2 Tesla Inc. Revenues in the Energy Generation and Storage Market 2016-2018

13.12 Panasonic Corporation

13.12.1 Panasonic Corporation Total Company Revenue 2013-2019

13.12.2 Panasonic Corporation Revenue in the Automotive and Industrial Systems Market 2013-2019

13.13 CATL Corporation

13.13.1 CATL Corporation Total Company Revenue 2014-2018

13.13.2 CATL Corporation Revenue in the Battery Systems Market 2014-2018

13.13 Other Companies Involved in the Next-Generation Energy Storage Technologies Market 2019

14. Conclusions and Recommendations

14.1 Drivers and Restraints of the Next-Generation Energy Storage Technologies Market

14.2 The Outlook for Innovative Pumped Hydro Storage

14.3 The Outlook for Advanced Compressed-Air Energy Storage

14.4 The Outlook for Liquid-Air Energy Storage

14.5 The Outlook for Large-Scale Hydrogen Storage Systems and Hydrogen Fuel Cells

14.6 The Outlook for Superconducting Magnetic Energy Storage

14.7 The Outlook for Next-Generation Batteries

14.8 The Outlook for Thermal Energy Storage

15. Glossary

List of figures

Figure 1.1 Next-Generation Energy Storage Technologies Market Overview

Figure 1.2 Development Stage of Different Energy Storage Technologies

Figure 1.3 The Performance Characteristics of Advanced and Conventional CAES (Lifecycle-Years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 2.1 Energy Storage Technologies Categorisation

Figure 2.2 Electricity Storage Matrix: EST Characteristics and Requirements of Key Applications

Figure 2.3 Global EST Market Structure Overview

Figure 2.4 Global Energy Storage Capacity by EST type (GW) 2000-2017

Figure 2.5 Global Energy Storage Capacity by EST type (GW) 2001-2017 (Excluding Pumped Hydro Storage)

Figure 2.6 Key Next-Generation EST Market Structure Overview

Figure 2.7 EST Overview of Types of Applications

Figure 3.1 Industrial Electricity Price History in France, Germany, Italy, UK, Japan, Canada, Spain and the USA 1990-2018 (Pence/kWh)

Figure 3.2 Industrial Electricity Prices for Medium-Sized Industries in European Countries 2007-2018 (EUR/kWh)

Figure 3.3 Industrial Electricity Prices for Medium-Sized Industries in Germany, Spain, France and the United Kingdom 2007-2018 (EUR/kWh)

Figure 3.4 Total Public Energy RD&D Spending of IEA Members 1974-2018 (% of Total RD&D Spending on Energy-Related Projects)

Figure 3.5 Evolution of Total Public Energy RD&D Spending by Selected IEA members 2008-2018 ($m)

Figure 3.6 The Scale and Composition of Installed RES in selected Countries and Regions (GW)

Figure 3.7 Electricity Generated from Renewable Sources, EU28, 1990-2017(TWh, % of Consumption)

Figure 3.8 Number of FCEVs expected to operate in the US, South Korea, Japan and Europe, 2020

Figure 3.9 Technology and Innovation Adoption Lifecycle

Figure 4.1 Global Next Generation Energy Storage Technologies Market Forecast, By Mechanical Energy Storage Technology 2020-2030 (MW, AGR %)

Figure 4.2 Main Types of PHS Installations

Figure 4.3 Evolution of Installed Capacity in the Open-Loop, Closed-Loop and Innovative PHS Submarkets (1926-2015, MW)

Figure 4.4 Main Patterns of Innovation in the Global PHS Sector

Figure 4.5 Average Capacity of Existing and Planned PHS Installations 2020-2030 (Submarket, MW)

Figure 4.6 The Performance Characteristics of Innovative PHS (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardized for all Emerging Technologies

Figure 4.7 Main Applications of Innovative PHS

Figure 4.8 Main Competitors of Innovative PHS

Figure 4.9 Key Market Spaces for Innovative PHS

Figure 4.10 Evolution of Installed Capacity in the Innovative PHS Submarket 1966 - 2020 (MW)

Figure 4.11 Total CAPEX on Innovative PHS by National Market (Cumulative to 2019 $m)

Figure 4.12 Structure of the CAES Market

Figure 4.13 Round-Trip Efficiency of Conventional Diabatic CAES and Advanced CAES (%)

Figure 4.14 The Performance Characteristics of Advanced and Conventional CAES (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 4.15 Main Applications of Advanced Compressed Air Energy Storage

Figure 4.16 Main Competitors of Advanced Compressed Air Energy Storage

Figure 4.17 Key Market Spaces for Advanced CAES

Figure 4.18 Installed CAES Capacity by Category: Diabatic, Isothermal and Adiabatic (MW, % of total)

Figure 4.19 Anticipated progress of AA-CAES through the pilot stage onto commercialisation (2014-2020)

Figure 4.20 Selection of Stakeholders and Companies Involved in the Advanced Compressed Air Energy Storage Market

Figure 4.21 The Stages Involved in Liquid Air Energy Storage

Figure 4.22 Round-Trip Efficiency of Liquid Air Energy Storage Variants (Standalone, Integrating Waste Heat and Integrating Waste Cold, %)

Figure 4.23 The Performance Characteristics of Liquid Air Energy Storage (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 4.24 Main Applications of Liquid Air Energy Storage

Figure 4.25 Main Competitors of Liquid Air Energy Storage

Figure 4.26 Key Market Spaces for Liquid Air Energy Storage

Figure 4.27 The Historic and Expected Development of Liquid Air Energy Storage (Conceptualization to Commercialization, 2004-2022)

Figure 4.28 Selection of Stakeholders and Companies Involved in the Liquid Air Energy Storage Market

Figure 5.1 Global Next Generation Energy Storage Technologies Market Forecast, By Chemical Energy Storage Technology 2020-2030 (MW, AGR%)

Figure 5.2 The Fundamentals of Hydrogen Storage and Hydrogen Fuel Cells

Figure 5.3 The Round-Trip Efficiency of Hydrogen Storage by Pathway Variant (Electricity > Gas > Electricity and Heat, Electricity > Gas > Electricity and Electricity > Gas) (%)

Figure 5.4 The Performance Characteristics of Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells (Lifecycle-Years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 5.5 Main Applications of Large-Scale Hydrogen Storage Systems and Hydrogen Fuel Cells

Figure 5.6 Main Competitors of Large-Scale Hydrogen Storage Systems

Figure 5.7 Main Competitors of Hydrogen Fuel Cells

Figure 5.8 Key Market Spaces for Hydrogen Storage and Hydrogen Fuel Cells

Figure 5.9 Cumulative FCEV in Circulation in Leading National and Regional Markets (2013-2018)

Figure 5.10 Hydrogen Fueling Stations in Operation in Leading National and Regional Markets as of 2018

Figure 5.11 The Main Types of Hydrogen Storage

Figure 5.12 Existing and Planned Hydrogen Infrastructure in Leading Global Markets (Hydrogen Fueling Stations) 2018-2025

Figure 5.13 Existing and Planned Fuel Cell Vehicles (Hydrogen Fueling Stations) 2018-2025

Figure 5.14 Existing Alternative Refueling Infrastructure, United States, 2018

Figure 5.15 Selection of Stakeholders and Companies Involved in the Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells Market

Figure 6.1 Variants of SMES technology

Figure 6.2 The Performance Characteristics of Superconducting Magnetic Energy Storage (Lifecycle-Years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 6.3 Main Applications for Superconducting Magnetic Energy Storage

Figure 6.4 Main Competitors of Superconducting Magnetic Energy Storage

Figure 6.5 Key Market Spaces for Superconducting Magnetic Energy Storage

Figure 6.6 Selection of Stakeholders and Companies Involved in the Superconducting Magnetic Energy Storage Market

Figure 7.1 Global Next Generation Energy Storage Technologies Market Forecast, By Electrochemical Energy Storage Technology 2020-2030 (MW, AGR%)

Figure 7.2 Key Emerging Battery Chemistries

Figure 7.3 Li-air Categorisation by Electrolyte

Figure 7.4 The Performance Characteristics of Lithium-Air Batteries (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 7.5 The Performance Characteristics of Lithium-Sulphur Batteries (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 7.6 Main Types of Applications of Lithium-Sulphur Batteries

Figure 7.7 Key Market Spaces for Lithium-Sulphur Batteries

Figure 7.8 Selection of Stakeholders and Companies Involved in the Lithium-Sulphur battery Market

Figure 7.9 Selection of Stakeholders and Companies Involved in the Magnesium-Ion Battery Market

Figure 7.10 The Performance Characteristics of Zinc-Air (Lifecycle-Years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 7.11 Main Applications of Zinc Air Batteries

Figure 7.12 Selection of Stakeholders and Companies Involved in the Zinc-Air Battery Market

Figure 8.1 Global Next Generation Energy Storage Technologies Market Forecast, By Thermal Energy Storage Technology 2020-2030 (MW, AGR %)

Figure 11.1 EST Characteristics and Requirements of Key Applications

Figure 11.2 Cost and Backup Time Comparison of Power Quality Energy Storage Technologies Except for Pumped Storage (Euro/kWh & hours)

Figure 11.3 Comparison of the Round-trip Efficiency of Key Established and Emerging Energy Storage Technologies (%)

Figure 12.1 Global Next Generation Energy Storage Technologies Market Forecast, By Region 2019-2030 (USD $bn, AGR %)

Figure 12.2 Key National Markets Involved in the Development of Next-Generation Energy Storage Technologies

Figure 12.3 Overview of the Energy Storage Technology Capacity per Region 2019.

Figure 12.4 Overview of the Key Next-Generation ESTs Under Development in North America

Figure 13.1 Top Companies Latest Revenues Overview (2018-2019)

Figure 13.2 Johnson Controls Net Company Revenue 2013-2018 (US$m, AGR %)

Figure 13.3 Johnson Controls Net Sales in the Energy Storage Technologies 2013-2018 (US$m, AGR %)

Figure 13.4 LG Chem Ltd. Total Company Revenue 2014-2018 (US$m, AGR %)

Figure 13.5 Duke Energy Corporation Total Company Revenue 2013-2018 (US$m, AGR %)

Figure 13.6 Duke Energy Corporation Revenues in the Energy Storage Technologies Market 2015-2018 (US$m, AGR %)

Figure 13.7 NextEra Energy, Inc. Operating Revenue 2013-2018 (US$m, AGR %)

Figure 13.8 NextEra Energy, Inc. Operating Revenue in the Renewable Technologies Market 2013-2018 (US$m, AGR %)

Figure 13.9 Edison International Total Company Operating Revenues 2013-2018 (US$m, AGR %)

Figure 13.10 Samsung SDI Co. Ltd. Total Company Revenue 2013-2018 (US$m, AGR %)

Figure 13.11 Samsung SDI Co. Ltd. Revenue from LI-Ion Market 2015-2018 (US$m, AGR %)

Figure 13.12 Mitsubishi Electric Corporation Total Company Revenue 2013-2019 (US$m, AGR %)

Figure 13.13 Mitsubishi Electric Corporation Revenue from Energy and Electric Systems 2013-2019 (US$m, AGR %)

Figure 13.14 BYD Co. Ltd Total Company Revenue 2013-2018 (US$m, AGR %)

Figure 13.15 BYD Co. Ltd Revenue from Rechargeable Battery and Photovoltaic 2013-2018 (US$m, AGR %)

Figure 13.16 Robert Bosch GmbH Total Company Revenue 2013-2018 (US$m, AGR %)

Figure 13.17 Robert Bosch GmbH Revenue from Energy and Building Technology 2013-2018 (US$m AGR%)

Figure 13.18 ABB Group Total Company Revenue 2013-2018 (US$m, AGR %)

Figure 13.19 ABB Group Revenue in the Electrification Products Market 2014-2018 (US$m, AGR %)

Figure 13.20 Tesla Inc. Total Company Revenue 2013-2018 (US$m, AGR %)

Figure 13.21 Tesla Inc. Revenue in the Energy Generation and Storage Market 2016-2018 (US$m, AGR %)

Figure 13.22 Panasonic Corporation Total Company Revenue 2013-2019 (US$m, AGR %)

Figure 13.23 Panasonic Corporation Revenue in the Automotive & Industrial Systems Market 2013-2019 (US$m, AGR %)

Figure 13.24 CATL Corporation Total Company Revenue 2014-2018 (US$m, AGR %)

Figure 13.25 CATL Corporation Revenue in the Battery Systems Market 2014-2018 (US$m, AGR %)

Figure 14.1 Next-Generation Energy Storage Technologies Market Overview

Figure 14.2 Development Stage of Different Energy Storage Technologies

Figure 14.3 Anticipated progress of AA-CAES through the pilot stage onto Commercialisation (2014-2020)

Figure 14.4 The historical Development of Liquid Air Energy Storage (Conceptualization to Commercialization, 2004-2022)

Figure 14.5 Existing and Planned Hydrogen Infrastructure in Leading Global Markets 2018-2025 (Hydrogen Fueling Stations)

List of Tables

Table 1.1 Example of Standardised Metric Used for the Comparison of Energy Storage Technologies in Radial Graphs Presented Throughout This Report

Table 2.1 Global Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 2.2 List and Description of Main EST Applications

Table 3.1 Recent Demonstration Projects Funded by ARRA (Name, EST, MW Size, $m Cost, Planned Application)

Table 3.2 Global EST Market Drivers & Restraints

Table 3.3 Global Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 4.1 Global Next Generation Energy Storage Technologies Market Forecast, By Mechanical Energy Storage Technology 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 4.2 PHS main characteristics (Lifetime, Capacity MW, Efficiency %, Maturity)

Table 4.3 List of all Operating Innovative Pumped Hydro Installations (Name, Location, Capacity MW, Type, Commissioning)

Table 4.4 Pumped Hydro Storage (PHS) Market Drivers & Restraints

Table 4.5 List of all Planned Innovative Pumped Hydro Installations (Name, Location, Capacity MW, Type, Commissioning)

Table 4.6 Performance Characteristics of Conventional and Advanced CAES (Lifetime, Capacity MW, Efficiency %, Maturity)

Table 4.7 Installed CAES Capacity by National Market (MW)

Table 4.8 Key Diabatic and Adiabatic Compressed Air Energy Projects (Name, Location, Capacity MW, Type, Commissioning)

Table 4.9 Advanced CAES Market Drivers & Restraints

Table 4.10 Project Details for the Poleggio-Loderio Pilot AA-CAES Plant (Name, Location, Companies and Organisations Involved, Capacity kW, Type, Commissioning Date)

Table 4.11 The Main Characteristics of Liquid Air Energy Storage (Lifetime, Capacity MW, Efficiency %, Maturity)

Table 4.12 Drivers and Restraints of the LAES technology

Table 5.1 Global Next Generation Energy Storage Technologies Market Forecast, By Chemical Energy Storage Technology 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 5.2 Hydrogen Main Characteristics (Lifetime, Capacity, Efficiency, Maturity)

Table 5.3 Large Scale Hydrogen Energy Storage and Hydrogen Fuel Cell Drivers & Restraints

Table 6.1 Performance characteristics SMES (Lifetime, Capacity MW, Efficiency %, Maturity)

Table 6.2 Drivers & Restraints of the SMES Market

Table 7.1 Global Next Generation Energy Storage Technologies Market Forecast, By Electrochemical Energy Storage Technology 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 7.2 Main Performance Characteristics of Lithium-Air Batteries (Energy density, Cycle life, Efficiency, Maturity)

Table 7.3 Lithium-Air Batteries Market Drivers & Restraints

Table 7.4 Main Performance Characteristics of Lithium-Sulphur Batteries (Energy Density, Cycle Life, Efficiency, Maturity)

Table 7.5 Lithium-Sulphur Batteries Market Drivers and Restraints

Table 7.6 Main Performance Characteristics for Magnesium Ion Batteries (Energy Density, Cycle Life, Efficiency, Maturity)

Table 7.7 Magnesium-Ion Batteries Market Drivers & Restraints

Table 7.8 Main Performance Characteristics of Zinc-Air Batteries (Energy Density, Cycle Life, Efficiency, Maturity)

Table 7.9 Zinc-Air Batteries Market Drivers & Restraints

Table 8.1 Global Next Generation Energy Storage Technologies Market Forecast, By Thermal Energy Storage Technology 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 10.1 PESTEL Analysis of the Emerging EST Market

Table 11.1 Comparison of Key Established and Emerging Energy Storage Technologies (Maturity, Capacity, Efficiency, Lifecycle)

Table 11.2 The Development Stage and Challenges of Established and Emerging Energy Storage Technologies

Table 12.1 Global Next Generation Energy Storage Technologies Market Forecast, By Region 2020-2030 ($bn, AGR %, CAGR %, Cumulative)

Table 12.2 Major Markets Investing in Next-Generation Energy Storage Technologies

Table 12.3 US and Canada Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 12.4 US and Canada Next-Generation EST Market Drivers & Restraints

Table 12.5 EU5 Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW AGR %, CAGR %, Cumulative)

Table 12.6 Rest of Europe Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 12.7 EU 5 and Rest of Europe Next-Generation EST Market Drivers & Restraints

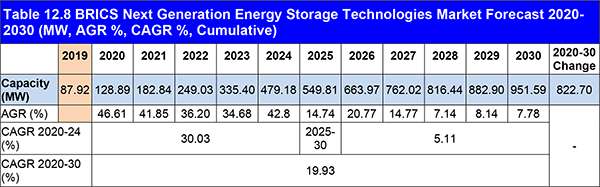

Table 12.8 BRICS Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 12.9 BRICS Next-Generation EST Market Drivers & Restraints

Table 12.10 Asia-Pacific Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 12.11 Rest of World Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 13.1 Johnson Controls 2019 (CEO, Total Company Revenue US$m, Revenue Related to EST US$m, Share of Revenue Related to EST %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.2 Johnson Controls Net Company Revenue 2013-2018 (US$m, AGR %)

Table 13.3 Johnson Controls Revenue in the Energy Storage Technologies Market 2013-2018 (US$m, AGR %)

Table 13.4 LG Chem Ltd. 2018 (CEO, Total Company Revenue US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.5 LG Chem Ltd. Total Company Revenue 2014-2018 (US$m, AGR %)

Table 13.6 Duke Energy Corporation Profile 2019 (CEO, Total Company Revenue US$m, Revenue from the storage Market US$m, Share of Company Sales from Energy Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.7 Duke Energy Corporation Total Company Revenue 2013-2018 (US$m, AGR %)

Table 13.8 Duke Energy Corporation Revenue in the Energy Storage Technologies Market 2015-2018 (US$m, AGR %)

Table 13.9 NextEra Energy, Inc. Profile 2018 (CEO, Total Operating Revenue US$m, Sales in the Renewable Energy Market US$m, Share of Company Sales from Renewable Energy %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.10 NextEra Energy, Inc. Operating Revenue 2013-2018 (US$m, AGR %)

Table 13.11 NextEra Energy, Inc. Operating Revenue in the Renewable Technologies Market 2013-2018 (US$m, AGR %)

Table 13.12 Edison International 2018 (CEO, Total Company Revenue US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.13 Edison International Total Operating Revenues 2013-2018 (US$m, AGR %)

Table 13.14 Samsung SDI Co. Ltd. 2018 (CEO, Total Company Revenue US$m, Revenue from Li-Ion Battery US$m, Share of Company Sales from Li-Ion %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.15 Samsung SDI Co. Ltd. Total Company Revenue 2013-2018 (US$m, AGR %)

Table 13.16 Samsung SDI Co. Ltd. Revenue from LI-Ion Market 2015-2018 (US$m, AGR %)

Table 13.17 Mitsubishi Electric Corporation Profile 2019 (CEO, Total Company Revenue US$m, Revenue from Energy and Electric Systems US$m, Share of Company Sales from Energy and Electric Systems %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.18 Mitsubishi Electric Corporation Total Company Revenue 2013-2019 (US$m, AGR %)

Table 13.19 Mitsubishi Electric Corporation Revenue from Energy and Electric Systems 2013-2019 (US$m, AGR %)

Table 13.20 BYD Co. Ltd Profile 2018 (CEO, Total Company Revenue US$m, Revenue from Rechargeable Battery and Photovoltaic, Share of Revenue from Rechargeable Battery and Photovoltaic %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.21 BYD Co. Ltd Total Company Revenue 2013-2018 (US$m, AGR %)

Table 13.22 BYD Co. Ltd Revenue from Rechargeable Battery and Photovoltaic 2013-2018 (US$m, AGR %)

Table 13.23 Robert Bosch GmbH Profile 2018 (CEO, Total Company Revenue US$m, Revenue from Energy and Building Technology US$m, Share of Company Sales from Energy and Building Technology %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website

Table 13.24 Robert Bosch GmbH Total Company Revenue 2013-2018 (US$m, AGR %)

Table 13.25 Robert Bosch GmbH Revenue from Energy and Building Technology 2013-2018 (US$m, AGR %)

Table 13.26 ABB Group Profile 2018 (CEO, Total Company Revenue US$m, Revenue from the Electrification Products Market (US$m), Share of Company Sales from Electrification Products Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.27 ABB Group Total Company Revenue 2013-2018 (US$m, AGR %)

Table 13.28 ABB Group Revenue in the Electrification Products 2014-2018 (US$m, AGR %)

Table 13.29 Tesla Inc. Profile 2018 (CEO, Total Company Revenue US$m, Revenue from the Energy Generation and Storage Market (US$m), Share of Company Revenue from the Energy Generation and Storage Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.30 Tesla Inc. Total Company Revenue 2013-2018 (US$m, AGR %)

Table 13.31 Tesla Inc. Revenue Energy Generation and Storage Market 2016-2018 (US$m, AGR %)

Table 13.32 Panasonic Corporation Profile 2019 (CEO, Total Company Revenue US$m, Revenue from the Automotive & Industrial Systems (US$m), Share of Company Revenue from the Automotive & Industrial Systems %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.33 Panasonic Corporation Total Company Revenue 2013-2019 (US$m, AGR %)

Table 13.34 Panasonic Corporation Revenue in the Automotive & Industrial Systems Market 2013-2019 (US$m, AGR %)

Table 13.35 CATL Corporation Profile 2019 (CEO, Total Company Revenue US$m, Revenue from the Battery Systems Market (US$m), Share of Company Sales from Battery Systems Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.36 CATL Corporation Total Company Revenue 2014-2018 (US$m, AGR %)

Table 13.37 CATL Corporation Revenue in the Battery Systems Market 2014-2018 (US$m, AGR %)

Table 13.38 Other Companies Involved in the Next Generation Energy Storage Technologies Market 2019 (Company, Location)

Table 14.1 Global Next Generation Energy Storage Technologies Market Forecast 2020-2030 (MW, AGR %, CAGR %, Cumulative)

Table 14.2 Global Next Generation Energy Storage Technologies Market Forecast, By Region 2020-2030 ($bn, AGR %, CAGR %, Cumulative)

Table 14.3 Global Next Generation EST Market Drivers & Restraints

24M Technologies Inc.

A123 Systems

ABB Group

Advanced Microgrid Solutions

AES Energy Storage

Aggreko

Air Liquide

Air Products

Airbus Defence and Space

ALACAES

Alpig

Amber Kinetics

Ambri

Ameresco Inc.

American Electric Power

ARPA-E

Axpo

Ballard Power Systems

Beacon Power

Bosch Energy Storage Solutions, LLC.

Bruker

BYD Co. Ltd

Centrica

China Electrical Power Research Institute (CEPRI)

Chubu Electric

Clean Energy Storage Inc.

Con Edison

Daimler AG

Demand Energy

DLR

Dressen-Rand

Duke Energy Corporation

Dynapower Company LLC

E.ON

Eagle Crest Energy

EDF

EDF Renewable Energy

Edison Energy Group.

Edison International

EGP North America

Electric Power Development

eMotorWorks

Enel Green Power

Enel Group

Enel X

Ener1

Enercom

Energias de Portugal

EnerNOC

Engie

EnZinc

Eos Energy Storage

Eos Systems

Florida Power & Light (FPL) Company

Fluidic Energy

Fraunhofer IOSB

Fujikura

Furukawa Electric

General Compression

General Electric

General Motors

Greensmith (Wärtsilä)

Grid Logic

Gridflex Energy LLC Principals

GTM

Highview Power Storage

Hitachi

Honda

Hydrogenics Corporation

Hydrostor

Hyundai

IBM

Illwerke AG

Invenergy LLC

ITM Power

Johnson Controls

J-Power

KWO Grimselstrom

Kyushu Electric Power

LG Chem Ltd.

Linde

llwerke AG

Lockheed Martin Energy

Magnum Energy Storage

Maxwell Technologies

Mercedes-Benz

Mitsubishsi Electric Corporation

National Grid

NextEra Energy Resources, LLC (NEER)

NextEra Energy, Inc. (NEE)

Nissan

Norsk Hydro

NRG

Nuvation Energy

OXIS Energy

Pacific Gas And Electric

Panasonic

Peak Hour Power

Pellion Technologies

Phinergy

PowerSecure Inc.

Proinso

Proton Motor

PSE&G

RES group

ReVolt Technology

Robert Bosch GmbH

RWE

S&C Electric

Samsung SDI Co. Ltd

Sharp Electronics

Siemens

Sion Power

SNC

Sony

Southern California Edison

Starwood Energy Group

State Grid Corporation of China (SGCC)

Sungrow

Sunwoda Electronic Co., Ltd.

Super-conductor Technologies

SuperPower

SustainX

Tesla

Texas Dispatchable Wind

The Linde Group

Thüga Group

Toyota

Trina Energy Storage Solutions CO. Ltd.

Uniper

UTC

Valence Technology

Verbund

Viridor

Volkswagen

Younicos

ZAF Energy Systems

Zhangbei National Wind and Solar Energy Storage

Züblin

Organisations Mentioned

Advanced Research Projects Agency-Energy (ARPA-E)

Brookhaven National Laboratory

California Public Utility Commission (CPUC)

Cambridge University

Canadian Ministry of Energy

China Electrical Power Research Institute (CEPRI)

Energy Information Administration (EIA)

European Consortium for Lithium-Sulphur power for Space Environments

Federal Association of Energy Storage (BVES)

Federal Energy Regulatory Commission (FERC)

FP7 (The 7th Framework Programme for Research and Technological Development)

Fraunhofer Center for Energy Storage

Fraunhofer Society

Fuel Cell Bus Club

Fuel Cells and Hydrogen (FCH) Joint Technology Initiative (JTI)

German National Research Center for Aeronautics

Hessian Ministry for the Environment, Energy, Agriculture and Consumer Protection

High Energy Research Organisation

International Atomic Energy Agency (IAEA)

International Energy Agency (IEA)

Joint Technology Initiative

Korea Institute of Energy Research (KIER)

Ministry of Economy, Trade and Industry (METI)

Ministry of Industry and Information Technology (MIIT)

San Onofre Community Engagement Panel (CEP)

Swiss Federal Office of Energy

Texas Center for Superconductivity

Toyota Research Institute of North America (TRINA)

UK Department of Energy and Climate Change (DECC)

UNFCCC

Universität Magdeburg-

US Department of Energy (DOE)

Vehicle Technologies Office (VTO)

Download sample pages

Complete the form below to download your free sample pages for Next Generation Energy Storage Technologies (EST) Market Forecast 2020-2030

Related reports

-

Lithium Iron Phosphate Battery Market Report 2020-2030

Are you aware that global Lithium Iron Phosphate Battery market spending reached $7,284.4 million in 2019? ...Full DetailsPublished: 27 March 2020 -

The Electric Power Transmission & Distribution (T&D) Infrastructure Market Forecast 2018-2028

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Electric Power Transmission & Distribution (T&D)...

Full DetailsPublished: 06 March 2018 -

Gigafactory Market Report 2020-2030

Recent rapid improvements in lithium-ion (Li-ion) battery costs and performance, coupled with growing demand for electric vehicles (EVs) and increased...

Full DetailsPublished: 09 September 2020 -

Wave and Tidal Energy Market Report 2019-2029

In contrast to wave technology, the tidal stream, which transforms kinetic energy into electricity, saw greater R&D investments. Factors such...

Full DetailsPublished: 01 January 1970 -

Global Energy Infrastructure Resilience Market Forecast 2020-2030

Are you aware that global energy infrastructure resillience market spending reached $8,901.8 million in 2019?

...Full DetailsPublished: 24 March 2020 -

Energy Storage Technologies (EST) Market Report 2021-2031

One of the major factor expected to positively influence demand is rising installation of renewable energy plus storage integration. Growing...Full DetailsPublished: 12 March 2021 -

Advanced Energy Storage Systems Market Report 2019-2029

Distributed energy storage systems enhance system resilience, prevent blackouts and surges, and increase end user overall reliability while saving them...

Full DetailsPublished: 01 January 1970 -

Zero Net Energy Buildings Market 2020-2030

Visiongain’s analysis indicates that total revenue on Zero Net Energy Buildings Market will be $15,057.2 million in 2020 as environmental...

Full DetailsPublished: 31 March 2020 -

Grid-Scale Battery Storage Technologies Market Forecast 2019-2029

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Grid Scale Battery Storage market. Visiongain...

Full DetailsPublished: 06 June 2019 -

Flywheel Energy Storage Systems Market Report 2021-2031

High demand for long lasting, reliable, and ecologically sound energy storage systems to support advanced energy storage applications is expected...Full DetailsPublished: 13 November 2020

Download sample pages

Complete the form below to download your free sample pages for Next Generation Energy Storage Technologies (EST) Market Forecast 2020-2030

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024