Industries > Pharma > Latin American Pharmaceutical Market Outlook 2018-2028

Latin American Pharmaceutical Market Outlook 2018-2028

Brazil, Mexico, Venezuela, Argentina, Colombia, Chile, Rest of Latin America, Generics, OTC, Biosimilars, Originator Drugs

The Latin American Pharmaceutical Market is expected to grow at a CAGR of 9.3% in the first half of the forecast period. In 2017, the Brazilian Pharmaceutical market accounted for 35.1% of the Latin American Pharmaceutical market.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 150-page report you will receive 69 tables and 60 figures– all unavailable elsewhere.

The 150-page report provides clear detailed insight into the Latin American Pharmaceutical Market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• Latin American Pharmaceutical Market forecasts from 2018-2028

• This report also breaks down the revenue forecast for the Latin American Pharmaceutical Market by Submarket:

– Generics

– OTC

– Biosimilars

– Originator Drugs

• This report also breaks down the revenue forecast for the Latin American Pharmaceutical Market by Country:

– Brazil

– Mexico

– Venezuela

– Argentina

– Colombia

– Chile

– Rest of Latin America

Each country is further segmented into Generics, OTC, Biosimilars and Originator Drugs.

• Our study provides a SWOT Analysis of the Latin American Pharmaceutical Market.

• Our study discusses the selected leading companies that are the major players in the Latin American Pharmaceutical Market:

– Pfizer

– Bayer

– Sanofi

– Novartis

– EMS

Visiongain’s study is intended for anyone requiring commercial analyses for the Latin American Pharmaceutical Market. You find data, trends and predictions.

Buy our report today Latin American Pharmaceutical Market Outlook 2018-2028: Brazil, Mexico, Venezuela, Argentina, Colombia, Chile, Rest of Latin America, Generics, OTC, Biosimilars, Originator Drugs.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Latin American Pharmaceutical Market: Overview

1.2 Latin American Pharmaceutical Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Main Questions Answered by This Study

1.6 Who is This Investigation For?

1.7 Research and Analysis Methods

1.8 Frequently Asked Questions (FAQs)

1.9 Some Associated Reports

1.10 About Visiongain

2. Introduction to the Latin American Pharmaceutical Market

2.1 Introduction to the Global Pharmaceutical Market

2.2 The Latin American Pharmaceutical Market 2017

2.2.1 Definition of Latin America

2.2.2 Regional Trade Bodies and Intergovernmental Organisations

2.2.2.1 Mercado Común del Sur/Mercado Comum do Sul (Mercosur)

2.2.2.2 The Andean Community (CAN)

2.2.2.3 The Union of South American Nations (USAN)

2.2.2.4 The Pacific Alliance

2.2.2.5 Bolivarian Alliance for the Peoples of Our America (ALBA)

3. The Latin American Pharmaceutical Market, 2018-2028

3.1 The Latin American Pharmaceutical Market Forecast, 2018-2028

3.2Factors Affecting the Latin American Pharmaceutical Market

3.2.1 Population Growth and Ageing

3.2.2 Economic Conditions

3.2.3 Trans-Pacific Partnership (TPP)

3.3 The Latin American Pharmaceutical Market Breakdown, 2018-2028

3.3.1 The Latin American Generic Drugs Market Forecast, 2018-2028

3.3.2 The Latin American OTC Market Forecast, 2018-2028

3.3.3 The Latin American Biosimilars Market Forecast, 2018-2028

3.3.4 Latin American Originator Drugs Market Forecast, 2018-2028

3.4 SWOT Analysis of the Latin American Pharmaceutical Market, 2018-2028

3.4.1 Strengths

3.4.1.1 One of the Quickest Growing Markets Globally

3.4.1.2 Increasing Incidence of Chronic Diseases

3.4.1.3 Ageing Population

3.4.1.4 Increasing Investment in Health Care Systems

3.4.2 Weaknesses

3.4.2.1 Poor Economic Performance and Devalued Currencies

3.4.2.2 Weak Regulation

3.4.2.3 Weak IP Protection

3.4.3 Opportunities

3.4.3.1 Emerging Biosimilars Market

3.4.3.2 Regional Pharmaceutical Companies Could Expand Outside Latin America

3.4.3.3 Increased Trade Liberalisation Could Open More Markets

3.4.4 Threats

3.4.4.1 Pharmaceutical Companies from Other Emerging Markets Could Challenge Regional Firms

3.4.4.2 Increased Protectionist Measures Could Severely Harm the Industry

3.4.4.3 Further Economic Problems and Currency Devaluations Possible

4. Latin American National Markets, 2018-2028

4.1 Latin American National Markets, 2017

4.2 Latin American National Pharmaceutical Market Forecasts, 2018-2028

4.3 Leading National Markets Shares of the Latin American Pharmaceutical Market

4.3.1 Leading National Markets Shares of the Latin American Pharmaceutical Market, 2017

4.3.2 Leading National Markets Shares of the Latin American Pharmaceutical Market, 2023

4.3.3 Leading National Markets Shares of the Latin American Pharmaceutical Market, 2028

5. The Brazilian National Pharmaceutical Market, 2018-2028

5.1 The Brazilian National Pharmaceutical Market, 2017

5.2 The Brazilian National Pharmaceutical Sub-Market Forecasts, 2018-2028

5.2.1 The Brazilian National Pharmaceutical Market Forecast, 2018-2028

5.2.2The Brazilian Generic Drugs Market Forecast, 2018-2028

5.2.3 The Brazilian OTC Market Forecast, 2018-2028

5.2.4 The Brazilian Biosimilars Market Forecast, 2018-2028

5.2.5 The Brazilian Originator Drugs Market Forecast, 2018-2028

5.3 The Brazilian National Pharmaceutical - Current Currency Fluctuations

6. The Mexican National Pharmaceutical Market, 2018-2028

6.1 The Mexican National Pharmaceutical Market, 2017

6.2 The Mexican National Pharmaceutical Sub-Market Forecasts, 2018-2028

6.2.1 The Mexican National Pharmaceutical Market Forecast, 2018-2028

6.2.2 The Mexican Generic Drugs Market Forecast, 2018-2028

6.2.3 The Mexican OTC Market Forecast, 2018-2028

6.2.4 The Mexican Biosimilars Market Forecast, 2018-2028

6.2.5 The Mexican Originator Drugs Market Forecast, 2018-2028

7. The Venezuelan National Pharmaceutical Market, 2018-2028

7.1 The Venezuelan National Pharmaceutical Market, 2018

7.2 The Venezuelan National Pharmaceutical Market Breakdown Forecast, 2018-2028

7.2.1 The Venezuelan National Pharmaceutical Market Forecast, 2018-2028

7.2.2 The Venezuelan Generic Drugs Market Forecast, 2018-2028

7.2.3 The Venezuelan OTC Market Forecast, 2018-2028

7.2.4 The Venezuelan Biosimilars Market Forecast, 2018-2028

7.2.5 The Venezuelan Originator Drugs Market Forecast, 2018-2028

8. The Argentine National Pharmaceutical Market, 2018-2028

8.1 The Argentine National Pharmaceutical Market, 2017

8.2 The Argentine National Pharmaceutical Market Breakdown, 2018-2028

8.2.1 The Argentine National Pharmaceutical Market Forecast, 2018-2028

8.2.2 The Argentine Generic Drugs Market Forecast, 2018-2028

8.2.3 The Argentine OTC Market Forecast, 2018-2028

8.2.4 The Argentine Biosimilars Market Forecast, 2018-2028

8.2.5 The Argentine Originator Drugs Market Forecast, 2018-2028

9. The Colombian National Pharmaceutical Market, 2018-2028

9.1 The Colombian National Pharmaceutical Market, 2017

9.2 The Colombian National Pharmaceutical Market Breakdown, 2018-2028

9.2.1 The Colombian National Pharmaceutical Market Forecast, 2018-2028

9.2.1.1 Economic Growth and Financial Constraints

9.2.1.2 Introduction of the Statutory Health Law

9.2.2 The Colombian Generic Drugs Market Forecast, 2018-2028

9.2.3 The Colombian OTC Market Forecast, 2018-2028

9.2.4 The Colombian Biosimilars Market Forecast, 2018-2028

9.2.5 The Colombian Originator Drugs Market Forecast, 2018-2028

10. The Chilean National Pharmaceutical Market, 2018-2028

10.1 The Chilean National Pharmaceutical Market, 2018

10.1.1 The Chilean Health Care System

10.1.2 Majority of Generic Revenue from Branded Generics

10.2 The Chilean National Pharmaceutical Market Breakdown, 2018-2028

10.2.1 The Chilean National Pharmaceutical Market Forecast, 2018-2028

10.2.2 The Chilean Generic Drugs Market Forecast, 2018-2028

10.2.3 The Chilean OTC Market Forecast, 2018-2028

10.2.4 The Chilean Biosimilars Market Forecast, 2018-2028

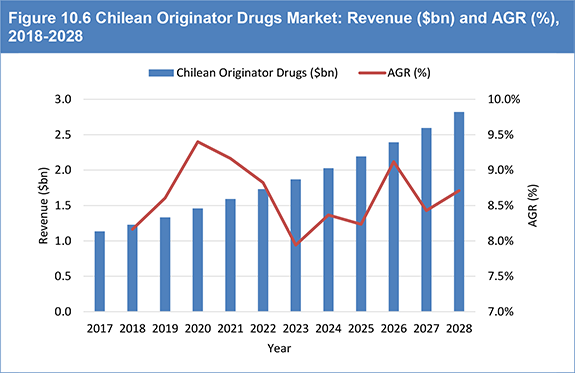

10.2.5 The Chilean Originator Drugs Market Forecast, 2018-2028

11. The Rest of the Latin American Pharmaceutical Market, 2018-2028

11.1 The Rest of the Latin American Pharmaceutical Market, 2017

11.2 The Rest of the Latin American Pharmaceutical Market Breakdown, 2018-2028

12. Top Five Pharmaceutical Companies in Latin America

12.1 Bayer AG

12.1.1 Bayer AG: Company Overview

12.1.2 Bayer AG: Product Portfolio

12.1.3 Bayer AG: Recent Developments

12.2 Pfizer Inc.

12.2.1 Pfizer Inc.: Company Overview

12.2.2 Pfizer Inc.: Product Portfolio

12.3 Sanofi S.A.

12.3.1 Sanofi S.A.: Company Overview

12.3.2 Sanofi S.A.: Product Portfolio

12.3.3 Sanofi S.A: Recent Developments

12.4 Novartis AG

12.4.1 Novartis AG: Company Overview

12.4.2 Novartis AG: Product Portfolio

12.5 EMS SA

12.5.1 EMS SA: Company Overview

13. Conclusions

13.1 The Latin American Pharmaceutical Market, 2017-2018

13.2 Latin American Pharmaceutical Market Forecast, 2018-2028

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

List of Tables

Table 2.1 Market Share (%) of the Global Pharmaceutical Market by Region, 2017

Table 2.2 Population Sizes of Latin American Countries/Regions and Percentage of Total Population (%), 2017

Table 3.1 The Latin American Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 3.2 Percentage (%) of Population Over 65 Years Old in Key Latin American Markets and Segment Average, 2010 and 2050

Table 3.3 The Latin American Pharmaceutical Market Breakdown by Submarket, Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 3.4 The Latin American Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 3.5 The Latin American OTC Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 3.6 The Latin American Biosimilars Market: Revenue (Constant Currencies) ($bn), AGR (%) and CAGR (%), 2018-2028

Table 3.7 The Latin American Originator Drugs Market: Revenue($bn), AGR (%) and CAGR (%), 2018-2027

Table 3.8 SWOT Analysis of the Latin American Pharmaceutical Market, 2018-2028

Table 4.1 Market Revenues ($bn) of the Six Largest Pharmaceutical Markets in Latin America, 2017

Table 4.2 The Latin American National Pharmaceutical Market by Country: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 4.3 National Market Revenues ($bn) and Latin American Market Shares (%) by Country, 2017

Table 4.4 National Market Revenues ($bn) and Latin American Market Shares (%), 2023

Table 4.5 National Market Revenues ($bn) and Latin American Market Shares (%), 2028

Table 5.1 Brazilian National Market Breakdown by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 5.2 Brazilian National Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 5.3 Brazilian Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 5.4 Brazilian OTC Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 5.5 Brazilian Biosimilars Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 5.6 Brazilian Originator Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 6.1 Mexican National Market Breakdown by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 6.2 Mexican National Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 6.3 Mexican Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 6.4 Mexican OTC Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 6.5 Mexican Biosimilars Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 6.6 Mexican Originator Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 7.1 Venezuelan National Market Breakdown by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 7.2 Venezuelan National Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 7.3 Venezuelan Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 7.4 Venezuelan OTC Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 7.5 Venezuelan Biosimilars Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 7.6 Venezuelan Originator Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 8.1 Argentine National Market Breakdown by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 8.2 Argentine National Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 8.3 Argentine Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 8.4 Argentine OTC Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 8.5 Argentine Biosimilars Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 8.6 Argentine Originator Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 9.1 Colombian National Market Breakdown by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 9.2 Colombian National Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 9.3 Colombian Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 9.4 Colombian OTC Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 9.5 Colombian Biosimilars Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 9.6 Colombian Originator Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 10.1 Branded Market Share (%) of Generic Drugs Market by Value, 2017

Table 10.2 Chilean National Market Breakdown by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 10.3 Chilean National Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 10.4 Chilean Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 10.5 Chilean OTC Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 10.6 Chilean Biosimilars Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 10.7 Chilean Originator Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 11.1 The Rest of the Latin American Pharmaceutical Market Breakdown by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 11.2 Rest of the Latin American Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 11.3 Rest of the Latin American Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 11.4 Rest of the Latin American OTC Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 11.5 Rest of the Latin American Biosimilars Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 11.6 Rest of the Latin American Originator Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2028

Table 12.1 Bayer AG: Company Overview

Table 12.2 Bayer AG: Product Portfolio

Table 12.3 Bayer AG: Recent Developments

Table 12.4 Pfizer Inc.: Company Overview

Table 12.5 Pfizer Inc.: Product Portfolio

Table 12.6 Sanofi S.A.: Company Overview

Table 12.7 Novartis AG: Company Overview

Table 12.8 Novartis AG: Product Portfolio

Table 12.9 EMS SA: Company Overview

Table 13.1 The Latin American National Pharmaceutical Markets: Revenue ($bn), 2017-2018

Table 13.2 The Latin American Pharmaceutical Market: Revenue ($bn), AGR (%), CAGR (%), 2017-2028

List of Figures

Figure 1.2 Key Markets within the Latin American Pharmaceutical Market

Figure 1.3 Key Product Types within the Latin American Pharmaceutical Market

Figure 2.1 Market Shares (%) of Pharmaceutical Market by Region, 2017

Figure 2.2 Population Sizes of Latin American Countries/Regions by Percentage (%), 2017

Figure 3.1 The Latin American Pharmaceutical Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 3.2 The Latin American Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 3.3 The Latin American OTC Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 3.4 The Latin American Biosimilars Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 3.5 The Latin American Originator Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 4.1 Market Revenues ($bn) of Six Largest Pharmaceutical Markets in Latin America plus Rest of Latin America, 2017

Figure 5.1 Brazilian National Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 5.2 Brazilian Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 5.3 Brazilian OTC Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 5.4 Brazilian Biosimilars Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 5.5 Brazilian Originator Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 6.1 Mexican National Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 6.2 Mexican Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 6.3 Mexican OTC Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 6.4 Mexican Biosimilars Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 6.5 Mexican Originator Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 7.1 Venezuelan National Pharmaceutical Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 7.2 Venezuelan Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 7.3 Venezuelan OTC Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 7.4 Venezuelan Biosimilars Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 7.5 Venezuelan Originator Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 8.1 Argentine National Pharmaceutical Market: Revenue($bn) and AGR (%), 2018-2028

Figure 8.2 Argentine Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 8.3 Argentine OTC Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 8.4 Argentine Biosimilars Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 8.5 Argentine Originator Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 9.1 Colombian National Pharmaceutical Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 9.2 Colombian Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 9.3 Colombian OTC Market: Revenue($bn) and AGR (%), 2018-2028

Figure 9.4 Colombian Biosimilars Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 9.5 Colombian Originator Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 10.1 Branded Market Share (%) of Generic Drugs Market by Value, 2017

Figure 10.2 Chilean National Pharmaceutical Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 10.3 Chilean Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 10.4 Chilean OTC Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 10.5 Chilean Biosimilars Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 10.6 Chilean Originator Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 11.1 Rest of the Latin American National Pharmaceutical Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 11.2 Rest of the Latin American Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 11.3 Rest of the Latin American OTC Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 11.4 Rest of the Latin American Biosimilars Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 11.5 Rest of the Latin American Originator Drugs Market: Revenue ($bn) and AGR (%), 2018-2028

Figure 12.1 Bayer AG, Revenue, ($million), 2012-2016

Figure 12.2 Bayer AG, Product Segments Share (%), 2016

Figure 12.3 Bayer AG, Geographic Presence Share (%), 2016

Figure 12.4 Pfizer Inc., Revenue, ($million), 2012-2016

Figure 12.5 Pfizer Inc., Product Segments Share (%), 2016

Figure 12.6 Pfizer Inc., Geographical Presence Share (%), 2016

Figure 12.7 Sanofi S.A., Revenue, ($million), 2012-2016

Figure 12.8 Sanofi S.A., Product Segments Share (%), 2016

Figure 12.9 Sanofi S.A., Geographical Presence Share (%), 2016

Figure 12.10 Novartis AG, Revenue, ($million), 2012-2016

Figure 12.11 Novartis AG, Product Segments Share (%), 2016

Figure 12.12 Novartis AG, Geographical Presence Share (%), 2016

Figure 13.1 The Latin American National Pharmaceutical Markets: Revenue ($bn), 2017-2018

Figure 13.2 The Latin American Pharmaceutical Market: Revenue ($bn), 2017-2028

Abbott Laboratories

Aspen Pharmaceuticals

Bago

Bayer AG

Bioceres

Biocon

Celltrion

CFR Pharmaceuticals

Ciba-Geigy

EMS S.A

Genfar

Germed

GlaxoSmithKline

Hospira

Janssen RA

Laboratorio Teuto Brasileiro.

Laboratorios Bernabo

Laboratorios Kendrick

LaFrancol

LeGrand

Medley

Merck AG

Merial S.A.S.

Merial, Inc.

Novartis

NC Participações S.A.

Orygen

Pemex

Pfizer

Priobiomed

Roemmers

Sandoz

Sanofi S.A

Shanghai CP Goujian

Takeda

List of Organizations Mentioned in the Report

Bolivarian Alliance for the Peoples of Our America (ALBA)

Brazilian Ministry of Health

Brazilian Unified Health System

Chilean Institute of Public Health

COFEPRIS

Instituto de Seguridad y Servicios Sociales de los Trabajadoes del Estad (ISSSTE)

Instituto Mexicano del Seguro Social (IMSS)

Instituto Venezolano de los Seguros Sociales (IVSS)

Mercosur

National Drugs Agency (ANAMED)

Pan American Health Organisation

Sistema General de Seguridad Social en Salud

The Andean Community (CAN)

The Pacific Alliance

The Union of South American Nations (USAN)

Trans-Pacific Partnership

United Nations Department of Economic and Social Affairs

Venezuelan Ministry of Popular Power for Health

Download sample pages

Complete the form below to download your free sample pages for Latin American Pharmaceutical Market Outlook 2018-2028

Download sample pages

Complete the form below to download your free sample pages for Latin American Pharmaceutical Market Outlook 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024

Visiongain Publishes Inflammatory Bowel Diseases (IBD) Drugs Market Report 2024-2034

The global Inflammatory Bowel Diseases (IBD) Drugs market was valued at US$27.53 billion in 2023 and is projected to grow at a CAGR of 6.2% during the forecast period 2024-2034.

11 April 2024