Industries > Energy > Land Seismic Equipment & Acquisition Market Forecast 2019-2029

Land Seismic Equipment & Acquisition Market Forecast 2019-2029

Forecast and Analysis by Equipment (Sensors, Sources, Cable Based Acquisition Systems, Wireless Acquisition Systems & Other Equipment) and by Region Plus Profiles of Leading Companies in the Land Seismic Equipment & Acquisition Market

Visiongain has calculated that the global Land Seismic Equipment & Acquisition Market will see a capital expenditure (CAPEX) of $2,405mn in 2019. Read on to discover the potential business opportunities available.

For E&P and mining industries, land seismic surveys are carried out to generate subsea bottom profiles. This type of surveying is conducted by generating mechanical sound waves that are sent into the earth. The energy reflected back from the earth is measured by recording sensors which are installed in mounted trucks which consist of tapes to record any activity. The land seismic operations require various equipment such as geophones, seismic sensors, streamers, hydrophones, air or water gun, streamers, and sub-bottom profilers.

Previously declining prices of oil & gas have resulted in cutting investments in the E&P oil & gas sector. This, in turn, has resulted in land seismic acquisition companies making major cuts with regards to spending in order to remain profitable during this market downturn. Thus, the land or onshore seismic equipment & acquisition is highly dependent on the price of oil & gas prevailing in the market.

Due to volatility in crude oil and natural gas prices, several upstream companies are cutting E&P budgets and even spending on land seismic equipment. However, technological advancements coupled with increased energy requirement in developing nations and exploitation of shale gas reserves are key drivers for the growth in demand for land seismic equipment over the forecast period.

The land seismic equipment market experienced a shock after the oil price fall in late 2014 with the industry becoming cautious and cutting exploration expenses to retain profitability. Oil price recovery and the need for oil companies to continue to add value to their resources will drive a new wave of investment in seismic equipment from 2019 but constrained from lower oil price levels. For years before 2019, the limited exploration activity will be mostly met by current equipment.

Visiongain’s global Land Seismic Equipment & Acquisition Market report can keep you informed and up to date with the developments in the market, across seven different regions: North America, Europe, Middle East, Africa, Asia Pacific, Russia/CIS and South America.

With reference to this report, it details the key investments trend in the global market, subdivided by regions, capital expenditure and equipment. Through extensive secondary research and interviews with industry experts, visiongain has identified a series of market trends that will impact the Land Seismic Equipment & Acquisition Market over the forecast timeframe.

The report will answer questions such as:

• How is the land seismic equipment & acquisition market evolving?

• What is driving and restraining the land seismic equipment & acquisition market dynamics?

• How will each technology in equipment & acquisition market submarket segment grow over the forecast period and how much sales will these submarkets account for in 2029?

• How will market shares of each the land seismic equipment & acquisition submarket develop from 2019-2029?

• Which individual technologies will prevail and how will these shifts be responded to?

• Which land seismic equipment & acquisition submarket will be the main driver of the overall market from 2019-2029?

• How will political and regulatory factors influence regional the land seismic equipment & acquisition market and submarkets?

• Will leading national the land seismic equipment & acquisition market broadly follow macroeconomic dynamics, or will individual country sectors outperform the rest of the economy?

• How will market shares of the national markets change by 2029 and which nation will lead the market in 2029?

• Who are the leading players and what are their prospects over the forecast period?

• How will the sector evolve as alliances form during the period between 2019 and 2029?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides forecasts for the Land Seismic Equipment & Acquisition market by Equipment, for the period 2019-2029

– Sensors submarket 2019-2029

– Sources submarket 2019-2029

– Cable Based Acquisition Systems submarket 2019-2029

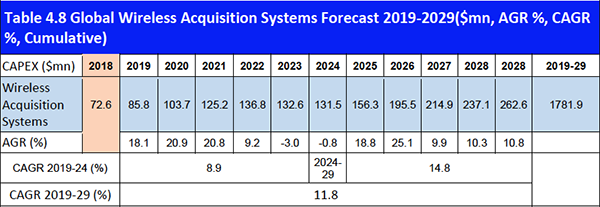

– Wireless Acquisition Systems submarket 2019-2029

– Other Equipment submarket 2019-2029

2) The report also forecasts and analyses the Land Seismic Equipment & Acquisition market by Region from 2019-2029

North America

– United States CAPEX 2019-2029

– Canada CAPEX 2019-2029

– Mexico CAPEX 2019-2029

Asia Pacific

– China CAPEX 2019-2029

– Japan CAPEX 2019-2029

– India CAPEX 2019-2029

– ASEAN CAPEX 2019-2029

– Australia CAPEX 2019-2029

– Rest of Asia Pacific CAPEX 2019-2029

Europe

– UK CAPEX 2019-2029

– Italy CAPEX 2019-2029

– Spain CAPEX 2019-2029

– Germany CAPEX 2019-2029

– Norway CAPEX 2019-2029

– Rest of Europe CAPEX 2019-2029

Middle East

– GCC CAPEX 2019-2029

– Iran CAPEX 2019-2029

– Rest of the Middle East and Africa CAPEX 2019-2029

Africa

– South Africa CAPEX 2019-2029

– Nigeria CAPEX 2019-2029

– Rest of the Africa CAPEX 2019-2029

Russia/CIS CAPEX 2019-2029

South America

– Brazil CAPEX 2019-2029

– Venezuela CAPEX 2019-2029

– Argentina CAPEX 2019-2029

– Rest of South America CAPEX 2019-2029

3) The report reveals the Drivers and Restraints in the Land Seismic Equipment & Acquisition market

4) The report includes PEST Analysis affecting the Land Seismic Equipment & Acquisition market

5) The report provides detailed profiles of the leading companies operating within the Land Seismic Equipment & Acquisition market:

– SA Exploration

– Terraseis

– Sercel

– Terrex Seismic

– WesternGeco

– Mitcham Industries

– International Seismic Co. (iSeis)

– ION Geophysical Corporation

– Geometrics

– Geospace Technologies

– Sinopec Corp.

This independent 165-page report guarantees you will remain better informed than your competitors. With 118 tables and figures examining the Land Seismic Equipment & Acquisition market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure by equipment and region, as well as in-depth analysis of leading companies in the Land Seismic Equipment & Acquisition Market from 2019-2029 that will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Land Seismic Equipment & Acquisition Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to The Land Seismic Equipment & Acquisition Market

2.1 The Land Seismic Acquisition Market Structure

2.2 Land Seismic Equipment Market Definitions

2.3 Land Seismic Acquisition Market Definition

2.4 Land Seismic Industry Outlook

2.5 Types of Land Seismic Equipment and Acquisition

2.5.1 Land Seismic Acquisition Methods

2.5.2 Land Seismic Equipment

2.6 Land Seismic Market Seasonality

2.7 Marine Seismic

2.8 Shallow Water Transition Zone (SWTZ) Seismic

2.9 Exploration Phase Seismic versus Production Phase Seismic

2.10 Multi-Client Seismic Services (MCS)

2.11 Shale Resource Development and Land Seismic Acquisition

2.12 Enhanced Oil Recovery and Production Stage Seismic

2.13 Liquefying Natural Gas to Monetise Onshore Gas Reserves

3. Global Overview of Land Seismic Equipment & Acquisition Market 2019-2029

3.1 Global Overview of Land Seismic Equipment Market 2019-2029

3.1.1 Land Seismic Equipment Driver and Restraints

3.2 Global Overview of Land Seismic Acquisition Market 2019-2029

3.2.1 Land Seismic Acquisition Driver and Restraints

3.3 Potential Planned Projects

4. Land Seismic Equipment Submarkets Forecast 2019-2029

4.1 Global Land Seismic Equipment Submarkets Forecasts, by Type 2019-2029

4.1.1 Global Sensors Forecast 2019-2029

4.1.1.1 Global Sensors Drivers and Restraints

4.1.2 Global Sources Forecast 2019-2029

4.1.2.1 Global Sources Drivers and Restraints

4.1.3 Global Cable Based Acquisition Systems Forecast 2019-2029

4.1.3.1 Global Cable Based Acquisition Systems Drivers and Restraints

4.1.4 Global Wireless Acquisition Systems Forecasts2019-2029

4.1.5 Global Other Equipment Forecast 2019-2029

5. Leading National Land Seismic Equipment & Acquisition Forecasts 2019-2029

5.1 Land Seismic Acquisition, Market Attractiveness Analysis, 2019

5.2 North America Land Seismic Acquisition Market Forecast 2019-2029

5.2.1 North America Land Seismic Acquisition Market Forecast

5.2.2 North America Land Seismic Acquisition Market Forecast, by Country

5.2.3 North America Land Seismic Acquisition Market Analysis

5.3 Asia Pacific Land Seismic Acquisition Market Forecast 2019-2029

5.3.1 Asia Pacific Land Seismic Acquisition Market Forecast

5.3.2 Asia Pacific Land Seismic Acquisition Market Forecast, by Country

5.3.3 Asia Pacific Land Seismic Acquisition Market Analysis

5.4 Middle East Land Seismic Acquisition Market Forecast 2019-2029

5.4.1 Middle East Land Seismic Acquisition Market Forecast

5.4.2 Middle East Land Seismic Acquisition Market Forecast, by Country

5.4.3 Middle East Land Seismic Acquisition Market Analysis

5.5 Russia/CIA Land Seismic Acquisition Market Forecast 2019-2029

5.5.1 Russia/CIS Land Seismic Acquisition Market Forecast

5.5.2 Russia/CIS Land Seismic Acquisition Market Analysis

5.6 Africa Land Seismic Acquisition Market Forecast 2019-2029

5.6.1 Africa Land Seismic Acquisition Market Forecast

5.6.2 Africa Land Seismic Acquisition Market Forecast, by Country

5.6.3 Africa Land Seismic Acquisition Market Analysis

5.7 South America Land Seismic Acquisition Market Forecast 2019-2029

5.7.1 South America Land Seismic Acquisition Market Forecast

5.7.2 South America Land Seismic Acquisition Market Forecast, by Country

5.7.3 South America Land Seismic Acquisition Market Analysis

5.8 Europe Land Seismic Acquisition Market Forecast 2019-2029

5.8.1 Europe Land Seismic Acquisition Market Forecast

5.8.2 Europe Land Seismic Acquisition Market Forecast, by Country

5.8.3 Europe Land Seismic Acquisition Market Analysis

6. PEST Analysis of the Land Seismic Equipment & Acquisition Market 2019-2029

7. Expert Opinion

7.1 Primary Correspondents

7.2 Land Seismic Equipment & Acquisition Outlook

7.4 Driver & Restraints

7.3 Dominant Region/Country

7.4 Land Seismic Equipment Scenario

7.5 Overall Growth Rate, Globally

8. The Leading Companies in the Land Seismic Equipment & Acquisition Market

8.1 Tesla Exploration Ltd.

8.1.1 Tesla Exploration Ltd Company Analysis

8.2 SA Exploration

8.2.1 SA Exploration Company Analysis

8.3 Terraseis

8.3.1 Terraseis Company Analysis

8.4 Sercel

8.4.1 Sercel Company Analysis

8.5 Terrex Seismic

8.5.1 Terrex Seismic Company Analysis

8.6 WesternGeco

8.6.1 WesternGeco Company Analysis

8.7 Mitcham Industries

8.7.1 Mitcham Industries Company Analysis

8.8 International Seismic Co. (iSeis)

8.8.1 International Seismic Co. (iSeis) Company Analysis

8.9 ION Geophysical Corporation

8.9.1 ION Geophysical Corporation Company Analysis

8.10 Geometrics

8.10.1 Geometrics Company Analysis

8.11 Geospace Technologies

8.11.1 Geospace Technologies Company Analysis

8.12 INOVA Technologies

8.12.1 INOVA Company Analysis

8.13 PASI Srl Technologies

8.13.1 PASI Srl Company Analysis

8.14 ARGAS

8.14.1 ARGAS Company Analysis

8.15 BGP Inc.

8.15.1 BGP Inc. Company Analysis

8.16 Baoding Longet Equipment Co., Ltd.

8.16.1 Baoding Longet Equipment Co., Ltd Company Analysis

8.17 CGG

8.17.1 CGG Company Analysis

8.18 Sinopec Corp.

8.18.1 Sinopec Corp. Company Analysis

8.19 Other Land Seismic Companies

9. Conclusions and Recommendations

10. Glossary

Appendix

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

Visiongain Report Evaluation Form

List of Tables

Table 2.1 Land Seismic Source Type Advantages / Disadvantages, (Explosives, Vibroseis)

Table 3.1 Global Land Seismic Equipment Market Forecast 2019-2029 ($ mn, AGR %, CAGR %, Cumulative)

Table 3.2 Global Land Seismic Equipment Drivers and Restraints

Table 3.3 Global Land Seismic Acquisition Market Forecast 2019-2029 ($ mn, AGR %, CAGR %, Cumulative)

Table 3.4 Global Land Seismic Acquisition Drivers and Restraints

Table 4.1 Global Land Seismic Equipment Market Forecast 2019-2029($mn, AGR %, Cumulative)

Table 4.2 Global Sensors Forecast 2019-2029($mn, AGR %, CAGR %, Cumulative)

Table 4.3 Global Sensors Drivers and Restraints

Table 4.4 Global Sources Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.5 Global Small-Scale Liquefaction Drivers and Restraints

Table 4.6 Global Cable Based Acquisition Systems Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.7 Global Cable Based Acquisition Systems Drivers and Restraints

Table 4.8 Global Wireless Acquisition Systems Forecast 2019-2029($mn, AGR %, CAGR %, Cumulative)

Table 4.9 Global Other Equipment Forecast 2019-2029($mn, AGR %, CAGR %, Cumulative)

Table 5.1 Global Land Seismic Acquisition Market, by Country Forecast 2019-2029 ($mn, AGR %, Cumulative)

Table 5.2 North America Land Seismic Acquisition Market Forecast, 2019-2029 ($ mn, AGR %, CAGR%, Cumulative)

Table 5.3 North America Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($ mn, AGR %, Cumulative)

Table 5.4 Asia Pacific Land Seismic Acquisition Market Forecast, 2019-2029 ($ mn, AGR %, CAGR%, Cumulative)

Table 5.5 Asia Pacific Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($ mn, AGR %, Cumulative)

Table 5.6 Middle East Land Seismic Acquisition Market Forecast, 2019-2029 ($ mn, AGR %, CAGR%, Cumulative)

Table 5.7 Middle East Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($ mn, AGR %, Cumulative)

Table 5.8 Russia/CIA Land Seismic Acquisition Market Forecast, 2019-2029 ($ mn, AGR %, CAGR%, Cumulative)

Table 5.9 Africa Land Seismic Acquisition Market Forecast, 2019-2029 ($ mn, AGR %, CAGR%, Cumulative)

Table 5.10 Africa Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($ mn, AGR %, Cumulative)

Table 5.11 South America Land Seismic Acquisition Market Forecast, 2019-2029 ($ mn, AGR %, CAGR%, Cumulative)

Table 5.12 South America Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($ mn, AGR %, Cumulative)

Table 5.13 Europe Land Seismic Acquisition Market Forecast, 2019-2029 ($ mn, AGR %, CAGR%, Cumulative)

Table 5.14 Europe Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($ mn, AGR %, Cumulative)

Table 6.1 PEST Analysis, Land Seismic Equipment & Acquisition Market

Table 8.1 SA Exploration Profile (Market Entry, Public/Private, Headquarters, No. of Employees, Revenue in $mn 2017, Change in Revenue from 2016, Geography, Key Markets, Products/Services)

Table 8.2 SA Exploration Services (Category, Type, & Description)

Table 8.3 Terraseis Profile (Market Entry, Public/Private, Headquarters, Geography, Key Markets, Listed on, Products/Services)

Table 8.4 Terraseis Seismic Acquisition Equipment

Table 8.5 Terraseis Seismic Acquisition Survey Details (Year, Location, Terrain, Source Type, Size, and 2D/3D)

Table 8.6 Sercel Profile (Market Entry, Public/Private, Headquarter, No. of Employees, Geography, Key Markets, Products/Services)

Table 8.7 Sercel Seismic Acquisition Equipment

Table 8.8 Terrex Seismic Profile (Market Entry, Public/Private, Headquarters, Geography, Key Markets, Products/Services)

Table 8.9 Terrex Seismic Details

Table 8.10 Terrex Seismic Equipment Details (Type and Model)

Table 8.11 WesternGeco Profile (Market Entry, Public/Private, Headquarters, No. of Employees, Revenue in $mn 2018, Change in Revenue from 2017, Geography, Key Markets, Listed on, Products/Services)

Table 8.12 WesternGeco Marine Seismic Fleet (Vessel Name, Year Built or Last Upgraded, Meters Length, Meters Width, No of Streamers, Capability)

Table 8.13 WesternGeco Major Seismic Acquisition Contracts (Client Company, Area, Region, Contract Start, Contract End, Type, Average km/km2, Multi-Client)

Table 8.14 WesternGeco Total Company Sales 2011-2018 ($bn, AGR %)

Table 8.15 Mitcham Industries Profile (Market Entry, Public/Private, Headquarters, No. of Employees, Revenue in $mn 2018, Change in Revenue from 2017, Geography, Key Markets, Products/Services)

Table 8.16 Mitcham Industries Total Company Sales 2014-2018 ($mn, AGR %)

Table 8.17 Mitcham Industries Land Seismic Leasing Details (Category, Type, & Model)

Table 8.18 International Seismic Co. Profile (Market Entry, Public/Private, Headquarter, Geography, Key Markets, Products/Services)

Table 8.19 iSeis-Seismic Source Co. Seismic Acquisition Details

Table 8.20 ION Geophysical Corporation Profile (Market Entry, Public/Private, Headquarters, Revenue in $mn 2017, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 8.21 ION Geophysical Corporation Total Company Sales 2014-2017 ($mn, AGR %)

Table 8.22 ION Geophysical Corporation Seismic Acquisition Details, (Type, Model, & Description)

Table 8.23 Geometrics Profile (Market Entry, Public/Private, Headquarters, Geography, Key Markets, Listed on, Products/Services)

Table 8.24 Geometrics Seismic Acquisition Equipment Details

Table 8.25 Geospace Technologies Profile (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue in $mn 2017, Change in Revenue from 2016, Geography, Key Markets, Products/Services)

Table 8.26 Geospace Technologies Total Company Sales 2013-2017 ($mn, AGR %)

Table 8.27 Geospace Technologies Seismic Acquisition Details

Table 8.28 Sinopec Corp. Profile (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue in $mn 2017, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 8.29 Sinopec Corp. Total Company Sales 2013-2017 ($bn, AGR %)

Table 8.30 Sinopec Corp. Services (Service, Type, & Description)

Table 8.31 Sinopec Corp Land Seismic Equipment and Acquisition Products

Table 8.32 List of Other Land Seismic Companies (Company, Data Acquisition Services)

List of Figures

Figure 2.1 Global Land Seismic Equipment Market Segmentation Overview

Figure 2.2 Global Land Seismic Acquisition Market Segmentation Overview

Figure 3.1 Global Land Seismic Equipment Forecast 2019-2029 ($ mn, AGR %)

Figure 3.2 Global Land Seismic Acquisition Forecast 2019-2029 ($ mn, AGR %)

Figure 3.3 Land Seismic Equipment vs Acquisition Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.1 Global Land Seismic Equipment Submarket Forecast 2019-2029 ($mn, AGR%)

Figure 4.2 Global Land Seismic Equipment Market by Type Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.3 Land Seismic Equipment Market, By Sensors Forecast 2019-2029 ($mn, AGR%)

Figure 4.4 Land Seismic Equipment Market, By Sources Forecast 2019-2029 ($mn, AGR%)

Figure 4.5 Land Seismic Equipment Market, By Cable Based Acquisition Systems Forecast 2019-2029 ($mn, AGR%)

Figure 4.6 Land Seismic Equipment Market, By Wireless Acquisition System Forecast 2019-2029 ($mn, AGR%)

Figure 4.7 Land Seismic Equipment Market, By Other Equipment Forecast 2019-2029 ($mn, AGR%)

Figure 5.1 Regional Land Seismic Acquisition Market2019-2029 ($mn)

Figure 5.2 Leading Nations Land Seismic Acquisition Market Share, 2019 (%)

Figure 5.3 Leading Nations Land Seismic Acquisition Market Share, 2024 (%)

Figure 5.4 Leading Nations Land Seismic Acquisition Market Share, 2029 (%)

Figure 5.5 Global Land Seismic Acquisition Market, Market Attractiveness, 2019, By Region

Figure 5.6 North America Land Seismic Acquisition Market Forecast 2019-2029 ($mn, AGR %)

Figure 5.7 North America Land Seismic Acquisition Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.8 North America Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($mn)

Figure 5.9 Asia Pacific Land Seismic Acquisition Market Forecast 2019-2029 ($mn, AGR %)

Figure 5.10 Asia Pacific Land Seismic Acquisition Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.11 Asia Pacific Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($mn)

Figure 5.12 Middle East Land Seismic Acquisition Market Forecast 2019-2029 ($mn, AGR %)

Figure 5.13 Middle East Land Seismic Acquisition Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.14 Middle East Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($mn)

Figure 5.15 Russia/CIA Land Seismic Acquisition Market Forecast 2019-2029 ($mn, AGR %)

Figure 5.16 Russia/CIA Land Seismic Acquisition Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.17 Africa Land Seismic Acquisition Market Forecast 2019-2029 ($mn, AGR %)

Figure 5.18 Africa Land Seismic Acquisition Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.19 Africa Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($mn)

Figure 5.20 South America Land Seismic Acquisition Market Forecast 2019-2029 ($mn, AGR %)

Figure 5.21 South America Land Seismic Acquisition Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.22 South America Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($mn)

Figure 5.23 Europe Land Seismic Acquisition Market Forecast 2019-2029 ($mn, AGR %)

Figure 5.24 Europe Land Seismic Acquisition Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.25 Europe Land Seismic Acquisition Market Forecast, by Country, 2019-2029 ($mn)

Figure 8.1 SA Exploration, % Revenue Share, by Regional Segment, 2017

Figure 8.2 SA Exploration, % Revenue Share, by Country Segment, 2017

Figure 8.3 WesternGeco, Revenue, ($bn& AGR %), 2011-2018

Figure 8.4 WesternGeco Revenue %Share, by Business Segment, 2017

Figure 8.5 WesternGeco Revenue %Share, by Regional Segment, 2017

Figure 8.6 Mitcham Industries Revenue %Share, by Regional Segment, 2018

Figure 8.7 Mitcham Industries Revenue %Share, by Business Segment, 2018

Figure 8.8 Mitcham Industries Revenue, ($mn & AGR %), 2014-2018

Figure 8.9 ION Geophysical Corporation Revenue %Share, by Sales Type Segment, 2017

Figure 8.10 ION Geophysical Corporation Revenue %Share, by Business Segment, 2017

Figure 8.11 ION Geophysical Corporation Revenue %Share, by Regional Segment, 2017

Figure 8.12 ION Geophysical Corporation Revenue, ($mn& AGR %), 2014-2017

Figure 8.13 Geospace Technologies Revenue %Share, by Business Segment, 2017

Figure 8.14 Geospace Technologies Revenue %Share, Seismic vs Non-Seismic, 2017

Figure 8.15 Geospace Technologies Revenue %Share, by Type, 2017

Figure 8.16 Geospace Technologies Revenue, ($mn & AGR %), 2013-2017

Figure 8.17 Sinopec Corp., Revenue, ($bn & AGR %), 2013-2017

Figure 8.18 Sinopec Corp., Sale of Chemical Products, By Product, 2017 (Thousand Tonnes)

Figure 9.1 Global Land Seismic Acquisition Market Forecast 2019-2029 ($ mn, AGR %)

Figure 9.2 Global Marine Seismic Equipment Submarket Forecast 2019-2029 ($mn, AGR%)

Abu Dhabi Company for Onshore Oil Exploration (ADCO)

Abu Dhabi National Energy Company (TAQA)

Acoustic Geophysical Services (AGS)

Advent Oilfield Services

Allegro Funds Group

Alphageo India Limited

Apache

Arabian Geophysical & Surveying (ARGAS)

ARGAS

ARM Geophysics

Asia Oilfield Services Limited (ASIAN)

AutoSeis

Baker Hughes

Baoding Longet Equipment Co., Ltd.

BGP Inc.

Breckenridge Geophysical

CAMAC Energy Inc.

CGG

Chaparral Energy

Chevron

China National Offshore Oil Corporation (CNOOC)

China National Petroleum Corporation (CNPC)

China Petroleum and Chemical Corporation (Sinopec)

Dawson Geophysical Co

Denbury Resources

DownUnder Geosolutions

Empresa Colombiana de Gas (Ecogás)

ERHC Energy Inc.

ExxonMobil

Fairfield Nodal

Fasken

Gazprom Neft

GEO EAST Co.

Geokinetics

Geometrics

Geopartners Ltd.

Geospace Technologies

Geotec Spa

Global Geophysical Services

Gold Oil Peru SAC

GSS

Hydrocarb Energy Corp (HECC)

INOVA Technologies

International Seismic Co. (iSeis)

ION Geophysical Corporation (ION)

ION Integrated Seismic Solutions

Kinder Morgan

KrisEnergy

LINC Energy

LoneStar Geophysical Surveys (LSGS)

Lukoil

Metgasco

Mitcham Industries

Monarch Geophysical Services

NIS Naftagas Oilfield Services

NovaSPAN

Occidental Petroleum

Oil & Natural Gas Corp. (ONGC)

OPACBARATA

Panamerican Geophysical

PASI srl Technologies

Pertamina

Petroleos Mexicanos (Pemex)

Petroleum Geo-Services (PGS)

Polaris Limited

Repsol-YPF

REXIMseis Ltd

Royal Dutch Shell

SAExploration

Saudi Aramco

Schlumberger

SDP Services Ltd

Seismic Exchange, Inc.

Seismic Source Co.

Sercel

Shaanxi Yanchang Petroleum Group

Sinopec

Southwest Energy

Statoil

Swala Energy Limited

Tanzanian Petroleum Development Corporation (TPDC)

Terraseis

Terrex Seismic

Tesla Exploration Limited

TGS

TGS-NOPEC Geophysical Co. ASA

Total

Tullow Oil

Viking Seismic Services

WesternGeco

WirelessSEISMIC

XTO Energy

Other Organisations Mentioned in This Report

Alberta Geological Survey

Argentine Government

China’s Ministry of Land and Resources

Chinese Government

European Union (EU)

Mexican Government

Ministry of Water Resources

Organization of the Petroleum Exporting Countries (OPEC)

SKSPMIGAS

UK Government

UK Oil & Gas Authority (OGA)

United States Geological Survey (USGS)

US Energy Information Administration (EIA)

Download sample pages

Complete the form below to download your free sample pages for Land Seismic Equipment & Acquisition Market Forecast 2019-2029

Related reports

-

Global Land Drill Rigs Market Analysis to 2027

Visiongain has calculated that the global Land Drill Rigs market will see a capital expenditure (CAPEX) of $2,823.7 mn in...Full DetailsPublished: 28 November 2017 -

EOR Yearbook 2019: The Ultimate Guide to Enhanced Oil Recovery (EOR)

Visiongain’s latest EOR yearbook provides you with unprecedented in-depth analysis of the global EOR market. Visiongain assesses that the global...

Full DetailsPublished: 13 November 2018 -

Carbon Capture & Storage (CCS) Market Report 2019-2029

Carbon Capture & Storage (CCS) market expected to continue growing amid climate change fears....Full DetailsPublished: 13 August 2019 -

Carbon Capture & Storage (CCS) Market Report 2018-2028

The Paris Climate Summit had 187 countries in attendance and certain measures were put in place to combat climate change...

Full DetailsPublished: 16 March 2018 -

Pipeline Leak Detection Market of the Oil and Gas Industry 2018-2028

The growing environmental concerns has led Visiongain to publish this timely report. The pipeline leak detection market is expected to...

Full DetailsPublished: 01 May 2018 -

Marine Seismic Equipment & Acquisition Market Forecast 2018-2028

This latest report by business intelligence provider Visiongain assesses that marine seismic equipment and acquisition market will reach $5.01bn in...

Full DetailsPublished: 26 June 2018 -

Lithium-Ion Battery Market Report 2019-2029

Visiongain values the lithium-ion battery market at $42.3bn in 2019.

...Full DetailsPublished: 16 May 2019 -

Multi-Well Drilling Market Forecast 2017-2027

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Multi-Well Drilling market. Visiongain assesses that...

Full DetailsPublished: 19 May 2017 -

Offshore Oil & Gas Decommissioning Market Report Forecasts 2019-2029

Visiongain has forecasted that the global Offshore Oil & Gas Decommissioning market will see a capital expenditure (CAPEX) of $7,076mn...Full DetailsPublished: 17 January 2019 -

Marine Seismic Equipment & Acquisition Market Forecast 2019-2029

Visiongain assesses that marine seismic equipment and acquisition market will reach $5.39bn in 2019. ...Full DetailsPublished: 21 June 2019

Download sample pages

Complete the form below to download your free sample pages for Land Seismic Equipment & Acquisition Market Forecast 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024