Industries > Pharma > Indian Pharmaceutical Market Forecast 2019-2029

Indian Pharmaceutical Market Forecast 2019-2029

Infectious Disease, Cardiovascular, Gastrointestinal, Respiratory, Pain Relief / Analgesics, Diabetes, Vitamins/ Minerals/ Nutrients, Dermatology, CNS, Gynaecology, Generic, OTC, Patented, Biosimilar, Leading Companies

The Indian pharmaceuticals market is estimated to have reach $28.8bn in 2018 and is expected to grow at a CAGR of 16.6% in the first half of the forecast period. The market for cardiovascular medication is the fastest growing segment of the Indian pharmaceutical market, followed by the anti-infective segment.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 212-page report you will receive 121 charts– all unavailable elsewhere.

The 212-page report provides clear detailed insight into the Indian Pharmaceutical Market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Indian Pharmaceuticals Market forecasts from 2019-2029

• Revenue forecasts for the leading therapeutic areas in India from 2019-2029:

• Anti-Infectives Therapeutics

• Cardiovascular Therapeutics

• Dermatological Therapeutics

• Diabetes Therapeutics

• Gastrointestinal Therapeutics

• Gynaecology Therapeutics

• CNS Therapeutics

• Pain Relief/Analgesics Therapeutics

• Respiratory Therapeutics

• Vitamins/Minerals/Nutrients Therapeutics

• Other Therapeutics

This report also discusses factors that drive and restrain these submarkets.

• Revenue forecasts for the leading drug types in India from 2019-2029:

• Generic Drugs

• Over-the-Counter (OTC) Drugs

• Patented Drugs

• Biosimilar Drugs

This report also discusses factors that drive and restrain these submarkets.

• Profiles and discusses the leading companies in the Indian pharmaceutical market:

• Abbott Healthcare Private Limited (Abbott India)

• Cadila Healthcare Limited

• Cipla Ltd.

• Dr. Reddy’s Laboratories Ltd.

• GlaxoSmithKline Pharmaceuticals Limited

• Glenmark Pharmaceuticals Limited

• Intas Pharmaceuticals Limited

• Lupin

• Pfizer Limited

• Sanofi India Limited

• Sun Pharmaceuticals Industries Limited

(Revenues are provided for those companies whose financial information is available on the public domain)

• Analysis of the drivers and restraints of the Indian Pharmaceutical market

• The report also discusses the Porter’s Five Forces Analysis and SWOT Analysis of the Indian Pharmaceuticals Market

• This report also discusses:

• Indian healthcare system and Indian healthcare expenditure

• Indian pharmaceutical regulatory framework, laws & regulations, market access, regulatory bodies

• Disease prevalence and incidence in India, disease mortality rates in India, top causes of death in India, mortality projections from 2019-2029

• What this report provides:

• The Indian pharmaceutical market forecasts and analysis from 2019 to 2029

• Analysis and forecasts for the Indian pharmaceutical submarkets from 2019 to 2029

• Profiles of the leading companies operating within the Indian pharmaceutical industry

• SWOT analysis and Porter’s five forces analysis of the major strengths and weaknesses of the Indian pharmaceutical market together with the opportunities available and the key threats faced

Visiongain’s study is intended for anyone requiring commercial analyses for the Indian Pharmaceuticals Market. You find data, trends and predictions.

Buy our report today Indian Pharmaceutical Market Analysis : Infectious Disease, Cardiovascular, Gastrointestinal, Respiratory, Pain Relief / Analgesics, Diabetes, Vitamins/ Minerals/ Nutrients, Dermatology, CNS, Gynaecology, Generic, OTC, Patented, Biosimilar, Leading Companies.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 The Indian Pharmaceutical Market Overview

1.2 Indian Pharmaceutical Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report

1.6 Who is This Report For?

1.7 Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Reports

1.10 About Visiongain

2. Indian Healthcare: Overview

2.1 India: Demographic Indicators Overview

2.2 Indian Healthcare System: Overview

2.2.1 Rashtriya Swasthya Bima Yojana – Bringing Healthcare Coverage to India’s Poorest Workers

2.3 Analysis of India’s Healthcare Expenditure

3. Indian Pharmaceutical Regulatory Framework

3.1 National Regulatory Bodies

3.1.1 Ministry of Health & Family Welfare (MoHFW)

3.1.2 Ministry of Chemicals and Fertilizers (MoC&F)

3.2 State Regulatory Bodies (State Food and Drug Administrations (FDAs)

3.3 Laws & Regulations for Indian Pharmaceutical Market

3.3.1 The Drugs and Cosmetics Act, 1940

3.3.2 The Pharmacy Act, 1948

3.3.3 The Drugs & Magic Remedies Act, 1954

3.3.4 The Narcotic Drugs and Psychotropic Substances Act, (NDPS)1985

3.3.5 The Medicinal and Toilet Preparations Act, 1956

3.3.6 The Drugs Price Control Order (DPCO), 1995

3.3.7 Indian Patent Act 1970

3.3.8 The Drugs Price Control Order (DPCO), 2013

3.3.9 Good Clinical Practices (GCP)

3.3.10 Good Laboratory Practices (GLP)

3.4 Market Access

3.4.1 Healthcare System

3.4.2 Status of Health Technology Assessment (HTA)

3.4.3 Pricing

3.4.4 Reimbursement of Drugs

4. Indian Pharmaceutical Market: Discussions and Predictions 2019-2029

4.1 Indian Pharmaceutical Market: The Third Biggest Market in the World by Volume

4.2 Indian Pharmaceuticals Market: Overall Revenue Forecast 2018-2029

5. Medical Treatment Needs in India, 2019-2029

5.1 Disease Prevalence in India, 2019-2029

5.2 Disease Incidence in India, 2019-2029

5.3 Disease Mortality Rates in India, 2019-2029

5.3.1 Top Causes of Death in India

5.3.2 Top Causes of Death in India: Mortality Projections, 2019-2029

6. Indian Pharmaceutical Market: Leading Therapeutic Areas, 2019-2029

6.1 Leading Therapeutic Areas in the Indian Pharmaceutical Market: Overview, 2018

6.2 Indian Pharmaceutical Market: Leading Therapeutic Areas Forecasts, 2019-2029

6.3 Infectious Disease Drugs: Overview, 2018

6.3.1 Infectious Disease Drugs Market: Forecast, 2019-2029

6.3.2 Diarrheal Diseases Responsible for Over Half a Million Annual Deaths, 2018

6.3.3 Lower Respiratory Tract Infections Among Leading Causes of Death

6.3.4 Tuberculosis Still Rife in India

6.3.5 Malaria, Risk and Opportunity

6.3.6 HIV in India: Growing Therapeutic Area Worth Watching

6.3.7 Drivers and Restraints for the Infectious Diseases Pharmaceutical Segment

6.4 Cardiovascular Therapeutics Segment: Overview, 2018

6.4.1 Cardiovascular Disease – India’s Leading Cause of Death, 2018

6.4.2 Cardiovascular Drugs Market: Forecast, 2019-2029

6.5 Gastro-Intestinal Therapeutic Segment: Overview, 2018

6.5.1 Gastro-Intestinal Drugs Market: Forecast, 2019-2029

6.5.2 Gastro-Intestinal Therapeutics in India: Challenges and Opportunities

6.5.3 Drivers and Restraints for the Gastro-Intestinal Therapeutics Segment

6.6 Respiratory Therapeutic Segment: Overview, 2018

6.6.1 Respiratory Disease Drugs Market: Forecast, 2019-2029

6.6.2 Drivers and Restraints for the Respiratory Therapeutics Segment

6.7 Pain Relief / Analgesics Therapeutic Segment: Overview, 2018

6.7.1 Pain Relief / Analgesics Drugs Market: Forecast, 2019-2029

6.7.2 Drivers and Restraints for the Pain Relief/Analgesics Therapeutics Segment

6.8 Diabetes Therapeutic Segment: Overview, 2018

6.8.1 Diabetes Therapeutics Market: Forecast, 2019-2029

6.8.2 Drivers and Restraints for the Diabetes Therapeutics Segment

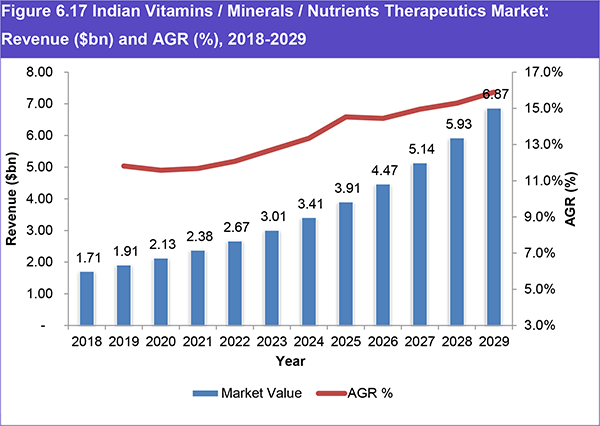

6.9 Vitamins / Minerals / Nutrients Therapeutic Segment: Overview, 2018

6.9.1 Vitamins / Minerals / Nutrients Therapeutics Market: Forecast, 2019-2029

6.9.2 Vitamins / Minerals / Nutrients in India: Challenges and Opportunities

6.9.3 Drivers and Restraints for the Vitamins / Minerals / Nutrients Therapeutics Segment

6.10 Dermatological Therapeutic Segment: Overview, 2018

6.10.1 Dermatological Therapeutics Market: Forecast, 2019-2029

6.10.2 Drivers and Restraints for the Dermatological Therapeutics Segment

6.11 Central Nervous System (CNS) Therapeutics: Overview, 2018

6.11.1 CNS Drugs Market: Forecast, 2019-2029

6.11.2 Intentional Injury Among the Top 10 Leading Causes of Death, 2018

6.11.3 India’s Aging Population: Driver for the CNS Segment

6.11.4 Drivers and Restraints for the CNS Therapeutics Segment

6.12 Gynaecological Treatment Market Overview: 2018

6.12.1 Infant Mortality Still High in India

6.12.2 Indian Gynaecological Treatments Market: Forecast, 2019-2029

6.12.3 Drivers and Restraints for the Gynaecological Segment

6.13 Other Pharmaceutical Products Market Overview: 2018

6.13.1 Incidence of Cancer is Rising in India

6.13.2 Indian Other Treatments Market: Forecast, 2019-2029

7. Indian Pharmaceutical Market: Leading Drug Types, 2019-2029

7.1 Drug Types in the Indian Market: Overview, 2018

7.2 Growth Forecasts for Leading Drug Types in India, 2019-2029

7.3 Generic Drugs Dominate the Indian Pharmaceutical Market

7.3.1 Indian Generics: Overview, 2018

7.3.2 Indian Generic Drugs Market: Forecast, 2018-2029

7.3.3 Branded Generics Preferred by Many Indian Patients

7.3.4 Drivers and Restraints for the Generic Drug Market in India

7.4 Indian Over-The-Counter (OTC) Drugs Market: Overview, 2018

7.4.1 Indian OTC Market: Forecast, 2019-2029

7.4.2 Drivers and Restraints of the Indian OTC Market

7.5 Indian Patented Drugs Market: Overview, 2018

7.5.1 Indian Patented Drugs Market: Forecasts, 2019-2029

7.5.2 Drivers and Restraints for the Indian Patented Drugs Market

7.6 Indian Biosimilar Drugs, 2018

7.6.1 Indian Biosimilar Drugs Market: Forecast, 2019-2029

7.6.2 A Number of Blockbuster Drugs Coming Off-Patent Over the Next Decade

7.6.3 Drivers and Restraints of the Indian Biosimilar Drugs Market

8. The Leading Companies in the Indian Pharmaceuticals Market

8.1 Indian Pharmaceuticals Market Overview

8.1.1 Indian Pharmaceutical Patent Law and the Effect on Big Pharmaceutical Companies

8.2 Top 50 Domestic Indian Pharmaceutical Companies, 2018

8.3 Sun Pharmaceuticals Industries Limited

8.3.1 Sun Pharma: Global Presence

8.3.1.1 Sun Pharmaceutical Sales by Region, 2017

8.3.2 Sun Pharmaceuticals Business Performance 2008-2017

8.3.3 Sun Pharmaceutical: The Acquisition of Ranbaxy Laboratories is the Largest Ever Deal Made by an Indian Pharmaceutical Company

8.3.3.1 Other Major M&A Activity

8.4 Abbott Healthcare Private Limited (Abbott India)

8.4.1 Abbott India: Business Performance 2007-2017

8.4.2 Abbott India: Major and Recent M&A Activity

8.5 Cipla Ltd.

8.5.1 Cipla: Business Performance 2008-2017

8.5.2 Cipla Ltd.: Major and Recent Activity

8.6 Cadila Healthcare Limited

8.6.1 Cadila: Business Performance 2008-2017

8.6.2 Cadila Healthcare Revenue by Therapeutic Area 2017

8.7 GlaxoSmithKline Pharmaceuticals Limited

8.7.1 GlaxoSmithKline India: Business Performance 2008-2017

8.8 Pfizer Limited., India

8.8.1 Pfizer India: Business Performance 2008-2017

8.9 Lupin

8.9.1 Lupin: Business Performance 2008-2017

8.9.2 Lupin Revenue by Therapeutic Area, 2017

8.10 Sanofi India Limited

8.10.1 Sanofi India Limited: Business Performance 2008-2017

8.10.2 Sanofi India Limited Revenue by Business Segments, 2017

8.10.3 Sanofi India Limited Revenue by Geographical Area, 2017

8.10.4 Sanofi India Limited Recent Activities

8.11 Intas Pharmaceuticals Limited

8.11.1 Intas Pharmaceuticals Limited: Business Performance 2008-2017

8.12 Dr. Reddy’s Laboratories Ltd.

8.12.1 Dr. Reddy’s Laboratories Ltd: Business Performance 2008-2017

8.12.2 Dr. Reddy’s Laboratories Ltd. Revenue by Business Segments, 2017

8.12.3 Dr. Reddy’s Laboratories Ltd Global Generics Segment Revenue by Geographical Area, 2017

8.13 Glenmark Pharmaceuticals Limited

8.13.1 Glenmark Pharmaceuticals Limited: Business Performance 2008-2017

8.13.2 Glenmark Pharmaceuticals Limited Revenue by Geographical Area, 2017

8.13.3 Glenmark Pharmaceuticals Limited Recent Activities

9. Qualitative Analysis of the Indian Pharmaceuticals Market, 2018

9.1 Indian Pharmaceutical Market: Drivers and Restraints

9.2 SWOT Analysis of the Indian Pharmaceuticals Market

9.3 Strengths

9.3.1 Increasing Investment in the Healthcare System

9.3.2 The Disease Burden and GDP Growing

9.3.3 India’s Population Set to Become the World’s Largest by 2030

9.3.4 India Popular for Pharmaceutical Outsourcing

9.4 Weaknesses

9.4.1 Stringent Pricing Regulations Hit the Indian Pharmaceuticals Market

9.4.2 Poor Infrastructure Threatens to Hinder Market Potential

9.4.3 Intense Competition Driving Down Drug Prices

9.5 Opportunities

9.5.1 Global Demand for Generics Rising

9.5.2 National Rural Health Mission Driving Healthcare Access in Rural Areas

9.5.3 Significant Investment from MNCs Expected

9.5.4 Innovative Biotechnology Sector Set to Capitalise on Patent Expiries

9.6 Threats

9.6.1 Rise of Other Low-Cost Generic Exporters

9.6.2 Will the Indian Government Stick to Increasing Healthcare Expenditure?

9.6.3 Recent Warnings and Export Bans from Regulatory Bodies Hit Confidence in Indian Pharmaceuticals

9.7 Porter’s Five Forces Analysis of the Indian Pharmaceuticals Market

9.7.1 Rivalry Among Competitors [High]

9.7.2 Threat of New Entrants [Low]

9.7.3 Power of Suppliers [Medium]

9.7.4 Power of Buyers [High]

9.7.5 Threat of Substitutes [Low]

10. Conclusion

10.1 The Indian Pharmaceuticals Market: Growing Global Market Share

10.2 Indian Pharmaceutical Market: Chronic Diseases Becoming Increasingly Prevalent

10.3 Commercial Drivers of the Indian Pharmaceuticals Market

10.4 Commercial Restraints of the Indian Pharmaceuticals Market

10.5 Concluding Remarks

11. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 4.1 The Indian Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 5.1 Leading Causes of Death in India, Proportion of Total Deaths (%) 2014

Table 5.2 Leading Types of Cancer in India by Age-Standardised Death Rate (per 100,000 People), 2014

Table 5.3 Causes of Death in India by World Ranking, 2014

Table 6.1 Leading Therapeutic Areas in the Indian Pharmaceutical Market: Market Share (%), 2018, 2024, 2029

Table 6.2 The Indian Pharmaceutical Market: Revenue ($bn), AGR (%) and CAGR (%) by Therapeutic Area, 2018-2029

Table 6.3 The Infectious Disease Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.4 The Indian Cardiovascular Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.5 Indian Gastro-Intestinal Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.6 The Indian Respiratory Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.7 Indian Pain Relief/Analgesics Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.8 Indian Diabetes Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.9 Indian Vitamins / Minerals / Nutrients Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.10 Indian Dermatological Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.11 Indian CNS Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.12 Indian Gynaecological Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 6.13 Indian Other Therapeutics Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 7.1 Leading Drug Types in the Indian Pharmaceutical Market: Revenue ($bn) and Market Share (%), 2019, 2024 and 2029

Table 7.2 Indian Pharmaceutical Market: Revenue ($bn), AGR (%), CAGR (%) by Drug Type, 2019-2029

Table 7.3 Indian Generic Drugs Market: Revenue ($bn), AGR (%) and CAGR (%) 2018-2029

Table 7.4 Indian OTC Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 7.5 Indian Patented Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 7.6 Selected Biosimilar Therapeutics on the Indian Market, 2018

Table 7.7 Indian Biosimilar Drugs Market: Revenue ($bn), AGR (%) and CAGR (%), 2018-2029

Table 7.8 Selected Blockbuster Biologic Patent Expiries in the US and EU, 2015-2028

Table 7.9 Selected Late-Stage Biosimilar Pipeline Products, 2015

Table 8.1 Top 50 Companies in the Indian Pharmaceutical Market: Revenue (Rs. m), Revenue ($m) and Market Share (%), 2017

Table 8.2 Sun Pharmaceuticals: Revenue (Rs. m), Revenue ($m) and Revenue Share (%) by Business Area, FY 2017

Table 8.3 Sun Pharmaceuticals: Revenue (Rs. m), AGR (%) and CAGR (%), 2008-2017

Table 8.4 Sun Pharmaceuticals: M&A Activity, 1997-2016

Table 8.5 Abbott India: Market Share (%) and Market Rank of Key Brands

Table 8.6 Abbott India: Revenue (Rs. m), AGR (%) and CAGR (%), 2006-2017

Table 8.7 Cipla: Total Revenue (Rs. m), AGR (%) and CAGR (%), 2008-2017

Table 8.8 Cipla: Revenue (Rs. m), Revenue ($m) and Revenue Share (%) by Geographical Area, 2017

Table 8.9 Cadila Healthcare Ltd.: Total Revenue (Rs. m), Total Revenue ($m), AGR (%) and CAGR (%), 2008-2017

Table 8.10 Cadila Healthcare Ltd.: Revenue (Rs.m) and Revenue Share (%) by Therapeutic Area, 2017

Table 8.11 GlaxoSmithKline India: Key Products in the Indian Market, 2017

Table 8.12 GlaxoSmithKline India Total Revenue (Rs. m), AGR (%) and CAGR (%), 2007-2017

Table 8.13 Pfizer India: Leading Brands on the Indian Market 2017

Table 8.14 Pfizer India: Total Revenue (Rs.m), AGR (%) and CAGR (%), 2008-2017

Table 8.15 Lupin: Total Revenue (Rs. m), AGR (%) and CAGR (%), 2008-2017

Table 8.16 Lupin: Revenue Share (%) by Therapeutic Area, 2017

Table 8.17 Sanofi India Limited: Major Products,2017

Table 8.18 Sanofi India Limited: Total Revenue (Rs. m), AGR (%) and CAGR (%), 2008-2017

Table 8.19 Sanofi India Limited: Revenue (Rs. m) and Revenue Share (%) by Domestic Segment, 2017

Table 8.20 Sanofi India Limited: Revenue (Rs. m) and Revenue Share (%) by Branded drugs, 2017

Table 8.21 Sanofi India Limited: Revenue (Rs. m), and Revenue Share (%) by Geographical Area, 2017

Table 8.22 Intas Pharmaceuticals Limited: Total Revenue (Rs. m), AGR (%) and CAGR (%), 2008-2017

Table 8.23 Dr. Reddy’s Laboratories Ltd: Major Products,2017

Table 8.24 Dr. Reddy’s Laboratories Ltd: Total Revenue (Rs. m), AGR (%) and CAGR (%), 2008-2017

Table 8.25 Dr. Reddy’s Laboratories Ltd: Revenue (Rs. m), and Revenue Share (%) by Business Segment, 2017

Table 8.26 Dr. Reddy’s Laboratories Ltd: Revenue (Rs.m), and Revenue Share (%) by Geographical Area, 2017

Table 8.27 Glenmark Pharmaceuticals Limited: Total Revenue (Rs.m), AGR (%) and CAGR (%), 2008-2017

Table 9.1 SWOT Analysis of the Indian Pharmaceuticals Market

List of Figures

Figure 1.1 Indian Pharmaceutical Market: Overview of Submarkets

Figure 2.1 Indian Population: Rural and Urban (Mn),1960-2020

Figure 2.2 Indian Population: Total (Mn) and Annual Population Growth Rate (%), 1960-2020

Figure 2.3 Indian GDP ($bn) and Growth Rate (%), 2010-2020

Figure 2.4 Access to Improved Water Sources as a Proportion of Total Population (%) and Access to Improved Sanitation as a Proportion of Total Population (%), 2008-2020

Figure 2.5 Indian GDP ($bn) and Health Expenditure as a Proportion of GDP (%), 2006-2014

Figure 2.6 Health Expenditure: Public Health expenditure as a Proportion of Total Health Expenditure (%) and Out of Pocket Expenditure as a Proportion of Private Health Expenditure 2008-2014

Figure 3.1 National Regulatory Bodies Regulating the Indian Pharmaceutical Market

Figure 4.1 The Indian Pharmaceutical Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 5.1 Leading Causes of Death in India, Proportion of Total Deaths (%) 2014

Figure 6.1 Leading Therapeutic Areas in the Indian Pharmaceuticals Market: Market Share (%), 2018

Figure 6.2 Leading Therapeutic Areas in the Indian Pharmaceuticals Market: Market Share (%), 2024

Figure 6.3 Leading Therapeutic Areas in the Indian Pharmaceutical Market: Market Share (%), 2029

Figure 6.4 The Infectious Disease Drugs Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.5 Malaria cases (m), P. falciparum cases (m) and Proportion of P. falciparum cases (%) in India, 1995-2014

Figure 6.6 Infectious Diseases Therapeutics Market in India: Drivers and Restraints, 2018-2029

Figure 6.7 The Indian Cardiovascular Drugs Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.8 Cardiovascular Diseases Therapeutics Market in India: Drivers and Restraints

Figure 6.9 Indian Gastro-Intestinal Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.10 Gastro-intestinal Therapeutics Market in India: Drivers and Restraints

Figure 6.11 Indian Respiratory Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.12 Respiratory Therapeutics Market in India: Drivers and Restraints, 2018-2029

Figure 6.13 Indian Pain Relief/Analgesics Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.14 Pain Relief/Analgesics Therapeutics Market in India: Drivers and Restraints, 2018-2029

Figure 6.15 Indian Diabetes Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.16 Diabetes Therapeutics Market in India: Drivers and Restraints

Figure 6.17 Indian Vitamins / Minerals / Nutrients Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.18 Vitamins / Minerals / Nutrients Therapeutics Market in India: Drivers and Restraints

Figure 6.19 Indian Dermatological Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.20 Dermatological Therapeutics Market in India: Drivers and Restraints

Figure 6.21 Indian CNS Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.22 CNS Therapeutics Market in India: Drivers and Restraints

Figure 6.23 Indian Gynaecological Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 6.24 Gynaecological Therapeutics Market in India: Drivers and Restraints

Figure 6.25 Indian Other Therapeutics Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 7.1 Leading Drug Types in the Indian Pharmaceutical Market: Market Share (%), 2019

Figure 7.2 Leading Drug Types in the Indian Pharmaceutical Market: Market Share (%), 2024

Figure 7.3 Leading Drug Types in the Indian Pharmaceutical Market: Market Share (%), 2029

Figure 7.4 Indian Generic Drugs Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 7.5 Generic Drugs Market in India: Drivers and Restraints

Figure 7.6 Indian OTC Drugs Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 7.7 OTC Drugs Market in India: Drivers and Restraints

Figure 7.8 Indian Patented Drugs Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 7.9 Patented Drugs Market in India: Drivers and Restraints

Figure 7.10 Indian Biosimilar Drugs Market: Revenue ($bn) and AGR (%), 2018-2029

Figure 7.11 Biosimilar Drug Market in India: Drivers and Restraints

Figure 8.1 Sun Pharmaceuticals: Revenue Share (%) by Business Area, FY 2017

Figure 8.2 Sun Pharmaceuticals: Revenue ($m) and AGR (%), 2008-2017

Figure 8.3 Abbott India: Revenue (Rs. m) and AGR (%), 2006-2017

Figure 8.4 Cipla Revenue (Rs.m) and AGR (%), 2008-2017

Figure 8.5 Cadila Healthcare Ltd.: Revenue Share (%), by Business Area, 2017

Figure 8.6 GlaxoSmithKline India: Revenue ($m) and AGR (%), 2007-2017

Figure 8.7 Pfizer India: Revenue (Rs.m) and AGR (%), 2007-2016

Figure 8.8 Lupin: Revenue (Rs.m) and AGR (%), 2008-2017

Figure 8.9 Lupin: Revenue Share (%) by Therapeutic Area, 2017

Figure 8.10 Sanofi India Limited: Revenue ($m) and AGR (%), 2008-2017

Figure 8.11 Sanofi India Limited: Revenue Distribution by Business Segments, 2017

Figure 8.12 Sanofi India Limited: Revenue Distribution by Domestic Segments, 2017

Figure 8.13 Sanofi India Limited: Revenue Distribution by Geographical Area, 2017

Figure 8.14 Intas Pharmaceuticals Limited: Revenue ($m) and AGR (%), 2008-2017

Figure 8.15 Dr. Reddy’s Laboratories Ltd: Revenue ($m) and AGR (%), 2008-2017

Figure 8.16 Dr. Reddy’s Laboratories Ltd: Revenue Distribution by Business Segments, 2017

Figure 8.17 Dr. Reddy’s Laboratories Ltd: Global Generics Segment Revenue Distribution by Geographical Area, 2017

Figure 8.18 Glenmark Pharmaceuticals Limited: Revenue ($m) and AGR (%), 2007-2017

Figure 8.19 Glenmark Pharmaceuticals Limited: Revenue Distribution by Geographical Area, 2017

Figure 9.1 Indian Pharmaceuticals Market: Drivers and Restraints

Figure 9.2 Porter’s Five Forces Analysis of the Indian Pharmaceuticals Market

Abbott India

Able Labs

Ajanta Pharma Ltd

Akumentis Healthcare Ltd

Albert David Ltd

Alembic

Alkem

Almirall

Amgen

Apex Laboratories Pvt. Ltd

Aristo Pharma

Ascendis Pharma

AstraZeneca

Aventis Pharma Limited

Bayer

Bharat Serums

Biocon Ltd

Biosintez

Blue Cross Laboratories Ltd.

Cadila Healthcare Ltd.

Caraco

Chattem Chemicals, Inc.

Cipla

Claris Lifesciences

Daiichi Sankyo

Divis Laboratories

Dr. Reddy's Laboratories

DUSA Pharma, Inc.

Eli Lilly and Company (India) Pvt. Ltd.

Emcare

Eris Lifesciences

Exelan

FDC

Fourrts (India) Laboratories Pvt, Ltd

Franco India

GlaxoSmithKline India

Glenmark Pharma

GSK India

Heinz India

Helsinn Group

Hetero Drugs Ltd

Hoechst India Limited

Hoechst Marion Roussel Limited

Hoechst Pharmaceuticals Private Limited

Indoco

Indi Pharma Pvt. Ltd.

InSite Vision

Intas Pharma

InvaGen

Ipca Laboratories

Janssen

JB Chemicals

JSC Biosintez

Lonza

Lupin

Macleods

MannKind Corporation

Medley Pharmaceuticals Ltd

MedproPhamaceutica (Pty) Ltd

Megafine Pharma

Merck KGaA

Meyer Organics

Micro Labs

MSD Pharma

Natco

Novartis India

Novo Nordisk

Odomzo

Pfizer India

Pharmalucence

Piramal Healthcare

Pola Pharma, Inc.

Ranbaxy

Raptakos, Brett & Co. Ltd

Roche Pharma India

Sandoz, Novartis Division

Sanofi India

Seciera

Sun Pharmaceuticals

Taro Pharmaceutical Industries Ltd.

Teva Pharmaceuticals (Pty)Ltd

The Himalaya Drug Company

Torrent Pharma

True North

Unichem

URL’s

USV

Wallace Pharmaceuticals

Win-Medicare

Wockhardt

Wockhardt

Zydus Wellness Ltd

List of Organizations Mentioned in the Report

Australia’s TGA (Therapeutic Goods Administration)

Central Drugs Standard Control Organisation

Competition Commission of India (CCI)

Dr. M.G.R. Medical University (TNMGRMU)

Drug Consultative Committee

Drug Controller General of India

Medical Council of India

MHLW (Ministry of Health, Labour and Welfare)

MHRA (Medicines & Healthcare Products Regulatory Agency)

Ministry of Chemicals & Fertilisers

Ministry of Health and Family Welfare

National AIDS Control Organisation (NACO)

National Pharmaceutical Pricing Authority

Organisation for Economic Co-operation and Development (OECD)

State Food and Drug Administrations

The Joint United Nations Programme on HIV/AIDS (UNAIDS)

US Federal Trade Commission (FTC)

World Health Organization (WHO)

Download sample pages

Complete the form below to download your free sample pages for Indian Pharmaceutical Market Forecast 2019-2029

Related reports

-

Global Angioplasty Balloons Market 2019-2029

Our 131-page report provides 94 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 01 January 1970 -

Global Asthma & COPD Therapies Market 2019-2029

The global asthma & COPD therapies market was valued at $32bn in 2018 and is projected to grow at a...

Full DetailsPublished: 19 March 2019 -

Global Pulmonary/Respiratory Drug Delivery Market Forecast 2019-2029

The global pulmonary/respiratory drug delivery market reached $40.67 bn in 2018 and is expected to grow at a CAGR of...

Full DetailsPublished: 29 May 2019 -

mRNA Vaccines and Therapeutics Market Forecast 2019-2029

The mRNA Vaccines and Therapeutics Market is estimated at $3.43 billion in 2018. The Standardized Therapeutic Cancer mRNA Vaccines segment...

Full DetailsPublished: 07 May 2019 -

Drug Delivery Technologies Market Forecast 2019-2029

The Drug Delivery Technologies market is estimated to grow at a CAGR of 8.3% in the first half of the...

Full DetailsPublished: 27 February 2019 -

Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2019-2029

The Pre-Filled Device Manufacturing market is estimated to reach $8.3bn in 2024, growing at a CAGR of 9.5% throughout the...Full DetailsPublished: 30 August 2019 -

Global Antidepressant and Anti-Anxiety Drugs Market 2019-2029

The global antidepressant and Anti-anxiety drugs market is estimated to have reached $12.16bn in 2018. In 2018, the SSRIs segment...

Full DetailsPublished: 29 March 2019 -

Biologics Market Trends and Forecasts 2019-2029

The global biologics market is estimated to reach $266bn in 2024. The market is expected to grow at a CAGR...

Full DetailsPublished: 28 August 2019 -

Generic Drugs Market Forecast 2019-2029

The generic drugs market is estimated to have reached $257.3bn in 2018 and is expected to grow at a CAGR...

Full DetailsPublished: 14 June 2019 -

Global Hypertension Drugs Market 2019-2029

The global hypertension drugs market is estimated to have reached $24.7bn in 2018 and is expected to reach the market...

Full DetailsPublished: 31 July 2019

Download sample pages

Complete the form below to download your free sample pages for Indian Pharmaceutical Market Forecast 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024

Visiongain Publishes Inflammatory Bowel Diseases (IBD) Drugs Market Report 2024-2034

The global Inflammatory Bowel Diseases (IBD) Drugs market was valued at US$27.53 billion in 2023 and is projected to grow at a CAGR of 6.2% during the forecast period 2024-2034.

11 April 2024