Visiongain has calculated that the Distributed Energy Generation Market will see a capital expenditure (CAPEX) of $246bn in 2019. Read on to discover the potential business opportunities available.

Fuel suppliers provide fossil fuels, nuclear and renewables sources including hydropower, solar, wind, bagasse and biomass for electrical energy generation. Other alternatives, including biomass such as peat and by products from the processing of sugar cane and palm oil, are increasingly being researched and exploited in cost-effective ways to energy generation.

Generating technologies are specific to the type of fuel that they employ, so there are strong linkages between the range of fuels that are available to a given country and the range of generating technologies that are feasible for investment. This stage has various activities including feasibility study & design, construction and installation, operation & maintenance. The firms operate, plan, design and/or construct electrical generators for energy generation.

The transmission arranges it serves to interface generation plants with conveyance frameworks, which, thusly, convey power to support areas. Transmission happens at high voltage levels to limit wasteful aspects; electrical voltage should, therefore, be “stepped up” and after that “stepped down” between the generation plant and when it achieves the distribution network. The step-up transformer is commonly viewed as a major aspect of the generation section of the value chain, while the step-down transformer normally falls inside the conveyance fragment. This phase of the esteem chain depends for the most part on electrical designers and network technicians.

The report will answer questions such as:

– How is the Distributed Energy Generation market evolving?

– What is driving and restraining Distributed Energy Generation market dynamics?

– How will each Distributed Energy Generation submarket segment grow over the forecast period and how much Sales will these submarkets account for in 2029?

– How will market shares of each Distributed Energy Generation submarket develop from 2019-2029?

– Which individual technologies will prevail and how will these shifts be responded to?

– Which Distributed Energy Generation submarket will be the main driver of the overall market from 2019-2029?

– How will political and regulatory factors influence regional Distributed Energy Generation markets and submarkets?

– Will leading national Distributed Energy Generation market broadly follow macroeconomic dynamics, or will individual country sectors outperform the rest of the economy?

– How will market shares of the national markets change by 2029 and which nation will lead the market in 2029?

– Who are the leading players and what are their prospects over the forecast period?

– How will the sector evolve as alliances form during the period between 2019 and 2029?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides Analysis and Forecasts for the Distributed Energy Generation markets by

– CAPEX (US$m)

2) The report provides forecasts for the Distributed Energy Generation market by Technology, for the period 2019-2029

– Combustion Turbines

– Reciprocating Engines

– Solar Photovoltaic

– Micro-Hydropower

– Wind Turbines

– Fuel Cells

3) The report provides forecasts for the Distributed Energy Generation market by Application, for the period 2019-2029

– Residential

– Industrial

– Commercial

4) The report provides forecasts for the Distributed Energy Generation Market by Region, for the period 2019-2029

North America Distributed Energy Generation market

– US Distributed Energy Generation Forecast 2019-2029

– Canada Distributed Energy Generation Forecast 2019-2029

Europe Distributed Energy Generation market Forecast

– Germany Distributed Energy Generation Forecast 2019-2029

– UK Distributed Energy Generation Forecast 2019-2029

– France Distributed Energy Generation Forecast 2019-2029

Asia-Pacific Distributed Energy Generation market

– China Distributed Energy Generation Forecast 2019-2029

– Japan Distributed Energy Generation Forecast 2019-2029

– India Microgrid Forecast 2019-2029

Rest of World Distributed Energy Generation market

– Middle east Distributed Energy Generation Forecast 2019-2029

– Africa Distributed Energy Generation Forecast 2019-2029

– South America Distributed Energy Generation Forecast 2019-2029

5) The report provides market share and detailed profiles of the leading companies operating within the Distributed Energy Generation market:

– General Electric

– Siemens

– Ballard Power Systems

– Caterpillar Inc.

– Rolls Royce

This independent 128-page report guarantees you will remain better informed than your competitors. With 89 tables and figures examining the Distributed Energy Generation market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure which will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 Distributed Energy Generation (DEG) Market Overview

1.2 Market Structure Overview and Market Definition

1.2.1 Market Definition

1.2.2 Market Structure Overview

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include

1.6 Who is This Report For? 1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to The Distributed Energy Generation (DEG)Market

2.1 Global Distributed Energy Generation (DEG)Market Structure

2.2 Market Definition

2.3 Distributed Energy Generation (DEG)-Value Chain Analysis

2.3.1 Stakeholders

3. Executive Summary

4. Market Insights

4.1 Lucrative Opportunities in the Distributed Energy Generation Market

4.2 Energy Generation Market In APAC

4.3 Market Share of Major Countries, 2019

5. Market Scenario

5.1 Growth Factors

5.1.1 Increasing demand of Renewable Power Generation and Increasing Government Mandates

5.1.2 Growing Electricity Consumption Boost the Distributed Energy Generation Market

5.2 Restraints

5.2.1 High Initial Cost

5.3 Opportunities

5.3.1 Shift from Centralized to Distributed Generation

5.3.2 Substitute for Grid Investments

5.3.3 Environmental friendliness

5.4 Challenges

5.4.1 Improving the Capability and Cost-Efficient Operation of Distribution Networks to Serve the Increasing Amount of Distributed Generation

5.5 Market Trends

6. Distributed Energy Generation Market by Technology

6.1 Introduction

6.1 Combustion Turbines

6.2 Reciprocating Engines

6.3 Solar Photovoltaic

6.4 Micro-Hydropower

6.5 Wind Turbines

6.6 Fuel Cells

7. Distributed Energy Generation Market by Application

7.1 Introduction

7.2 Residential

7.3 Industrial

7.4 Commercial

8. Distributed Energy Generation Market by Region

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 United Kingdom

8.4 Asia Pacific (APAC)

8.4.1 China

8.4.2 Japan

8.4.3 India

8.5 Rest of World (RoW)

8.5.1 Middle East

8.5.2 Africa

8.5.3 South America

9.Leading Companies in DEG Market

9.1 Introduction

9.2 General Electric

9.2.1 Business Overview

9.2.2 Recent Developments

9.2.3 Business Strategy

9.2.4 Marketing Channel

9.2.4.1Strength

9.2.4.1.1 Business segment performance Oil & Gas

9.2.4.1.2 Wide Customer Base

9.2.4.1.3 Robust Research and Development Capabilities

9.2.4.2Weakness

9.2.4.2.1 Dependence on Third Parties for Raw Materials

9.2.4.3 Opportunities

9.2.4.3.1 Inorganic growth strategy

9.2.4.3.2 Partnerships

9.2.4.3.3 Robust Outlook of Global Renewable Energy Market

9.2.4.4 Challenges

9.2.4.4.1 Environmental and Other Government Regulations

9.2.4.4.2 Aggressive competition

9.2.4.4.3 Technological changes

9.3 Siemens AG

9.3.1 Business Overview

9.3.2 Recent Developments

9.3.3 Business Strategy

9.3.4 Marketing Channel

9.3.5 SWOT Analysis

9.3.5.1 Strengths

9.3.5.1.1 Pioneer of Technology Driven Services

9.3.5.1.2 Sustained Financial Growth

9.3.5.1.3 Diversified Revenue Mix and Strong Order Backlog

9.3.5.2 Restraints

9.3.5.2.1 Decline in Cash Reserves

9.3.5.3 Opportunities

9.3.5.3.1 Focus on Innovation

9.3.5.3.2 Strategic Acquisitions

9.3.5.3.3 Contracts, Agreements and Alliances

9.3.5.4 Challenges

9.3.5.4.1 Environmental and Other Government Regulations

9.3.5.4.2 Intense Competition

9.3.5.4.2 Foreign Exchange Risks

9.4 Ballard Power System Inc

9.4.1 Business Overview

9.4.2 Recent Developments

9.4.3 Business Strategy

9.5 Caterpillar Inc.

9.5.1 Business Overview

9.5.2 Recent Developments

9.5.3 Business Strategy

9.5.4 Marketing Channel

9.5.5 SWOT Analysis

9.5.5.1 Strength

9.5.5.1.1 Strong portfolio of brands and diversified geographic presence

9.5.5.1.2 Customer driven product innovation capabilities

9.5.5.2 Weakness

9.5.5.2.1 Litigations

9.5.5.3 Opportunities

9.5.5.3.1 New product launches

9.5.5.3.2 Strategic agreements

9.5.5.4 Challenges

9.5.5.4.1 Price changes or shortage of commodities and components

9.5.5.4.2 Intense Competition

9.6 Rolls-Royce Holdings Plc

9.6.1 Business Overview

9.6.2 Recent Developments

9.6.3 Business Strategy

9.6.4 Marketing Channel

9.6.5 SWOT Analysis

9.6.5.1 Drivers

9.6.5.1.1 Order Book

9.6.5.1.2 Market Position

9.6.5.2 Weakness

9.6.5.2.1 Product Failures

9.6.5.3 Opportunities

9.6.5.3.1 Growing Global Aircraft Maintenance, Repair and Overhaul Business

9.6.5.3.2 Business Restructuring

9.6.5.3.3 Relationship with International Customers

9.6.5.4 Challenges

9.6.5.4.1 Foreign Currency Fluctuations

9.6.5.4.2 Cybersecurity Risks

9.6.5.4.3 Stringent Regulations

9.7 Other Companies Involved in The Distributed Energy Generation Market

10. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 3.1 Global Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Bn)

Table 6.1 Global Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Billion) by Technology

Table 6.2 Combustion Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 6.3 Reciprocating Engines Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 6.4 Solar Photovoltaic Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

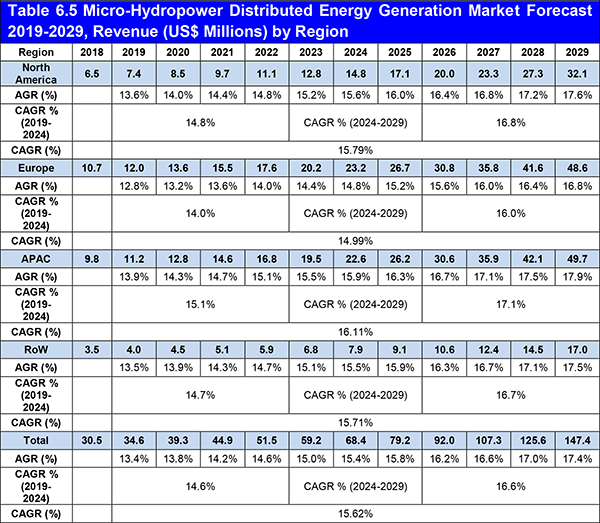

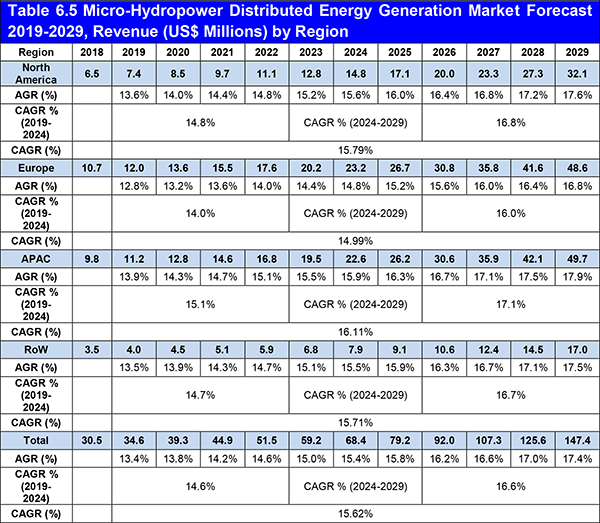

Table 6.5 Micro-Hydropower Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 6.6 Wind Turbines Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 6.7 Fuel Cell Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 7.1 Global Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Application

Table 7.2 Residential Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 7.3 Industrial Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 7.4 Commercial Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 8.1 Global Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Region

Table 8.2 North America Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Technology

Table 8.3 North America Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Application

Table 8.4 North America Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Country

Table 8.5 Europe Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Technology

Table 8.6 Europe Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Application

Table 8.7 Europe Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Country

Table 8.8 APAC Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Technology

Table 8.9 APAC Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Application

Table 8.10 APAC Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Country

Table 8.11 RoW Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Technology

Table 8.12 RoW Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Application

Table 8.13 RoW Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions) by Country

Table 9.1 General Electric Profile 2018(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue (%), Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 9.2 General Electric Total Company Revenue 2015-2018 ($bn, AGR %)

Table 9.3 Siemens AG Profile 2018(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 9.4 Siemens AG, Total Company Revenue 2015-2018 ($bn, AGR %)

Table 9.5 Ballard Power System Inc Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue (%), Geography, Key Market, Listed on, Products/Services)

Table 9.5 Ballard Power System Inc., Total Company Revenue 2013-2017 ($bn, AGR %)

Table 9.7 Caterpillar Inc. Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue (%), Geography, Key Market, Listed on, Products/Services)

Table 9.8 Caterpillar Inc., Total Company Revenue 2013-2017 ($bn, AGR %)

Table 9.9 Ballard Power System Inc Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue (%), Geography, Key Market, Listed on, Products/Services)

List of Figures

Figure 2.1 Global Distributed Energy Generation (DEG)Market Segmentation Overview

Figure 2.2 Distributed Energy Generation (DEG) -Value Chain Analysis

Figure 3.1 Global Distributed Energy Generation Market Forecast 2019-2029, Revenue (US$ Millions)

Figure 3.2 Solar PV is the fastest growing Technology During the Forecast Period

Figure 3.3 The commercial application of distributed generation is expected to grow at the highest CAGR 15.81% during the forecast period

Figure 3.4 The Asia Pacific distributed generation market is expected to grow at the highest CAGR 16.04% during the forecast period

Figure 4.1 The global distributed generation is expected to grow at the highest CAGR 15.53% during the forecast period

Figure 4.2 The APAC distributed generation is expected to grow at the highest CAGR 16.04% during the forecast period

Figure 4.3 The US distributed generation market hold the largest share in 2019

Figure 5.1 Market Overview for Distributed Energy Generation Market

Figure 6.1 Wind Turbines Hold the Largest Market Share for Distributed Energy Generation in 2019

Figure 6.2 Solar Photovoltaic is Expected to Hold the Highest CAGR (%) For Distributed Energy Generation in 2019-2029

Figure 6.3 Europe is Expected to Hold the Largest Share in 2029 for Distributed Energy Generation by Combustion Turbines

Figure 6.4 Europe is Expected to Hold the Largest Share in 2029 for Distributed Energy Generation by Reciprocating Engines

Figure 6.5 North America is to Hold the Largest Share in 2019 for Distributed Energy Generation by Solar Photovoltaic

Figure 6.6 APAC is Expected to Hold the Largest Share in 2029 for Distributed Energy Generation by Micro-Hydropower

Figure 6.7 APAC is Expected to Hold the Highest CAGR 15.06% for Distributed Energy Generation by Wind Turbines During the Forecast Period

Figure 6.8 Europe is Expected to Hold the Largest Market Share for Distributed Energy Generation by Fuel Cells in 2029

Figure 7.1 Commercial Application is Expected to Hold the Highest CAGR 15.83% for Distributed Energy Generation Market During the Forecast Period

Figure 7.2 Europe is Expected to Hold the Market Share for Residential Distributed Energy Generation Market in 2029

Figure 7.3 Europe is Expected to Hold the Market Share for Industrial Distributed Energy Generation Market in 2029

Figure 7.4 Europe is Expected to Hold the Largest Market Share for Commercial Distributed Energy Generation Market in 2029

Figure 8.1 Europe is Expected to Hold the Largest Market Share for Global Distributed Energy Generation Market in 2029

Figure 8.2 Solar Photovoltaic is Expected to Hold the Highest CAGR 16.38% for North America Distributed Energy Generation Market During the Forecast Period

Figure 8.3 Commercial is Expected to Hold the Largest Market Share for North America Distributed Energy Generation Market in 2029

Figure 8.5 US is Expected to Hold the Largest Market Share for North America Distributed Energy Generation Market in 2019

Figure 8.6 Solar Photovoltaic is Expected to Hold the Highest CAGR 15.61% for Europe Distributed Energy Generation Market During the Forecast Period

Figure 8.7 Commercial is Expected to Hold the Largest Market Share for Europe Distributed Energy Generation Market in 2029

Figure 8.8 Germany is Expected to Hold the Largest Market Share for Europe Distributed Energy Generation Market in 2019

Figure 8.9 Wind Turbine is Expected to Hold the Largest Market Share for APAC Distributed Energy Generation Market During the Forecast Period

Figure 8.10 Industrial is Expected to Hold the Highest CAGR % for APAC Distributed Energy Generation Market During the Forecast Period

Figure 8.11 India is Expected to Hold the Highest CAGR % for APAC Distributed Energy Generation Market During the Forecast Period

Figure 8.12 Wind Turbine is Expected to Hold the Largest Market Share for Row Distributed Energy Generation Market During the Forecast Period

Figure 8.13 Industrial is Expected to Hold the Largest Market Share for Row Distributed Energy Generation Market in 2029

Figure 8.14 Middle East is Expected to Hold the Largest Market Share for Row Distributed Energy Generation Market in 2019

Figure 9.1 General Electric Total Company Revenue, ($bn& AGR %), 2013-2017

Figure 9.2 General Electric % Revenue Share, by Business Segment, 2018

Figure 9.3 General Electric % Revenue Share, by Regional Segment, 2018

Figure 9.4 General Electric SWOT Analysis

Figure 9.5 Siemens AG, Company Revenue, ($bn & AGR %), 2015-2018

Figure 9.6 Siemens AG, % Revenue Share, by Regional Segment, 2018

Figure 9.7 Siemens AG, % Revenue Share, by Business Segment, 2018

Figure 9.8 Siemens AG, SWOT Analysis Figure 9.8 Siemens AG, SWOT Analysis

Figure 9.9 Ballard Power System Inc., Company Revenue, ($bn & AGR %), 2013-2017

Figure 9.10 Ballard Power System Inc., % Revenue Share, by Regional Segment, 2017

Figure 9.11 Ballard Power System Inc., % Revenue Share, by Business Segment, 2017

Figure 9.12 Ballard Power System Inc., Breakup Revenue (US$ Mn), by Sale of Product & Services, 2017

Figure 9.13 Caterpillar Inc., Company Revenue, ($bn & AGR %), 2013-2017

Figure 9.14 Caterpillar Inc., % Revenue Share, by Regional Segment, 2017

Figure 9.15 Caterpillar Inc., % Revenue Share, by Business Segment, 2017

Figure 9.16 Caterpillar Inc., SOWT Analysis

Figure 9.17 Rolls Royce, Company Revenue, ($bn & AGR %), 2013-2017

Figure 9.18 Rolls Royce, % Revenue Share, by Regional Segment, 2017

Figure 9.19 Roll-Royce, SOWT Analysis

Alstom

AMERESCO

Americas Inc

ARENA

Ballard Power System Inc

Ballard Power Systems Inc

Bloom Energy

Capstone Turbine Corporation

Caterpillar Inc

Caterpillar Power Plants

Constellation

DERlab

Doosan Fuel Cell America

E.ON SE

Electronic Industries Alliance (EIA)

ENERCON GMBH

First Solar

Fourth Partner Energy

Fuel Cell Energy

General Electric

General Electrical Energy

Huawei Technologies

IBEF

Mitsubishi Power Systems

NRG

OPRA Turbines BV

Rolls-Royce Holdings Plc

Rolls-Royce plc

Schneider Electric

Sharp Corporation

Siemens AG

Siemens Energy

SMA Solar Technology

Suzlon

Vestas Wind Systems A/S

World Energy Council

Organisations Mentioned

Department of Environment (DOE)

Distributed Power Generation Association

Energy Alternatives India (EAI)

Geospatial World

India Smart Grid Forum (ISGF)

Ministry of Statistics and Programme Implementation

North American Electric Reliability Corporation

Solar Energy Industries Association (SEIA)

T&D World

World Building Design Guide