Industries > Pharma > Chinese Pharmaceutical Market Forecast 2017-2027

Chinese Pharmaceutical Market Forecast 2017-2027

Cardiovascular Diseases, Oncology, Respiratory Diseases, Infectious Diseases, Diabetes, CNS, Autoimmune Diseases, Hypertension, Dyslipidaemia, COPD, Asthma, Antidepressants, Small Molecules, Branded Drugs, Traditional Chinese Medicine, Biologics, Vaccines, Biosimilars, Generic Prescription Drugs, Over-the-Counter Drugs, Patented Prescription Drugs, Hospitals, Retail Pharmacies, Grassroots Clinics

The Chinese Pharmaceutical market is expected to grow at a CAGR of 12.3% in the second half of the forecast period. The Chinese Pharmaceutical market reached $145.4bn in 2016, dominated by the Cardiovascular therapy area which held 13.6% share of the market.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 253-page report you will receive 68 tables and 90 figures– all unavailable elsewhere.

The 253-page report provides clear detailed insight into the Chinese Pharmaceutical market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Chinese Pharmaceutical market forecasts from 2017-2027

• This report also breaks down the revenue forecast for the Chinese Pharmaceutical market by therapy area:

– Cardiovascular: including specific revenue forecasts for Hypertension and Dyslipidaemia

– Anticancer

– Infectious Diseases

– Diabetes

– Respiratory: including specific revenue forecasts for Asthma and COPD

– Central Nervous System: including specific revenue forecasts for Antidepressants

– Autoimmune

– Others

This report lists and discusses the domestic pharmaceutical companies that dominate each submarket. Moreover, this report discusses the drivers and restraints of each submarket.

• This report also breaks down the revenue forecast for the Chinese Pharmaceutical market by leading product class:

– Small Molecules: further broken down into Generics Drugs and Branded Drugs

– Traditional Chinese Medicine

– Biologics: further broken down into Biologics (branded), Vaccines and Biosimilars

This report lists and discusses the domestic pharmaceutical companies that dominate each submarket. Moreover, this report discusses the drivers and restraints of each submarket.

• This report also breaks down the revenue forecast for the Chinese Pharmaceutical market by leading type of drug:

– Generic Prescription Drugs

– Over-the-Counter (OTC) Drugs

– Patented Prescription Drugs

This report lists and discusses the domestic pharmaceutical companies that dominate each submarket.

• This report also breaks down the revenue forecast for the Chinese Pharmaceutical market by sales channel:

– Hospitals

– Retail Pharmacies

– Grassroots Clinics

This report lists and discusses the domestic pharmaceutical companies that dominate each submarket.

• This report discusses trends in the industry and assesses strengths and weaknesses, as well as opportunities and threats (SWOT) that influence the Chinese Pharmaceutical Market. It also analyses social, technological, economic and political factors (STEP) that influence the Chinese Pharmaceutical Market

• Our study ranks and provides 2016 revenues as well as market share of the top 50 domestic Chinese Pharmaceutical companies and top 10 Multinational Pharmaceutical Companies that are the major players in the Chinese Pharmaceutical Market

• Our study lists and discusses the leading domestic and multinational Contract Research Organizations (CRO) that dominate the Chinese Pharmaceutical Market.

Visiongain’s study is intended for anyone requiring commercial analyses for the Chinese Pharmaceutical market. You find data, trends and predictions.

Buy our report today Chinese Pharmaceutical Market Forecast 2017-2027: Cardiovascular Diseases, Oncology, Respiratory Diseases, Infectious Diseases, Diabetes, CNS, Autoimmune Diseases, Hypertension, Dyslipidaemia, COPD, Asthma, Antidepressants, Small Molecules, Branded Drugs, Traditional Chinese Medicine, Biologics, Vaccines, Biosimilars, Generic Prescription Drugs, Over-the-Counter (OTC) Drugs, Patented Prescription Drugs, Hospitals, Retail Pharmacies, Grassroots Clinics, Domestic Pharmaceutical Companies, Multinational Pharmaceutical Companies.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 The Chinese Pharmaceutical Market, 2017-2027

1.2 Chinese Pharmaceutical Market: Segmentation, 2017

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Main Questions Answered by This Analytical Study

1.6 Who is This Report For?

1.7 Methods of Research and Analysis

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Chinese Healthcare: Overview, 2017

2.1 China: Demographic Indicators Overview, 2017

2.2 Chinese Healthcare System: Overview, 2017

2.3 Analysis of China’s Healthcare Expenditure

2.4 The Chinese System: Who Really Pays the Bill?

2.5 State Bodies Regulating the Chinese Pharmaceutical Market

2.6 Healthy China 2020: The Government’s Long-term Plan

2.7 Analysis of the Potential of ‘Healthy China Initiative’, 2017

2.8 The Big Debate About Healthcare Funding

3. Chinese Pharmaceutical Market: Discussions and Predictions, 2017-2027

3.1 Chinese Pharmaceutical Market: The Second Biggest Market in the World, 2016

3.2 Chinese Pharmaceutical Market: Overall Revenue Forecast, 2017-2027

4. Medical Treatment Needs in China, 2017-2027

4.1 Disease Prevalence in China, 2017-2027

4.2 Disease Mortality Rates in China

4.2.1 Top 5 Broad Causes of Death in China

5. Chinese Pharmaceutical Market: Leading Therapeutic Areas, 2017-2027

5.1 Leading Therapeutic Areas in the Chinese Pharmaceutical Market: Overview, 2016

5.2 Chinese Pharmaceutical Market: Leading Therapeutic Areas Forecasts, 2017-2027

5.3 Chronic Diseases Overtook the Infectious Diseases Segment, 2017-2027

5.4 Expanding China’s EDL: New Blockbusters for 2017

5.5 Cardiovascular Therapeutic Segment: Overview, 2017

5.5.1 Cardiovascular Drugs Market: Forecast, 2017-2027

5.5.2 Hypertension in China Reaches Unprecedented Levels

5.5.3 Chinese Hypertension Drugs Market Continuing to Thrive: Forecast, 2017-2027

5.5.4 Chinese Hypertension Drugs Market: Leading Products

5.5.5 Treatment of Chinese Hypertensive Patients

5.5.6 Dyslipidaemia: Overview of China’s Most Prevalent Disease

5.5.7 Treatment of Dyslipidaemia Affected by Reimbursement Issues

5.5.8 Chinese Dyslipidaemia Market Prospects: Forecast, 2017-2027

5.5.9 Chinese Cardiovascular Disease Segment: Major Focus of Western Companies

5.5.10 Big Pharma Companies Dominate the Chinese Hypertension Drugs Market

5.5.11 Increasing Domestic Company Presence in the Cardiovascular Therapeutic Segment

5.5.12 Drivers and Restraints for the Chinese Cardiovascular Drugs Market, 2017

5.6 Anticancer Therapeutic Segment: Overview, 2017

5.6.1 Anticancer Drugs will be the Largest Segment of the Chinese Pharmaceutical Market by 2027: Forecast, 2017-2027

5.6.2 Cancer Incidence Boosts the Eminence of China’s Anticancer Drugs Market

5.6.3 Targeted Anticancer Therapeutics Making Progress in China

5.6.4 Chinese Pharma Companies Focusing on Anticancer Drugs

5.6.5 Eli Lilly and Innovent Biologics’ Strategic Alliance: New Big Player in China’s Anticancer Market?

5.6.6 Improved Healthcare Coverage for Cancer Patients Promises Strong Revenue Stream from Anticancer Drugs

5.6.7 Marketing Innovative Anticancer Drug in China – Example from Roche

5.6.8 Negative Impact of Late Cancer Diagnosis

5.6.9 Cost of Treatment Critical for the Choice of Anticancer Medicine

5.6.10 Tailored Anticancer Treatment for the Chinese Market - Notable Companies and their Developments

5.6.11 Biomarker Testing in China – What Improvement is Possible?

5.6.12 Drivers and Restraints for the Anticancer Drugs Segment, 2017

5.7 Infectious Disease Therapeutics: Overview, 2017

5.7.1 Infectious Disease Drugs Market: Forecast, 2017-2027

5.7.2 What Makes China Prominent for Antibiotics Use: Analysis of Cephalosporin, 2016

5.7.3 China’s Infectious Disease Market Dominated by Domestic Companies

5.7.4 Antibiotics Over-use Reported in China: Causes and Results

5.7.5 HIV and Hepatitis in China: Viread Added to EDL in 2017

5.7.6 Hepatitis C Drug Challenges

5.7.7 Drivers and Restraints for the Infectious Diseases Pharma Segment, 2017

5.8 Diabetes Therapeutic Segment: Overview, 2017

5.8.1 Diabetes Drugs Market: Forecast, 2017-2027

5.8.2 Multinational Companies in the Chinese Diabetes Drug Market: Overview and Analysis, 2017

5.8.3 Domestic Companies Competing in the Chinese Diabetes Drug Market

5.8.4 Diabetes in China: Challenges and Opportunities

5.8.5 Drivers and Restraints for the Diabetes Drugs Segment, 2017

5.9 Respiratory Therapeutic Segment: Overview, 2017

5.9.1 Respiratory Disease Drugs Market: Forecast, 2017-2027

5.9.2 Chinese COPD Market: How Profitable Could It Be?

5.9.3 Chinese COPD Treatments Market: Predicted Revenue Increase – Forecast, 2017-2027

5.9.4 Chinese Asthma Drugs Market to Give Dependable Growth: Forecast, 2017-2027

5.9.5 Domestic Respiratory Drug Producers

5.9.6 Leading Respiratory Disease Drugs in China

5.9.7 AstraZeneca Sustains Market Penetration through Collaboration and Research

5.9.8 Drivers and Restraints for the Respiratory Diseases Segment, 2017

5.10 Central Nervous System (CNS) Therapeutics: Overview, 2017

5.10.1 CNS Drugs Market: Forecast, 2017-2027

5.10.2 By 2027, 8 Million People in China will Suffer from Depression

5.10.3 Depression Drugs Market in China will Reach a 25% Annual Growth Rate: Forecast, 2017-2027

5.10.4 Domestic Companies in China’s CNS Disorders Market

5.10.5 China’s Aging Population: Driver for the CNS Segment

5.10.6 Rise of Dementia and Alzheimer’s Disease Presents Strong Market Opportunity

5.10.7 High Demand for Pain Relief Medicines in China

5.10.8 Drivers and Restraints for the CNS Drugs Segment, 2017

5.11 Immunomodulators: Overview, 2017

5.11.1 Autoimmune Drugs Market: Forecast, 2017-2027

5.11.2 Notable Chinese Companies in the Immunomodulators Market

5.11.3 Challenges Erode the Immunomodulators Market’s Potential

5.11.4 Immunomodulator Treatments to Gain Momentum in China

5.11.5 Drivers and Restraints for the Autoimmune Drugs Segment, 2017

6. Chinese Pharmaceutical Market: Leading Product Classes, 2017-2027

6.1 Product Classes in the Chinese Pharmaceutical Market: Overview, 2016

6.2 Chinese Pharmaceutical Market: Product Classes Forecasts, 2017-2027

6.3 Small Molecules: Overview, 2017

6.3.1 Chinese Small Molecule Drugs Market: Forecast, 2017-2027

6.3.2 Generics: Growth Engine for the Small Molecules Segment

6.3.3 Healthcare Reform Provides Opportunities for Original-Branded and Generic Drugs

6.3.4 Drivers and Restraints for the Small Molecule Treatments Market in China, 2017

6.4 Traditional Chinese Medicine (TCM): Overview, 2017

6.4.1 Traditional Chinese Medicine Market: Forecast, 2017-2027

6.4.2 Investments in TCM Development: Analysis of China’s TCM Market, 2017

6.4.3 Expansion of the TCM Market

6.4.4 Leading Chinese Companies in the TCM Segment, 2017

6.4.5 Drivers and Restraints for the Traditional Chinese Medicines Market, 2017

6.5 Chinese Biological Drugs Market: Overview, 2016

6.5.1 Chinese Biologics Market: Forecasts, 2017-2027

6.5.2 Branded Biologics Perform Well in China: Forecast, 2017-2027

6.5.3 Biomedicines Set for Strategic Growth: Analysis of China’s Fastest Growing Product Class, 2017

6.5.4 Roche Finding a Way Forward in China with Branded Biologics

6.5.5 Chinese Vaccines Market: Overview, 2016

6.5.6 China: The World’s Fifth Largest Vaccine Market

6.5.7 Chinese Vaccines Segment Loses Share: Forecast, 2017-2027

6.5.8 Companies Dominating the Vaccines Market in China

6.5.9 Domestic Manufacturer Supplies 80% of Vaccines in China

6.5.10 Multinational Companies Compete for a Share of the Chinese Vaccines Market

6.5.11 Hepatitis B Vaccine in China – a Story of Success

6.5.12 Chinese Biosimilars Market: Overview, 2016

6.5.13 Chinese Biosimilars Market: Forecast, 2017-2027

6.5.14 A Boost for Biosimilars? Pfizer Set up a New Chinese Manufacturing Facility

6.5.15 Chinese Biosimilar Development Guidelines Released in 2015

6.5.16 Leading Chinese Biosimilar Manufacturers

6.5.17 Market Access for Biosimilars: Critical to Leverage Opportunities in China

6.5.18 Drivers and Restraints of the Chinese Biologics Market

7. Chinese Pharmaceutical Market: Leading Drug Types, 2017-2027

7.1 Drug Types in the Chinese Market: Overview, 2016

7.2 Growth Forecasts for Leading Drug Types in China, 2017-2027

7.3 Generic Drugs Dominate the Chinese Pharmaceutical Market

7.3 Generic Prescription Drugs Market in China: Forecast, 2017-2027

7.3.1 Chinese Pharmaceutical Market Structure Favours Generics’ Sales

7.3.2 Which Drugs Benefit More from the Government’s Healthcare Reform: Original-Patented or Generic?

7.3.3 Many Chinese Patients Favour Branded Generics

7.3.4 AstraZeneca and Pfizer: Leaders in the Chinese Branded Generics Market

7.4 Chinese Over-the-Counter Medicines Market: Forecast, 2017-2027

7.4.1 Chinese OTC Drugs Segment: Insights and Analysis of the Market’s Potential, 2016

7.4.2 China: The World’s Biggest OTC Pharmaceuticals Market

7.4.3 Leading Domestic Companies in the Chinese OTC Market, 2017

7.4.4 Bayer: The Biggest Multinational Player in China’s OTC Market

7.5 Chinese Patented Prescription Drugs Market: Forecast, 2017-2027

7.5.1 Online Sales Prohibited in 2016: A Big Blow to the Market?

8. Chinese Pharmaceutical Market: Sales Channels, 2017-2027

8.1 Chinese Pharmaceutical Market: Sales Channels Overview and Value, 2016

8.2 Chinese Pharmaceutical Market: Sales Channels Forecasts, 2017-2027

8.3 Only Five Domestic Companies Have a Sizable Share of the Chinese Pharma Distribution Market

8.4 Chinese Distribution Channels are Highly Fragmented Compared to Western Counterparts

8.5 Chinese Distribution Channels: Why Consolidation is Essential?

8.6 Shift Towards Consolidation within the Distribution Chain: Key Market Developments

8.7 China’s Drugs Distribution Environment: Issues and Challenges

8.8 Chinese Distribution Value Chain Follows a Complex Model

8.9 Chinese Pharmaceutical Distribution Network Comprises the World’s Largest Sales Force

8.10 Bribery Penalties: Indication of China’s Changing Pharmaceutical Distribution Practices

8.11 Hospital Sales Channels: Forecast, 2017-2027

8.11.1 Hospitals: Foundation of the Chinese Healthcare System

8.11.2 Chinese Public Hospitals: Healthcare Reform’s Priority

8.11.3 How does the Medicines Mark-up Ban Affect Hospitals’ Revenues?

8.12 Retail Pharmacies Channels: Forecast, 2017-2027

8.12.1 Difficulties in Retail Pharmacy Market Estimates

8.12.2 Online Sale Prohibition May Affect the Distribution of Revenue Within the Market

8.13 Grassroots Clinics’ Sales Channels: Forecast, 2017-2027

8.13.1 Rural Investment Will Facilitate Drug Sales Growth in Grassroots Clinics

8.14 Other Sales Channels: Forecast, 2017-2027

8.14.1 Other Sales Channels: The Grey Pharmaceuticals in China

9. Leading Companies in the Chinese Pharmaceuticals Market, 2016

9.1 Top 50 Domestic Chinese Pharmaceutical Companies, 2016

9.2 China’s Pharma is Highly Fragmented Compared to Other Prominent Markets

9.3 Leading Chinese Contract Research Organizations

9.4 Leading Multinational Companies in the Chinese Pharmaceutical Market: Strategies that Win, 2017

9.4.1 MNC Revenue and Market Share Estimates, 2016

9.4.2 AstraZeneca and Pfizer: Leaders in the Chinese Branded Generics Segment

9.4.3 Bayer – Exceeds $3bn of Pharma Sales in China

9.4.4 Pfizer’s Strategic Approach in China – Does it Work?

9.4.5 Multinational Contract Research Organizations in China

9.5 New Policies Shift the Market Dynamics for Leading Players

9.6 Emerging Strategies to Boost Drug Sales and Comply with Regulations

9.7 What is Next in China for Multinational Pharma Companies?

9.8 Drivers and Restraints for Big Pharma’s Sales Growth in China, 2017

10. Qualitative Analysis of the Chinese Pharmaceutical Market, 2017

10.1 Strengths: Increasing Investment in the Healthcare System

10.1.1 As the Disease Burden Grows, So Does GDP

10.1.2 Chinese Pharmaceutical Market Still Has Untapped Potential

10.1.3 Progressive Urbanization Continues to Drive Healthcare Spending

10.1.4 New Policies Recognize the Importance of IP

10.1.5 Research Hub for Asia Pacific and Beyond

10.2 Weaknesses: Imbalance of Resources and Quality Challenges

10.2.1 Healthcare Quality Issues Hit the Chinese Pharmaceutical Market

10.2.2 Highly Fragmented Pharmaceutical Market

10.2.3 Reimbursement and Market Access

10.2.4 Limited First-Class Laboratory Facilities Reported

10.2.5 Regulations and Clinical Trial Research

10.3 Opportunities: Quickly Emerging Volume Growth

10.3.1 Tailored Strategies to Meet the Chinese Pharma Market’s Need

10.3.2 Portfolio Diversification Matters

10.3.3 Enhancing Consolidation Activities

10.3.4 Innovative Biotechnology Sector

10.3.5 Liberal Regulations on Stem Cells Research

10.4 Threats: What if Things Go Wrong in China?

10.4.1 Strong Government Intervention

10.4.2 Anhui Model and its Results

10.5 Social Forces: The Increasing Power of China’s Demographics

10.5.1 The Ageing Dragon

10.5.2 The Obesity Epidemic

10.5.3 Social Changes and Their Effect on China’s Shifting Medical Treatment Patterns

10.6 Technological Factors: Embracing Technology and Increasing R&D Capabilities

10.6.1 National Database and Telemedicine: New Trends Shaping the Industry

10.6.2 Developing China’s R&D Capabilities through Technology

10.6.3 China Has the World’s Largest and Most Affordable Genomic Sequencing Facilities

10.7 Economic Factors: Economic Growth Closely Related to the Chinese Pharmaceutical Market Growth

10.7.1 China’s Rise as an Economic Superpower

10.7.2 Underlying Problems of China’s Economic Growth

10.7.3 How Many Five-Year Plans Will Follow?

10.8 Political: The Chinese Government Possesses the Ultimate Power

11. Conclusions

11.1 China’s Healthcare Reform: Crucial Factor for Pharmaceutical Market Growth

11.2 China: The Country Driving Growth for the World’s Pharmaceutical Market, 2017-2027

11.3 Cancer Will Form a Main Therapeutic Segment in the Chinese Pharmaceutical Market in 2027

11.4 Generic and OTC Drugs Set to Remain the Main Product Types, but Patented Drugs Will Experience Momentum

11.5 Pharmacy Sales are the Next Big Market Opportunity in China

11.6 Domestic Companies Still Dominate the Chinese Pharma Market, Amid Increasing Competition from MNCs

11.7 Concluding Thoughts on the Research and Analysis

Appendices

Visiongain Report Sales Order Form

About Visiongain

Associated Visiongain Reports

Visiongain report evaluation form

List of Tables

Table 2.1 China: Demographic Indicators, 2006-2016

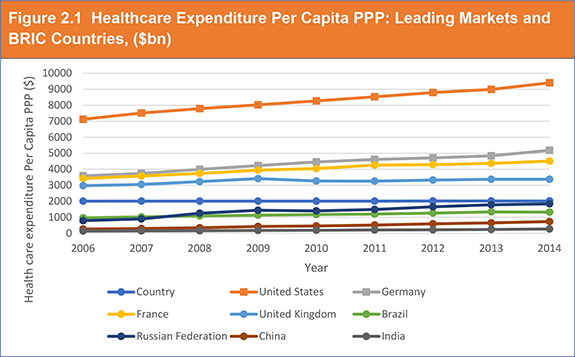

Table 2.2 Healthcare Expenditure: Leading Markets and BRIC Countries, Total (%) of GDP, 2006-2014

Table 2.3 Out-of-pocket Health Expenditures in China: (%) of Private Spending on Healthcare, 2006-2014

Table 2.4 Chinese Institutions Regulating the Pharmaceutical and Healthcare Industries in China, 2017

Table 3.1 Chinese Pharmaceutical Market Overall Forecast: Market Size ($bn), Annual Growth Rate (%), CAGR (%), 2017-2027

Table 4.1 Top 5 Causes of Death per (000s) in China’s Urban and Rural Areas, 2016

Table 5.1 Chinese Pharmaceutical Market by Therapy Area: Market Size ($bn), Market Share (%), 2016

Table 5.2 Chinese Pharmaceutical Market by Therapy Area: Forecast Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 5.3 Chinese Pharmaceutical Market by Therapy Area: Market Share Forecast (%), 2017-2027

Table 5.4 Selected High Profile Drugs: China’s Essential Drugs List

Table 5.5 Chinese Cardiovascular Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 5.6 Chinese Hypertension Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), CAGR (%), 2017-2027

Table 5.7 Chinese Hypertension Market by Drug Class: Market Size ($bn), Market Share (%), 2016

Table 5.8 Chinese Dyslipidaemia Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), CAGR (%), 2017-2027

Table 5.9 Top Companies in the Chinese Hypertension Market: Revenue ($bn), Market Share (%), 2016

Table 5.10 Leading Domestic Chinese Cardiovascular Drug Manufacturers and Their Activities, 2017

Table 5.11 Chinese Anticancer Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 5.12 Selected Domestic Chinese Anticancer Drug Manufacturers and Their Activities, 2017

Table 5.13 Chinese Infectious Disease Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 5.14 Chinese Infectious Disease Drugs Market by Drug Class: Market Size ($bn), Market Share (%), 2016

Table 5.15 Domestic Antibacterial Drug Manufacturers and Their Activities, 2017

Table 5.16 Chinese Diabetes Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 5.17 Selected Domestic Chinese Diabetes Drug Manufacturers and Their Activities, 2017

Table 5.18 Chinese Respiratory Disease Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 5.19 Chinese COPD Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), CAGR (%), 2017-2027

Table 5.20 Chinese Asthma Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), CAGR (%), 2017-2027

Table 5.21 Selected Domestic Companies in the Respiratory Market and Their Activities, 2017

Table 5.22 Chinese Respiratory Drug Market by Product Class: Sales ($bn), Market Share (%), 2016

Table 5.23 Chinese CNS Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 5.24 Chinese Antidepressants Market Forecast: Market Size ($bn), Annual Growth Rate (%), 2017-2027

Table 5.25 Selected Domestic Companies in the CNS Market and Their Activities, 2017

Table 5.26 Chinese Autoimmune Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 5.27 Selected Chinese Immunomodulator Drug Companies and Their Activities, 2017

Table 6.1 Chinese Pharmaceutical Market by Product Class: Market Size ($bn), Market Share (%), 2016

Table 6.2 Chinese Pharmaceutical Market by Product Class: Forecast Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 6.3 Chinese Small Molecule Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 6.4 Chinese Small Molecule Drugs Market by Product Type: Forecast Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 6.5 Traditional Chinese Medicine Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 6.6 Selected TCM Manufacturers and their Activities, 2017

Table 6.7 Chinese Biological Drugs Market by Product Type: Forecast Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 6.8 Chinese Branded Biologics Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 6.9 Chinese Vaccines Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 6.10 Chinese Biosimilars Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 6.11 Selected Chinese Biosimilar Manufacturers and Their Product Lines, 2017

Table 7.1 Chinese Pharmaceutical Market by Drug Type: Market Size ($bn), Market Share (%), 2016

Table 7.2 Chinese Pharmaceutical Market by Drug Type: Forecast Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 7.3 Chinese Generic Prescription Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 7.4 Chinese Over-the-Counter Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 7.5 Selected Chinese OTC Drug Manufacturers and Their Activities, 2017

Table 7.6 Chinese Patented Prescription Drugs Market Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 8.1 Hospital Channels Market Size ($bn), Market Share (%), 2016

Table 8.2 Chinese Pharmaceutical Market by Sales Channel: Market Size ($bn), Market Share (%), 2016

Table 8.3 Chinese Pharmaceutical Market by Sales Channel: Forecast Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 8.4 Chinese Hospital Sales of Pharmaceuticals Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 8.5 Chinese Retail Pharmacy Sales of Pharmaceuticals Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 8.6 Chinese Grassroots Clinics Sales of Pharmaceuticals Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 8.7 Chinese Pharmaceuticals Sales Through Other Channels Forecast: Market Size ($bn), Annual Growth Rate (%), Market Share (%), CAGR (%), 2017-2027

Table 9.1 Top 50 Domestic Chinese Pharmaceutical Companies: Rank (1-25), Revenue ($bn), Market Share (%), 2016

Table 9.2 Top 50 Domestic Chinese Pharmaceutical Companies: Rank (26-50), Revenue ($bn), Market Share (%), 2016

Table 9.3 Selected Domestic Contract Research Organizations and Their Activities, 2017

Table 9.4 Selected Multinational Pharmaceutical Companies in the Chinese Market and Their Activities, 2017

Table 9.5 Selected Multinational Pharmaceutical Companies in the Chinese Market and Their Activities (Continued), 2017

Table 9.6 Selected Multinational Pharmaceutical Companies in the Chinese Market and Their Activities (Continued), 2017

Table 9.7 Top 10 Multinational Pharmaceutical Companies in the Chinese Pharmaceutical Market: Revenue ($bn), Market Share (%), 2016

Table 11.1 Summary of the Chinese Pharmaceutical Market by Product Class: Market Size ($bn), Market Share (%), CAGR (%), 2016, 2022, 2026

Table 11.2 Summary of the Chinese Pharmaceutical Market by Therapy Class: Market Size ($bn), Market Share (%), CAGR (%), 2016, 2022, 2027

Table 11.3 Summary of Chinese Pharmaceutical Sales Channels: Market Size ($bn), Market Share (%), CAGR (%), 2016, 2022, 2027

List of Figures

Figure 1.1 Chinese Pharmaceutical Market Segmentation, 2017

Figure 2.1 Healthcare Expenditure Per Capita PPP: Leading Markets and BRIC Countries, ($bn)

Figure 2.2 Out-of-pocket Health Expenditures in China: (%) of Private Spending on Healthcare, 2006-2014

Figure 3.1 Chinese Pharmaceutical Market: Value Chain, 2017

Figure 3.2 Chinese Pharmaceutical Market Forecast: Market Size ($bn), 2017-2027

Figure 3.3 Chinese Pharmaceutical Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 4.1 Top 5 Broad Causes of Death in China Urban Areas, 2016

Figure 4.2 Top 5 Broad Causes of Death in China Rural Areas, 2016

Figure 5.1 Chinese Pharmaceutical Market by Therapy Area: Market Size ($bn), 2016

Figure 5.2 Chinese Pharmaceutical Market by Therapy Area: Market Share (%), 2016

Figure 5.3 Chinese Pharmaceutical Market by Therapy Area: Market Share (%), 2022

Figure 5.4 Chinese Pharmaceutical Market by Therapy Area: Market Share (%), 2027

Figure 5.5 Chinese Cardiovascular Disease Market: Segmentation by Drug Class, 2017

Figure 5.6 Chinese Cardiovascular Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.7 Chinese Cardiovascular Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.8 Chinese Hypertension Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.9 Chinese Hypertension Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.10 Chinese Hypertension Market by Drug Class: Market Share (%), 2016

Figure 5.11 Chinese Dyslipidaemia Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.12 Chinese Cardiovascular Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.13 Chinese Cardiovascular Drugs Market: Drivers and Restraints, 2017-2027

Figure 5.14 Chinese Anticancer Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.15 Chinese Anticancer Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.16 Chinese Anticancer Drugs Market: Drivers and Restraints, 2017-2027

Figure 5.17 Chinese Infectious Disease Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.18 Chinese Infectious Disease Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.19 Chinese Antibacterial Drugs Market by Drug Class: Market Share (%), 2016

Figure 5.20 Chinese Infectious Disease Drugs Market: Drivers and Restraints, 2017-2027

Figure 5.21 Chinese Diabetes Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.22 Chinese Diabetes Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.23 Chinese Diabetes Drugs Market: Drivers and Restraints, 2017-2027

Figure 5.24 Chinese Respiratory Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.25 Chinese Respiratory Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.26 Chinese COPD Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.27 Chinese COPD Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.28 Chinese Asthma Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.29 Chinese Asthma Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.30 Chinese Respiratory Disease Drugs Market: Drivers and Restraints, 2017-2027

Figure 5.31 Chinese CNS Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.32 Chinese CNS Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.33 Chinese Antidepressant Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.34 Chinese Antidepressant Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.35 Chinese CNS Drugs Market: Drivers and Restraints, 2017-2027

Figure 5.36 Chinese Autoimmune Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 5.37 Chinese Autoimmune Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 5.38 Chinese Autoimmune Drugs Market: Drivers and Restraints, 2017-2027

Figure 6.1 Chinese Pharmaceutical Market by Product Class: Market Size ($bn), 2016

Figure 6.2 Chinese Pharmaceutical Market by Product Class: Market Size ($bn), 2017-2027

Figure 6.3 Chinese Pharmaceutical Market by Product Class: Market Size (%), 2016

Figure 6.4 Chinese Small Molecule Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 6.5 Chinese Small Molecule Drugs Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 6.6 Chinese Small Molecule Drugs Market: Drivers and Restraints, 2017-2027

Figure 6.7 Traditional Chinese Medicine Market Forecast: Market Size ($bn), 2017-2027

Figure 6.8 Traditional Chinese Medicine Market Forecast: Annual Growth Rate (%), 2017-2027

Figure 6.9 Traditional Chinese Medicine Market: Drivers and Restraints, 2017-2027

Figure 6.10 Chinese Biologics Market Forecast: Market Size ($bn), 2017-2027

Figure 6.11 Chinese Biologics Market Forecast: Annual Growth (%), 2017-2027

Figure 6.12 Chinese Branded Biologics Market Forecast: Market Size ($bn), 2017-2027

Figure 6.13 Chinese Branded Biologics Market Forecast: Annual Growth (%), 2017-2027

Figure 6.14 Chinese Vaccines Market Forecast: Market Size ($bn), 2017-2027

Figure 6.15 Chinese Vaccines Market Forecast: Annual Growth (%), 2017-2027

Figure 6.16 Chinese Biosimilars Market Forecast: Market Size ($bn), 2017-2027

Figure 6.17 Chinese Biosimilars Market Forecast: Annual Growth (%), 2017-2027

Figure 6.18 Chinese Biologics Market: Drivers and Restraints, 2017-2027

Figure 7.1 Chinese Pharmaceutical Market by Drug Type: Market Size ($bn), 2016

Figure 7.2 Chinese Pharmaceutical Market by Drug Type: Market Share (%), 2016

Figure 7.3 Chinese Generic Prescription Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 7.4 Chinese Generic Prescription Drugs Market Forecast: Annual Growth (%), 2017-2027

Figure 7.5 Chinese Over-the-Counter Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 7.6 Chinese Over-the-Counter Drugs Market Forecast: Annual Growth (%), 2017-2027

Figure 7.7 Chinese Patented Prescription Drugs Market Forecast: Market Size ($bn), 2017-2027

Figure 7.8 Chinese Patented Prescription Drugs Market Forecast: Annual Growth (%), 2017-2027

Figure 8.1 Hospital Channels Market Size ($bn), Market Share (%), 2016

Figure 8.2 Chinese Pharmaceutical Market by Sales Channel: Market Size ($bn), 2016

Figure 8.3 Chinese Pharmaceutical Market by Sales Channel: Market Share (%), 2016

Figure 8.4 Chinese Pharmaceutical Market by Sales Channels: Revenue Forecasts ($bn), 2017-2027

Figure 8.5 Fragmented Nature of the Chinese Pharmaceutical Distribution Market: Market Share (%) by Revenue ($bn) for the Leading Five Distributors, 2016

Figure 8.6 Chinese Hospital Sales of Pharmaceuticals Market Forecast: Market Size ($bn), 2017-2027

Figure 8.7 Chinese Hospital Sales of Pharmaceuticals Forecast: Annual Growth (%), 2017-2027

Figure 8.8 Chinese Retail Pharmacy Sales of Pharmaceuticals Forecast: Market Size ($bn), 2017-2027

Figure 8.9 Chinese Retail Pharmacy Sales of Pharmaceuticals Forecast: Annual Growth (%), 2017-2027

Figure 8.10 Chinese Grassroots Clinics Sales of Pharmaceuticals Forecast: Market Size ($bn), 2017-2027

Figure 8.11 Chinese Grassroots Clinics Sales of Pharmaceuticals Forecast: Annual Growth (%), 2017-2027

Figure 8.12 Chinese Pharmaceuticals Sales Through Other Channels Forecast: Market Size ($bn), 2017-2027

Figure 8.13 Chinese Pharmaceuticals Sales Through Other Channels Forecast: Market Size ($bn), 2017-2027

Figure 9.1 Top 10 Multinational Pharmaceutical Companies in the Chinese Pharmaceutical Market: Revenue ($bn) Chinese Pharma Market, 2016

Figure 9.2 Chinese Pharmaceutical Market: Drivers and Restraints for MNCs’ Growth, 2017-2027

Figure 11.1 Summary of the Chinese Pharmaceutical Market by Product Class: Market Size ($bn), 2016, 2022, 2027

Figure 11.1 Summary of the Chinese Pharmaceutical Market by Therapy Class: Market Size ($bn), 2016, 2022, 2027

Figure 11.2 Summary of the Chinese Pharmaceutical Sales Channels: Market Size ($bn), 2016, 2022, 2027

3SBio

Acambis

Agilent

Alibaba Group

Alliance Boots

Amerisource-Bergen

Amgen

Anhui Anke Biotech

AppTech Laboratory Services

Asian Cancer Research Group

Astellas

AstraZeneca

Asymchem Laboratories

AXM Pharma

Baxter

Bayer

Bayer Healthcare

BeiGene

Beijing Four Rings Bio-pharmaceutical

Beijing Genomics Institute

Beijing Kexing Bioproducts

Beijing Key Yuan Xinhai Pharmaceutical

Beijing SL Pharmaceutical

Beijing Taiyang

Beijing Tiantan Biological Products

Beijing Tong Ren Tang

Bio-Bridge Science

BiODura

Bloomberg

Boehringer Ingelheim

Bristol-Myers Squibb

Buchang Pharma

Cardinal Health

CASiGEN Pharma

Celgene

Celsion Corp

Changzhou Qianhong Biopharma

Chemizon (Beijing) Pharma-Tech

Chengdu Di'ao Pharmaceutical Group

Chengdu Institutes of Biological Products

Chiesi Edding Hong Kong Limited

Chi-Med

China Chemical & Pharmaceutical Group

China National Accord

China National Biotec Group

China National Pharmaceutical Group

China NT Pharma Group

China Pharmaceutical Commerce Association

China Pharmaceutical Quality Management Association

China Resources Double-Crane Pharmaceuticals

China Resources Sanjiu Medical

China Shineway Pharmaceutical

China Traditional Chinese Medicine Co.

ChinaBio Group

ChinaGate

Chonqqing Taiji Industry

Cipla

Consun Pharmaceutical Group

Cord Blood America

Covance

CSPC Pharmaceutical Group

Daan Gene

Daiichi Sankyo

Dalian Hissen Bio-Pharm

Dawnrays Pharmaceutical Holdings

Dihon Pharmaceutical Group

Dongsheng Pharmaceutical

Dr. Reddy’s Laboratories

Egret

Eisai

Eli Lilly

Excel PharmaStudies

FeRx Incorporated

Financial Times

Foshan City

Furen Pharmaceutical Group

Gan & Lee Pharmaceutical

Genentech

GeneScience Pharmaceuticals

Gilead Sciences

GlaxoSmithKline

Goldman Sachs

Guangdong BeiKang Pharmaceutical

Guangdong Techpool

Guangxi Wuzhou Zhongheng Group

Guangzhou Medical University

Guangzhou Pharma

Guangzhou Pharmaceutical Corporation

Guizhou Baiqiang Pharmaceutical

Hangzhou East China Pharmaceutical Group

Hangzhou Jiuyuan Gene Engineering

Hangzhou Tigermed Consulting

Hangzhou Zhongmei Huadong Pharmaceutical

Harbin Pharmaceutical Group

Harbin Tri-Lion Pharmaceutical

Harvard University

HD Biosciences

Henan Lingrui Pharmaceutical

Hengrui

Henlius Biopharmaceuticals

HitGen

Hua Medicine

Huadong Medicine

Hualan Biological Engineering

Hualida Biotech

Hutchinson Whampoa

Hutchison MediPharma

i3 Research

ICON

Inner Mongolia Yili Energy

Innovent Biologics

JD.com (Jindong Mall)

JHL Biotech

Jiangsu Chia-tai Tianqing Pharmaceutical

Jiangsu Hansen Pharmaceutical

Jiangsu Hansoh Pharmaceutical

Jiangsu Hengrui Medicine

Jiangsu Nhwa Pharmaceutical

Jilin Extrawell Changbaishan

Jilin Province Huinan Changlong

Jinling Pharmaceutical

Johnson & Johnson

Joincare Pharma

JOINN Laboratories

Kangmei Pharmaceutical

KPC Pharmaceuticals

Lepu Medical

Livzon Pharmaceutical Group

Lundbeck

Lundbeck Institute

Massachusetts Institute of Technology

McKesson

Merck & Co.

Merck Sharp & Dohme

Microport Medical

Mycenax

Mylan

Nanjing Kanghai Pharmaceutical

Nanjing Pharmaceutical Factory

Nestle Health Sciences

Nestle SA

Newsummit Biopharma

North China Pharmaceutical Group

Northeast Pharmaceutical Group (NEPG)

Novartis

Novast Laboratories

Novo Nordisk

Oncobiologics

Otsuka

Pfizer

Pharmaceutical Product Development LLC

Pharmaron

PKU Healthcare Group

Qilu Pharmaceutical

Quintiles

Roche

Sanofi

Schering-Plough

Servier

Shandong Dong-E E-Jiao

Shandong Kexing Bioproducts

Shanghai Celgen Bio-Pharmaceutical

Shanghai Charity Foundation

Shanghai CP Guojian Pharmaceuticals

Shanghai DND Pharm-Technology

Shanghai Fosun Pharmaceutical Group

Shanghai Furen Industrial

Shanghai Institutes of Biological Sciences

Shanghai Jinhe Bio-Technology

Shanghai Pharmaceuticals Holding

ShangPharma

Shenzhen Heapalink

Shenzhen Kangtai Biological Products

Shenzhen Neptunus Bioengineering

Shenzhen Salubris Pharmaceuticals

Shenzhen Wenle ('Main Luck') Pharmaceutical

Shijiazhuang Pharmaceutical Group

Shijiazhuang Yiling

Shineway Pharmaceutical Group

Sichuan Jiufeng Pharmaceutical

Sichuan Kelun Pharmaceutical

Sichuan Kelun Pharmaceutical

Sichuan Yuanda Shuyang Pharmaceutical

Sihuan Pharmaceutical Holdings

Simcere Pharmaceutical

SiniWest Holdings

Sino Biological

Sino Biopharmaceutical

Sinopharm

State Key Lab of Respiratory Disease

Sundia MediTech

Sundiro Pharma

Swiss Re

Symbio Pharmaceuticals

Takeda

Tangshan Yian Bioengineering

Tasly Pharmaceuticals

Teva

The Financial Times

Thermo Fisher Scientific

Tianjin Jin Yao Group

Tianjin Kinnovata Pharmaceutical Company

Tonghua Dongbao

United Pharmatech

Vectura

Venturepharm Laboratories

Vertex Pharmaceuticals

Viva Biotech

Wai Yuen Tong Medicine Holdings

Walmart Holdings

Wanbang Biopharmaceuticals

Weigao Holding

Winteam Pharmaceutical Group

WuXi AppTec

Xiamen Amoytop Biotech

Xian-Janssen Pharmaceuticals

Xiuzheng Pharmaceutical

Xizang Haisco

Yabao Pharmaceutical Group

Yangtze River Pharmaceuticals

Youcare Pharmaceutical Group

Yunnan Baiyao

Zai Lab

Zendex Bio Strategy

Zensun (Shanghai) Sci & Tech

Zhejiang Beta Pharma

Zhejiang Hisun Pharmaceutical

Zhejiang Huahai Pharmaceutical

Zhejiang Medicine

Zhejiang Tianyuan

Zhenjian Hisun Pharmaceuticals

Zhuhai United States Labs

Zuellig Pharma China

List of Organizations Mentioned in the Report

China Food and Drug Administration (CFDA)

China Academy of Chinese Medical Sciences

Chinese Academy of Sciences (CAS)

Chinese Center for Drug Evaluation

Chinese Ministry of Commerce

Diabetes Society

Ministry of Commerce of the People's Republic of China

Ministry of Health of the People's Republic of China

Ministry of Labor and Social Security of the People's Republic of China

National Development and Reform Commission

National Institute for the Control of Pharmaceutical and Biological Products

Northwest University

Shandong University

State Traditional Chinese Medicine Administration

The World Bank

University of Warwick

US Food and Drug Administration

Washington University

WHO World Health Organization

WTO World Trade Organization

Download sample pages

Complete the form below to download your free sample pages for Chinese Pharmaceutical Market Forecast 2017-2027

Related reports

-

Indian Pharmaceutical Market Forecast 2018-2028

Our 188-page report provides 104 tables, charts, and graphs. Discover the most lucrative areas in the industry and the future...

Full DetailsPublished: 22 February 2018 -

Pharma Leader Series: Top 30 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market Forecast 2017-2027

The global pharmaceutical contract manufacturing market was valued at $76.6bn in 2016 and is expected to grow at a CAGR...

Full DetailsPublished: 18 July 2017 -

Global Inflammatory Bowel Diseases (IBD) Drug Market Forecast 2018-2028

The global inflammatory bowel diseases (IBD) drug market is estimated at $6.7bn in 2017 and $7.6bn in 2023. Biologic therapies...

Full DetailsPublished: 29 May 2018 -

Global Antibacterial Drugs Market 2017-2027

The global antibacterial drugs market is expected to grow at a CAGR of 1.3% in the first half of the...Full DetailsPublished: 13 March 2017 -

Top 25 Antibiotic Drugs Manufacturers 2018

Visiongain forecasts the antibiotic drugs market to increase to $ 43,841.7m in 2022. The market is estimated to grow at...

Full DetailsPublished: 12 June 2018

Download sample pages

Complete the form below to download your free sample pages for Chinese Pharmaceutical Market Forecast 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024