Industries > Pharma > Biobanking Market Forecasts 2017-2027

Biobanking Market Forecasts 2017-2027

Discover Prospects for Medical Research and Therapeutic Uses, Including Human Tissues, Fluids and Stem Cells, Leading Biobanking Companies and Key Geographies

Biobanking – our new study reveals trends, R&D progress, and predicted revenues

Where is the Biobanking market heading? If you are involved in this sector you must read this brand new report. Visiongain’s report shows you the potential revenues streams to 2027, assessing data, trends, opportunities and business prospects there.

Discover How to Stay Ahead

Our 259-page report provides 144 tables, charts, clearly illustrating the data presented in this research. Read on to discover the most lucrative areas in the industry and the future market prospects. Our new study lets you assess forecasted drug sales at overall world market regional level, as well as giving a deep insight into the pipeline for Biobanking. See financial results, trends, opportunities, and revenue predictions. Much opportunity remains in this growing Biobanking market. See how to exploit these opportunities.

Forecasts to 2027 and other analyses reveal the commercial prospects

• In addition to revenue forecasting to 2027, our new study provides you with recent results, R&D overview, growth rates, and market shares.

• You will find original analyses, with business outlooks and developments.

• Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), product profiles and commercial developments.

Discover sales predictions for the world market and following Biobanking Submarkets:

• Biobanking for Research

• Human Tissue

• Commercial

• Public

• Stem Cells

• Others (DNA, Blood fluids etc.)

• Biobanking for Therapeutic Use

• Umbilical Cord Banking

• Adult Stem Cell Banking

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for 12 leading national markets:

• The US

• Germany

• France

• The UK

• Spain

• Italy

• The Netherlands

• Japan

• China

• India

• Brazil

• Russia

• RoW

Our analysis shows activities of biobanks, including these organisations:

• Stemgent

• Biopta

• BioServe

• Coriell Institute for Medical Research

• Cord Blood America

• Cryo-Cell International.

And other companies, including these:

• China Cord Blood Corp

• LifebankUSA

• ViaCord

• Cord Blood Registry

• Biogenea Pharmaceuticals

• StemLife

• Caladrius Biosciences.

There will be growth in both established and in developing countries. Our analyses show that the both developed and developing markets, China, India and the US in particular, will continue to achieve high revenue growth to 2027.

Leading companies and the potential for market growth

Overall world revenue for Biobanking will surpass $53bn in 2027, our work calculates. This will be driven by the use of biobanking in drug development and medical research, as well as the expected rise in number of commercial biobanks over the forecast period

Our work identifies which organisations hold the greatest potential. Discover their capabilities, progress, and commercial prospects, helping you stay ahead.

How the Biobanking Market report helps you

In summary, our 259-page report provides you with the following knowledge:

• Revenue forecasts to 2027 for the Biobanking market and Leading Submarkets – discover the industry’s prospects, finding the most lucrative places for investments and revenues

• Revenue forecasts to 2027 for 12 of the leading national markets – US, Germany, France, UK, Italy, Spain, Netherlands, Japan, Russia, China, India, Brazil

• Discussion of what stimulates and restrains companies and the market

• Prospects for established firms and those seeking to enter the market – including company profiles for 17 companies involved in commercial biobanking and biobanking for therapeutic use

Find quantitative and qualitative analyses with independent predictions. Receive information that only our report contains, staying informed with this invaluable business intelligence.

Information found nowhere else

With our survey you are less likely to fall behind in knowledge or miss opportunity. See how you could benefit your research, analyses, and decisions. Also see how you can save time and receive recognition for commercial insight.

Visiongain’s study is for everybody needing commercial analyses for the Biobanking market and leading companies. You will find data, trends and predictions.

Get our report today Biobanking Market Forecasts 2017-2027: Discover Prospects for Medical Research and Therapeutic Uses, Including Human Tissues, Fluids and Stem Cells, Leading Biobanking Companies and Key Geographies. Avoid missing out – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Biobanking for Medicine: World Market Review 2017 and Global Segmentation

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report

1.5 Who is This Report For?

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to Biobanking and its Applications

2.1 Defining the Human Tissue Banking Market for the Scope of this Report

2.2 The Stem Cell Banking Market – Our Breakdown

2.3 What is Biobanking?

2.4 Main Features of Biobanks

2.5 What Processes are Involved in Biobanking?

2.6 Classification of Biobanks: Tissue Type, Volunteer Group and Ownership Classification Models

2.6.1 Volunteer Group: General vs. Disease Population

2.6.2 Ownership Structure: Public vs. Private

2.7 The Guidelines and Standards for Biobanking

2.8 Laws and Regulations for Biobank-Based Research

2.8.1 HIPAA Amendments

2.9 Biobanking and the Pharmaceutical Industry

2.9.1 Biobanking in Research, Drug Discovery and Development

2.9.1.1 Biobanking – Facilitates Genetic Epidemiology Studies

2.9.1.2 Novel Drug Discovery through Better Understanding of Disease Pathways

2.9.1.3 Biomarker Discovery in Drug Development

2.9.2 Biobanking for Therapeutic Purposes

2.9.3 Biobanking in Clinical Trials

3. Biobanking for Medicine: World Market 2017 to 2027

3.1 The World Biobanking for Medicine Market in 2017

3.2 Biobanking for Medicine: Research vs. Therapeutics in 2022 and 2027

3.3 World Biobanking for Medicine Market: Overarching Revenue Forecast 2017 to 2027

3.4 Biobanks Stored More Than 1.5 Billion Specimens in 2017

3.5 The Biobanking for Medicine Market by Sector: Grouped Revenue Forecasts 2017 to 2027

3.6 Biobanking for Research: Mostly Non-Profit

3.6.1 Biobanking for Research: Revenue Forecast 2017 to 2027

3.6.2 Driving Forces: Outweighs Restraints on the Biobanking Industry for Research

3.7 Biobanking for Future Therapeutic Use: Is It Too Commercial?

3.7.1 Arguments against Commercial Stem Cell Banking for Therapeutic Uses

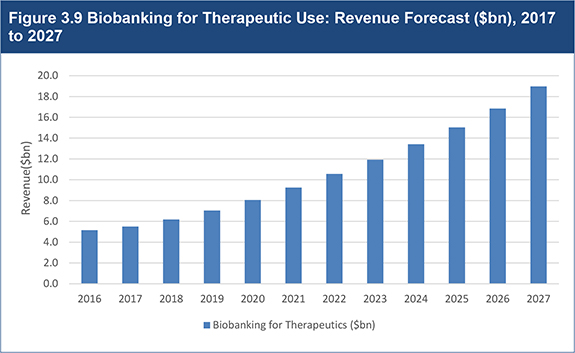

3.7.2 Biobanking for Future Therapeutic Use: Revenue Forecast 2017 to 2027

3.7.3 Driving and Restraining Forces Influencing the Biobanking Market for Therapeutic Applications, 2017 to 2027

4. Biobanking for Research Purposes

4.1 Breakdown of Biobanking for Research Market by Tissue Type, 2017

4.2 Biobanking for Research in 2022 and 2027: Comparison by Tissue Type

4.3 Biobanking for Research by Tissue Type: Grouped Revenue Forecasts 2017 to 2027

4.4 How Many Specimens are Biobanked for Research?

4.5 The Human Tissue Banking Market for Research in 2017

4.6 The Human Tissue Banking Market for Research: Revenue Forecast 2017 to 2027

4.7 The Human Tissue Banking Market: Commercial vs. Public Sector

4.7.1 Commercial Human Tissue Banks: Revenue Forecast 2017 to 2027

4.7.2 Public Sector Human Tissue Banks: Revenue Forecast 2017 to 2027

4.8 The Stem Cell Banking Market for Research in 2017

4.9 The Stem Cell Banking Market for Research: Revenue Forecast 2017 to 2027

4.9.1 R&D- Growing Interest Towards iPSCs

4.10 Banking of Other Biologics Specimens for Research in 2017

4.11 Banking of Other Biologic Specimens for Research: Revenue Forecast 2017 to 2027

5. Stem Cell Banking for Future Therapeutic Use

5.1 Stem Cell Banking for Therapeutic Use in 2017: A Breakdown by Stem Cell Type

5.2 Stem Cell Banking for Therapeutic Use by Stem Cell Type: Comparison of Revenue and Market Share, 2022 and 2027

5.3 Stem Cell Banking for Therapeutic Use by Stem Cell Type: Grouped Revenue Forecasts

5.4 How Many Stem Cells Are Biobanked Each Year?

5.5 The Umbilical Cord Blood Banking Market in 2017

5.5.1 Private vs. Public Cord Blood Banking

5.5.2 Umbilical Cord Blood Banking: The Controversies

5.6 The Umbilical Cord Blood Banking Market: Revenue Forecast 2017 to 2027

5.7 The Adult Stem Cell Banking Market in 2017

5.8 The Adult Stem Cell Banking Market: Revenue Forecast 2017 to 2027

6. Leading National Markets 2017 to 2027

6.1 The Geographical Footprint of Biobanking

6.1.1 Biobanking in Europe: Leading the World with Biobanking Networks and Infrastructure

6.1.2 Biobanks in the US: A Fragmented Picture

6.1.3 Biobanking in Asia: A Region Fast Gaining Prominence

6.2 Biobanking for Medicine: The US Led the Way in 2017

6.3 The Leading National Markets: Grouped Revenue Forecasts 2017 to 2027

6.4 How Will Regional Market Shares Change to 2027?

6.5 The US Biobanking Market 2017 to 2027: Diversifying and Expanding

6.6 The Top European Biobanking Markets 2017 to 2027: Leading the Way in Biobanking Infrastructure

6.6.1 Germany: An Advanced Industry with 74 Biobanks Associated with the BBMRI

6.6.2 France: Restrictions on Private Stem Cell Banking Limit the Market

6.6.3 Italy: Is the Limited Private Stem Cell Banking Market Off-Set by Strong Biobanking Networks for Research?

6.6.4 UK: Limited Presence of Biobanking Networks

6.6.5 Spain: Controversy Between Private and Public Umbilical Cord Blood Banks

6.6.6 The Netherlands is Characterised by Comprehensive Biobanking Networks

6.7 The Japanese Biobanking Market 2017 to 2027: A High Level of Government Investment Drives Growth

6.8 The Biobanking Industry in the BRIC Countries: High Growth and Increasing Market Share between 2017 and 2027

6.8.1 The Chinese Biobanking Market 2017 to 2027: The High Rate of Growth Will Continue

6.8.2 The Indian Biobanking Market 2017 to 2027: Set to Become the Leading Market for Private Stem Cell Banking?

6.8.3 The Brazilian Biobanking Market 2017 to 2027: Will New Regulations Drive or Restrain the Market?

6.8.4 Russia: Ban on the Import and Export of Human Tissue and Genetic Information Restricts the Market, But Can This Be Overcome from 2017 to 2027?

7. Technology for Biobanking: Systems, Software, Consumables, and Services Associated with Biobanking

7.1 The Biobanking-Associated Market: Overview

7.2 Systems Technology: Fully Automated Handling

7.2.1 Automated Liquid Handling Systems

7.2.2 Frozen Aliquoting: Patented Technology from CryoXtract

7.2.3 Automated DNA Isolation

7.3 Storage Technology: Sustainability, Easy Sample Tracking, and Added Security

7.3.1 Dry State, Room Temperature Storage Eliminates the Need for Expensive, Energy-Consuming Freezers

7.3.2 Ultra-Low Temperature Freezers: Is Their Use Declining?

7.3.3 Cryopreservation: Mechanical vs. Liquid/ Vapour Phase Nitrogen

7.3.4 Automated Storage and Retrieval Systems: Essential Technology

7.3.5 RFID and Tagging Technology: Advantages over Barcodes

7.4 Software for Biobanks

7.4.1 Laboratory Information Management System (LIMS): Unmet Needs in the Market Remain, Despite Recent Advances

7.4.2 LIMS Functions

7.5 Consumables: High Quality Required for Effective Sample Management

7.5.1 Addressing Sample Storage and Tracking Issues

7.6 Biobanking Services: Storage, Management and Transport of Biologic Samples for a Fee

8. Leading Companies in the Biobanking Market

8.1 The Differing Business Models of Biobanking Companies: Sourcing vs. Storing

8.2 Commercial Biobanks for Research Purposes in 2017

8.2.1 Tissue Solutions: A Virtual Biobank with a Global Presence

8.2.1.1 An Overview of the Products and Services Offered by Tissue Solutions

8.2.1.2 Banked Samples Occur in Many Formats

8.2.1.3 Prospective Tissue Collection for Hard-to-Find Samples

8.2.1.4 Fresh Samples from Surgical Resections are in High Demand

8.2.1.5 Freshly Isolated Human Cells are a Valuable Research Tool

8.2.1.6 FDA/EMA Panel of Normal Tissues

8.2.1.7 Strengths, Capabilities and the Future Outlook for Tissue Solutions

8.2.2 Asterand Bioscience is now Part of Stemgent

8.2.2.1 Asterand's Products and Services: XpressBANK, BioSpoke and PhaseZERO

8.2.2.2 The Future Outlook for Asterand

8.2.3 Biopta: Human Tissue Provider Now Acquired by Japanese Company ReproCELL

8.2.3.1 Services from Biopta: A Variety of Lab Services and Fresh Tissue Sample Procurement

8.2.3.2 The First Catalogue of Assays Based on Human Functional Tissues

8.2.3.3 The Future Outlook for Biopta: Fresh Tissue Will Be in Demand

8.2.4 BioServe: One of the World's Largest Commercial Biorepositories

8.2.4.1 BioServe Offers a Comprehensive List of Services: Biobanking, Sourcing and Preclinical Molecular Services

8.2.4.2 The Future Outlook for BioServe

8.2.5 Coriell Institute for Medical Research: Reportedly the Largest Biobank in the World

8.2.5.1 Features of and Recent Developments at Coriell Biobank

8.2.5.2 Future Outlook for the Coriell Biobank

8.3 Prominent Biobanks for Therapeutic Use in 2017

8.3.1 Cord Blood America: Expansion into the Emerging Markets Apparently Stalled, Strategic Alternatives Being Considered

8.3.2 Cryo-Cell International: The First Private Cord Blood Bank in the Market

8.3.3 Cryo-Save's Educational Programme Benefits Company's Growth

8.3.4 China Cord Blood Corp: The Only Cord Blood Bank in China with Multiple Licences Is Under a New Owner

8.3.5 LifebankUSA: Acquisition from Human Longevity Inc Will Potentially Drive Growth

8.3.6 ViaCord: More Blood Units Released for Therapy than Any Other Family Bank

8.3.7 Cord Blood Registry: The World's Largest Newborn Stem Cell Company Will Be Promoted By New Parent Company

8.3.8 Biogenea Pharmaceuticals: A Comprehensive Offering of Stem Cell Banking Services across the Balkan Peninsula

8.3.9 StemLife is Reportedly Facing Challenges due to Government Regulations in Malaysia

8.3.10 Future Health Biobank: A Strong Market Presence Owing to International Operations

8.3.11 Caladrius Biosciences (formerly NeoStem): More Focus on Cell Therapy Than Stem Cell Banking

8.3.12 Precious Cells is Well Positioned to Take Advantage of the Growing Demand in India

9. Qualitative Analysis of the Biobanking Market 2017 to 2027

9.1 Industry Trends

9.1.1 The Growing Demand for Biobank Resources for Research

9.1.2 The Establishment of Biobanking Networks

9.1.2.1 BBMRI: The Most Extensive Biobank Network

9.1.3 Virtual Biobanks: Connecting a Fragmented Industry

9.1.4 Commercial Biobanks as Intermediaries: New Resources for Research

9.1.5 Automated Biobanking Has Become Imperative

9.1.6 Increasing Uptake of LIMS

9.1.7 Green Banking – Becoming More Energy Efficient

9.2 The Strengths and Weaknesses of the Biobanking Market in 2017

9.2.1 HBS are Valuable Resources for R&D

9.2.2 Governmental Support for Biobanking Forms a Strength of that Industry

9.2.3 Development of Potential Novel Stem Cell Therapies has Increased Public Awareness of Stem Cell Banking

9.2.4 The Effect of Big Data on Biobanking

9.2.5 Insufficient Accessible Numbers of High Quality Biospecimens

9.2.6 Biobanks are Fragmented and Uncoordinated

9.2.7 Lack of Standardisation is a Weakness of the Industry

9.2.8 Lack of Public Awareness Limits Number of Donors

9.2.9 Lack of Engagement with Public Health Services Limits the Stem Cell Banking Market

9.3 Opportunities and Threats Facing the Biobanking Market, 2017 to 2027

9.3.1 Increasing Use of Biobanked Specimens in Genome-Wide Association Studies (GWAS)

9.3.2 Increasing Demand for Biobanked Samples for Preclinical Research

9.3.3 Biobanking Networks as a Basis for Personalised Medicine

9.3.4 Options for Adult Stem Cell Banking Mean an Increasing Target Population for Private Stem Cell Banks

9.3.5 Even With Governmental Funding, Biobanks Must Become Self-Sufficient to Thrive Long-Term

9.3.6 Public Concerns over Confidentiality and Security Threaten Availability of Donors

9.3.7 Limitations Surrounding Informed Consent

9.4 Social, Technological, Economic and Political Factors (STEP) Influencing the Biobanking Industry, 2017 to 2027

10. Conclusions from Our Research and Analysis

10.1 World Biobanking Market 2017 to 2027: High Revenue Growth Predicted

10.2 Biobanking for Research 2017 to 2027: The Value of Biobanked Specimens is Increasingly Recognised

10.3 Biobanking for Therapeutic Use 2017 to 2027: Rapid Expansion in Adult Stem Cell Banking

10.4 The Leading National Markets: High Sales Growth Worldwide

10.5 Current and Future Trends in Biobanking

10.5.1 Increasing Demand for Biobanked Samples - Increasing Revenue

10.5.2 Improving Biobanking Infrastructure – Growth Driver and a Need for Strategic Planning for Sustainability

10.5.3 Marked Challenges, but Opportunities for Expansion

11. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Figures

Figure 1.1 Global Biobanking Industry Segmentation Overview, 2017

Figure 2.1 Processes Involved in Biobanking, 2017

Figure 2.2 The Classification of Biobanks, 2017

Figure 3.1 Breakdown of the Biobanking Industry by Research vs. Therapeutics: Revenue ($bn) and Market Share (%), 2017

Figure 3.2 Breakdown of the Biobanking Industry by Research vs. Therapeutics: Market Shares (%), 2022

Figure 3.3 Breakdown of the Biobanking Industry by Research vs. Therapeutics: Market Shares (%), 2027

Figure 3.4 Biobanking for Medicine: Overarching Revenue Forecast ($bn), 2017 to 2027

Figure 3.5 The No. of Samples Stored in Biobanks by Purpose: Overall World Forecast, No. Of Samples (m), 2017 to 2027

Figure 3.6 Biobanking for Medicine by Sector: Grouped Forecasts, Revenue ($bn), 2017 to 2027

Figure 3.7 Biobanking Market for Research: Revenue Forecast ($bn), 2017 to 2027

Figure 3.8 Biobanking for Research: Drivers and Restraints, 2017 to 2027

Figure 3.9 Biobanking for Therapeutic Use: Revenue Forecast ($bn), 2017 to 2027

Figure 3.10 Biobanking for Therapeutic Use: Drivers and Restraints, 2016 to 2027

Figure 4.1 The Biobanking for Research Market by Tissue Type: Market Share (%), 2017

Figure 4.2 Biobanking for Research by Tissue Type: Market Shares (%), 2022

Figure 4.3 Biobanking for Research by Tissue Type: Market Shares (%), 2027

Figure 4.4 Biobanking for Research by Tissue Type: Grouped Revenue Forecasts ($bn), 2017 to 2027

Figure 4.5 Biobanking for Research: Market Drivers and Restraints, 2017 to 2027

Figure 4.6 Number of Research Samples Banked: Overall World Forecast, No. of Samples (m), 2017 to 2027

Figure 4.7 The Human Tissue Banking Market: Revenue Forecast ($bn), 2017 to 2027

Figure 4.8 Human Tissue Banking for Research: Market Drivers and Restraints, 2017 to 2027

Figure 4.9 The Commercial vs. Public Sector Human Tissue Banking Market: Market Shares (%), 2017

Figure 4.10 The Commercial vs. Public Sector Human Tissue Banking Market: Market Shares (%), 2022

Figure 4.11 The Commercial vs. Public Sector Human Tissue Banking Market: Market Share (%), 2027

Figure 4.12 The Human Tissue Banking Market by Subsector: Revenue Forecasts ($bn), 2017 to 2027

Figure 4.13 Commercial Human Tissue Banking: Revenue Forecast ($bn), 2017 to 2027

Figure 4.14 Public Sector Human Tissue Banking: Revenue Forecast ($bn), 2017 to 2027

Figure 4.15 The Stem Cell Banking Market for Research: Revenue Forecast ($bn), 2017 to 2027

Figure 4.16 Stem Cell Banking for Research: Market Drivers and Restraints, 2017 to 2027

Figure 4.17 Banking of Other Biologic Specimens for Research: Revenue Forecast ($bn), 2017 to 2027

Figure 4.18 Biobanking of Other Biologic Specimens for Research: Market Drivers and Restraints, 2016 to 2027

Figure 5.1 Biobanking for Therapeutic Use by Stem Cell Type: Market Shares (%), 2017

Figure 5.2 Biobanking for Therapeutic Use by Stem Cell Type: Market Shares (%), 2022

Figure 5.3 Biobanking for Therapeutic Use by Stem Cell Type: Market Shares (%), 2027

Figure 5.4 Biobanking for Therapeutic Use by Stem Cell Type: Grouped Revenue Forecasts ($bn), 2017 to 2027

Figure 5.5 The Number of Stem Cell Samples Banked for Therapeutic Use (m): Forecast 2017 to 2027

Figure 5.6 The Stem Cell Banking Market for Future Therapeutic Use: Drivers and Restraints, 2017 to 2027

Figure 5.7 The Umbilical Cord Banking Market: Revenue Forecast ($bn), 2017 to 2027

Figure 5.8 The Umbilical Cord Blood Banking Market: Drivers and Restraints, 2017 to 2027

Figure 5.9 The Adult Stem Cell Banking Market: Revenue Forecast ($bn), 2017 to 2027

Figure 5.10 The Adult Stem Cell Banking Market: Drivers and Restraints, 2017 to 2027

Figure 6.1 The Leading National Biobanking Markets: Market Shares (%), 2017

Figure 6.2 The Leading National Markets: Grouped Revenue Forecasts ($bn), 2017 to 2027

Figure 6.3 The Leading National Markets: Market Share (%), 2022

Figure 6.4 The Leading National Markets: Market Share (%), 2027

Figure 6.5 Biobanking for Medicine in the US: Revenue Forecast ($bn), 2017 to 2027

Figure 6.6 Driving and Restraining Factors of the US Biobanking Market, 2017 to 2027

Figure 6.7 The Leading European Markets for Biobanking: Grouped Revenue Forecasts ($bn), 2017 to 2027

Figure 6.8 Biobanking in the Leading European Countries: Driving and Restraining Factors, 2017 to 2027

Figure 6.9 The German Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 6.10 The French Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 6.11 The Italian Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 6.12 The UK Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 6.13 The Spanish Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 6.14 The Netherlands Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 6.15 The Japanese Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 6.16 Driving and Restraining Factors Influencing the Japanese Biobanking Industry, 2017 to 2027

Figure 6.17 The Biobanking Industry in the BRIC Countries: Grouped Revenue Forecasts ($bn), 2017 to 2027

Figure 6.18 Driving and Restraining Factors of the Biobanking Industry in the BRIC Countries, 2017 to 2027

Figure 6.19 The Chinese Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 6.20 The Indian Biobanking Industry: Revenue ($bn) Forecast, 2017 to 2027

Figure 6.21 The Brazilian Biobanking Market: Revenue Forecast ($bn), 2017 to 2027

Figure 6.22 The Russian Biobanking Industry: Revenue Forecast ($bn), 2017 to 2027

Figure 7.1 Structure of the Biobanking Industry: Biobanking-Associated Market, Biobanks and End Users, 2017

Figure 7.2 The Basic Function of LIMS

Figure 8.1 Biobanking Business Model: Commercial Sourcing of Biological Samples, 2017

Figure 8.2 Business Model: Commercial Banking of Biological Samples, 2017

Figure 8.3 China Cord Blood Corp: Revenue ($m), 2014 to 2016

Figure 8.4 StemLife: Comparison of Revenue ($m), 2015 and 2016

Figure 10.1 The Global Biobanking Market by Industry Sector: Comparison of Revenues ($bn), 2017, 2022 and 2027

Figure 10.2 Biobanking for Research by Sample Type: Comparison of Revenues ($bn), 2017, 2022 and 2027

Figure 10.3 Stem Cell Banking for Therapeutic Use by Stem Cell Type: Comparison of Revenues ($bn), 2017, 2022 and 2027

Figure 10.4 Leading Regional Markets for Biobanking: Comparison of Revenues ($bn), 2017, 2027 and 2027

List of Tables

Table 1.1 Biobanking for Medicine by Sector: Grouped Forecasts, Revenue ($bn), Annual Growth (%), CAGR (%), 2017 to 2027 (redacted)

Table 2.1 Prominent Population-Based Biobanks, 2017

Table 2.2 Prominent Disease-Based Biobanks, 2017

Table 2.3 Guidelines and Recommendations for Biobanks, 2017

Table 2.4 Laws and Other Regulations for Biobank-Based Research by Country/ Organisation 2017

Table 2.5 Pharmaceutical and Biotechnology Companies with In-House Biobanks, 2017

Table 3.1 Breakdown of the Biobanking Industry by Research vs. Therapeutics: Revenue ($bn) and Market Share (%), 2017

Table 3.2 Biobanking for Medicine: Research vs. Therapeutics in 2022 and 2027

Table 3.3 Biobanking for Medicine: Overall World Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2017 to 2027

Table 3.4 The No. of Samples Stored in Biobanks by Purpose: Overall World Forecast No. Of Samples (m), Annual Growth (%), CAGR (%), 2017 to 2027

Table 3.5 Biobanking for Medicine by Sector: Grouped Forecasts, Revenue ($bn), Annual Growth (%), CAGR (%), 2017 to 2027

Table 3.6 Biobanking Market for Research Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 3.7 Biobanking for Therapeutic Use Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2016 to 2027

Table 4.1 The Biobanking for Research Market by Tissue Type: Revenues ($bn) and Market Shares (%), 2017

Table 4.2 Biobanking for Research by Tissue Type: A Comparison of Revenues ($bn) and Market Shares (%), 2022 and 2027

Table 4.3 Biobanking for Research by Tissue Type: Grouped Forecasts, Revenue ($bn), Annual Growth (%), CAGR (%), 2017 to 2027

Table 4.4 Number of Research Samples Banked: Overall World Forecast, No. of Samples (m), Annual Growth (%), CAGR (%), 2017 to 2027

Table 4.5 The Human Tissue Banking Market Forecast: Revenue ($bn), Market Share (%) Annual Growth (%), CAGR (%), 2017 to 2027

Table 4.6 The Commercial vs. Public Sector Human Tissue Banking Market: Comparison of Revenues ($bn) and Market Share (%), 2017, 2022 and 2027

Table 4.7 Commercial Human Tissue Banking Forecast, Revenue ($bn) Annual Growth (%), CAGR (%), 2017 to 2027

Table 4.8 Commercial Human Tissue Banking Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 4.9 Prominent Commercial Human Tissue Banks, 2017

Table 4.10 Public Sector Human Tissue Banking Forecast: Revenue ($bn), Market Share (%) Annual Growth (%), CAGR (%), 2017 to 2027

Table 4.11 Prominent Public-Funded Human Tissue Banks, 2016

Table 4.12 The Stem Cell Banking Market for Research Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 4.13 Prominent Stem Cell Banks Serving the Research Community, 2017

Table 4.14 Banking of Other Biologic Specimens for Research Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 4.15 Prominent Biobanks Storing Other Biologic Samples, 2017

Table 5.1 Biobanking for Therapeutic Use by Stem Cell Type: Market Share (%), 2017

Table 5.2 Biobanking for Therapeutic Use by Stem Cell Type: Comparison of Revenues ($bn) and Market Share (%), 2022 and 2027

Table 5.3 Number of Research Samples Banked: Overall World Forecast, No. of Samples (m), Annual Growth (%), CAGR (%), 2017 to 2027

Table 5.5 Prominent Public and Private Cord Blood Banks, 2017

Table 5.6 The Umbilical Cord Banking Market Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 5.7 Prominent Companies in the Adult Stem Cell Banking Industry, 2017

Table 5.8 The Adult Stem Cell Banking Market Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.1 Breakdown of BBMRI Network Directory Members by Country, 2017

Table 6.2 The Leading National Biobanking Markets: Comparison of Revenues ($bn) and Market Shares (%), 2017

Table 6.3 Leading National Markets Grouped Forecasts: Revenue ($bn), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.4 Leading National Markets: Comparison of Market Share (%), 2017, 2022 and 2027

Table 6.5 Biobanking for Medicine in the US Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.6 The Leading European Markets for Biobanking Grouped Forecasts: Revenue ($bn), Market Share (%) Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.7 Examples of Biobanking Initiatives Funded by the European Commission, 2016

Table 6.8 The German Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.9 The French Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.10 The Italian Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.11 The United Kingdom Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.12 The Spanish Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.13 Prominent Clinical and Population Biobanks in the Netherlands, 2017

Table 6.14 The Netherlands Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.15 The Japanese Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.17 The Chinese Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.18 The Indian Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.19 Prominent Research Biobanks in India, 2017

Table 6.20 The Brazilian Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 6.21 The Russian Biobanking Industry Forecast: Revenue ($bn), Market Share (%), Annual Growth (%), CAGR (%), 2017 to 2027

Table 7.1 Prominent Companies Providing Automated Liquid Handling Technology, 2017

Table 7.2 Prominent Companies Providing Room Temperature Storage Solutions, 2017

Table 7.3 Prominent Companies Providing Ultra-Low Temperature Freezers (-80∞C), 2017

Table 7.4 Mechanical Freezing vs. Liquid Nitrogen: Comparison of Advantages and Disadvantages, 2017

Table 7.5 Prominent Companies Providing Cryogenic Storage Solutions, 2017

Table 7.6 Prominent Providers of Automated Biobanking Systems, 2017

Table 7.7 Major Vendors in the LIMS Market, 2017

Table 7.8 Prominent Vendors of Consumables for Biobanking, 2017

Table 7.9 Prominent Biorepository Service Providers, 2017

Table 8.1 Prominent Players in the Biobanking Industry for Research, 2017

Table 8.2 Prominent Companies in the Stem Cell Banking Industry for Therapeutic Use, 2017

Table 8.3 China Cord Blood Corp: Revenue ($m), Total Units Stored for Subscribers, and No. Of New Subscribers, 2014 to 2016

Table 8.4 StemLife: Comparison of Revenue ($m) between 2015 and 2016

Table 9.1 Strengths and Weaknesses of the Biobanking Industry, 2017

Table 9.2 Opportunities and Threats Facing the Biobanking Industry, 2016 to 2027

Table 9.3 Social, Technological, Economic and Political (STEP) Forces Influencing the Biobanking Industry, 2016 to 2027

Abbott Laboratories

AIS

AKH Biobank

AllCells

American CryoStem

American Type Culture Collection

Analytical Biological Services

ARUP Laboratories

ASPREE Healthy Ageing Biobank

Assure Immune

Asterand

AstraZeneca

Aurora Biomed

Auto scribe Informatics

Bangalore Brain Bank

Barts Gynae Tissue Bank

Bayer

BBMRI

Beckman Coulter

BINDER

Bio Fortis

Bio Life Solutions

Bio Repository Resources

BioCision

Biogenea

Biomatrica

Biopta

BioreclamationIVT

BioRep

BioServe Biotechnologies

BioSHARE

Biovault Technical

BIOVIA

BrainNet Europe

Bristol-Myers Squibb

Brooks Automation (acquired Bio Storage Technologies)

Brooks Life Science Systems

Caladrius Biosciences

Cambridge Biomedical Research Centre

CARTaGENE

CCLG Tissue Bank

Cells4Life

Celltex Therapeutics

Cesca Therapeutics

China Cord Blood Corp.

China Kadoorie Biobank

CLB/Amsterdam Medical Center

CMD Biobank

CONCOR

CorCell

Cord Blood America

Cord Life

CORE Informatics

Coriell Institute for Medical Research

Cryo Bio System

Cryo-Cell

Cryo-Cell International

Cryogene Lab

CryoLogic

Cryo-Save

Cureline

Custom Biogenic Systems

Cybrdi

Cybrdi

DeCODE Genetics (Amgen)

Eli Lilly

ENGAGE

Eppendorf

Esco

ESFRI

Fisher Bio Services

FluidX

Future Health Biobank

GE Healthcare SeqWright Genomic Services

GEN2PHEN

Genentech

Gilson

GlaxoSmithKline

Haier Biomedical

Hamilton Robotics

Hamilton Storage Technologies

Hospital Necker Paris

Hudson Robotics

Hungarian Biobank

Huntington Disease Biobank

In biomed

Indivumed

Infectious Disease Biobank

IntegenX

International Stem Cell Corporation

Kaiser Permanente

King's College London Tissue Bank

Lab ware

LABVANTAGE

Leiden Longevity

Leiden University Medical Center

Life Bank USA

Life Gene

Life Lines Biobank

Malm? Microbiology Biobank

Merck

Micronics

Mitochondrial Disease Biobank

NESDA

Novare Biologistics

Novartis

Ocimum Bio solutions

OnCore UK

Organisation for Economic Co-operation and Development (OECD)

OriGene

Pacific Bio Storage

PALGA

Panasonic Biomedical

Parelsnoer

PerkinElmer

Pfizer

Pharma Cells

PHOEBE

Pop-Gen National Cohort

Precious Cells

Precision Bio services

PrecisionMed

PREVEND

Progenicyte

ProMedDx

ProteoGenex

Qiagen

Riken BRC Cell Bank

Roche

Sapien Biosciences

ScÈil

Smart Cells

StarLIMS

Steelgate

Stem Life

Stem Save

Stemcyte

System Biosciences

Taiyo Nippon Sanso

TAP Bio systems (now owned by Sartorius Stedim Biotech)

TCG Life Sciences Tissue Bank

Tecan

Thermo Fisher Scientific

TISS-EU Project

Tissue Solutions

TTP Labtech

UCL Biobank

US Biomax

Via Cord

Virgin Health Bank

List of Organisations

Chernobyl Tissue Bank

Cord Blood Registry (CBR)

Estonian Genome Project

FDA

Germany's Institut f¸r Qualit‰t und Wirtschaftlichkeit im Gesundheitswesen (IQWiG)

Harvard Stem Cell Institute

Imperial Tissue Bank

Japanese Ministry of Health, Labour and Welfare

Narayana Hrudayalaya Tissue Bank and Stem Cell Research Center

Netherlands Twin Registry

NHS

NHS Blood and Transplant Cord Blood Bank

NICE

Singapore Cord Blood Bank

Stanford Tissue Bank

Swedish Institute for Infectious Disease Control Biobank

Tata Memorial Hospital Tissue Bank

The Cambridge Brain Bank

The Guangzhou Biobank

The National Cancer Tissue Bank, Indian Institute of Technology

UK Biobank

UK ME-CFS Biobank

UK Multiple Sclerosis Tissue Bank

UK Parkinson's Disease Tissue Bank

UK Stem Cell Bank

University of T¸ebingen

WHO

Wisconsin International Stem Cell Bank

Download sample pages

Complete the form below to download your free sample pages for Biobanking Market Forecasts 2017-2027

Download sample pages

Complete the form below to download your free sample pages for Biobanking Market Forecasts 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024