Industries > Automotive > Automotive Composites Market Report 2020-2030

Automotive Composites Market Report 2020-2030

Global Industry Size, Share, Trends, Sub Segments, Growth Factors, Key Country Analyses with Competitive Landscape

This report evaluates the current levels of global investment in the Automotive Composites market. Over the next decade, this industry will register strong, stable growth.

Visiongain forecasts that the automotive composite market has been witnessing a positive growth owing to rising production in Asia Pacific, Europe and Central & South America. Growing preference for higher fuel-efficiency in passenger cars, product differentiation with vehicle aesthetics, and rising vehicle production is expected to drive the industry over the forecast period.

Exponential economic growth of various developed and developing countries such as the U.S., Germany, the UK, China, India, UAE, etc. has driven concerns regarding sustainability and carbon emission levels. Increasing awareness regarding application of lightweight materials to manufacture interior and exterior automotive components, thereby reducing overall fuel consumption are other factors likely to drive market growth. Automotive composites consumption has witnessed a steady rise, mainly in the U.S. which has 800 vehicles per 1,000 people.

Rapid industrialisation and growing disposable consumer income in emerging economies such as China & India led to greatest market share in Asia Pacific. Increasing demand for lightweight, fuel-efficient vehicles lead to focused manufacturer efforts towards automotive composite applications in this region. Increasing partnerships, agreements, and numerous product launches made APAC a favourable market for automotive composite investments.

The global automotive composites market has a moderate number of vendors with a limited number of players involved in the production of each composite type. Thus, the competition between the players is intense, and there are high barriers to entry into the market. The entry into the market is also difficult due to the high initial investment required by the new entrants and the similarity of the products offered by the different vendors. The products are similar because they were developed for the same target customers, that is, automotive OEMs and other key automakers. To lure the automotive end-users to buy their products and also to enhance their market position, the key vendors implement various types of business strategies like product development, product differentiation, and strategic pricing

Report Scope

View detailed company profiles of key players within the market with analysis of their product portfolios and strategies.

• BASF

• DOW Inc.

• Gurit

• SGl group

• Solvey Group

• Mitsubishi Chemical Corporation

• Hexcel

• Teijin Limited

• Toray

• UFP Technologies

• Huntsman

• Advanced Composites Group

• Scott Bader

Review the Automotive Composites Market 2020-2030

See Forecasts for Regional Automotive Composites Market from 2020-2030

• US Automotive Composites Market Forecast 2020-2030

• Canada Automotive Composites Market Forecast 2020-2030

• Mexico Automotive Composites Market Forecast 2020-2030

• Germany Automotive Composites Market Forecast 2020-2030

• France Automotive Composites Market Forecast 2020-2030

• UK Automotive Composites Market Forecast 2020-2030

• Italy Automotive Composites Market Forecast 2020-2030

• Spain Automotive Composites Market Forecast 2020-2030

• China Automotive Composites Market Forecast 2020-2030

• Japan Automotive Composites Market Forecast 2020-2030

• India Automotive Composites Market Forecast 2020-2030

• South Korea Automotive Composites Market Forecast 2020-2030

• Brazil Automotive Composites Market Forecast 2020-2030

• Argentina Automotive Composites Market Forecast 2020-2030

View details of latest developments For Automotive Composites Market

Regulation, emerging market growth and other factors have had a quantifiable effect on the market. This report covers developments such as these, as well as other factors that could affect automotive composites technologies market and the wider aviation sector. By also covering the below submarkets, the report gives readers a concise overview of the market:

Examine Automotive Composites Forecast by Submarket 2020-2030

• By Composite Material:

• Polymer Matrix Composites (PMC)

• Metal Matrix Composites (MMC)

• Ceramic Matrix Composites (CMC)

• By Automotive Component

• Interior Components

• Body Components

• Engine & Drivetrain Components

• Other Components

Detailed Analysis of the Polymer Matrix Composites (PMC) submarket

• By Type of Polymer Material:

• Carbon Fibre Reinforced Polymer (CFRP)

• Glass Fibre Reinforced Polymer (GFRP)

• Aramid Fibre Reinforced Polymer (AFRP)

• By Resin:

• Thermoplastics

• Thermosets

• By End-use:

• Cars (Conventional, Electric),

• Trucks & Buses

• By Manufacturing Process:

• Compression Molding

• Injection Molding

• Sheet Molding

• Resin Transfer Molding

Detailed information on Automotive Composites market can be used to help develop your business plans and strategy. Visiongain’s report provides clarity and a comprehensive overview of the market. Concise analysis supports Visiongain’s conclusions, and our market evaluations will help you when considering the Military Stealth Technologies market.

Why you should read this report:

The report will prove invaluable for anyone wanting to better understand the military stealth technologies industry and its underlying dynamics. It will prove useful for businesses who wish to expand into different sectors or explore a new region for expansion of their existing operations. The report comprehensively lays out the market drivers and restraints, market forecasts, technologies, investments, leading companies and their strategies, as well as market investment status, and risks and trends to help the reader formulate a better-informed business strategy. This report will be ideal for senior executives, business development managers, marketing managers, consultants, CEOs, CIOs, COOs, and Directors. Furthermore, governments, agencies and organisations will also find value in our research report.

Buy our report today Automotive Composites Market Report 2020-2030: Global Industry Size, Share, Trends, Sub Segments, Growth Factors, Key Country Analyses with Competitive Landscape. Avoid missing out by staying informed – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Global Automotive Composites Market 2020-2030 Overview

1.1 Why You Should Read This Report

1.2 What This Report Delivers

1.3 Key Questions Answered By This Analytical Report Include:

1.4 Who is This Report For?

1.5 Methodology

1.6 Frequently Asked Questions (FAQs)

1.7 Associated Visiongain Reports

1.8 About Visiongain

2 Introduction to the Automotive Composites Market

2.1 Opportunities for the Automotive Composites Market: Light-weighting, Fuel Efficiency, Durability & Emission Reduction

2.2 Automotive Composites Market Definition

2.2.1 Composite Materials Definition

2.2.2 Global Automotive Composites Market Definition

2.3 Automotive Composites Market Segmentation

2.3.1 Automotive Composites Market Segmentation-By Type of Composite Materials

2.3.2 Polymer Matrix Composites

2.3.3 Carbon Fibre Reinforced Polymer(CFRP)

2.3.4 Metal Matrix Composites

2.3.5 Ceramic Matrix Composites

2.3.6 Automotive Composites Market Segmentation-By Type of Composite Components

2.3.7 Interior Components Submarket

2.3.8 Body Components Submarket

2.3.9 Engine & Drivetrain Components Submarket

2.3.10 Other Components Submarket

2.4 Penetration and growth prospect mapping

3 Global Automotive Composites Market Forecast 2020-2030

3.1 Global Automotive Composites Market Overview

3.2 Historical Trends for Composite Materials In Automotive Industry

3.2.1 Learn What Drives the Growth of the Automotive Composites Market between 2020 and 2030

3.2.2 Challenges faced by the Global Automotive Composites Market

3.2.3 Key Opportunities

3.2.4 Market Trends

3.2.5 Five Force Analysis

3.2.6 Industry analysis - Porter’s

3.2.7 Industry analysis – PESTEL

3.3 Global Automotive Composites Market Size Forecast 2020-2030 by Composite Materials

3.3.1 Automotive Polymer Matrix Composites (PMC) Submarket Forecast 2020-2030

3.3.2 Automotive Polymer Matrix Composites Submarket Overview 2020-2030

3.3.3 Automotive Polymer Matrix Composites Drivers & Restraints

3.4 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast 2020-2030 by Type of Polymer Fibre

3.4.1 Automotive Carbon Fibre Reinforced Polymer (CFRP) Submarket Forecast 2020-2030

3.5 Automotive Glass Fibre Reinforced Polymer (GFRP) Submarket Forecast 2020-2030

3.5.2 Automotive Aramid Fibre Reinforced Polymer (AFRP) Submarket Forecast 2020-2030

3.5.3 Automotive Aramid Fibre Reinforced Polymer (AFRP) Submarket Overview 2020-2030

3.5.4 Automotive Polymer Matrix Composites Submarket Revenue Forecast 2020-2030 by Thermoplastic or Thermosetting Polymer

1.1.1 Automotive Thermoplastic Polymer Matrix Composites (PMC) Submarket Forecast 2020-2030

3.5.5 Automotive Thermoset Polymer Matrix Composites (PMC) Submarket Forecast 2020-2030

3.5.6 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast 2020-2030 by End Use

3.5.7 Automotive Polymer Matrix Composites (PMC) Submarket Forecast for Conventional Vehicles 2020-2030

3.5.8 Automotive Polymer Matrix Composites (PMC) Submarket Forecast for Electrical Vehicles 2020-2030

1.1.2 Automotive Polymer Matrix Composites (PMC) Submarket Forecast for Trucks & Buses 2020-2030

3.5.9 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast 2020-2030 by Manufacturing Process

3.5.10 Automotive Polymer Matrix Composites (PMC) Submarket Forecast for Compression Moulding 2020-2030

3.5.11 Automotive Polymer Matrix Composites (PMC) Submarket Forecast for Injection Moulding 2020-2030

3.5.12 Automotive Polymer Matrix Composites (PMC) Submarket for Injection Moulding Overview 2020-2030

3.5.13 Automotive Polymer Matrix Composites (PMC) Submarket Forecast for Resin Transfer Moulding 2020-2030

3.5.14 Automotive Polymer Matrix Composites (PMC) Submarket Forecast for Sheet Moulding 2020-2030

3.5.15 Automotive Metal Matrix Composites (MMC) Submarket Forecast 2020-2030

3.5.16 Automotive Ceramic Matrix Composites (CMC) Submarket Forecast 2020-2030

3.6 Global Automotive Composites Market Revenue Forecast 2020-2030 by Composite Components

3.6.1 Automotive Composite Interior Components Submarket Forecast 2020-2030

3.6.2 Automotive Composite Body Components Submarket Forecast 2020-2030

3.6.3 Automotive Composite Engine & Drivetrain Components Submarket Forecast 2020-2030

3.6.4 Other Automotive Composite Components Submarket Forecast 2020-2030

4 Regional and Leading National Automotive Composites Market Forecasts 2020-2030

4.1 Global Automotive Composites Market by National Market Share Forecast 2020-2030

4.2 United States Automotive Composites Market Forecast 2020-2030

4.2.1 Second Largest Producer and Consumer of Automobiles in the Word

4.3 Canada Automotive Composites Market Forecast 2020-2030

4.3.1 Canada’s automotive industry is largely driven by export sales

4.4 Mexico Automotive Composites Market Forecast 2020-2030

4.4.1 Mexico automotive industry export is ~80% of total production

4.5 Germany Automotive Composites Market Forecast 2020-2030

4.5.1 Germany has a mature automotive market

4.6 France Automotive Composites Market Forecast 2020-2030

4.6.1 Polymer Matrix Composites (PMC) is the largest product segment

4.7 United Kingdom Automotive Composites Market Forecast 2020-2030

4.7.1 UK is the fourth-largest automotive manufacturer in EU

4.8 Italy Automotive Composites Market Forecast 2020-2030

4.8.1 Automotive sector accounts for 20% of Italy's gross value added in industry

4.9 Rest of Europe (RoE) Automotive Composites Market Forecast 2020-2030

4.9.1 Spain

4.10 China Automotive Composites Market Forecast 2020-2030

4.10.1 China Automotive Composites Market Drivers & Restraints

4.10.2 The China market was accounted for the largest market share in terms of both value and volume

4.11 Japan Automotive Composites Market Forecast 2020-2030

4.11.1 Japan Automotive Composites Market Drivers & Restraints

4.11.2 Japan is one of the top three major producer for automobiles with focus on innovation, quality and meeting standards

4.12 India Automotive Composites Market Forecast 2020-2030

4.12.1 India Automotive Composites Market Drivers & Restraints

4.12.2 Major global OEMs have made India a component sourcing hub for their global operations

4.13 South Korea Automotive Composites Market Forecast 2020-2030

4.13.1 South Korea Automotive Composites Market Drivers & Restraints

4.13.2 South Korea is overcoming constraints by strengthening future car “ecosystem”

4.14 Brazil Automotive Composites Market Forecast 2020-2030

4.14.1 Focus on lightweight vehicle technology is expected to boost the automotive composites in Brazil

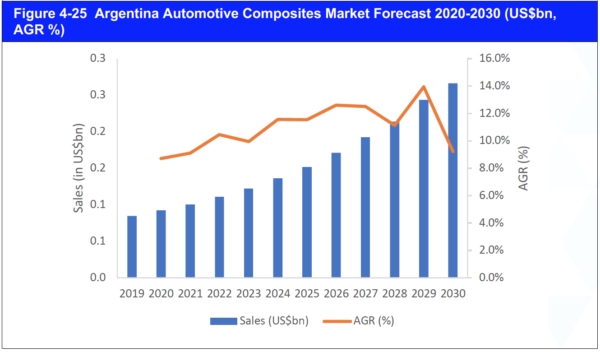

4.15 Argentina Automotive Composites Market Forecast 2020-2030

4.15.1 Stringent environmental regulations on pollution and carbon emissions are necessitating heavy investments in the automotive composites

5 Value chain analysis

5.1 Automotive Composites Value Chain Analysis

5.2 Market dynamics

6 Leading Companies in the Automotive Composites Market

6.1 Competitive Environment

6.2 Strategy Framework

6.3 Heat Map Analysis for Automotive Polymer Matrix Composites Market

6.4 BASF

6.4.1 BASF Total Company Sales 2014-2018

1.1.3 BASF Sales by Segment of Business 2017-2018

6.4.2 BASF Total Company Net Income 2014-2018

6.4.3 BASF Automotive Composites Products / Services

6.4.4 BASF Primary Market Competitors 2020

6.4.5 BASF. Latest Developments

6.4.6 BASF. Mergers & Acquisitions (M&A) Activity

6.4.7 BASF Analysis

6.4.8 BASF Future Outlook

6.5 DOW Inc.

6.5.1 DOW Inc. Total Company Sales 2015-2019

6.5.2 DOW Inc. Sales by Segment of Business 2018-2019

6.5.3 DOW Inc. Automotive Composites Products / Services

6.5.4 DOW Inc. Primary Market Competitors 2020

6.5.5 DOW Inc. Latest Developments

6.5.6 DOW Inc. Analysis

6.5.7 .DOW Inc. Future Outlook

6.6 Gurit

6.6.1 Gurit Total Company Sales 2015-2018

6.6.2 Gurit Sales by Segment of Business 2017-2018

6.6.3 Gurit Sales by Geographical Location

6.6.4 Gurit Automotive Composites Products / Services

6.6.5 Gurit Primary Market Competitors 2020

6.6.6 Gurit Mergers & Acquisitions (M&A) Activity

6.6.7 Gurit Latest Developments

6.6.8 Gurit Analysis

6.6.9 Gurit Future Outlook

6.7 Hexcel

6.7.1 Hexcel Total Company Sales 2014-2018

6.7.2 Hexcel Sales by Segment of Business 2016-2018

6.7.3 Hexcel Total Company Net Income 2014-2018

6.7.4 Hexcel Automotive Composites Products / Services

6.7.5 Hexcel Primary Market Competitors 2020

6.7.6 Hexcel Mergers & Acquisitions (M&A) Activity

6.7.7 Hexcel Latest Developments

6.7.8 Hexcel Analysis

6.7.9 Hexcel Future Outlook

6.8 Mitsubishi Chemical Corporation

6.8.1 Mitsubishi Chemical Corporation Total Company Sales 2015-2018

6.8.2 Mitsubishi Chemical Corporation Sales by Segment of Business 2017-2018

6.8.3 Mitsubishi Chemical Corporation Automotive Composites Products / Services

6.8.4 Mitsubishi Chemical Corporation Primary Market Competitors 2020

6.8.5 Mitsubishi Chemical Corporation Mergers & Acquisitions (M&A) Activity

6.8.6 Mitsubishi Chemical Corporation Latest Developments

6.8.7 Mitsubishi Chemical Corporation Analysis

6.8.8 Mitsubishi Chemical Corporation Future Outlook

6.9 SGL Group

6.9.1 SGL Group Total Company Sales 2015-2018

6.9.2 SLG Group Sales by Segment of Business 2017-2018

6.9.3 SGL Group Sales by Geographical Location 2017-18

6.9.4 SGL Group Automotive Composites Products / Services

6.9.5 SGL Group Primary Market Competitors 2020

6.9.6 SGLGroup Latest Developments

6.9.7 SGL Group Analysis

6.9.8 SGL Group Future Outlook

6.10 Solvey Group

6.10.1 Solvey Group Total Company Sales 2015-2018

6.10.2 Solvey Group Sales by Segment of Business 2017-2018

6.10.3 Solvey Group Sales by Geographical Location 2017-18

6.10.4 Solvey Group Organisational Structure

6.10.5 Solvey Group Automotive Composites Products / Services

6.10.6 Solvey Group Primary Market Competitors 2020

6.10.7 Solvey Group Mergers & Acquisitions (M&A) Activity

6.10.8 Solvey Group Latest Developments

6.10.9 Solvey Group Analysis

6.10.10 Solvey Group Future Outlook

6.11 Teijin Limited

6.11.1 Teijin Limited Total Company Sales 2015-2019

6.11.2 Teijin Limited Sales by Segment of Business 2018-2019

6.11.3 Teijin Limited Sales by Geographical Location

6.11.4 Teijin Limited Automotive Composites Products / Services

6.11.5 Teijin Limited Primary Market Competitors 2020

6.11.6 Figure 5 33Teijin Limited Primary Market Competitors 2020

6.11.7 Teijin Limited Mergers & Acquisitions (M&A) Activity

6.11.8 Teijin Latest Developments

6.11.9 Teijin Limited Analysis

6.11.10 Teijin Limited Future Outlook

6.12 Toray

6.12.1 Toray Total Company Sales 2015-2019

6.12.2 Toray Sales by Segment of Business 2015-2019

6.12.3 Toray Sales by Geographical Location 2017-18

6.12.4 Toray Total Company Net Income 2018-2019

6.12.5 Toray Automotive Composites Products / Services

6.12.6 Toray Primary Market Competitors 2020

6.12.7 Toray Mergers & Acquisitions (M&A) Activity

6.12.8 Toray Latest Developments

6.12.9 Toray Analysis

6.12.10 Toray Future Outlook

6.13 UFP Technologies, Inc.

6.13.1 UFP Technologies, Inc Total Company Sales 2014-2018

6.13.2 UFP Technologies, Inc. Sales by Segment of Business 2016-2018

6.13.3 UFP Technologies, Inc Total Company Net Income 2014-2018

6.13.4 UFP Technologies, Inc Automotive Composites Products / Services

6.13.5 UFP Technologies, Inc Primary Market Competitors 2020

6.13.6 UFP Technologies, Inc. Mergers & Acquisitions (M&A) Activity

6.13.7 UFP Technologies, Inc Analysis

6.13.8 UFP Technologies, Inc. Future Outlook

6.14 Huntsman

6.14.1 Huntsman Total Company Sales 2016-2019

6.14.2 Huntsman Sales by Segment of Business 2018-2019

6.14.3 Huntsman Automotive Composites Products / Services

6.14.4 Huntsman Primary Market Competitors 2020

6.14.5 HUNTSMAN Mergers & Acquisitions (M&A) Activity

6.14.6 Huntsman Latest Developments

6.14.7 Huntsman Analysis

6.14.8 Huntsman Future Oulook

6.15 Advanced Composites Group

6.15.1 ADVANCED COMPOSITES GROUP Automotive Composites Products / Services

6.15.2 ADVANCED COMPOSITES GROUP Latest Developments

6.15.3 ADVANCED COMPOSITES GROUP Analysis

6.16 Scott Bader

6.16.1 SCOTT BADER Automotive Composites Products / Services

6.16.2 SCOTT BADER Primary Market Competitors 2020

6.16.3 SCOTT BADER. Mergers & Acquisitions (M&A) Activity

6.16.4 Scott Bader Latest Developments

6.16.5 SCOTT BADER Analysis

6.16.6 SCOTT BADER Future Outlook

7 Conclusions and Recommendations

7.1 Other Important Companies in the Automotive Composites Market

8 Glossary

8.1 Associated Visiongain Reports

List of Figures

Figure 2 1 Comparison of Historical and Enacted Passenger Car Fuel Economy Standards

Figure 2 2 Global Automotive Composites Market Structure Overview

Figure 2 3 Global Automotive Composites Market by Type of Composite Materials

Figure 2 4 Picture of a Honeycomb structure made of carbon-fibre-reinforced polymer on a BMW i3

Figure 2 5 Picture of AMG Carbon Ceramic Brake Disc

Figure 2 6 Global Automotive Composites Market by Type of Composite Components

Figure 2 7 CFRP and Aramid Fibre interior on JaguarXJR-15

Figure 2 8 Cut-out of BMW Turbo-Charged Engine

Figure 3 1 Global Automotive Composites Market Revenue Forecast 2020-2030 (US$bn, AGR%)

Figure 3 2 Global Automotive Composites Market Volume Forecast 2020-2030 (KT,AGR %)

Figure 3 3 Milestones and recent examples of composites applied to the automotive sector

Figure 3 4 Five Force Analysis

Figure 3 5 Porter’s Analysis

Figure 3 6 PESTEL Analysis

Figure 3 7 Global Automotive Composites Market Segmentation by Type of Composite Material

Figure 3 8 Global Automotive Composites Submarket Revenue Share 2020-2030 by Composite Materials (%)

Figure 3 9 – Global Automotive Composites Submarket Share Forecast, 2020 (% Share)

Figure 3 10 – Global Automotive Composites Submarket Share Forecast, 2025 (% Share)

Figure 3 11 – Global Automotive Composites Submarket Share Forecast, 2030 (% Share)

Figure 3 12 Global Automotive Composites Submarket AGR Forecast, 2020-2030 (AGR%)

Figure 3 13– Global Automotive Composites Submarket Forecast by Volume, 2020-2030 (KT, Global AGR %)

Figure 3 14 – Global Automotive Composites Submarket Share Forecast by Volume, 2020 (% Share)

Figure 3 15 – Global Automotive Composites Submarket Share Forecast by Volume, 2025 (% Share)

Figure 3 16 – Global Automotive Composites Submarket Share Forecast by Volume, 2030 (% Share)

Figure 3 17 Automotive Polymer Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn, AGR%)

Figure 3 18 Automotive Polymer Matrix Composites Submarket Volume Forecast 2020-2030 (KT, AGR%)

Figure 3 19 Automotive Polymer Matrix Composites (PMC) Submarket Segmentation by Type of Fibre & Resin

Figure 3 20 Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2020-2030 by Type of Polymer Fibre (%)

Figure 3 21 Automotive Polymer Matrix Composites Submarket AGR by Type of Polymer Fibre (%)

Figure 3 22 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2020 by Type of Polymer Fibre

Figure 3 23 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2025 by Type of Polymer Fibre

Figure 3 24 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2030 by Type of Polymer Fibre

Figure 3 25Automotive Polymer Matrix Composites Submarket Volume Forecast 2020-2030 by Type of Polymer Fibre(KT), Share%)

Figure 3 26 – Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2020 (%) by Type of Polymer Fibre

Figure 3 27 Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2025 (%) by Type of Polymer Fibre

Figure 3 28 – Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2030 (%) by Type of Polymer Fibre

Figure 3 29 Automotive Carbon Fibre Reinforced Polymer (CFRP) Submarket Revenue Forecast 2020-2030 (US$bn, AGR%)

Figure 3 30 Automotive Carbon Fibre Reinforced Polymer (CFRP) Submarket Volume Forecast 2020-2030 (KT, AGR%)

Figure 3 31 Automotive Glass Fibre Reinforced Polymer (GFRP) Submarket Revenue Forecast 2020-2030 (US$bn, AGR%)

Figure 3 32 Automotive Glass Fibre Reinforced Polymer (GFRP) Submarket Volume Forecast 2020-2030 (KT, AGR%)`

Figure 3 33 Automotive Aramid Fibre Reinforced Polymer (GFRP) Submarket Revenue Forecast 2020-2030 (US$bn, AGR%)

Figure 3 34 Automotive Aramid Fibre Reinforced Polymer (GFRP) Submarket Volume Forecast 2020-2030 (US$bn, AGR%)

Figure 3 35 Polymer Matrix Composites (PMC) Submarket Segmentation by Thermoplastic or Thermosetting Polymer

Figure 3 36 Automotive Polymer Matrix Composites Market Revenue Share Forecast 2020-2030 by Thermoplastic or Thermosetting Polymer (%)

Figure 3 37 – Automotive Thermoset Polymer Matrix Composites (PMC) Submarket Volume Share Forecast 2020(%)

Figure 3 38 Automotive Thermoset Polymer Matrix Composites (PMC) Submarket Volume Share Forecast 2025 (%)

Figure 3 39 Automotive Thermoset Polymer Matrix Composites (PMC) Submarket Volume Share Forecast 2030 (%)

Figure 3 40 Automotive Polymer Matrix Composites Market Volume Forecast 2020-2030 by Thermoplastic or Thermosetting Polymer (KT, AGR%)

Figure 3 41 Automotive Thermoplastic Polymer Matrix Composites (PMC) Submarket Revenue Forecast 2020-2030 (US$bn, AGR%)

Figure 3 42 Automotive Thermoplastic Polymer Matrix Composites (PMC) Submarket Volume Forecast 2020-2030(KT, AGR%)

Figure 3 43 Automotive Thermoset Polymer Matrix Composites (PMC) Submarket Value Forecast 2020-2030 (US$bn, AGR%)

Figure 3 44 Automotive Thermoset Polymer Matrix Composites (PMC) Submarket Volume Forecast 2020-2030 (KT, AGR%)

Figure 3 45Automotive Polymer Matrix Composites (PMC) Submarket Segmentation by End Use

Figure 3 46 Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2020-2030 by End Use (%)

Figure 3 47 Automotive Polymer Matrix Composites Submarket AGR by End Use (%)

Figure 3 48 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2020 by End Use

Figure 3 49 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2025 by End Use

Figure 3 50 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2030 by End Use

Figure 3 51Automotive Polymer Matrix Composites Submarket Volume Forecast 2020-2030 by End Use Application (KT), Share%)

Figure 3 52 – Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2020 (%) by End Use Application

Figure 3 53 Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2025 (%) by End Use Application

Figure 3 54 – Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2030 (%) by End Use Application

Figure 3 55 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Conventional Vehicles 2020-2030 (US$bn,AGR%)

Figure 3 56 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Conventional Vehicles 2020-2030 (KT, AGR%)

Figure 3 57 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Electrical Vehicles 2020-2030 (US$bn,AGR%)

Figure 3 58 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Electrical Vehicles 2020-2030 (KT, AGR%)

Figure 3 59 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Trucks & Buses 2020-2030 (US$bn,AGR%)

Figure 3 60 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Trucks & Buses 2020-2030 (KT, AGR%)

Figure 3 61Automotive Polymer Matrix Composites (PMC) Submarket Segmentation by Manufacturing Process

Figure 3 62 Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2020-2030 by Manufacturing Process (%)

Figure 3 63 Automotive Polymer Matrix Composites Submarket AGR by Manufacturing Process (%)

Figure 3 64 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2020 by Manufacturing Process

Figure 3 65 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2025 by Manufacturing Process

Figure 3 66 – Automotive Polymer Matrix Composites Submarket Revenue Share Forecast 2030 by Manufacturing Process

Figure 3 67Automotive Polymer Matrix Composites Submarket Volume Forecast 2020-2030 by Manufacturing Process (KT), Share%)

Figure 3 68 – Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2020 (%) by Manufacturing Process

Figure 3 69 Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2025 (%) by Manufacturing Process

Figure 3 70 – Automotive Polymer Matrix Composites Submarket Volume Share Forecast 2030 (%) by Manufacturing Process

Figure 3 71 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Compression Molding 2020-2030 (US$bn,AGR%)

Figure 3 72 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Compression Molding 2020-2030 (KT, AGR%)

Figure 3 73 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Injection Moulding 2020-2030 (US$bn,AGR%)

Figure 3 74 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Injection Moulding 2020-2030 (KT, AGR%)

Figure 3 75 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Resin Transfer Moulding 2020-2030 (US$bn,AGR%)

Figure 3 76 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Resin Transfer Moulding 2020-2030 (KT, AGR%)

Figure 3 77 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Sheet Moulding 2020-2030 (US$bn,AGR%)

Figure 3 78 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Sheet Moulding 2020-2030 (KT, AGR%)

Figure 3 45 Automotive Metal Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn, AGR%)

Figure 3 46Automotive Metal Matrix Composites Submarket Revenue Share Forecast 2020 (%)

Figure 3 47 Automotive Metal Matrix Composites Submarket Revenue Share Forecast 2025 (%)

Figure 3 48 Automotive Metal Matrix Composites Submarket Revenue Share Forecast 2030 (%)

Figure 3 49 Automotive Metal Matrix Composites Submarket Volume Forecast 2020-2030 (KT, AGR%)

Figure 3 50 Automotive Metal Matrix Composites Submarket Volume Share Forecast 2020

Figure 3 51 Automotive Metal Matrix Composites Submarket Volume Share Forecast 2025

Figure 3 52 Automotive Metal Matrix Composites Submarket Volume Share Forecast 2030

Figure 3 53Automotive Ceramic Matrix Composites Submarket Revenue Forecasts 2020-2030 (US$bn, AGR%)

Figure 3 54 Automotive Metal Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn, AGR%)

Figure 3 55 Automotive Ceramic Matrix Composites Submarket Revenue Share Forecast 2020 (%)

Figure 3 56 Automotive Ceramic Matrix Composites Submarket Revenue Share Forecast 2025 (%)

Figure 3 57 Automotive Ceramic Matrix Composites Submarket Revenue Share Forecast 2030 (%)

Figure 3 58 Automotive Ceramic Matrix Composites Submarket Volume Forecasts 2020-2030 (KT, AGR%)

Figure 3 59Automotive Metal Matrix Composites Submarket Volume Share Forecast 2020

Figure 3 60 Automotive Metal Matrix Composites Submarket Volume Share Forecast 2025

Figure 3 61 Automotive Metal Matrix Composites Submarket Volume Share Forecast 2030

Figure 3 62 Global Automotive Composites Market Revenue Share Forecast by Composite Components , 2020 (%)

Figure 3 63 Global Automotive Composites Market Revenue Share Forecast by Composite Components , 2025 (%)

Figure 3 64 Global Automotive Composites Market Revenue Share Forecast by Composite Components , 2030 (%)

Figure 3 65 Automotive Composite Interior Components Submarket Forecast 2020-2030 (US$bn, AGR%)

Figure 3 66 Automotive Composite Body Components Submarket Forecast 2020-2030 (US$bn, AGR%)

Figure 3 67 Automotive Composite Engine & Drivetrain Components Submarket Forecast 2020-2030 (US$bn, AGR%)

Figure 3 68 Other Automotive Composite Components Submarket Forecast 2020-2030 (US$bn, AGR%)

Figure 3 69Global Automotive Composites Market by National MarketForecast 2020-2030 (US$bn, Global AGR %)

Figure 3 70Global Automotive Composites Market by National Market AGR Forecast 2020-2030 (AGR %)

Figure 3 71 Leading National Automotive Composites Market CAGR Forecast 2020-2025 (CAGR %)

Figure 3 72 Leading National Automotive Composites Market CAGR Forecast 2025-2030 (CAGR %)

Figure 3 73 Leading National Automotive Composites Market CAGR Forecast 2020-2030 (CAGR %)

Figure 3 74Global Automotive Composites Market by National Market Share Forecast 2020 (% Share)

Figure 3 75Global Automotive Composites Market by National Market Share Forecast 2025 (% Share)

Figure 3 76Global Automotive Composites Market by National Market Share Forecast 2030 (% Share)

Figure 3 77National Automotive Composites Market Percentage Change in Market Share 2020-2025 (% Change)

Figure 3 78National Automotive Composites Market Percentage Change in Market Share 2025-2030 (% Change)

Figure 3 79National Automotive Composites Market Percentage Change in Market Share 2020-2030 (% Change)

Figure 3 80 US Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 81 Canada Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 82 Mexico Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 83 Germany Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 84 France Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 85 United Kingdom Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 86 Italy Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 87 RoE Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 88 China Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 89 Japan Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 90 India Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 91 South Korea Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 92 Brazil Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 3 93 Argentina Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %)

Figure 4 1 Automotive composites value chain analysis

Figure 4 2 Penetration Mapping by Application, Trucks

Figure 4 3Penetration Mapping by Application, Buses

Figure 4 4 Automotive composites market dynamics

Figure 5 1 Competitive Environment

Figure 5 2 Competitive Environment

Figure 5 3 Competitive Environment

Figure 5 4 BASF Total Company Sales 2014-2018 (US$mn, AGR %)

Figure 5 5BASF Sales by Segment of Business 2017-2018 (US$mn, Total Company Sales AGR %)

Figure 5 6 BASF Net Income 2014-2018 (US$mn, AGR %)

Figure 5 7BASF Primary Market Competitors 2020

Figure 5 8 DOW Inc. Total Company Sales 2015-2019 (US$mn, AGR %)

Figure 5 9DOW Inc. Primary Market Competitors 2020

Figure 5 10 Gurit Total Company Sales 2015-2018 (US$mn, AGR %)

Figure 5 11Gurit Sales by Segment of Business 2018-2019 (US$mn, Total Company Sales AGR %)

Figure 5 12Gurit Sales by Geographical Location 2017-2018 (US$mn, Total Company Sales AGR %)

Figure 5 13Gurit Primary Market Competitors 2020

Figure 5 14 Hexcel Total Company Sales 2014-2018 (US$mn, AGR %)

Figure 5 15Hexcel Sales by Segment of Business 2016-2018 (US$mn, Total Company Sales AGR %)

Figure 5 16 Hexcel Net Income 2014-2018 (US$mn, AGR %)

Figure 5 17Hexcel Primary Market Competitors 2020

Figure 5 18 Mitsubishi Chemical Corporation Total Company Sales 2015-2018 (US$mn, AGR %)

Figure 5 19Mitsubishi Chemical Corporation Sales by Segment of Business 2017-2018 (US$mn, Total Company Sales AGR %)

Figure 5 20Mitsubishi Chemical CorporationPrimary Market Competitors 2020

Figure 5 21 SGLGroup Total Company Sales 2015-2018 (US$mn, AGR %)

Figure 5 22SGLGroup Sales by Segment of Business 2017-2018 (US$mn, Total Company Sales AGR %)

Figure 5 23 SGL Group Sales by Geographical Location 2017-2018 (US$mn, Total Company Sales AGR %)

Figure 5 24 SGLGroup Primary Market Competitors 2020

Figure 5 25 Solvey Group Total Company Sales 2015-2018 (US$mn, AGR %)

Figure 5 26Solvey Group Sales by Segment of Business 2017-2019 (US$mn, Total Company Sales AGR %)

Figure 5 27Solvey Group Sales by Geographical Location 2018-2019 (US$mn, Total Company Sales AGR %)

Figure 5 28Solvey Group Organisational Structure 2020

Figure 5 29Solvey Group Primary Market Competitors 2020

Figure 5 30 Teijin Limited Total Company Sales 2015-2019 (US$mn, AGR %)

Figure 5 31 Teijin Limited Sales by Segment of Business 2018-2019 (US$mn, Total Company Sales AGR %)

Figure 5 32Teijin Limited Sales by Geographical Location 2018-2019 (US$mn, Total Company Sales AGR %)

6.11.6 Figure 5 33Teijin Limited Primary Market Competitors 2020

Figure 5 34 Toray Total Company Sales 2015-2019 (US$mn, AGR %)

Figure 5 35Toray Sales by Segment of Business 2015-2019 (US$mn, Total Company Sales AGR %)

Figure 5 36Toray Sales by Geographical Location 2018-2019 (US$mn, Total Company Sales AGR %)

Figure 5 37 Toray Net Income 2018-2019 (US$mn, AGR %)

Figure 5 38Toray Primary Market Competitors 2020

Figure 5 39 UFP Technologies, Inc. Total Company Sales 2014-2018 (US$mn, AGR %)

Figure 5 40 UFP Technologies, Inc Sales by Segment of Business 2014-2018 (US$mn, Total Company Sales AGR %)

Figure 5 41 UFP Technologies, Inc Net Income 2014-2018 (US$mn, AGR %)

Figure 5 42 UFP Technologies, Inc Primary Market Competitors 2020

Figure 9 31 Huntsman Total Company Sales 2016-2019 (US$mn, AGR %)

Figure 9 32 Huntsman Sales by Segment of Business 2018-2019 (US$mn, Total Company Sales AGR %)

Figure 9 38 Huntsman Primary Market Competitors 2020

Figure 9 38 SCOTT BADER Primary Market Competitors 2020

List of Tables

Table 2 1 Composite application in automotive components 34

Table 3 1 Global Automotive Composites Market Revenue Forecast 2020-2030 (US$bn, AGR %, CAGR%) 35

Table 3 2 Global Automotive Composites Market Volume Forecast 2020-2030 (KT, AGR %,CAGR%) 36

Table 3 3 Global Automotive Composites Submarket Revenue Forecast 2020-2030 by Composite Materials (US$bn, AGR%) 50

Table 3 4 Global Automotive Composites Submarket Volume Forecast 2020-2030 by Composite Materials (KT,AGR%) 54

Table 3 5 Automotive Polymer Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn, AGR%, CAGR%) 57

Table 3 6 Automotive Polymer Matrix Composites Submarket Volume Forecast 2020-2030 (KT, AGR%, CAGR%) 58

Table 3 7 Automotive Polymer Matrix Composites Drivers & Restraints 2020 60

Table 3 8 Automotive Polymer Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn) by Type of Polymer Fibre - AGR Comparison (%) 62

Table 3 9 Automotive Polymer Matrix Composites Submarket Volume Forecast 2020-2030(KT) by Type of Polymer Fibre - AGR Comparison (%) 65

Table 3 10 Automotive Carbon Fibre Reinforced Polymer (CFRP) Submarket Revenue Forecast 2020-2030 ( US$bn, AGR%, CAGR%) 68

Table 3 11 Automotive Carbon Fibre Reinforced Polymer (CFRP) Submarket Volume Forecast 2020-2030(KT, AGR%, CAGR%) 69

Table 3 12 Automotive Glass Fibre Reinforced Polymer (GFRP) Submarket Revenue Forecast 2020-2030 (US$bn, AGR%, CAGR%) 71

Table 3 13 Automotive Glass Fibre Reinforced Polymer (GFRP) Submarket Volume Forecast 2020-2030 (KT, AGR%) 72

Table 3 14 Automotive Aramid Fibre Reinforced Polymer (AFRP) Submarket Revenue Forecast 2020-2030 (US$bn, AGR%, CAGR%) 74

Table 3 15 Automotive Aramid Fibre Reinforced Polymer (AFRP) Submarket Volume Forecast 2020-2030(KT, AGR%, CAGR%) 75

Table 3 16 Automotive Polymer Matrix Composites Market Revenue Forecast 2020-2030 (US$bn) by Thermoplastic or Thermosetting Polymer - AGR Comparison (%) 79

Table 3 17 Automotive Polymer Matrix Composites Market Volume Forecast 2020-2030 by Thermoplastic or Thermosetting Polymer – (KT, AGR Comparison (%) 82

Table 3 18 Automotive Thermoplastic Polymer Matrix Composites (PMC) Submarket Revenue Forecast 2020-2030 (US$bn, AGR%, CAGR%) 83

Table 3 19 Automotive Thermoplastic Polymer Matrix Composites (PMC) Submarket Volume Forecast 2020-2030 (KT, AGR%, CAGR%) 84

Table 3 20 Automotive Thermoset Polymer Matrix Composites (PMC) Submarket Revenue Forecast 2020-2030 (US$bn, AGR%, CAGR%) 87

Table 3 21 Automotive Thermoset Polymer Matrix Composites (PMC) Submarket Volume Forecast 2020-2030 (KT, AGR%, CAGR%) 88

Table 3 22 Automotive Polymer Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn) by End use - AGR Comparison (%) 92

Table 3 23 Automotive Polymer Matrix Composites Submarket Volume Forecast 2020-2030(KT) by End use application - AGR Comparison (%) 95

Table 3 24 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Conventional Vehicles 2020-2030 (US$bn,AGR%, CAGR%) 98

Table 3 25 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Conventional Vehicles 2020-2030 (KT,AGR%, CAGR%) 99

Table 3 26 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Electrical Vehicles 2020-2030 (US$bn,AGR%, CAGR%) 101

Table 3 27 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Electrical Vehicles 2020-2030 (KT,AGR%, CAGR%) 102

Table 3 28 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Trucks & Buses 2020-2030 (US$bn,AGR%, CAGR%) 104

Table 3 29 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Trucks & Buses 2020-2030 (KT,AGR%, CAGR%) 105

Table 3 30 Automotive Polymer Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn) by Manufacturing Process - AGR Comparison (%) 108

Table 3 31 Automotive Polymer Matrix Composites Submarket Volume Forecast 2020-2030(KT) by Manufacturing Process - AGR Comparison (%) 111

Table 3 32 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast for Compression Molding 2020-2030 (US$bn,AGR%, CAGR%) 114

Table 3 33 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Compression Moulding 2020-2030 (KT,AGR%, CAGR%) 114

Table 3 34 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast forn Injection Moulding 2020-2030 (US$bn,AGR%, CAGR%) 116

Table 3 35 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Injection Moulding 2020-2030 (KT,AGR%, CAGR%) 117

Table 3 36 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast forn Resin Transfer Moulding 2020-2030 (US$bn,AGR%, CAGR%) 118

Table 3 37 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Resin Transfer Moulding 2020-2030 (KT,AGR%, CAGR%) 119

Table 3 38 Automotive Polymer Matrix Composites (PMC) Submarket Revenue Forecast forn Sheet Moulding 2020-2030 (US$bn,AGR%, CAGR%) 120

Table 3 39 Automotive Polymer Matrix Composites (PMC) Submarket Volume Forecast for Sheet Moulding 2020-2030 (KT,AGR%, CAGR%) 121

Table 3 40 Automotive Metal Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn, AGR%, CAGR%) 122

Table 3 41Automotive Metal Matrix Composites Submarket Volume Forecast 2020-2030 (KT, AGR%, CAGR%) 124

Table 3 42 Automotive Metal Matrix Composites Submarket Drivers & Restraints 128

Table 3 43 Automotive Ceramic Matrix Composites Submarket Revenue Forecast 2020-2030 (US$bn, AGR%, CAGR%) 128

Table 3 44 Automotive Ceramic Matrix Composites Submarket Volume Forecast 2020-2030 (KT, AGR%, CAGR%) 131

Table 3 45 Automotive Ceramic Matrix Composites Submarket Drivers & Restraints 136

Table 3 46 Global Automotive Composites Market Revenue Forecast 2020-2030 by Composite Components (US$bn, AGR) 137

Table 3 47 Automotive Composites Interior Components Submarket Revenue Forecast 2020-2030 (US$bn, AGR%, CAGR%) 140

Table 3 48 Automotive Composite Interior Components Submarket Drivers & Restraints 142

Table 3 49 Automotive Composite Body Components Submarket Forecast 2020-2030 (US$bn, AGR%, CAGR%) 143

Table 3 50Automotive Composites Body Components Submarket Drivers & Restraints 144

Table 3 51 Automotive Composite Engine & Drivetrain Components Submarket Forecast 2020-2030 (US$bn, AGR%, CAGR%) 145

Table 3 52 Automotive Composite Engine & Drivetrain Components Submarket Drivers & Restraints 146

Table 3 53 Other Automotive Composite Components Submarket Forecast 2020-2030 (US$bn, AGR%, CAGR%) 147

Table 3 54 Other Automotive Composites Components Submarket Drivers & Restraints 148

Table 4 1 Leading National Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, Cumulative) 149

Table 4 2Global Automotive Composites Market by National Market CAGR Forecast 2020-2025, 2025-2030, 2020-2030 (CAGR %) 152

Table 4 3National Automotive Composites Market Percentage Change in Market Share 2020-2025, 2025-2030, 2020-2030 (% Change) 156

Table 4 4 US Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 159

Table 4 5 Canada Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 161

Table 4 6 Mexico Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 163

Table 4 7 Germany Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 165

Table 4 8 France Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 167

Table 4 9 United Kingdom Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 169

Table 4 10 Italy Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 171

Table 4 11 Rest of Europe (RoW) Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 172

Table 4 12 China Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 174

Table 4 13 China Automotive Composites & Restraints 2020 175

Table 4 14 Japan Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 177

Table 4 15 Japan Automotive Composites & Restraints 2020 178

Table 4 16 India Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 179

Table 4 17 India Automotive Composites & Restraints 2020 180

Table 4 18 South Korea Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 182

Table 4 19 South Korea Automotive Composites & Restraints 2020 183

Table 4 20 Brazil Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 184

Table 4 21 Argentina Automotive Composites Market Forecast 2020-2030 (US$bn, AGR %, CAGR %, Cumulative) 186

Table 5 1 Strategies adopted by key market participants 190

Table 6 1 BASF Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 197

Table 6 2 BASF Total Company Sales 2014-2018 (US$mn, AGR %) 198

Table 6 3 BASF Sales by Segment of Business 2017-2018 (US$mn, AGR %) 198

Table 6 4 BASF Net Income 2014-2018 (US$mn, AGR %) 199

Table 6 5BASF Automotive Composites Enabled Products / Services (Product, Specification / Features) 199

Table 9 41 Selected Recent BASF. Automotive Composites Market Latest Developments (Year, Initiatives, Details) 200

Table 6 6BASF Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 201

Table 6 7 DOW Inc. Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 203

Table 6 8 DOW Inc. Total Company Sales 2015-2019 (US$mn, AGR %) 203

Table 6 9 DOW Inc. Sales by Segment of Business 2018-2019 (US$mn, AGR %) 204

Table 6 10DOW Inc. Automotive Composites Enabled Products / Services (Product, Specification / Features) 205

Table 9 41 Selected Recent DOW Inc. Automotive Composites Market Latest Developments (Year, Initiatives, Details) 205

Table 6 11 Gurit Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 208

Table 6 12 Gurit Total Company Sales 2015-2018 (US$mn, AGR %) 208

Table 6 13 Gurit Sales by Segment of Business 2017-2018 (US$mn, AGR %) 209

Table 6 14Gurit Sales by Geographical Location 2017-2018 (US$mn, AGR %) 210

Table 6 15Gurit Automotive Composites Enabled Products / Services (Product, Specification / Features) 210

Table 6 16Gurit Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 211

Table 9 41 Selected Recent Gurit Automotive Composites Market Latest Developments (Year, Initiatives, Details) 212

Table 6 17 Hexcel Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 215

Table 6 18 Hexcel Total Company Sales 2014-2018 (US$mn, AGR %) 216

Table 6 19 Hexcel Sales by Segment of Business 2016-2018 (US$mn, AGR %) 216

Table 6 20 Hexcel Net Income 2014-2018 (US$mn, AGR %) 217

Table 6 21Hexcel Automotive Composites Enabled Products / Services (Product, Specification / Features) 217

Table 6 22Hexcel Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 218

Table 9 41 Selected Recent Hexcel Automotive Composites Market Latest Developments (Year, Initiatives, Details) 218

Table 6 23 Mitsubishi Chemical CorporationProfile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 221

Table 6 24 Mitsubishi Chemical Corporation Total Company Sales 2015-2018 (US$mn, AGR %) 222

Table 6 25 Mitsubishi Chemical Corporation Sales by Segment of Business 2017-2018 (US$mn, AGR %) 222

Table 6 26Mitsubishi Chemical Corporation Automotive Composites Enabled Products / Services (Product, Specification / Features) 223

Table 6 27Mitsubishi Chemical Corporation Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 224

Table 9 41 Selected Recent Mitsubishi Chemical Corporation Automotive Composites Market Latest Developments (Year, Initiatives, Details) 224

Table 6 28 SGL Group Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 228

Table 6 29 SGL Group Total Company Sales 2015-2018 (US$mn, AGR %) 229

Table 6 30 SGL Group Sales by Segment of Business 2017-2018 (US$mn, AGR %) 229

Table 6 31 SGL Group Sales by Geographical Location 2017-2018 (US$mn, AGR %) 230

Table 6 32SGLGroup Automotive Composites Enabled Products / Services (Product, Specification / Features) 231

Table 9 41 Selected Recent SGLGroup Automotive Composites Market Latest Developments (Year, Initiatives, Details) 231

Table 6 33 Solvey Group Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 235

Table 6 34 Solvey Group Total Company Sales 2015-2018 (US$mn, AGR %) 236

Table 6 35 Solvey Group Sales by Segment of Business 2017-2018 (US$mn, AGR %) 236

Table 6 36Solvey Group Sales by Geographical Location 2017-2018 (US$mn, AGR %) 237

Table 6 37Solvey Group Automotive Composites Enabled Products / Services (Product, Specification / Features) 238

Table 6 38Solvey Group Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 239

Table 9 41 Selected Recent Solvey Group Automotive Composites Market Latest Developments (Year, Initiatives, Details) 239

Table 6 39 Teijin Limited Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 242

Table 6 40 Teijin Limited Total Company Sales 2015-2019 (US$mn, AGR %) 243

Table 6 41 Teijin Limited Sales by Segment of Business 2018-2019 (US$mn, AGR %) 243

Table 6 42Teijin Limited Sales by Geographical Location 2018-2019 (US$mn, AGR %) 244

Table 6 43Teijin Limited Automotive Composites Enabled Products / Services (Product, Specification / Features) 244

Table 6 44Teijin Limited Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 246

Table 9 41 Selected Recent Teijin Automotive Composites Market Latest Developments (Year, Initiatives, Details) 246

Table 6 45 Toray Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 249

Table 6 46 Toray Total Company Sales 2015-2019 (US$mn, AGR %) 250

Table 6 47 Toray Sales by Segment of Business 2015-2019 (US$mn, AGR %) 250

Table 6 48Toray Sales by Geographical Location 2018-2019 (US$mn, AGR %) 251

Table 6 49 Toray Net Income 2018-2019 (US$mn, AGR %) 252

Table 6 50Toray Automotive Composites Enabled Products / Services (Product, Specification / Features) 252

Table 6 51Toray Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 253

Table 9 41 Selected Recent Toray Automotive Composites Market Latest Developments (Year, Initiatives, Details) 254

Table 6 52 UFP Technologies, Inc Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 256

Table 6 53 UFP Technologies, Inc Total Company Sales 2014-2018 (US$mn, AGR %) 257

Table 6 54 UFP Technologies, Inc Sales by Segment of Business 2016-2018 (US$mn, AGR %) 257

Table 6 55 UFP Technologies, Inc Net Income 2014-2018 (US$mn, AGR %) 258

Table 6 56UFP Technologies, Inc Automotive Composites Enabled Products / Services (Product, Specification / Features) 258

Table 6 57UFP Technologies, Inc Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 259

Table 6 58 Huntsman Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 261

Table 6 59 Huntsman Total Company Sales 2016-2019 (US$mn, AGR %) 261

Table 6 60 Huntsman Sales by Segment of Business 2018-2019 (US$mn, AGR %) 262

Table 6 61Huntsman Automotive Composites Enabled Products / Services (Product, Specification / Features) 262

Table 6 62BASF Mergers and Acquisitions (Date, Company Involved, Value US$mn, Details) 263

Table 9 41 Selected Recent Huntsman Automotive Composites Market Latest Developments (Year, Initiatives, Details) 263

Table 6 63 ADVANCED COMPOSITES GROUP Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 265

Table 6 64ADVANCED COMPOSITES GROUP Automotive Composites Enabled Products / Services (Product, Specification / Features) 265

Table 9 41 Selected Recent ADVANCED COMPOSITES GROUP Automotive Composites Market Latest Developments (Year, Initiatives, Details) 266

Table 6 65 SCOTT BADER Profile 2020 (CEO, Total Company Sales US$mn, Net Income US$mn, Order Backlog US$mn, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website) 267

Table 6 66SCOTT BADER Automotive Composites Enabled Products / Services (Product, Specification / Features) 267

Table 6 67SCOTT BADER Mergers and Acquisitions (Date, Company Involved, Value US$M, Details) 268

Table 9 41 Selected Recent Scott Bader Automotive Composites Market Latest Developments (Year, Initiatives, Details) 268

Table 7 1 Other Important Automotive Manufacturing Companies in the Automotive Composites Market 2020 272

3A Composites

3B – The Fibreglass Company

3M

Acrolab Ltd.

Advanced Composites Group

Ahlstrom

Aircelle

Airtech Europe

Alcan Baltek

Alfa Romeo

Alva Sweden AB

Amber Composites

AMEL automotive composites

AOC LLC

AOC Resins

Apogee Products

ARC Technologies

Argentine Association of Automotive Makers

Asahi Kasei Plastics

Ashland Performance Materials

Ashland Specialty Chemical

ATC

Attwater Group

Automotive Composite Alliance

Automotive Composites Consortium

Avtovaz

Azdel Inc.

BAE Systems

BASF

Bayer Corporation

Bayer Material Science

Beijing Automotive

Belgian internet platform UBench

Benet Automotive

Benteler-SGL

Bluestar Fibres

BMC Inc.

BMW

Bombardier

Borealis

Bosch GmbH

Brilliance

BYD Automotive

Canmet MATERIALS Laboratory

CCP Composites

Chang’an Automobile

Chemetall

Chery

Chrysler

CIDESI

Clean Motion

Cleanpart Group

Composite Integration Ltd

Composites Innovation Centre

Continental

Continental Structural Plastics

Core Molding Technologies

Coriolis Composites

CPC Group

Cristex

Crosby Composites

Cytec

Cytec Solvay

Daihatsu

Daimler

Dana Holding Corp.

Dassault Systemes

Delphi

Denso

DIAB Group

Dieffenbacher

DIELECTRICS, INC.

Dongfeng Motor Corporation

Dow Automotive Systems

Dow Chemical Company

Dow Chemicals

DSM Composite Resins

Dutch Filaments B.V.

ESI group

European Carbon Fiber GmbH

European Thermoplastic Automotive Composites (eTAC)

e-Xstream engineering

Faurecia

Faurecia Automotive Seating

Federal Mogul

Fibre Corporation

Ford

Formax

Formosa Plastics Corp

Fraunhofer ICT-A

Fuso

Gazechim Composites

General Motors

Gordon Murray Design Ltd.

Guangdong Yinfan Chemistry

Gurit

Henkel Corp.

Hexcel Corporation

Hexcel Total

Hino

Hivocomp Consortium

Holding B.V

Honda

Huntsman

Huntsman Advanced Materials

Icynene-Lapolla

IDI Composites International

IFS Chemicals Limited (IFS)

Inapal Plasticos SA (Inapal)

Innegrity

INVISTA Engineering Polymers

Jaguar XJR

Jaguar-LandRover

JDR AUTOMOTIVE COMPOSITES LIMITED

JEC Composites ltd,

JHM Technologies

Johnson Controls GmbH

JRL

Kia

Lamborghini

Lexus

Lotus Cars

LyondellBasell

MAG Industrial Automation Systems

Magna Exteriors and Interiors

Magna International Inc

Magnetti Marelli

Mahindra Mahindra

Mahle

MAN Truck & Bus AG

Matrasur Composites

Mazda

McLaren

Mclaren Automotive Composites

Mecaplast Group

Milliken Chemical

Mitsubishi

Mitsubishi Rayon

Molded Fibre Glass Companies

Momentive Specialty Chemicals

National Research Council Canada, Automotive and Surface Transportation

Nippon Graphite Fibre Corporation

Nissan

Norco GRP

OMNIA LLC,

Owens Corning

Owens Corning Automotive

Owens Corning4

Park Electrochemical Corporation

Paxford Composites

Plasan USA

PlasanCarbon Composites

Plasticolors Incorporated

PlastiComp, LLC

Polyscope Polymers

Polystrand

Porsche

PPG Industries

PRF Composite Materials

Propex Fabrics,

Pultrex

Quadrant Plastics Composites

Quantum Composites

Quickstep Technologies

Reichhold, Inc.

Renault

Reverie

Ricardo Plc

Roctool

Rolls-Royce Motor Cars Limited

RTP Company

Ryton® PPS

Saati S.p.A

SAIC

Saint-Gobain Adfors

Sasol

Scott Bader

SGL Group

Sigmatex

Solvay Specialty Polymers

Solvey Group

Sora Composites

Subaru

Suzuki Motor Corporation

Tata Motors

Technique Composites

Tecnoelastomeri

Teijin

Teijin Limited

TenCate

TenCate Advanced Composites

Teufelberger GmbH,

The Composites Group

Ticona Engineering Polymers

Toho Tenax

Toray

Toyota

Toyoto

Trexel, Inc.

UFP Technologies

Umeco Plc

URT Group Ltd

US Environmental Protection Agency

Valplastic S.r.l.

Voith

Volkswagen

Wacker Chemie

Welset Plast Extrusions

Williams, White & Co.

Woodward

Zoltek

Zotefoams Plc

Download sample pages

Complete the form below to download your free sample pages for Automotive Composites Market Report 2020-2030

Related reports

-

Automotive Bushing Market Report 2020-2030

The automotive bushing market is about to enter a period of phenomenal growth and innovation. The next ten years will...

Full DetailsPublished: 01 January 1970 -

Automotive Chassis Market Report 2020-2030

The global market for automotive chassis is expected to grow with the healthy CAGR of 5.1% during the forecast period...

Full DetailsPublished: 01 January 1970 -

Carbon Fibre Reinforced Plastic (CFRP) Composites Market Report 2018-2028

With this definitive 204-page report you will receive a highly granular market analysis segmented by region, by application and by...Full DetailsPublished: 13 September 2018 -

Automotive Chips Market Report 2021-2031

The US is ahead of the global automotive chips adoption and application in terms of automakers and vehicle owners approaching...Full DetailsPublished: 03 November 2020 -

Gigafactory Market Report 2020-2030

Recent rapid improvements in lithium-ion (Li-ion) battery costs and performance, coupled with growing demand for electric vehicles (EVs) and increased...

Full DetailsPublished: 09 September 2020 -

Electric Vehicle Supply Equipment (EVSE) Market Report 2020-2030

The latest report from business intelligence provider company name offers comprehensive analysis of the global Electric Vehicle Supply Equipment market....

Full DetailsPublished: 06 May 2020 -

Autonomous Trucks Market Report 2020-2030

Visiongain anticipates that the Global Autonomous Trucks Market is projected to surpass US$7,328.6 million in 2030 while growing at a...

Full DetailsPublished: 30 April 2020 -

Hybrid Powertrain Systems Market Report 2019-2029

The latest report from business intelligence provider Visiongain offers a comprehensive analysis of the global Hybrid powertrain systems market. Visiongain...

Full DetailsPublished: 31 July 2019 -

Top 20 Composites Companies 2018

We reveal the competitive positioning for the top 20 companies in the overall composites market- and also the leading companies...Full DetailsPublished: 24 October 2018 -

Battery Management System Market Report 2019-2029

This latest report by business intelligence provider Visiongain assesses that Battery Management System Market spending will reach $3.87 bn in...

Full DetailsPublished: 01 January 1970

Download sample pages

Complete the form below to download your free sample pages for Automotive Composites Market Report 2020-2030

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain automotive reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain automotive reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Alliance of Automobile Manufacturers (USA)

Association of Russian Automakers

Audio Video Bridging (AVB)

China Association Of Automoblie Manufacturers

European Association of Automotive Suppliers

European Automobile Manufacturers’ Association

European Council for Automotive Research and Development

Former Society of Automotive Engineers

German Association of the Automotive Industry

International Organization of Motor Vehicle Manufacturers

In-Vehicle Infotainment (IVI)

Italian Association of the Automotive Industry

Japan Automobile Manufacturers Association

One-Pair Ether-Net

Society of Indian Automobile Manufacturers (SIAM)

Society of Motor Manufacturers and Traders

The International Council For Clean Transport

US National Highway Traffic Safety Administration

Latest Automotive news

Visiongain Publishes Connected Vehicle Market Report 2024-2034

The global Connected Vehicle market was valued at US$82.67 billion in 2023 and is projected to grow at a CAGR of 14.7% during the forecast period 2024-2034.

24 April 2024

Visiongain Publishes Automotive Electronics Market Report 2024-2034

The global Automotive Electronics market was valued at US$270.7 million in 2023 and is projected to grow at a CAGR of 8.7% during the forecast period 2024-2034.

15 April 2024

Visiongain Publishes Automobile AI and Generative Design Market Report 2024-2034

The global Automobile AI and Generative Design market was valued at US$630.7 million in 2023 and is projected to grow at a CAGR of 19% during the forecast period 2024-2034.

02 April 2024

Visiongain Publishes Vehicle to Grid (V2G) Market Report 2024-2034

The global Vehicle to Grid (V2G) market was valued at US$3,391 million in 2023 and is projected to grow at a CAGR of 27.6% during the forecast period 2024-2034.

08 March 2024