• Do you need definitive Automotive UBI market data?

• Succinct Automotive UBI market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The rising share of digital distribution of automotive insurance sales and arrival of connected cars, has led Visiongain to publish this timely report. The automotive UBI market has 65.1 million policyholders and is expected to flourish in the next few years because of rapid development and adoption of the Connected Car and also because of growth of Automotive UBI products is expected to feed through in the latter part of the decade driving growth to new heights. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report Highlights

170 Tables, Charts, And Graphs

Analysis Of Key Vendors In The Automotive UBI Sector

• Intelligent Mechatronic System Inc

• Octo Telematics S.p.A.

• Vodafone Automotive

• Wunelli

• Sierra Wireless

Profiles Of Leading Insurance Providers In The Automotive UBI Market

• Allstate

• AXA SA

• Progressive Corporation

• Unipol Gruppo S.P.A

• Generali S.P.A

Global Automotive UBI Market Outlook And Analysis From 2018-2028 ($m)

Global Automotive UBI Market Forecast 2018-2028 (Policyholders)

Global UBI Average Premium Forecast 2018-2028 ($)

Global Automotive Usage-Based Insurance (UBI) Submarkets by Pricing Model From 2018-2028 (Policyholders)

• Pay As You Drive (PAYD) Forecast 2018-2028

• Pay How You Drive (PHYD) Forecast 2018-2028

• Manage How You Drive (MHYD) Forecast 2018-2028

Global Automotive Usage-Based Insurance (UBI) Submarkets By Data Collection Method From 2018-2028 (Policyholders)

• On-Board Diagnostics Forecast 2018-2028

• OBD II Forecast 2018-2028

• Smartphone Forecast 2018-2028

• Hybrid Forecast 2018-2028

• Black-Box Forecast 2018-2028

Global Automotive Usage-Based Insurance (UBI) Submarkets By Technology Incorporated From 2018-2028 (Policyholders)

• Application Based System Forecast 2018-2028

• Embedded System Forecast 2018-2028

Regional Automotive UBI market forecasts from 2018-2028 ($m)

• North America Automotive UBI Forecast 2018 – 2028 (policyholders)

• US Automotive UBI Forecast 2018 – 2028

• Canada Automotive UBI Forecast 2018 – 2028

• Rest of NA Automotive UBI Forecast 2018 – 2028

• Europe Automotive UBI Forecast 2018 – 2028 (policyholders)

• UK Automotive UBI Forecast 2018 – 2028

• Italy Automotive UBI Forecast 2018 – 2018

• France Automotive UBI Forecast 2018 – 2028

• Spain Automotive UBI Forecast 2018 – 2028

• Germany Automotive UBI Forecast 2018 – 2028

• Rest of Europe Automotive UBI Forecast 2018 – 2028

• Asia Pacific Automotive UBI Forecast 2018 – 2028 (policyholders)

• Japan Automotive UBI Forecast 2018 – 2028

• China Automotive UBI Forecast 2018 – 2028

• Rest of APAC Automotive UBI Forecast 2018 – 2028

• RoW Automotive UBI Forecast 2018 – 2028 (policyholders)

Key Questions Answered

• What does the future hold for the Automotive UBI industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

Target Audience

• Leading Insurance companies

• Automotive telematics specialists

• Connected car companies

• Components suppliers

• Telecoms companies

• Technologists

• R&D staff

• Consultants

• Market analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organisations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Overview of the Global Automotive Usage-Based Insurance Market 2018-2028

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Automotive Usage-Based Insurance (UBI) Market

2.1 Insurance Telematics Definition

2.2 History of the Global Automotive Usage-Based Insurance (UBI) Market

2.3 Benefits of Telematics Solutions

2.4 The Target Audience For Usage-Based Insurance

3. Global Automotive Usage-Based Insurance (UBI) Market

3.1 Global Usage Based Insurance segments based on Pricing Model

3.1.1 Self-reporting Based Insurance

3.1.2 Telematics-based insurance

3.2 Global Usage Based Insurance Segments Based on Data Collection Method

3.3 Global Usage Based Insurance segments based on Technology Incorporated

4. Global Automotive Usage-Based Insurance (UBI) Market 2018 2028

4.1 Global Automotive Usage-Based Insurance (UBI) Market (By Premium) Forecast 2018-2028

4.2 Global Automotive Usage-Based Insurance (UBI) Market (By Policyholders) Forecast 2018-2028

5. Global Automotive Usage-Based Insurance (UBI) Sub-Market 2018 2028

5.1 Global Automotive Usage-Based Insurance (UBI) Sub-Market by Pricing Model 2018-2028

5.2 Global Automotive Usage-Based Insurance (UBI) Sub-Market by Data Collection Method 2018-2028

5.2.1 Global Automotive OBD-II Based UBI Solutions Submarket Forecast 2018-2028

5.2.2 Global Automotive Smartphone Based UBI Solutions Submarket Forecast 2018-2028

5.2.3 Global Automotive Hybrid UBI Solutions Submarket Forecast 2018-2028

5.2.4 Global Automotive Black-Box Based UBI Solutions Submarket Forecast 2018-2028

5.3 Global Automotive Usage-Based Insurance (UBI) Sub-Market by Technology Used 2018-2028

6. Regional Automotive Usage-Based Insurance (UBI) Market 2018 2028

6.1 North American Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.1.1 North America Automotive Usage-Based Insurance Market By Country 2018 – 2028

6.1.2 Drivers and Challenges of the North America Automotive Usage-Based Insurance Market 2018 – 2028

6.2 United States Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.2.1 Drivers and Challenges of the United States Automotive Usage-Based Insurance Market 2018 – 2028

6.3 Canadian Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.3.1 Drivers and Challenges of the Canadian Automotive Usage-Based Insurance Market 2018 – 2028

6.4 European Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.4.1 European Automotive Usage-Based Insurance Market Forecast By Country 2018 – 2028

6.4.2 Drivers and Challenges of the European Automotive Usage-Based Insurance Market 2018 – 2028

6.5 United Kingdom Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.5.1 Drivers and Challenges of the UK Automotive Usage-Based Insurance Market 2018 – 2028

6.6 Italian Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.6.1 Drivers and Challenges of the Italian Automotive Usage-Based Insurance Market 2018 – 2028

6.7 French Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.7.1 Drivers and Challenges of the French Automotive Usage-Based Insurance Market 2018 – 2028

6.8 German Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.8.1 Drivers and Challenges of the German Automotive Usage-Based Insurance Market 2018 – 2028

6.9 Spanish Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.9.1 Drivers and Challenges of the Spanish Automotive Usage-Based Insurance Market 2018 – 2028

6.10 APAC Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.10.1 APAC Automotive Usage-Based Insurance Market By Country 2018 – 2028

6.10.2 Drivers and Challenges of the APAC Automotive Usage-Based Insurance Market 2018 – 2028

6.11 Chinese Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.11.1 Drivers and Challenges of the Chinese Automotive Usage-Based Insurance Market 2018 – 2028

6.12 Japanese Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.12.1 Drivers and Challenges of the Japanese Automotive Usage-Based Insurance Market 2018 – 2028

6.13 Rest of the World Automotive Usage-Based Insurance (UBI) Market Forecast 2018-2028

6.13.1 Drivers and Challenges of the Rest of the World Automotive Usage-Based Insurance Sub-Market 2018 – 2028

6.14 Insurance Providers by Region

7. Market Drivers in the Automotive Usage-Based Insurance Market

8. Market Challenges in the Automotive Usage-Based Insurance Market

9. SWOT Analysis of the Global Usage-Based Insurance Market 2018 - 2028

10. Five Forces Analysis of the Global Automotive Usage-Based Insurance Market 2018 – 2028

11. Value Chain Analysis for Usage Based Insurance Market

12. Trends in the UBI Automotive Market

13. Opportunities for Service Providers in the Automotive Usage-Based Insurance Market

14. Leading Vendors in the Automotive Usage-Based Insurance (UBI) Market

14.1Intelligent Mechatronic System Inc

14.1.1 Overview

14.1.2 IMS’ Role in the Automotive UBI Market

14.1.3 IMS’ Recent Developments in the UBI Market

14.2 Octo Telematics S.p.A.

14.2.1 Overview

14.2.2 Octo Telematics’ Role in the Automotive UBI Market

14.2.3 Octo Telematics’ Recent Developments in the UBI Market

14.3 Vodafone Automotive

14.3.1 Overview

14.3.2 Vodafone Automotive’s Role in the Automotive UBI Market

14.3.3 Vodafone Automotive’s Key Developments in the UBI Market

14.4 Wunelli

14.4.1 Overview

14.4.2 Wunelli’s Role in the Automotive UBI Market

14.4.3 Wunelli’s Key Developments in the UBI Market

14.5 Sierra Wireless

14.5.1 Overview

14.5.2 Sierra Wireless’ Role in the Automotive UBI Market

14.5.3 Sierra Wireless Key Developments in the UBI Market

14.6 Other UBI Vendors

15. Leading Insurance Providers in the Automotive Usage-Based Insurance Market

15.1 Allstate

15.1.1 Overview

15.1.2 Allstate’s Financial Overview

15.1.2 Allstate’s Financial Overview

15.1.3 Allstate’s Role in the Automotive UBI Market

15.1.4 Allstate’s Key Developments

15.2 AXA SA

15.2.1 Overview

15.2.2 AXA’s Financial Overview

15.2.3 AXA’s Role in the Automotive UBI Market

15.2.4 AXA’s Key Developments

15.3 Progressive Corporation

15.3.1 Overview

15.3.2 Progressive’s Financial Overview

15.3.3 Progressive’s Role in the Automotive UBI Market

15.3.4 Progressive’s Key Developments

15.4 Unipol Gruppo S.P.A

15.4.1 Overview

15.4.2 Unipol Gruppo’s Financial Overview

15.4.3 Unipol’s Role in the Automotive UBI Market

15.4.4 Unipol’s Key Developments

15.5 Generali S.P.A

15.5.1 Overview

15.5.2 Generali’s Financial Overview

15.5.3 Generali’s Role in the Automotive UBI Market

15.5.4 Generali’s Key Developments

15.6 Other Automotive UBI Insurance Companies

16. Conclusions and Recommendations

16.1 Key Findings

16.2 Key Highlights

17. Glossary

List of Tables

Table 3.1 Advantage and Disadvantages of OBD II-based Telematics

Table 3.2 Advantage and Disadvantages of Smartphone based Telematics

Table 3.3 Global Smartphone Forecast 2018-2028 (US$ bn, AGR%, CAGR %)

Table 3.4 Advantage and Disadvantages of Hybrid Solution Based Telematics

Table 3.5 Advantage and Disadvantages of Hybrid Solution Based Telematics

Table 4.1 Global Automotive Usage Based Insurance Market Forecast 2018-2028 (Premium USD bn, AGR%, CAGR %)

Table 4.2 Global Automotive Usage Based Insurance Market Average Premium Forecast 2018-2028 (Premium US$, AGR%)

Table 4.3 Global Automotive Usage-Based Insurance Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 5.1 Global Automotive Usage-Based Insurance Sub-Market Forecast by Pricing Model 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 5.2 Global Automotive Usage Based Insurance Sub-Market Forecast by Technology Incorporated 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 5.3 Global Automotive OBD-II Based UBI Solutions Submarket Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 5.4 Global Automotive OBD-II Based UBI Solutions Submarket Forecast by Region 2018-2028 (Policyholder mn), AGR (%), CAGR (%)

Table 5.5 Global Automotive Smartphone Based UBI Solutions Submarket Forecast 2018-2028 (Policyholders bn, AGR%, CAGR %)

Table 5.6 Global Automotive Smartphone Based UBI Solution Market Forecast by Region 2018-2028 (Policyholders mn, AGR %, CAGR %)

Table 5.7 Global Automotive Hybrid UBI Solutions Submarket Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 5.8 Global Automotive Hybrid Based UBI Solution Market Forecast by Region 2018-2028 (Policyholders mn, AGR %, CAGR %)

Table 5.9 Global Automotive Black-Box Based UBI Solutions Submarket Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 5.10 Global Automotive Black-Box UBI Solution Market Forecast by Region 2018-2028 (Policyholders mn, AGR %, CAGR %)

Table 5.11 Global Automotive UBI Sub-Market Forecast by Technology Incorporated 2018-2028 (Policyholders mn, AGR %, CAGR %)

Table 6.1 Regional Automotive Usage-Based Insurance Market Forecast 2018-2028 (Policyholders mn), AGR (%), and CAGR (%)

Table 6.2 North American Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.3 North Americas Automotive UBI Market Forecast By Country 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.4 Drivers and Challenges of North America Automotive Usage-Based Insurance Market

Table 6.5 United States Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.6 Drivers and Challenges of United States Automotive Usage-Based Insurance Market

Table 6.6 Canadian Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.7 Drivers and Challenges of Canadian Automotive Usage-Based Insurance Market

Table 6.8 European Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.9 European Automotive UBI Market Forecast By Country 2018 - 2028 (Policyholders mn), AGR (%), CAGR (%)

Table 6.10 Drivers and Challenges of European Automotive Usage-Based Insurance Market

Table 6.11 United Kingdom Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.12 Drivers and Challenges of United Kingdom Automotive Usage-Based Insurance Market

Table 6.13 Italian Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.14 Drivers and Challenges of Italian Automotive Usage-Based Insurance Market

Table 6.15 French Automotive UBI Market Forecast 2018-2028 (Policyholder mn, AGR%, CAGR %)

Table 6.16 Drivers and Challenges of French Automotive Usage-Based Insurance Market

Table 6.17 German Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.18 Drivers and Challenges of German Automotive Usage-Based Insurance Market

Table 6.19 Spanish Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.20 Drivers and Challenges of Spanish Automotive Usage-Based Insurance Market

Table 6.21 APAC Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.22 APAC Automotive Usage-Based Insurance Market Forecast By Country 2018 - 2028 (Policyholders mn, AGR %, CAGR %)

Table 6.23 Drivers and Challenges of APAC Automotive Usage-Based Insurance Market

Table 6.24 Chinese Automotive UBI Market Forecast 2018-2028 (Policyholders bn, AGR%, CAGR %)

Table 6.25 Drivers and Challenges of Chinese Automotive Usage-Based Insurance Market

Table 6.26 Japanese Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.27 Drivers and Challenges of Japanese Automotive Usage-Based Insurance Market

Table 6.28 Rest of the World Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR%, CAGR %)

Table 6.29 Drivers and Challenges of Rest of the World Automotive Usage-Based Insurance Sub-Market

Table 6.30 Insurance Providers by Region

Table 7.1 Government Initiatives and Feature

Table 9.1 Global Usage-Based Insurance Market SWOT Analysis 2018-2028

Table 14.1 IMS Overview (Company Revenue, Year incorporated, HQ, Product Portfolio, Employees, Key Clients Website)

Table 14.2 Key Developments

Table 14.3 Octo Telematics S.p.A. Overview (Company Revenue, Year incorporated, HQ, UBI Portfolio Overview, Key Clients, Employees, Website)

Table 14.4 Key Developments

Table 14.5 Vodafone Automotive (Company Revenue, Year incorporated, HQ, UBI Portfolio Overview, Key Clients, Employees, Website)

Table 14.6 Key Developments

Table 14.7 Wunelli Overview (Company Revenue, Year incorporated, HQ, UBI Portfolio Overview, Key Clients, Employees, Website)

Table 14.8 Key Developments

Table 14.9 Sierra Wireless Overview (Company Revenue, Year incorporated, HQ, UBI Portfolio Overview, Key Clients, Employees, Website)

Table 14.10 Key Developments

Table 14.11 Other UBI Vendors

Table 15.1 Allstate Overview (Company Revenue, Year Incorporated, HQ, UBI Portfolio, Employees, Website)

Table 15.2 Allstate’s Group Financials 2013- 2017

Table 15.3 Key Developments

Table 15.4 AXA SA Overview (Company Revenue, Year incorporated, HQ, UBI Portfolio, Employees, Website)

Table 15.5 AXA’s Group Financials 2013- 2017

Table 15.6 AXA Key Developments

Table 15.7 Progressive Corporation Overview (Company Revenue, Year incorporated, HQ, UBI Portfolio, Employees, Website)

Table 15.8 Progressive’s Financials 2013- 2017

Table 15.9 Key Developments

Table 15.10 Unipol Gruppo Overview (Company Revenue, Year incorporated, HQ, UBI Portfolio, Employees, Website)

Table 15.11 Unipol’s Financials 2013- 2017

Table 15.12 Key Developments

Table 15.13 Generali’s Overview (Company Revenue, Year incorporated, HQ, UBI Portfolio, Employees, Website)

Table 15.14 Generali’s Financials 2013- 2017

Table 15.15 Key Developments

Table 15.16 Other UBI Insurance Providers

List of Figures

Figure 2.1 Explains the Usage-Based Insurance Process

Figure 2.2 Evolution of Automotive Usage Based Insurance

Figure 3.1 Global Automotive UBI Market Segments

Figure 3.2 Global Automotive Market Segments According To Pricing Model

Figure 3.3 Explains the Pay-as-you-Drive Process

Figure 3.4 Explains the Pay-How-you-Drive Process

Figure 3.5 Explains the Manage-how-you-drive Process

Figure 3.6 Global Automotive UBI Market Segments According to Data Collection

Figure 3.7 Global Smartphone Market Forecast 2018 - 2028 (US$ bn, AGR %)

Figure 3.8 Global Automotive Market Segments According To Technology Incorporated

Figure 4.1 Global Usage Based Insurance Market Forecast 2018-2028 (Premium US$ bn, AGR %)

Figure 4.2 Global Automobile Usage-Based Insurance Market Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 4.3 Global Automotive Usage-Based Insurance Adoption for 2018-2028 (Market Share %)

Figure 5.1 Global Automotive Usage-Based Insurance Sub-Market Forecast by Pricing Model 2018-2028 (Policyholders mn)

Figure 5.2 Global Automotive Usage-Based Insurance Sub-Market Share by Pricing Model 2018 (%)

Figure 5.3 Global Automotive Usage-Based Insurance Sub-Market Share by Pricing Model 2023 (%)

Figure 5.4 Global Automotive Usage-Based Insurance Sub-Market Share by Pricing Model 2028 (%)

Figure 5.5 Global Usage Based Insurance Sub-Market Forecast by Technology Incorporated 2018-2028 (Policyholders mn)

Figure 5.6 Global Usage Based Insurance Sub-Market Forecast by Technology Incorporated 2018-2028 (AGR %)

Figure 5.7 Global Automotive UBI Submarket Share by Technology Incorporated 2018 (%)

Figure 5.8 Global Automotive UBI Submarket Share by Technology Incorporated 2023 (%)

Figure 5.9 Global Automotive UBI Submarket Share by Technology Incorporated 2028 (%)

Figure 5.10 Global Automotive OBD-II Based UBI Solutions Submarket Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 5.11 Global Automotive OBD-II Based UBI Solutions Submarket Forecast by Region 2018-2028 (Policyholders mn)

Figure 5.12 Global Automotive OBD-II Based UBI Solutions Submarket Share by Region 2018 (%)

Figure 5.13 Global Automotive OBD-II Based UBI Solutions Submarket Share by Region 2023 (%)

Figure 5.14 Global Automotive OBD-II Based UBI Solutions Submarket Share by Region 2028 (%)

Figure 5.15 Global Automotive Smartphone Based UBI Solutions Submarket Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 5.16 Global Automotive Smartphone Based UBI Solution Sub-Market Forecast by Region 2018-2028 (Policyholders mn)

Figure 5.17 Global Automotive Smartphone Based UBI Solutions Submarket Share by Region 2018 (%)

Figure 5.18 Global Automotive Smartphone Based UBI Solutions Submarket Share by Region 2023 (%)

Figure 5.19 Global Automotive Smartphone Based UBI Solutions Submarket Share by Region 2028 (%)

Figure 5.20 Global Automotive Hybrid UBI Solutions Submarket Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 5.21 Global Automotive Hybrid UBI Solution Regional Sub-Market Forecast 2018-2028 (Policyholders mn)

Figure 5.22 Global Automotive Hybrid UBI Solutions Submarket Share by Region 2018 (%)

Figure 5.23 Global Automotive Hybrid UBI Solutions Submarket Share by Region 2023 (%)

Figure 5.24 Global Automotive Hybrid UBI Solutions Submarket Share by Region 2028 (%)

Figure 5.25 Global Automotive Black-Box UBI Solutions Submarket Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 5.26 Global Automotive Black-Box UBI Solution Regional Market 2018-2028 (Policyholders mn)

Figure 5.27 Global Automotive Black- Box Based UBI Solutions Submarket Share by Region 2018 (%)

Figure 5.28 Global Automotive Black- Box Based UBI Solutions Submarket Share by Region 2023 (%)

Figure 5.29 Global Automotive Black- Box Based UBI Solutions Submarket Share by Region 2028 (%)

Figure 5.30 Global Automotive UBI Sub-Market Forecast by Technology Incorporated 2018-2028 (Policyholders mn)

Figure 5.31 Global Automotive UBI Sub-Market Forecast by Technology Incorporated 2018-2028 (AGR %)

Figure 5.32 Global Automotive UBI Submarket Share by Technology Incorporated 2018 (%)

Figure 5.33 Global Automotive UBI Submarket Share by Technology Incorporated 2023 (%)

Figure 5.34 Global Automotive UBI Submarket Share by Technology Incorporated 2028 (%)

Figure 6.1 Regional Automotive Usage-Based Insurance Market Forecast 2018-2028 (policyholders mn)

Figure 6.2 Regional Automotive Usage-Based Insurance Market Forecast 2018-2028 (AGR %)

Figure 6.3 Regional Automotive UBI Submarket Share Forecast 2018 (%)

Figure 6.4 Regional Automotive UBI Submarket Share Forecast 2023 (%)

Figure 6.5 Regional Automotive UBI Submarket Share Forecast 2028 (%)

Figure 6.6 North American Automotive UBI Market Forecast 2018-2028 (Policyholders mn AGR %)

Figure 6.7 North Americas Automotive UBI Market Forecast By Country 2018-2028 (Policyholders mn)

Figure 6.8 North Americas Automotive UBI-Market Share By Country 2018 (%)

Figure 6.9 North Americas Automotive UBI Market Share By Country 2023 (%)

Figure 6.10 North Americas Automotive UBI Market Share By Country 2028 (%)

Figure 6.11 United States Automotive UBI Market Forecast 2018-2028 (Policyholders mn AGR %)

Figure 6.12 Canadian Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 6.13 European Automotive UBI Market Forecast 2018-2028 (Policyholders mn AGR %)

Figure 6.14 European Automotive UBI Market Forecast By Country 2018-2028 (Policyholders mn, AGR %)

Figure 6.15 European Automotive UBI Market Share By Country 2018 (%)

Figure 6.16 European Automotive UBI Market Share By Country 2023 (%)

Figure 6.17 European Automotive UBI Market Share By Country 2028 (%)

Figure 6.18 United Kingdom Automotive UBI Market Forecast 2018-2028 (Policyholders mn AGR %)

Figure 6.19 Italian Automotive UBI Market Forecast 2018-2028 (Policyholders mn AGR %)

Figure 6.20 French Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 6.21 German Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 6.22 Spanish Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 6.23 APAC Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 6.24 APAC Automotive UBI Market Forecast By Country 2018-2028 (Policyholders mn)

Figure 6.25 APAC Automotive UBI Market Share By Country 2018 (%)

Figure 6.26 APAC Automotive UBI Market Share By Country 2023 (%)

Figure 6.27 APAC Automotive UBI Market Share By Country 2028 (%)

Figure 6.28 Chinese Automotive UBI Market Forecast 2018-2028 (Policyholders mn AGR %)

Figure 6.29 Japanese Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR %)

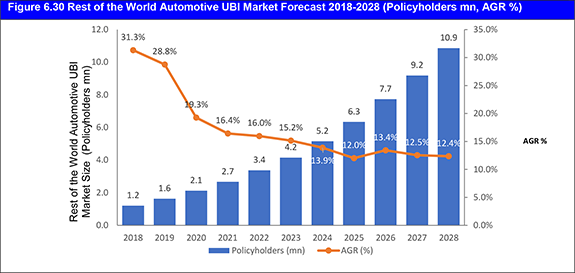

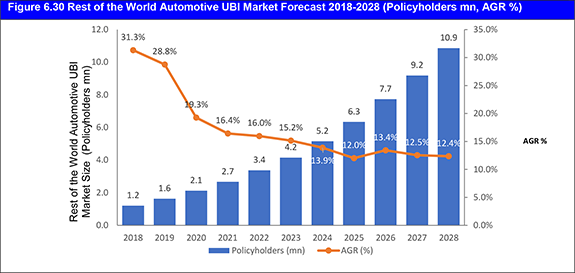

Figure 6.30 Rest of the World Automotive UBI Market Forecast 2018-2028 (Policyholders mn, AGR %)

Figure 7.1 Global Shipment of Connected Cars Market Forecast (2018-2028)

Figure 10.1 Five Force Analysis of Automotive Usage-Based Insurance Market 2018-2028

Figure 11.1 Value Chain Analysis for Usage Based Insurance Market 2018-2028

Figure 12.1 Billing Model For Data Services To Automotive Segment

Figure 14.1 Leading Vendors in the Global Automotive Usage-Based Insurance Market

Figure 15.1 Leading Insurance Providers in the Global Automotive Usage-Based Insurance Market

Figure 15.2 Allstate’s Group Revenue (2013-2017)

Figure 15.3 AXA’s Group Revenue (2013-2017)

Figure 15.4 Progressive’s Revenue (2013-2017)

Figure 15.5 Unipol Gruppo’s Revenue (2013-2017)

Figure 15.6 Generali’s Revenue (2013-2017)

Figure 16.1 Global Usage Based Insurance Market Policyholder Forecast 2018-2028 (policyholders mn, AGR %)

Figure 16.2 Market Drivers in the Global Automotive UBI Market

Figure 16.3 Market Challenges in the Global Automotive UBI Market

Figure 16.4 Market Trends in the Global UBI Automotive Market