Visiongain has identified automotive financing as one of the largest markets for automotive companies and financing companies to exploit. Financing typically includes loans and leasing activities through various sources of finance such as banks, CLFCs, credit unions, and independent financial and leasing companies. The global Automotive Financing market is expected to reach US $ 4.79 Tn in 2017.

Automotive financing has become more competitive with an increase in the number of car showrooms and used-car outlets. Buyers have easy access to pre-approved credit from direct lenders. So, it is important to leverage analytics to build risk-based pricing models that ensure wider profit margins during the loan origination phase. Successful firms will find new opportunities in a demanding market while making the best of the existing portfolios during the forecast period. Specialized operating models, such as risk-based pricing, will enable cost-effective deployment of loans that suit economies of scale. To benefit from this, automotive finance providers must adapt to volatility and risk in market conditions and changing customer behaviour such as demand for instant loans. As a result, lenders are expected to come up with smarter collection and recovery strategies to reduce default rates.

Visiongain’s report keeps you informed and ahead of your competitors. Gain that competitive advantage.

This report answers questions such as:

• How is the global automotive financing market evolving?

• What is driving and restraining automotive financing market dynamics?

• How will each automotive financing submarket segment grow over the forecast period and how much sales will these submarkets account for in 2027?

• Which automotive financing submarket will be the main driver of the overall market from 2017-2027?

• How will sociodemographic and macroeconomic factors influence regional automotive financing markets and submarkets?

• Which automotive financing region will lead the market in 2027?

• Who are the leading players and what are their prospects over the forecast period?

5 Reasons why you must order and read this report today:

1) The report provides detailed profiles of 15 leading companies operating within the automotive financing market:

– Ally Financials

– Wells Fargo

– Toyota Financial Services

– Bank of America

– Ford Motor Credit

– Citibank

– BNP Paribas

– Volkswagen Financial Services

– HDFC Bank

– Chase Auto Finance Corporation

– Hitachi Capital Asia Pacific

– AK Sberegatel’nyi bank Rossiyskoy Federatsii OAO (Sberbank of Russia OJSC)

– ZAO UniCredit Bank

– OJSC Alfa-Bank

– VTB Bank OJSC

2) Global Automotive Financing Forecast 2017-2027

3) The study further investigates the regional Automotive Financing market

– US Automotive Financing Market 2017-2027

– Europe Automotive Financing Market 2017-2027

– Germany Automotive Financing Market 2017-2027

– France Automotive Financing Market 2017-2027

– UK Automotive Financing Market 2017-2027

– Netherlands Automotive Financing Market 2017-2027

– Spain Automotive Financing Market 2017-2027

– RoE Automotive Financing Market 2017-2027

– APAC Automotive Financing Market 2017-2027

– RoW Automotive Financing Market 2017-2027

4) Our overview also forecasts and analyses the Automotive Financing market by sub segments from 2017-2027

– Captive Leasing and Financing Companies (CLFC) Automotive Financing Forecast 2017-2027

– Banks Automotive Financing Forecast 2017-2027

– Credit Unions Automotive Financing Forecast 2017-2027

– Independent Financial and Leasing Companies (Financial Leasing, Operating Lease) Automotive Financing Forecast 2017-2027

5) Analysis of disruptive trends & technologies influencing the automotive financing market, including new leasing models, digitalisation, on-demand mobility and the development of autonomous vehicles,

Competitive advantage

This independent 130 page report guarantees you are better informed than your competitors. With 91 tables and figures examining the automotive financing market the report gives you an immediate, one-stop breakdown of your market. as well as analysis, from 2017-2027 keeping your knowledge that one step ahead of your rivals.

Who should read this report?

• Banks

• Captive Leasing and Financing Company (CLFC)

• Credit Unions

• Independent Leasing and Financing Companies

• Automotive OEMs

• Automotive dealerships

• Credit card companies

• CEOs

• Asset managers

• Heads of strategic development

• Marketing staff

• Market analysts

• Company managers

• Industry associations

• Consultant

• Governmental departments & agencies

Don’t miss out

This report is essential reading for you or anyone in the finance sector with an interest in automotive financing. Purchasing this report today helps you to recognise those important market opportunities and understand the possibilities there. Order the Automotive Financing Market Report 2017-2027 report now. Get our new report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Automotive Financing Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Automotive Financing Market

2.1 Global Automotive Financing Market - Introduction

2.2 Global Automotive Financing Market – Market Overview

2.2.1 Captive Leasing and Financing Companies (CLFC)

2.2.2 Banks and Credit Unions

2.2.3 Independent Financial and Leasing Companies

2.2.4 Financial Leasing

2.2.5 Operating Lease

3. Global Automotive Financing Market 2017 2027

3.1 Global Automotive Financing Market Forecast 2017-2027

3.2 Global Automotive Financing Drivers, Trends & Restraints 2017

3.2.1 Global Automotive Financing Market Drivers 2017

3.2.2 Global Automotive Financing Market Challenges 2017

3.2.3 Global Automotive Financing Market Trends 2017

3.3 Impact of Digitization on Automotive Financing

3.3.1 Knowledge is Shared with Customers

3.3.2 Big Data - Ownership and Usage of Data

4. Global Automotive Financing Submarket Forecast 2017- 2027

5. Regional & Leading National Automotive Financing Market Forecast 2017-2027

5.1 Overview of the US Automotive Financing Market 2017-2027

5.2 European Automotive Financing Market 2017- 2027

5.2.1 Overview of the European Automotive Financing Market 2017-2027

5.3 Germany Automotive Financing Market 2017- 2027

5.3.1 Overview of the German Automotive Financing Market 2017-2027

5.4 France Automotive Financing Market 2017-2027

5.4.1 Overview of the French Automotive Financing Market 2017-2027

5.5 United Kingdom Automotive Financing Market 2017- 2027

5.5.1 Overview of the UK Automotive Financing Market 2017-2027

5.6 Netherlands (Dutch) Automotive Financing Market 2017- 2027

5.6.1 Overview of the Dutch Automotive Financing Market 2017-2027

5.7 Spain Automotive Financing Market 2017- 2027

5.7.1 Overview of the Spanish Automotive Financing Market 2017-2027

5.8 Rest of Europe (ROE) Automotive Financing Market 2017- 2027

5.8.1 Overview of the Rest of Europe Automotive Financing Market 2017-2027

5.9 APAC Automotive Financing Market 2017- 2027

5.9.1 Overview of the APAC Automotive Financing Market 2017-2027

5.10 Rest of the World Automotive Financing Market 2017- 2027

5.10.1 Overview of the Rest of the World Automotive Financing Market 2017-2027

6. Buying Criteria

7. Leading 10 Automotive Financing Companies

7.1 Ally Financials

7.1.1 Ally Financials Latest Developments (M&A, etc) – Automotive Financing Market

7.1.2 Ally Financials Automotive Financing Portfolio

7.1.3 Ally Financials Future Outlook

7.2 Wells Fargo & Co. Overview

7.2.1 Wells Fargo Latest Developments (M&A, etc) - Automotive Financing

7.2.2 Wells Fargo Automotive Financing Portfolio

7.2.3 Wells Fargo Future Outlook

7.3 Toyota Financial Services Overview

7.3.1 Toyota Financial Services Latest Developments (M&A, etc) - Automotive Financing Portfolio

7.3.2 Toyota Financial Services Automotive Financing Portfolio

7.3.3 Toyota Financial Services Future Outlook

7.4 Bank of America Corporation Overview

7.4.1 Bank of America Latest Developments (M&A, etc) - Automotive Financing

7.4.2 Bank of America Automotive Financing Portfolio

7.4.3 Bank of America Future Outlook

7.5 Ford Motor Credit Overview

7.5.1 Ford Motor Credit Latest Developments (M&A, etc) - Automotive Financing

7.5.2 Ford Motor Credit Automotive Financing Portfolio

7.5.3 Ford Motor Credit Future Outlook

7.6 Citibank Overview

7.6.1 Citibank Latest Developments (M&A, etc) - Automotive Financing

7.6.2 Citibank Automotive Financing Portfolio

7.6.3 Citibank Future Outlook

7.7 BNP Paribas Overview

7.7.1 BNP Paribas Latest Developments (M&A, etc) - Automotive Financing

7.7.2 BNP Paribas Automotive Financing Portfolio

7.7.3 BNP Paribas Future Outlook

7.8 Volkswagen Financial Services AG Overview

7.8.1 Latest Developments (M&A, etc) - Automotive Financing

7.8.2 Volkswagen Financial Services AG Automotive Financing Portfolio

7.8.3 Volkswagen Financial Services AG Future Outlook

7.9 HDFC Bank Overview

7.9.1 HDFC Bank Latest Developments (M&A, etc) - Automotive Financing

7.9.2 HDFC Bank Automotive Financing Portfolio

7.9.3 HDFC Bank Future Outlook

7.10 Chase Auto Finance Corporation Overview

7.10.1 Chase Auto Finance Corporation Latest Developments (M&A, etc) - Automotive Financing

7.10.2 Chase Auto Finance Corporation Automotive Financing Portfolio

7.11 Hitachi Capital Asia Pacific Overview

7.11.1 Hitachi Capital Asia Pacific Latest Developments (M&A, etc) - Automotive Financing

7.11.2 Hitachi Capital Asia Pacific Automotive Financing Portfolio

7.11.3 Hitachi Capital Asia Pacific Future Outlook

7.12 AK Sberegatel'nyi bank Rossiyskoy Federatsii OAO (Sberbank of Russia OJSC ) Overview

7.12.1 AK Sberegatel'nyi bank Rossiyskoy Federatsii OAO (Sberbank of Russia OJSC ) (M&A, etc) - Automotive Financing

7.12.2 AK Sberegatel'nyi bank Rossiyskoy Federatsii OAO (Sberbank of Russia OJSC ) Automotive Financing Product Portfolio

7.12.3 AK Sberegatel'nyi bank Rossiyskoy Federatsii OAO (Sberbank of Russia OJSC ) Future Outlook

7.13 ZAO UniCredit Bank Overview

7.13.1 ZAO UniCredit Bank- Automotive Financing

7.13.2 ZAO UniCredit Bank - Automotive Financing Portfolio

7.13.3 ZAO UniCredit Bank Future Outlook

7.14 OJSC Alfa-Bank Overview

7.14.1 OJSC Alfa Bank: Key Developments

7.14.2 OJSC Alfa Bank - Automotive Financing Portfolio

7.14.3 OJSC Alfa Bank - Future Outlook

7.15 VTB Bank OJSC Overview

7.15.1 VTB Bank OJSC – Key Developments

7.15.2 VTB Bank OJSC - Automotive Financing Portfolio

7.15.3 VTB Bank OJSC Future Outlook

7.16 Other Automotive Financing Companies

8. Opportunities for Carsharing and Micro-Entrepreneurs

9. Conclusions and Recommendation

9.1 Global Automotive Financing Market Forecast 2017-2027

9.2 Regional & Leading National Automotive Financing Market Forecast 2017-2027

10. Key Market Highlights

11. Glossary

List of Tables

Table 1.1 Example of Global Automotive Financing Market by Regional Market Forecast 2017-2027 (US$ bn, AGR %, Cumulative)

Table 3.1 Global Automotive Financing Forecast 2017-2027 (US$ bn, AGR %, CAGR %, Cumulative)

Table 3.2 Global Automotive Financing Vehicle Market Drivers & Restraints 2017 20

Table 4.1 Global Automotive Financing Submarket Forecast 2017-2027 (US$ bn, AGR %, CAGR%)

Table 5.1 Regional Automotive Financing Markets Forecast 2017-2027 (US$bn, AGR %, CAGR%)

Table 5.2 Regional Automotive Financing Market CAGR from 2017-2022, 2022-2027, 2017-2027 (%)

Table 5.3 United States Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.4 European Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.5 Germany Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.6 French Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.7 UK Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.8 Dutch Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.9 Spanish Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.10 ROE Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.11 APAC Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 5.12 Rest of the World Automotive Financing Market Forecast 2017-2027 (US$ bn, CAGR%)

Table 7.1 Ally Financial Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.2 Ally Financial Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.3 Ally Financials - Automotive Financing Product Portfolio

Table 7.4 Wells Fargo & Co. Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.5 Wells Fargo Financials 2012-2016

Table 7.6 Wells Fargo - Automotive Financing Product Portfolio

Table 7.7 Toyota Financial Services Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.8 Toyota Financial Services Financials 2013-2017

Table 7.9 Toyota Financial Services - Automotive Financing Product Portfolio

Table 7.10 Bank of America Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.11 Bank of America Financials 2012-2016

Table 7.12 Bank of America - Automotive Financing Product Portfolio

Table 7.13 Ford Motor Credit Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.14 Ford Motor Credit Financials 2012-2016

Table 7.15 Ford Motor Credit - Automotive Financing Product Portfolio

Table 7.16 Citibank Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.17 Citigroup Financials 2012-2016

Table 7.18 Citibank Loan Statistics 2015-2016

Table 7.19 Citigroup Company - Automotive Financing Product Portfolio

Table 7.20 BNP Paribas Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.21 BNP Paribas Financials 2012-2016

Table 7.22 BNP Paribas Financials by Region 2015-2016

Table 7.23 BNP Paribas - Automotive Financing Product Portfolio

Table 7.24 Volkswagen Financial Services AG Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.25 Volkswagen Financial Services AG Financials 2012-2016

Table 7.26 Volkswagen Financial Services – Automotive Financing Product Portfolio

Table 7.27 HDFC Bank Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.28 HDFC Bank Financials 2013-2017

Table 7.29 HDFC Banks - Automotive Financing Product Portfolio

Table 7.30 Chase Auto Finance Corporation Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.31 Chase Auto Finance Corporations – Automotive Financing Product Portfolio

Table 7.32 Hitachi Capital Asia Pacific Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.33 Hitachi Financials 2014-2017

Table 7.34 Hitachi Product Portfolio

Table 7.35 AK Sberegatel'nyi bank Rossiyskoy Federatsii OAO Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.36 AK Sberegatel'nyi bank Rossiyskoy Federatsii OAO Financial Overview

Table 7.37 AK Sberegatel'nyi bank Rossiyskoy Federatsii OAO (Sberbank of Russia OJSC) Product Portfolio

Table 7.38 ZAO UniCredit Bank Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.39 ZAO UniCredit Bank Financial Overview

Table 7.40 ZAO UniCredit Bank Product Portfolio

Table 7.41 OJSC Alfa-Bank Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.42 OJSC Alfa-Bank Financial Overview

Table 7.43 OJSC Alfa Bank Product Portfolio

Table 7.44 VTB Bank OJSC Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 7.45 VTB Bank OJSC Financial Overview

Table 7.46 VTB Bank OJSC Product Portfolio

Table 7.47 Details of Other Automotive Financing Companies

Table 9.1 Global Automotive Financing Forecast 2017-2027 (US$ bn, AGR %, CAGR %, Cumulative)

Table 9.2 Global Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR %, Cumulative)

Table 9.3 Regional Automotive Financing Markets Forecast 2017-2027 (US$bn, AGR %, CAGR%)

List of Figures

Figure 1.1 Example of Automotive Financing Market by Regional Market Share Forecast 2017, 2022, 2027(% Share)

Figure 3.1 Global Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR %)

Figure 4.1 Global Automotive Financing Submarket Forecast 2017-2027 ($bn )

Figure 4.2 Global Automotive Financing Submarket Share Forecast 2017 (% Share)

Figure 4.3 Global Automotive Financing Submarket Share Forecast 2022 (% Share)

Figure 4.4 Global Automotive Financing Submarket Share Forecast 2027 (% Share)

Figure 5.1 Regional Automotive Financing Market Forecast 2017-2027 (US$ bn)

Figure 5.2 Global Automotive Financing Market by Region Market Share Forecast 2017 (% Share)

Figure 5.3 Global Automotive Financing Market by Region Market Share Forecast 2022 (% Share)

Figure 5.4 Global Automotive Financing Market by Region Market Share Forecast 2027 (% Share)

Figure 5.5 Regional Automotive Financing Market Share Forecast Summary 2017, 2022, 2027 (%)

Figure 5.6 United States Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 5.7 European Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 5.8 Germany Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 5.9 French Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 5.10 UK Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 5.11 Dutch Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 5.12 Spanish Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 5.13 ROE Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 5.14 APAC Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

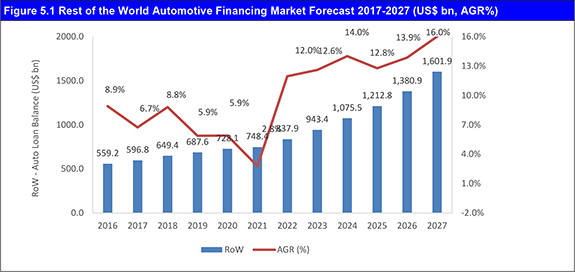

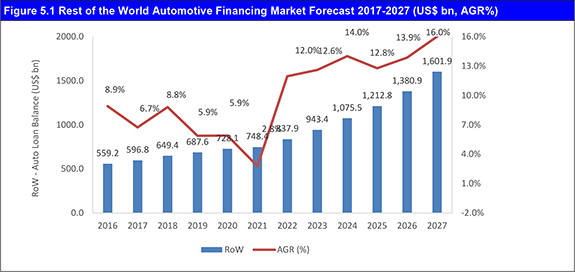

Figure 5.15 Rest of the World Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR%)

Figure 6.1 Automotive Financing – Buying Criteria Categories

Figure 7.1 Ally Financials- Product Segmentation - 2016

Figure 9.1 Global Automotive Financing Market Forecast 2017-2027 (US$ bn, AGR %)

Figure 9.2 Global Automotive Financing Submarket Forecast 2017-2027 (US$ bn, Global AGR %)