Industries > Pharma > The Molecular Diagnostics (MDx) Market Forecast 2017-2027

The Molecular Diagnostics (MDx) Market Forecast 2017-2027

Infectious Disease Testing, Oncology Testing, Blood Screening, Genetic Testing, Tissue Typing

The molecular diagnostics (MDx) market was worth $6.13bn in 2016 and is estimated to grow at a CAGR of 12.5% from 2017-2021. The fastest growing segment of the molecular diagnostics market over the forecast period 2017-2027 will be the oncology testing segment. The segment was worth $1.08bn in 2016 and represented 17.6% of the molecular diagnostics market.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 206-page report you will receive 135 charts – all unavailable elsewhere.

The 206-page report provides clear detailed insight into the molecular diagnostics (MDx) market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• World IVD market forecasts from 2017-2027

• Molecular diagnostics (MDx) market forecasts from 2017-2027

• Revenue and growth forecasts to 2027 for the leading submarkets:

• Infectious Disease Testing

• Oncology Testing

• Blood Screening

• Genetic Testing

• Tissue Typing

• This report provides individual revenue forecasts to 2027 for these regional and national markets:

– US

– Europe:

• Germany

• UK

• Spain

• Italy

• France

• Rest of Europe

– Japan

– China

– Brazil

– Russia

– India

– South Korea

– Mexico

– RoW

• This report discusses the leading companies in the molecular diagnostics (MDx) market:

• Roche Diagnostics

• Qiagen

• Hologic

• Becton, Dickinson & Company

• bioMérieux

• Agilent Technologies

A company profile gives you the following information where available:

• Discussion of a company’s activities and outlook

• Analysis of assays and instruments currently on the market as well as pipeline products

• Acquisitions and strategic partnerships

• This report discusses the SWOT analysis as well as porter’s five forces analysis of the molecular diagnostics (MDx) market

Visiongain’s study is intended for anyone requiring commercial analyses for the molecular diagnostics (MDx). You find data, trends and predictions.

Buy our report today The Molecular Diagnostics (MDx) Market Forecast 2017-2027: Infectious Disease Testing, Oncology Testing, Blood Screening, Genetic Testing, Tissue Typing.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 The Molecular Diagnostics Market Overview

1.2 Molecular Diagnostics Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report

1.6 Who is This Report For?

1.7 Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Reports

1.10 About visiongain

2. Introduction to Molecular Diagnostics

2.1 What are In Vitro Diagnostic (IVD) Tests?

2.2 Classifying In Vitro Diagnostics

2.2.1 FDA Classifications

2.2.2 The EC (European Commission) Classification

2.2.3 IVD Classification in Australia

2.3 IVD Submarkets

2.3.1 Clinical Chemistry

2.3.2 Immunochemistry

2.3.3 Point-of-care Testing (Including Self-Monitoring Blood Glucose Tests)

2.3.4 Molecular Diagnostics

2.3.4.1 Infectious Disease Testing

2.3.4.2 Oncology Testing

2.3.4.3 Blood Screening

2.3.4.4 Genetic Testing

2.3.4.5 Tissue Typing (HLA Testing)

2.3.5 Clinical Microbiology

2.3.6 Haematology/ Haemostasis

2.4 Regulation of the IVD and MDx Market

2.4.1 FDA and CLIA Regulation of IVD and MDx Tests

2.4.2 Regulation of IVD/MDx Tests in the EU: The EC (European Commission) Classification

2.4.3 Top Ten Challenges in Regulation for In-Vitro Diagnostics

2.4.3.1 Challenges in Regulations of MDx Tests

2.5 Device Excise Tax: A Threat to the Diagnostics Manufacturers

3. The Molecular Diagnostics Segment within the In Vitro Diagnostics Market, 2017-2027

3.1 Molecular Diagnostics in the IVD Market, 2016

3.2 Sales Forecast for the Global IVD Market 2017-2027

3.3 Molecular Diagnostics Gaining a Greater Share of the IVD Market

4. The Molecular Diagnostics Market by Sectors, 2017-2027

4.1 The Molecular Diagnostic Market by Sectors, 2016

4.2 The Molecular Diagnostic Market by Sectors 2016-2027

4.2.1 Market Shares of the Molecular Diagnostics Sectors 2016-2027

4.3 The Infectious Disease Testing Market 2016-2027

4.3.1 Breakdown of the MDx Infectious Disease Testing Market by Disease, 2016

4.3.1.1 CT/NG

4.3.1.2 HPV Testing

4.3.1.3 HIV

4.3.1.4 Healthcare Associated Infections (HAI)

4.3.1.5 Hepatitis C (HCV)

4.3.1.6 Respiratory Infections

4.4 The Oncology Testing Market, 2016-2027

4.4.1 Targeted Therapies: A Major Driver of the Oncology Testing Market

4.4.2 Molecular Diagnostics: Currently Concentrated on a Few Cancer Indications

4.4.2.1 Breast Cancer

4.4.2.2 Prostate Cancer

4.4.2.2.1 Prostate Cancer Pipeline Biomarkers

4.4.2.2.1.1 TMPRSS2-ERG (OriGene)

4.4.2.2.1.2 PTEN

4.4.2.3 Colorectal Cancer

4.5 The Blood Screening Market 2016-2027

4.5.1 Grifols’ Acquisition of Novartis’s Blood Screening Unit

4.5.2 Leading Blood Screening Test Products

4.5.2.1 Cobas s 201 System (Roche Molecular)

4.5.2.2 Procleix Assays (Grifols)

4.6 The Genetic Testing Market 2016-2027

4.6.1 Genetic Testing by Clinical Impact Area

4.6.2 Genetic Testing: Potential beyond Oncology

4.6.3 Cystic Fibrosis

4.6.4 Factor V Leiden and Factor II Thrombophilia

4.6.5 Inflammatory Diseases

4.6.5.1 Alzheimer’s Disease (AD)

4.6.5.2 Rheumatoid Arthritis

4.6.5.2.1 Vectra®DA (Crescendo Bioscience)

4.6.5.2.2 Quest Diagnostics: Biomarker Study

4.6.5.3 Rare Diseases

4.7 The Tissue Typing (HLA Typing) Market 2016-2027

4.7.1 Tissue Typing: Next-Generation Sequencing

5. The Leading Molecular Diagnostics National Markets, 2016-2027

5.1 Regional Breakdown of the Global MDx Market, 2016

5.2 The Global MDx Market Forecast, 2017-2027

5.3 The Regional Market Shares of the MDx Market, 2016, 2021 and 2026

5.4 The US MDx Market 2016

5.4.1 The US MDx Market Forecast 2017-2027

5.4.1.1 United States: Diagnostic Reimbursement

5.5 The European MDx Markets Forecast 2017-2027

5.5.1 Changes in the Shares of the Leading European Markets, 2016, 2021 and 2027

5.5.2 Shares of the Major European Markets in a Global Context

5.5.3 The German MDx Market Forecast 2017-2027

5.5.3The French MDx Market Forecast 2017-2027

5.5.4 The Italian MDx Market Forecast 2017-2027

5.5.5 The Spanish MDx Market Forecast 2017-2027

5.5.6 The UK MDx Market Forecast 2017-2027

5.5.7 The Other European MDx Markets Forecast 2017-2027

5.7 Japanese MDx Market Forecast 2017-2027

5.7 The Chinese MDx Market Forecast 2017-2027

5.7.1 China: Increasing Cancer Burden

5.8 The Brazilian MDx Market Forecast 2017-2027

5.9 The Russian MDx Market Forecast 2017-2027

5.10 The Indian MDx Market Forecast 2017-2027

5.10.1 India: Expansion of Healthcare Provisions

5.11 The South Korean MDx Market Forecast 2017-2027

5.12 The Mexican MDx Market Forecast 2017-2027

5.13 The Rest of the World Market Forecast 2017-2027

6. The Leading Companies in the Molecular Diagnostics Market, 2017

6.1 Roche Diagnostics

6.1.1 Roche: Global Presence

6.1.2 Roche Diagnostics, 2016-2027

6.1.3 Roche Diagnostics Business Performance within the IVD Market, 2016

6.1.3.1 Molecular Diagnostics Sales Performance, 2016

6.1.3.2 Molecular Diagnostic Sales by Region, 2016

6.1.4 Roche Diagnostics: MDx Product Launches and Indication Expansion, 2016

6.1.4.1 Roche Diagnostics: Product Launch Plans, 2017

6.1.5 Roche: Major M&A Activity and Strategic Partnerships Strengthen Position as Market Leader

6.1.5.1 Genia Acquisition to Strengthen DNA Sequencing Capabilities

6.1.5.2 IQuum Acquisition Allows Movement into POC MDx Market

6.1.5.3 Seragon Acquisition Strengthens Leading Position in Oncology

6.1.5.4 Santaris Acquisition Enchances Roche’s Position in RNA-Targeted Drugs Market

6.1.5.5 Bina Acquisition Brings Big Data Solution to Support NGS Development

6.1.5.6 Dutalys Acquisition Enhances Roche’s mAB Portfolio

6.1.5.7 Ariosa Acquisition Adds NIPT to MDx Portfolio

6.1.5.8 Foundation Medicine Deal Enhances Personalised Medicine Capabilities for Oncology

6.1.5.9 Signature and CAPP Acquisitions Strengthen Circulating DNA Testing Abilities

6.1.5.10 GENEWEAVE and Kapa Acquisitions Help Cement Roche’s Position as the MDx Market Leader

6.2 Qiagen NV

6.2.1 Sales and Recent Performance Analysis, 2016

6.2.2 Qiagen Sales by Region, 2016

6.2.3 Qiagen Sales by Segment, 2016

6.2.4 Qiagen: Molecular Diagnostics

6.2.5 Molecular Diagnostics: Product Expansion

6.2.5.1 QIASymphony

6.2.5.2 QuantiFERON-TB Gold: Expansion into Asia

6.2.5.3 Personalised Healthcare: Collaborative Efforts

6.2.5.4 Qiagen’s Software Company Acquisitions Cement Leadership in Bioinformatics

6.3 Hologic

6.3.1 Hologic Recent Sales Performance by Business Segment, 2016

6.3.2 Hologic Molecular Diagnostics: Product Portfolio

6.4 Becton, Dickinson and Company

6.4.1 Sales and Financial Performance, 2016

6.4.2 Sales and Financial Performance by Region, 2016

6.4.3 Becton, Dickinson and Company Diagnostics Sales and Financial Performance, 2015-2016

6.4.4 BD Diagnostics: Product Portfolio

6.4.5 BD Diagnostics: Mergers and Acquisitions

6.5 bioMérieux

6.5.1 Sales and Recent Performance Analysis, 2012-2016

6.5.2 Sales by Region, 2016

6.5.3 Sales by Technology, 2016

6.5.4 Molecular Diagnostics: Product Portfolio

6.5.5 Companion Diagnostics: Collaborations with GSK and Novartis

6.5.6 Mergers, Acquisitions and Collaborations

6.5.7 bioTheranostics: Subsidiary for Oncology Diagnostics

6.6 Agilent Technologies

6.6.1 Sales and Recent Performance Analysis, 2016

6.6.2 Sales Performance by Business Segment, 2016

6.6.3 Agilent Technologies: Strong Player in Target Enrichment for Next-Generation Sequencing

7. Qualitative Analysis of the MDx Market, 2017-2027

7.1 MDx Market: Drivers and Restraints

7.2 SWOT Analysis of the MDx Market, 2017-2027

7.2.1 Strengths

7.2.1.1 Patient Demographics

7.2.1.2 Increased Awareness and availibilty of advanced tests

7.2.1.3 High Growth in Oncology Molecular Diagnostics

7.2.1.4 Increasing Laboratory Test Menus

7.2.1.5 Personalised Medicine: Optimising Treatment Outcomes

7.2.2 Weaknesses

7.2.2.1 Lack of Clear Regulatory Guidelines for Molecular Diagnostics

7.2.2.2 Reimbursement Challenges for Molecular Diagnostic Companies

7.2.2.3 Consolidation of Healthcare Systems Increases Pricing Pressure

7.2.2.4 MDx: An Expensive, but Undervalued Diagnostic Tool

7.2.3 Opportunities

7.2.3.1 Next-Generation Sequencing

7.2.3.2 Emerging Markets

7.2.3.3 The Emergence of New Microorganisms

7.2.4 Threats

7.2.4.1 US Medical Device Excise Tax

7.2.4.2 Gene Patents: Controversial Ruling

7.3 Porter’s Five Forces Analysis of the MDx Market

7.3.1 Rivalry among Competitors [High]

7.3.2 Threat of New Entrants [Medium]

7.3.3 Power of Suppliers [Medium]

7.3.4 Power of Buyers [High]

7.3.5 Threat of Substitutes [High]

8. Conclusion

8.1 The Molecular Diagnostics Market: Growing Market Share

8.2 Molecular Diagnostics: Oncology Testing Market Growth

8.3 Commercial Drivers of the Molecular Diagnostics Market

8.4 Commercial Restraints of the Molecular Diagnostics Market

8.5 Emerging Markets

8.6 Concluding Remarks

Appendices

Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Advantages and Disadvantages of POC Diagnostics, 2017

Table 3.1 World IVD Market: Revenues ($bn) and Market Share (%) by Segment, 2016

Table 3.2 World IVD Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) by Segment, 2016-2027

Table 3.3 Market Shares (%) of MDx in the IVD Market, 2016, 2021 & 2027

Table 4.1 The MDx Market: Revenues ($bn) and Market Shares (%) by Segment, 2016, 2021, & 2027

Table 4.2 The Global MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) by Segment, 2016-2027

Table 4.3 The MDx Market: Market Shares (%) by Segment, 2016, 2021 and 2027

Table 4.4 The Infectious Disease Testing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 4.5 The Infectious Disease Testing Market: Revenues ($bn) and Market Share (%) by Disease, 2016

Table 4.6 Selected FDA and CE-Approved Molecular Diagnostics Test for CT/NG, 2017

Table 4.7 Selected FDA and CE-Approved Molecular Diagnostics Test for HPV, 2017

Table 4.8 Selected FDA and CE-Approved Molecular Diagnostics Tests for HIV, 2017

Table 4.9 Selected FDA and CE-Approved Molecular Diagnostics Test for HAIs, 2017

Table 4.10 Selected FDA and CE-Approved Molecular Diagnostics Tests for HCV, 2015

Table 4.11 Selected FDA-Approved Molecular Diagnostics Test for Respiratory Infections, 2017

Table 4.12 The Oncology Testing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 4.13 Examples of Clinically Relevant Cancer Biomarkers Tied with a Drug, 2017

Table 4.14 Selected List of FDA-Approved MDx Tests for Breast Cancer, 2017

Table 4.15 Selected List of FDA-Approved MDx Tests for Prostate Cancer, 2017

Table 4.16 Selected List of FDA-Approved MDx tests for Colorectal Cancer, 2017

Table 4.17 The Blood Screening Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 4.18 The Genetic Testing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 4.19 Selected Genetic Tests for Cystic Fibrosis on the Market, 2017

Table 4.20 Selected Genetic Tests for Factor V Leiden/Factor II Thrombophilia on the Market, 2017

Table 4.21 Selected Alzheimer’s MDx Diagnostic Tests in Development, 2017

Table 4.22 The Tissue Typing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 4.23 Selected tissue typing Kits on the Market, 2017

Table 5.1 The MDx Market: Revenue ($bn) and Market Share (%) by Region, 2016

Table 5.2 The MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) by Region, 2016-2027

Table 5.3 The MDx Market: Market Shares (%) by Regional Markets, 2016, 2021 and 2027

Table 5.4 The US MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.5 The European MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.6 The European MDx Market: Market Shares (%) by Country, 2016, 2021 and 2027

Table 5.7 The German MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.8 The French MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.9 The Italian MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.10 The Spanish MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.11 The UK MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.12 The Other European MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.13 The Japanese MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.14 The Chinese MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.15 The Brazilian MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.16 The Russian MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.17 The Indian MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.18 The South Korean MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.19 The Mexican MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 5.20 The Rest of the World MDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2016-2027

Table 6.1 Roche Diagnostics: Revenue ($bn) and Revenue Share (%) by Business Area, 2016

Table 6.2 Roche Molecular Diagnostics: Revenue ($bn), Revenue Shares (%) by Region, 2016

Table 6.3 Roche Diagnostics: Key Product Launches (Instruments/Devices) Planned for 2017

Table 6.4 Roche Diagnostics: Key Product Launches (Tests/Assays) Planned for 2017

Table 6.5 Qiagen: Revenue ($m) and Revenue Share (%) by Region, 2014-2016

Table 6.6 Hologic: Revenue ($bn) and Revenue Share (%) by Segment, 2014-2016

Table 6.7 Becton, Dickinson and Company: Revenue ($bn) and AGR (%) by Region, 2014-2016

Table 6.8 Becton, Dickinson and Company: Sales ($bn), AGR (%) by Life Sciences Segment, 2015-2016

Table 6.9 bioMérieux: Revenue ($bn) and AGR (%), 2012-2016

Table 6.10 bioMérieux: Revenue ($bn) and Revenue Change (%) by Region, 2015-2016

Table 6.11 bioMérieux: Revenue ($bn) and Revenue Share (%) by Region, 2016

Table 6.12 bioMérieux: Revenue ($bn) and Revenue Change (%) by Technology, 2015-2016

Table 6.13 Agilent Technologies: Revenue ($bn) and AGR (%), 2012-2016

Table 6.14 Agilent Technologies: Revenue ($bn) and AGR (%) by Business Segment, 2014-2016

Table 6.15 Agilent Technologies: Revenue ($bn) by Segment, 2014-2016

Table 7.1 SWOT Analysis of the Global MDx Market, 2017-2027

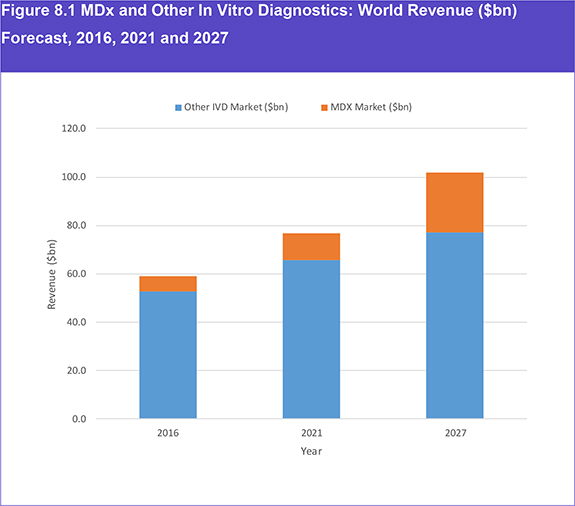

Table 8.1 MDx and Other In Vitro Diagnostics: World Revenue ($bn) Forecast, 2016, 2021 and 2027

List of Figures

Figure 1.1 Molecular Diagnostics: Overview of Submarkets

Figure 3.1 World IVD Market: Revenues ($bn) by Segment, 2016

Figure 3.2 World IVD Market: Revenue Shares (%) by Segment, 2016

Figure 3.3 World IVD Market Forecast: Revenue ($bn) and AGR (%) by Segment, 2016-2027

Figure 3.4 World MDx Market Share (%) in the IVD Market, 2021

Figure 3.5 World MDx Market Share (%) in the IVD Market, 2027

Figure 4.1 The MDx Market Shares (%) by Sector in the IVD Market, 2016

Figure 4.2 The MDx Market: Revenue ($bn) by Segment, 2016

Figure 4.3 The MDx Market: Market Shares (%) by Segment, 2016

Figure 4.4 The Global MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 4.5 The MDx Market: Market Shares (%) by Segment, 2021

Figure 4.6 The MDx Market: Market Shares (%) by Segment, 2027

Figure 4.7 The Infectious Disease Testing Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 4.8 The Infectious Disease Testing Market: Market Shares (%) by Disease, 2016

Figure 4.9 The Oncology Testing Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 4.10 The Cancer Treatment Sequence and the Application of Molecular Diagnostics and Companion Diagnostics

Figure 4.11 The Blood Screening Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 4.12 The Genetic Testing Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 4.13 The Genetic Testing Market by Clinical Impact Area, 2016

Figure 4.14 The Tissue Typing Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.1 The MDx Market: Market Shares (%) by Region, 2016

Figure 5.2 The MDx Market: Revenue ($bn) by Region, 2016

Figure 5.3 The MDx Market Forecast: Revenue by Region ($bn), 2016-2027

Figure 5.4 The MDx Market: Market Shares (%) by Region, 2021

Figure 5.5 The MDx Market: Market Shares (%) by Region, 2027

Figure 5.6 The US MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.7 The European MDx Market Forecast: Revenue ($bn) by Region, AGR (%), 2016-2027

Figure 5.8 The European MDx Market: Market Shares (%) by Country, 2016

Figure 5.9 The European MDx Market: Market Shares (%) by Country, 2021

Figure 5.10 The European MDx Market: Market Shares (%) by Country, 2027

Figure 5.11 Europe in The Global MDx Market: Market Shares (%) by Country, 2016

Figure 5.12 Europe in The Global MDx Market: Market Shares (%) by Country, 2021

Figure 5.13 Europe in The Global MDx Market: Market Shares (%) by Country, 2027

Figure 5.14 The German MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.15 The French MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.16 The Italian MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.17 The Spanish MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.18 The UK MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.19 The Other European MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.20 The Japanese MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.21 The Chinese MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.22 The Brazilian MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.23 The Russian MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.24 The Indian MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.25 The South Korean MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.26 The Mexican MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 5.27 The Rest of the World MDx Market Forecast: Revenue ($bn) and AGR (%), 2016-2027

Figure 6.1 Roche Diagnostics: Revenues ($bn) by Business Area, 2016

Figure 6.2 Roche Diagnostics: Revenue Share (%) by Business Area, 2016

Figure 6.3 Roche Molecular Diagnostics: Revenue Share (%) by Region, 2016

Figure 6.4 Qiagen:Revenue ($bn), Net Income ($bn) and Profit Margin (%), 2012-2016

Figure 6.5 Qiagen: Revenue ($m) by Region, 2016

Figure 6.6 Qiagen: Revenue Share (%) by Region, 2016

Figure 6.7 Hologic: Revenue ($bn) by Business Segment, 2014-2016

Figure 6.8 Hologic: Revenue Share (%) by Business Segment, 2016

Figure 6.9 Becton, Dickinson and Company: Revenue Share (%) by Segment, 2016

Figure 6.10 Becton, Dickinson and Company: Revenue ($bn) by Region, 2014-2016

Figure 6.11 Becton, Dickinson and Company: Revenue Share (%) by Region, 2016

Figure 6.12 Becton, Dickinson and Company: Revenue Share (%) by Life Sciences Segment, 2016

Figure 6.13 bioMérieux: Revenue ($m) and AGR (%), 2012-2016

Figure 6.14 bioMérieux: Revenue ($bn) by Region, 2016

Figure 6.15 bioMérieux: Revenue Share (%) by Region, 2016

Figure 6.16 bioMérieux: Revenue Share (%) by Technology, 2016

Figure 6.17 Agilent Technologies: Revenue ($bn) and AGR (%), 2012-2016

Figure 6.18 Agilent Technologies: Revenue Share (%) by Business Segment, 2016

Figure 6.19 Agilent Technologies: Revenue Share (%) by Segment, 2016

Figure 7.1 MDx Market: Drivers and Restraints, 2017-2027

Figure 7.2 The Global Over 65 Population: Forecast (millions, AGR%), 2014-2025

Figure 7.3 Porter’s Five Forces Analysis of the MDx Market, 2017-2027

Figure 8.1 MDx and Other In Vitro Diagnostics: World Revenue ($bn) Forecast, 2016, 2021 and 2027

Figure 8.2 Molecular Diagnostics Market Forecast: AGRs (%) in the US, India, China and Global Market, 2016-2027

Abbott Laboratories / Abbott Molecular

AdvanDx

Agilent Technologies

Alere

Applied Maths

ArcherDx

ARGENE

Ariosa Diagnostics

Atria Genetics

Astute Medical

Autogenomics, Inc.

AvariaDx

Becton, Dickinson & Co. / BD Diagnostics

Bina Technologies, Inc.

BIOBASE

Biocartis

BioFire Diagnostics

bioMérieux

Bio-Reference Laboratories

bioTheranostics

Boehringer Ingelheim

Bristo Myers Squibb

CAPP Medical

CareFusion Corporation

Celera Diagnostics

Cepheid

Chiron

Chugai Pharmaceuticals

Clarient

CLC Bio.

Cognoptix

COPAN

Crescendo Bioscience

Dako A/S

Danaher Corporation

DiaGenic

DiagnoCure

Dutalys

DxS

EliTechGroup Epoch Biosciences

Enzymatics

Exact Sciences Corporation

Exosome

Focus Diagnostics, Inc.

Foundation Medicine

GE Healthcare

GenCell Biosystems

Genia Technologies, Inc.

Genentech

Genomic Health

GeneWEAVE Biosciences, Inc.

Gen-Probe

Gilead Sciences

Great Basin Scientific, Inc.

Grifols

Hain Lifescience

HandyLab

Hologic

Hyglos

IGEN International

Illumina, Inc.

Ingenuity Systems

Infectio Diagnstic, Inc.

Intelligent Medical Devices, Inc.

Ipsogen

IQuum, Inc.

IRIS International, Inc.

Janssen Diagnostics, LLC

Kapa Biosystems

Keysight Technologies Inc.

KIESTRA Lab Automation BV

Luminex Molecular Diagnostics, Inc.

MDx Health

Merck

Meridian Bioscience, Inc.

Meso Scale Diagnsotics

Multiplicom N.V.

Myriad Genetic Laboratories, Inc.

Nanosphere, Inc.

Nanostring Technologies

Novartis

Olerup SSP AB

One Lambda

OPKO

OriGene

Ortho Clinical Diagnostics

Osmetech Molecular Diagnostics

PrimeraDx

Prodesse, Inc.

Proteome Sciences

Qiagen

Quest Diagnostics, Inc.

Quidel Corporation

RAS Lifesciences Pvt. Ltd

Roche Diagnostics (F. Hoffmann-La Roche Ltd.)

Saladax Biomedical Inc.

Santaris Pharma A/S

Seragon Pharmaceuticals, Inc.

Siemens Healthcare Diagnostics

Signature Diagnostics AG

Texas BioGene Inc.

Thermo Fisher Scientific

Trophos

Ventana Medical Systems, Inc.

Veridex, LLC

Organizations Mentioned in the Report

American Medical Association

FDA’s Office of In Vitro Diagnostic Device Evaluation and Safety (OIVD)

French Court of Auditors

National Institute for Health and Clinical Excellence (NICE)

Rospotrebnadzor Federal Monitoring Agency

Rashtriya Swasthya Bima Yojana (RSBY) – (Indian National Health Insurance Programme)

Seguro Popular (Mexican National Health Insurance Programme)

United Nations Population Division

US Centers for Disease Control and Prevention (CDC)

US Centers for Medicare and Medicaid Services (CMS)

US Congressional Research Service (CRS)

US Food and Drug Administration (FDA)

USPS (United States Postal Service)

US National Healthcare Safety Network (NHSN)

World Health Organisation (WHO)

Download sample pages

Complete the form below to download your free sample pages for The Molecular Diagnostics (MDx) Market Forecast 2017-2027

Related reports

-

Next-Generation Cancer Diagnostics Market Forecast 2017-2027

The next-generation cancer diagnostics market is expected to grow at a CAGR of 16.5% in the first half of the...

Full DetailsPublished: 10 May 2017 -

Global Biomarkers Market Forecast 2017-2027

The global biomarkers market is expected to grow at a CAGR of 9.1% in the first half of the forecast...

Full DetailsPublished: 18 October 2017 -

Global Precision Medicine Market Forecast 2018-2028

The global precision medicine market is expected to grow at an estimated CAGR of 12.08% from 2018 to 2028. The...

Full DetailsPublished: 26 March 2018 -

Global Respiratory Diagnostics Market Report 2017-2027

The global respiratory diagnostics market is expected to grow at a CAGR of 7.1% in the first half of the...Full DetailsPublished: 08 June 2017 -

Global Alzheimer’s Disease Therapeutics and Diagnostics Market 2018-2028

The Alzheimer’s Disease Therapeutics and Diagnostics Market will reach $7.93bn in 2018. The Alzheimer’s Disease Therapeutics and Diagnostics Market is...

Full DetailsPublished: 18 June 2018 -

Medical Devices Leader Series: Top In Vitro Diagnostics (IVD) Companies 2017-2027

What does the future hold for companies of the in vitro diagnostics (IVD) industry? Visiongain's new report Medical Devices Leader...Full DetailsPublished: 18 November 2016 -

In-Vitro Diagnostics World Market 2018-2028

The revenue of the in-vitro diagnostics market in 2017 was estimated at $63bn and was dominated by the Point of...

Full DetailsPublished: 11 September 2018 -

Global Infectious Disease Diagnostics Market Forecast 2017-2027

Our 142-page report provides 83 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...Full DetailsPublished: 27 September 2017 -

The Companion Diagnostics (CDx) Market Forecast 2018-2028

What can be expected from the Companion Diagnostics market? Which areas are going to grow at the fastest rates? This...

Full DetailsPublished: 10 April 2018 -

The Next Generation Sequencing Market Forecast 2017-2027

Our 248-page report provides 192 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 16 October 2017

Download sample pages

Complete the form below to download your free sample pages for The Molecular Diagnostics (MDx) Market Forecast 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024

Visiongain Publishes Inflammatory Bowel Diseases (IBD) Drugs Market Report 2024-2034

The global Inflammatory Bowel Diseases (IBD) Drugs market was valued at US$27.53 billion in 2023 and is projected to grow at a CAGR of 6.2% during the forecast period 2024-2034.

11 April 2024

Visiongain Publishes Female Health Tech Market Report 2024-2034

The global Female Health Tech market was estimated to be valued at US$ 140.9 billion in 2034 and is expected to register a CAGR of 9.6% from 2024 to 2034.

05 April 2024

Visiongain Publishes Meningococcal Vaccines Market Report 2024-2034

The global Meningococcal Vaccines market is projected to grow at a CAGR of 2.5% by 2034

26 March 2024